Key Takeaways

- Structural shifts toward remote work and stagnant ridership threaten long-term organic growth and expose the company to policy and competitive risks.

- Rising compliance costs, aging demographics, and operational inefficiencies from acquisitions are likely to suppress operating margins and hinder meaningful earnings improvement.

- Strategic investments in sustainability, disciplined capital allocation, and geographic diversification are supporting stable revenue, margin expansion, and resilience to market fluctuations.

Catalysts

About Kelsian Group- Provides land and marine transport and tourism services in Australia, the United States, Singapore, and the United Kingdom.

- Slowing demand for commuter transport due to persistent remote and hybrid work trends in key developed markets risks structurally capping Kelsian's long-term organic revenue growth, as evidenced by ongoing service reductions for tech clients in California and stagnation in international bus ridership.

- The company is exposed to mounting capital intensity and margin pressure from accelerating decarbonization mandates and zero-emission requirements, driving elevated recurring and replacement CapEx across the fleet and increasing the risk that medium-term return on invested capital continues to trail the cost of capital.

- Dependence on multi-year government contracts leaves the group increasingly exposed to retendering risk and policy-driven revenue volatility, especially as competitive pressure from emerging mobility platforms and alternate operators intensifies, putting both stable earnings and long-term top line growth at risk.

- Aging and declining ridership in core developed markets, coupled with industry-wide labor, insurance, and compliance cost inflation, threaten to suppress operating margins and undermine efforts to sustainably improve earnings, regardless of indexation mechanisms in place.

- Integration risks and operational inefficiencies stemming from cross-border and bolt-on acquisitions, particularly in the U.S. and U.K., may continue to drive underperformance in acquired businesses, constraining company-wide EBITDA recovery and leading to persistently suboptimal profit margins.

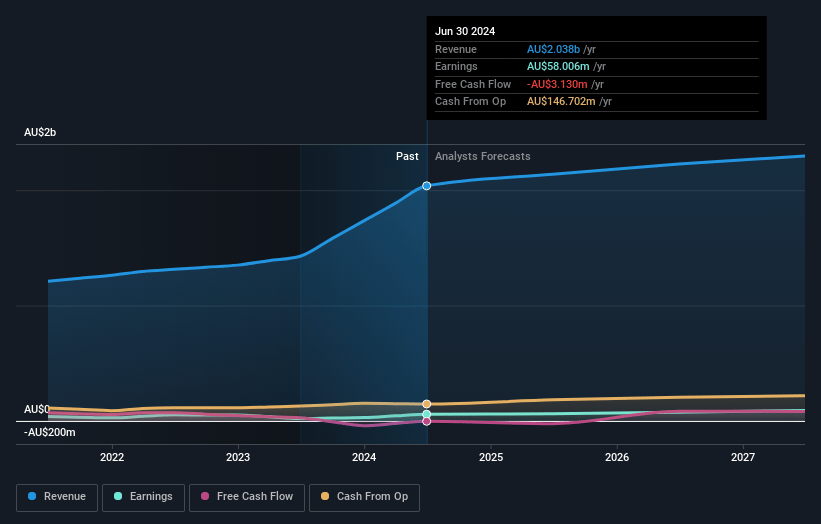

Kelsian Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kelsian Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kelsian Group's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.4% today to 2.6% in 3 years time.

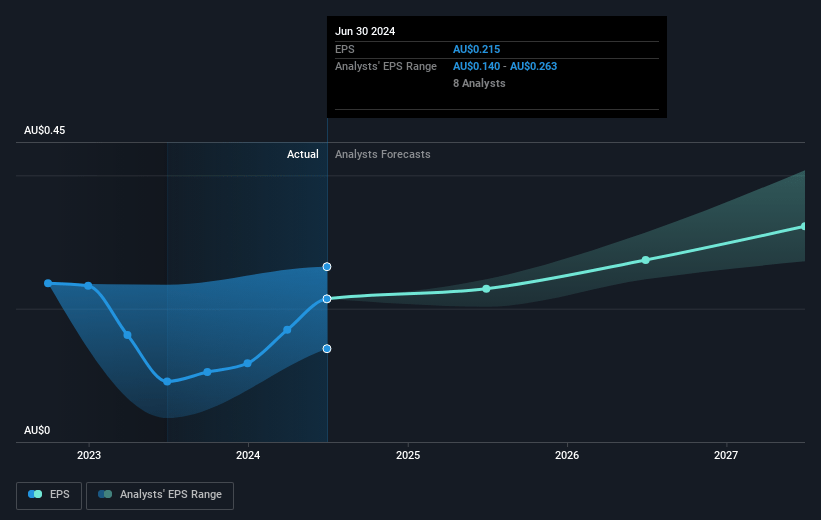

- The bearish analysts expect earnings to reach A$61.9 million (and earnings per share of A$0.23) by about July 2028, up from A$50.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.4x on those 2028 earnings, down from 20.8x today. This future PE is greater than the current PE for the AU Transportation industry at 12.4x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.58%, as per the Simply Wall St company report.

Kelsian Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued urbanisation and population growth, especially in regions where Kelsian operates, are supporting sustained demand for mass transit and contract-backed revenue, with 90% of group revenues secured under long-dated, index-linked contracts, thus underpinning revenue stability and likely long-term growth.

- The business benefits from strong global policy momentum toward decarbonisation, increasing government investment in public transport and zero-emission vehicle fleets; Kelsian's early mover investments in electric and hydrogen buses and ferries may result in access to premium contracts, higher cost efficiencies, and expanding net margins over time.

- Kelsian's disciplined capital management framework, active portfolio review, and goal to deliver group return on invested capital at least 200 basis points above pre-tax WACC (with management incentives aligned) position the company for improved capital allocation, higher return on assets, and expanding earnings in the medium term.

- Ongoing international diversification (e.g. new and renewed U.S. and UK contracts, expansion in Singapore) is reducing geographic concentration risk, improving revenue resilience, and introducing further growth levers that support stable or rising earnings even if one market underperforms.

- The company is capturing yield and margin upside from dynamic pricing in marine/tourism, contract indexation, cost-out programs in underperforming bus regions, digital technology upgrades, and targeted bolt-on acquisitions, all of which are expected to increase profit margins and earnings per share over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kelsian Group is A$3.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kelsian Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.6, and the most bearish reporting a price target of just A$3.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$2.4 billion, earnings will come to A$61.9 million, and it would be trading on a PE ratio of 20.4x, assuming you use a discount rate of 9.6%.

- Given the current share price of A$3.83, the bearish analyst price target of A$3.5 is 9.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.