Key Takeaways

- Investments in advanced networks, digital infrastructure, and automation position Telstra for sustained revenue growth, margin uplift, and expanding high-value digital service offerings.

- Strategic cost discipline and regulatory tailwinds support further operating leverage, diversified revenues, and improved shareholder returns through stronger cash flow.

- Shrinking high-margin revenues, rising competition, heavy network investments, and regulatory pressures undermine diversification, revenue growth, and long-term profitability.

Catalysts

About Telstra Group- Provides telecommunications and information services in Australia and internationally.

- Telstra's ongoing investment in expanding and modernizing its core mobile and fixed network-demonstrated by the rollout of 5G Advanced, intercity fibre projects, and satellite-to-mobile services-positions the company to benefit from surging mobile data consumption, proliferation of connected devices, and the anticipated explosion in demand from IoT, AR/VR, and cloud-enabled applications; these are likely to drive sustained revenue growth and justify premium pricing. (Impacts: Revenue, ARPU, long-term growth)

- Strategic focus on cost discipline, digital transformation, and AI-driven automation (including major staff reorganization, migration to a new digital stack, and rollout of AI initiatives) point to further operating leverage and margin improvement as automation scales and legacy cost structures are reduced, potentially supporting higher net margins and earnings. (Impacts: Net margins, EBITDA, earnings growth)

- Increased monetization of digital infrastructure-such as the intercity fibre network and towers (Amplitel)-plus the structural separation from InfraCo, is expected to unlock new high-margin revenue streams, improve capital efficiency, and underpin stronger free cash flow, enabling enhanced shareholder returns through dividends and buybacks. (Impacts: Free cash flow, net margins, shareholder returns)

- Rising enterprise and government demand for cloud, managed, and cybersecurity services, alongside Telstra's leadership in network quality, sovereign status, and digital transformation partnerships, should drive growth in higher-margin business and digital services, diversifying revenues beyond traditional connectivity. (Impacts: Revenue mix, margin expansion, earnings stability)

- Regulatory and government initiatives aimed at universal connectivity, particularly in regional and remote areas, alongside new spectrum allocations, offer Telstra opportunities to capture market share, benefit from public investment, and enlarge its customer base-all contributing to revenue stability and long-term growth prospects. (Impacts: Revenue growth, addressable market, long-term resilience)

Telstra Group Future Earnings and Revenue Growth

Assumptions

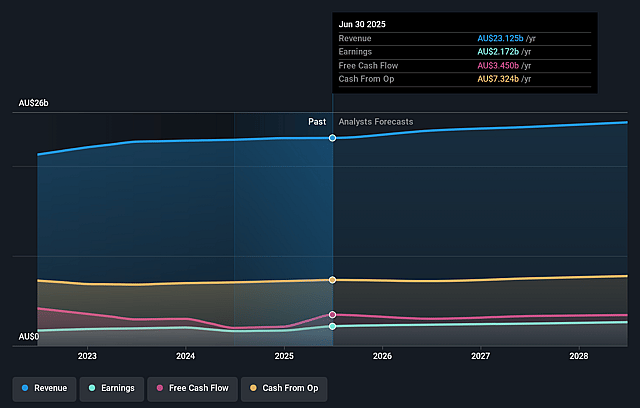

How have these above catalysts been quantified?- Analysts are assuming Telstra Group's revenue will grow by 2.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.4% today to 10.6% in 3 years time.

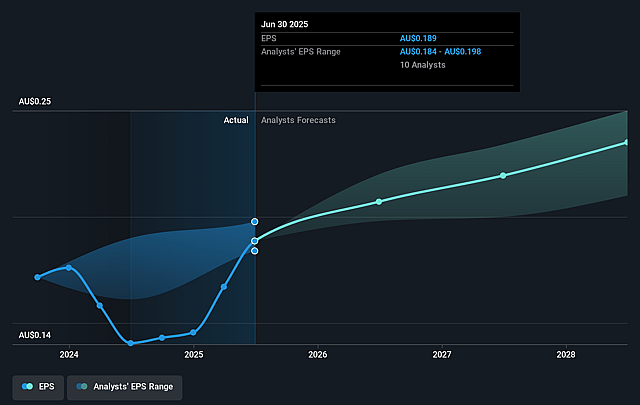

- Analysts expect earnings to reach A$2.6 billion (and earnings per share of A$0.24) by about September 2028, up from A$2.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.5x on those 2028 earnings, down from 25.3x today. This future PE is lower than the current PE for the AU Telecom industry at 620.5x.

- Analysts expect the number of shares outstanding to decline by 1.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Telstra Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing transition away from legacy copper networks and NBN customer losses continues to pressure fixed-line and broadband revenues, while high-margin fixed revenues shrink, limiting both revenue growth and net margins long-term.

- Intensifying competition from MVNOs and digital-native providers in both prepaid and postpaid segments, along with a subdued broader mobile market, increases churn and ARPU compression risk, threatening future mobile revenue growth and margin expansion.

- Dependency on the Australian domestic market, with international EBITDA in decline due to restructuring and exit from NAS products, restricts diversification, leaving Telstra vulnerable to domestic economic downturns, regulatory changes, and earnings volatility.

- Ever-increasing network investment demands (5G/6G, intercity fiber, satellite-to-mobile) paired with only incremental revenue contributions from these projects in the near term risk outpacing revenue growth, pressuring free cash flow and returns on invested capital.

- Regulatory interventions, such as spectrum renewal uncertainty, forced wholesale access, price controls, and potential spectrum allocation changes, may reduce pricing power and profitability, further constraining long-term earnings and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$4.892 for Telstra Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.4, and the most bearish reporting a price target of just A$4.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$24.9 billion, earnings will come to A$2.6 billion, and it would be trading on a PE ratio of 24.5x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$4.84, the analyst price target of A$4.89 is 1.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.