Last Update 05 Dec 25

TPG: Upcoming Capital Return Will Support Future Shareholder Upside Potential

Analysts have trimmed their price target on TPG Telecom slightly to approximately $5.00 per share, citing marginally higher discount rate assumptions, along with largely unchanged expectations for revenue growth, profit margins, and future valuation multiples.

What's in the News

- TPG Telecom has completed a follow-on equity offering of approximately AUD 300 million via a subsequent direct listing of 83.1 million ordinary shares at AUD 3.61 per share (company filing).

- The company has filed an additional follow-on equity offering of about AUD 550 million, comprising 152.4 million ordinary shares at AUD 3.61 per share, also structured as a subsequent direct listing (company filing).

- TPG Telecom has filed a separate follow-on equity rights offering totaling approximately AUD 138 million, covering 38.2 million ordinary shares at AUD 3.61 per share (company filing).

- A special dividend of AUD 0.09 per share has been announced, with an ex date of November 14, 2025, a record date of November 17, 2025, and a payment date of November 24, 2025 (company announcement).

- A special shareholders meeting is scheduled for November 11, 2025, at 16:00 Australian Eastern Standard Time, with a key agenda item to consider a return of capital to ordinary shareholders (company notice).

Valuation Changes

- Fair Value Estimate remains unchanged at approximately A$5.00 per share, with no revision to the underlying intrinsic value model.

- The discount rate has risen slightly from about 7.23 percent to roughly 7.26 percent, reflecting a modest increase in the assumed cost of capital.

- Revenue growth is effectively unchanged, with long term forecasts remaining at around negative 1.51 percent.

- The net profit margin is essentially flat, with the projected margin holding near 4.47 percent.

- The future P/E has increased marginally from about 48.09x to roughly 48.12x, indicating a very small uplift in the valuation multiple applied to future earnings.

Key Takeaways

- Expanded 5G infrastructure and digital-first brands are driving profitable subscriber growth, reducing churn, and supporting sustained revenue and margin expansion amid strong connectivity demand.

- Completed major investment cycles position TPG for higher free cash flow, capital returns, and sustainable margin improvement through operating model simplification and controlled cost growth.

- Intensifying competition, price sensitivity, technical risks, and domestic market exposure threaten TPG Telecom's subscriber growth, margin expansion, and long-term earnings stability.

Catalysts

About TPG Telecom- Provides telecommunications services to consumer, business, enterprise, and government and wholesale customers in Australia.

- The doubling of TPG's mobile network coverage and persistent investments in 5G and digital infrastructure have significantly improved subscriber growth, driven higher ARPU over time, and lowered customer churn, which is likely to support ongoing revenue and margin expansion as accelerated connectivity demand and digitization trends continue in Australia.

- Digital-first brands-such as TPG and Felix-are efficiently capturing market share, leveraging low-cost, scalable digital channels; this allows TPG to add subscribers at a lower cost-to-serve than traditional premium postpaid, enhancing operating leverage and driving profitable growth even as value-seeking consumer behavior remains elevated.

- With population growth in Australia and renewed government student visit programs, TPG's serviceable market is expanding and has further upside as urbanization and business adoption of cloud, IoT, and remote solutions drive higher data consumption, supporting medium-term growth in both subscriber base and enterprise/SMB revenue streams.

- Material network and IT investment cycles-including 5G rollout, Huawei equipment replacement, and brand system overhauls-are now largely complete, setting up a multi-year period of structurally lower capex; this will directly boost free cash flow conversion and capital returns, while also enabling cost-outs ($100m targeted by 2029) to flow through to net profit.

- Structural improvements in TPG's cost base and simplification of the operating model (including ongoing digitization, IT/app rationalization and leveraging infrastructure-sharing agreements) underpin flat-to-lower OpEx growth relative to inflation over the long term, leading to sustainable EBITDA margin improvement and stronger earnings growth.

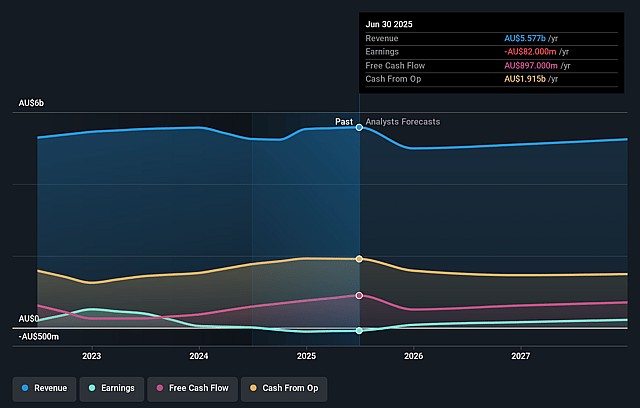

TPG Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TPG Telecom's revenue will decrease by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.5% today to 4.7% in 3 years time.

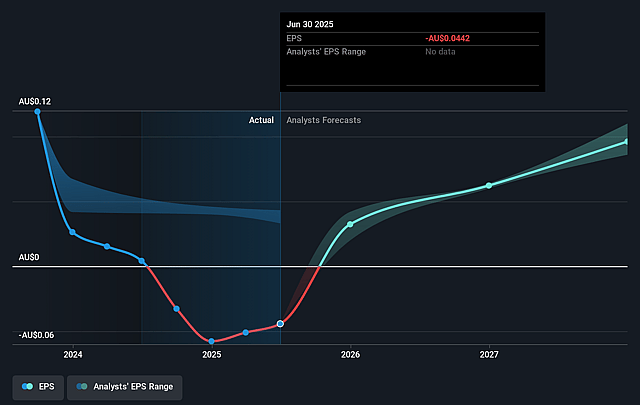

- Analysts expect earnings to reach A$247.4 million (and earnings per share of A$0.13) by about September 2028, up from A$-82.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$286.9 million in earnings, and the most bearish expecting A$174 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.9x on those 2028 earnings, up from -114.0x today. This future PE is lower than the current PE for the AU Telecom industry at 620.5x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

TPG Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TPG faces ongoing intense competition in both mobile and fixed segments, including pressure from low-cost MVNOs and challenger NBN brands, which could constrain subscriber growth, suppress ARPU increases, and pressure margins over time, negatively impacting revenue and EBITDA.

- A significant portion of digital brand (TPG, Felix) subscriber growth is from lower-ARPU segments, and management acknowledges price increases have lagged those of premium brands; if consumer price sensitivity remains high, further uptrading could be limited, and margin expansion from these segments may stall, impacting long-term earnings growth.

- The fixed broadband market is described as highly competitive and "challenging," with persistent subscriber declines and aggressive discounting from smaller operators; if TPG cannot consistently regain subscriber growth or is forced to prioritize profitability over share, revenue growth could stagnate or reverse in this key business line.

- TPG's cost reduction targets and digital transformation hinge on complex IT consolidation and customer migrations; any technical issues or disruptions (such as billing or order management failures or further cyber incidents) could increase churn, damage reputation, and trigger unexpected one-off costs, pressuring both margins and net profit.

- The company's operations and revenue remain almost entirely domestic, leaving TPG highly exposed to adverse regulatory changes, shifts in Australia's economic environment (e.g., cost-of-living pressures, lower international arrivals), and any domestic telecom sector price wars or market structure shifts, all of which could threaten top-line growth and margin improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$5.496 for TPG Telecom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.4, and the most bearish reporting a price target of just A$4.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$5.3 billion, earnings will come to A$247.4 million, and it would be trading on a PE ratio of 49.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$5.04, the analyst price target of A$5.5 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on TPG Telecom?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.