Catalysts

About TPG Telecom

TPG Telecom is an Australian telecommunications provider offering mobile, fixed broadband and related connectivity services to consumers and businesses.

What are the underlying business or industry changes driving this perspective?

- Rapid mobile subscriber growth, driven by the expanded regional network, could slow materially once the "once in a generation" coverage catch up is complete. This may limit incremental market share gains and constrain service revenue growth.

- Heavy reliance on digital first subscription brands with structurally lower ARPU exposes TPG to mix shift pressure. Higher volume but cheaper plans can dilute overall pricing power and cap future improvements in EBITDA margins.

- Intensifying competition in NBN resale and from non telco broadband challengers, combined with speed boost driven plan upgrades, may force more aggressive discounting in fixed services to defend share. This could squeeze fixed line gross margins and earnings.

- Non volumetric but CPI linked network sharing and fiber access costs under long term agreements risk outpacing achievable price rises in a weak macro environment. This may erode the ownership economics narrative and limit net margin expansion.

- As CapEx normalizes and free cash flow improves, rising cash tax payments and the absence of past spectrum and Huawei swap distortions may reveal slower underlying profit growth. This could reduce the scope for ongoing dividend increases and EPS growth.

Assumptions

This narrative explores a more pessimistic perspective on TPG Telecom compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

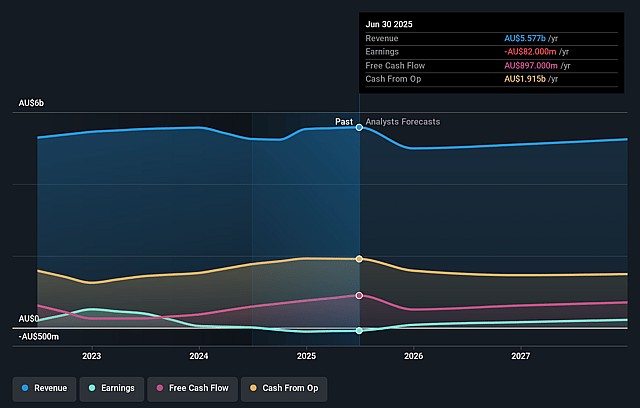

- The bearish analysts are assuming TPG Telecom's revenue will decrease by 2.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.5% today to 5.6% in 3 years time.

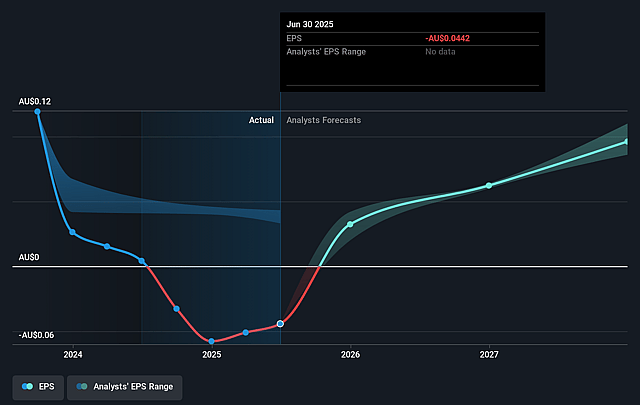

- The bearish analysts expect earnings to reach A$286.4 million (and earnings per share of A$0.14) by about December 2028, up from A$-82.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as A$333.4 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from -89.1x today. This future PE is lower than the current PE for the AU Telecom industry at 262.9x.

- The bearish analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is delivering consistent mobile subscriber gains, taking share from competitors even in a weak international arrivals environment. This supports sustained service revenue growth and could underpin a higher share price through stronger top line performance.

- Disciplined cost control, with operating expenses growing well below inflation and a stated plan to hold OpEx broadly flat in nominal terms to 2029, may structurally lift EBITDA margins and earnings, challenging expectations of long term profit pressure.

- Capital intensity is trending down as major 5G rollout and IT modernization programs peak. Management is guiding to materially lower CapEx from 2026 onwards, which can drive robust free cash flow expansion and support higher equity valuations via improved cash generation.

- Balance sheet strengthening through large scale debt repayment and a clearer, sustainable dividend policy signals improving financial resilience and shareholder returns. This may support multiples and total shareholder return rather than a prolonged share price decline by enhancing net profit after tax and reducing interest expense.

- Strategic positioning as a domestic, low cost challenger with growing digital first brands, fixed wireless leadership and early moves into higher speed fixed broadband could capture long term secular demand for data and convergence, providing multi year support for revenue growth and net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for TPG Telecom is A$3.3, which represents up to two standard deviations below the consensus price target of A$4.77. This valuation is based on what can be assumed as the expectations of TPG Telecom's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.9, and the most bearish reporting a price target of just A$3.3.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be A$5.1 billion, earnings will come to A$286.4 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$3.77, the analyst price target of A$3.3 is 14.2% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.