Key Takeaways

- Transitions to lightweight and advanced materials, along with increased ESG demands, threaten core revenues, elevate compliance costs, and compress margins.

- Industry cyclicality, regionalization trends, and market overcapacity erode Bekaert's resilience and competitive advantages, constraining sustainable profit growth.

- Strategic portfolio shifts, emerging market growth, and investments in innovation position Bekaert for long-term margin expansion and shareholder value creation despite near-term headwinds.

Catalysts

About NV Bekaert- Provides steel wire transformation and coating technologies worldwide.

- The ongoing shift in key end markets such as automotive and construction toward lightweight composites and alternative materials is likely to reduce long-term demand for Bekaert's traditional steel wire products. This structural trend threatens to erode the company's core revenues as customers transition to more advanced, non-metallic solutions.

- Intensifying ESG regulations and the rapid tightening of carbon emissions standards globally are set to raise compliance costs and require substantial ongoing capital expenditure, particularly in Bekaert's legacy operations. This added cost burden is expected to pressure net margins over time, especially as lower-cost competitors adapt faster or shift to lighter production footprints.

- The company's heavy exposure to highly cyclical industries such as automotive, construction, and oil and gas leaves it acutely vulnerable to continued end-market volatility, with little ability to offset volume and earnings declines during economic downturns or prolonged sectoral contraction.

- Secular trends toward regionalization and local supply chain development diminish the importance of Bekaert's global supplier network, undermining its traditional competitive advantage and likely reducing international sales and overall growth potential.

- Persistent overcapacity in global steel and wire production, especially in Asia, coupled with rising use of protectionist trade barriers and tariffs, is expected to exert further downward pressure on average selling prices and gross margins, constraining the company's ability to achieve sustainable profit growth in the medium to long term.

NV Bekaert Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NV Bekaert compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NV Bekaert's revenue will grow by 1.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.0% today to 7.1% in 3 years time.

- The bearish analysts expect earnings to reach €290.7 million (and earnings per share of €5.62) by about July 2028, up from €238.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.3x on those 2028 earnings, down from 8.0x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 10.8x.

- Analysts expect the number of shares outstanding to decline by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

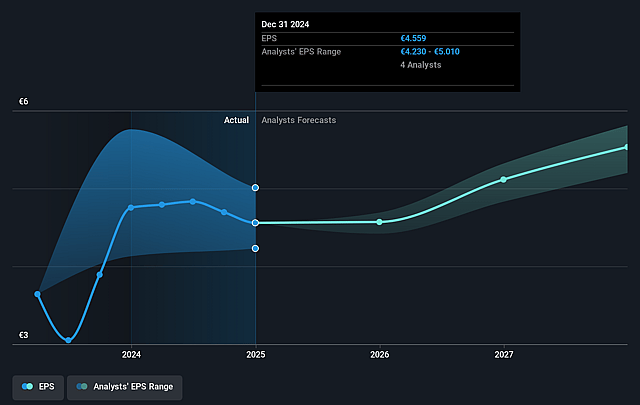

NV Bekaert Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company achieved resilient profitability in a challenging environment by stabilizing its EBITDA margin near 9 percent, helped by successful cost optimization, working capital improvements, and mix enrichment, indicating an ability to protect net margins even under top-line pressure.

- Despite weak demand in some end markets, Bekaert continues to benefit from volume growth in key emerging markets such as India and Southeast Asia, particularly in Rubber Reinforcement, which supports long-term revenue streams as infrastructure and mobility investment rise in those regions.

- The company is strategically repositioning its portfolio away from commoditized, lower-margin operations and toward higher-margin, growth-oriented segments, as evidenced by recent divestments at attractive multiples and ongoing M&A in adjacent and innovation-driven sectors, which could boost medium

- to long-term earnings.

- Investments in new technologies, product innovation (such as hydrogen solutions and advanced wires), and R&D are sustaining Bekaert's positioning for future secular growth trends such as energy transition and electrification, which could drive long-term top-line and margin expansion as these markets mature.

- Robust free cash flow generation, a progressive dividend policy with a recent 6 percent increase, and a significant share buyback program indicate management confidence in ongoing earnings power and capital returns, which can enhance earnings per share and shareholder value if sustained.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NV Bekaert is €35.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NV Bekaert's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €55.0, and the most bearish reporting a price target of just €35.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €4.1 billion, earnings will come to €290.7 million, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of €37.65, the bearish analyst price target of €35.0 is 7.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.