Key Takeaways

- Margin expansion is expected from cost optimization, improved product mix, and disciplined investments, elevating profit profile and fueling aggressive cash return strategies.

- Growth will be driven by Asia-Pacific demand, electrified mobility trends, and decarbonization, with increased R&D enabling premium products and deeper customer relationships.

- Structural market decline, cyclical demand dependence, and delayed growth platforms expose Bekaert to ongoing earnings, margin, and competitive pressures across its core and specialty businesses.

Catalysts

About NV Bekaert- Provides steel wire transformation and coating technologies worldwide.

- Analysts broadly agree that Bekaert's cost structure optimization and mix improvement will lift net margins, but the combination of sustained SG&A reductions, working capital rationalization and modular investments means Bekaert will accelerate to a structurally higher margin profile, with group EBIT margin moving decisively above 10% as soon as late 2025 rather than hovering just below.

- Analyst consensus expects incremental volume gains in Rubber Reinforcement from capacity expansions in India and Indonesia, but this likely underestimates the scale of multi-year growth as local electrified mobility adoption climbs and Bekaert leverages long-term contracts, setting up both volume and price outperformance in Asia-Pacific and a sizable step-up in recurring revenues.

- Bekaert is uniquely positioned to become a leading supplier of advanced steel wire solutions for the global decarbonization push, especially as utility grid investments, renewable energy infrastructure, and EV adoption globally expand demand for transmission, battery, and high-performance wire-this will drive multi-year volume growth across both established and new segments.

- The company's increased R&D allocation to high-value, traceable, and low-carbon products is already pulling in strategic OEM contracts that should drive premium pricing and gross margin gains, while also raising customer retention and reducing Bekaert's cyclicality exposure over the cycle.

- The company's best-in-class cash flow generation-amplified by divestments, streamlined inventory, and resilient earnings-will enable stepped-up share buybacks and bolt-on acquisitions in specialty and energy transition markets, resulting in a much faster compounding effect for EPS than currently modeled by the market.

NV Bekaert Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NV Bekaert compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NV Bekaert's revenue will grow by 3.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.0% today to 7.3% in 3 years time.

- The bullish analysts expect earnings to reach €322.7 million (and earnings per share of €6.04) by about July 2028, up from €238.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from 8.1x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 10.8x.

- Analysts expect the number of shares outstanding to decline by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

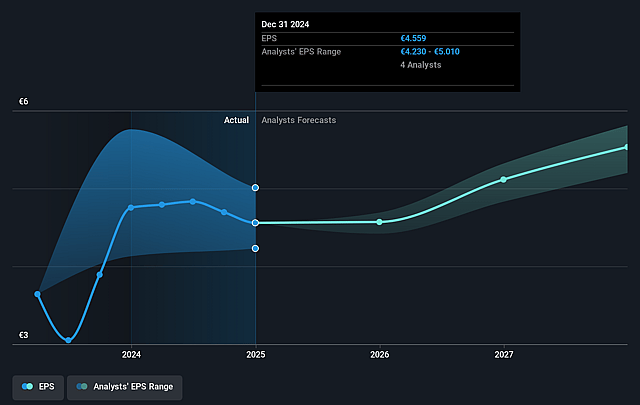

NV Bekaert Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term secular decline in developed-world steel wire consumption, as well as the shift to alternatives like composites and lightweight materials, risks structurally reducing Bekaert's addressable markets and could lead to sustained lower revenues over time.

- Persistent overreliance on cyclical end-markets such as automotive and construction-both of which experienced weaker demand, particularly in Europe and China-creates ongoing risk of volatile earnings and revenue contraction if economic cycles or sector disruption persist.

- Delays and policy uncertainty in sustainability-driven growth platforms, including hydrogen and energy transition segments, slowed anticipated progress and may continue to hamper Bekaert's ability to shift its product mix, which could result in prolonged margin and revenue pressure.

- Intensifying global competition, especially in the tire reinforcement and steel wire segments, together with rising protectionism, new tariffs, and risks of further trade barriers, may erode pricing power and compress net margins across core markets.

- Underperformance and profit decline in Specialty Businesses-driven by negative trends such as technology transition in ultra-fine wires, persistent weak demand in hose, conveyor belt, and combustion tech, and underutilization of new hydrogen facilities-indicate a risk that some high-margin or innovation-driven areas may not recover, challenging longer-term earnings and margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NV Bekaert is €55.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NV Bekaert's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €55.0, and the most bearish reporting a price target of just €35.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €4.4 billion, earnings will come to €322.7 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of €38.2, the bullish analyst price target of €55.0 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.