Key Takeaways

- Modular architecture, automation, and open technology could drive margin expansion and scalable growth, far surpassing initial synergy expectations from integration efforts.

- Strong adviser partnerships and next-gen platform features position Praemium for accelerated client acquisition, recurring revenue growth, and defensible long-term market leadership.

- Rapid fintech disruption, fee pressures, and geographic concentration expose Praemium to risks of stalled growth, shrinking margins, and potential loss of market relevance without strategic adaptation.

Catalysts

About Praemium- Provides advisors and wealth management solutions in Australia and internationally.

- While analyst consensus sees integration of OneVue as a source of moderate cost synergies and operational efficiencies, a more bullish view is warranted: Praemium's rapid shift to modular, open architecture and selective use of best-in-class third-party technology could unlock far greater-than-expected automation, allowing fixed-cost scalability and driving substantial expansion in net margins and EBITDA well beyond initial synergy targets.

- Analyst consensus expects the Spectrum platform and high-net-worth adviser focus to expand market share and revenues, but this may be understated given Praemium's strong early wins with large, sophisticated advice firms and the potential to roll out multi-product, full-suite solutions-creating a long runway for cross-sell, upsell, and deeply embedded client relationships that underpin multi-year double-digit revenue and earnings compounding.

- The global demographic shift towards an aging population and the growing need for retirement and sophisticated wealth management solutions are accelerating flows onto Praemium's platforms; as regulatory pressure and fiduciary standards rise, Praemium's integrated compliance and reporting stack position the company as the platform of choice, supporting outsized FUA growth and sustained increases in recurring revenues.

- The industry-wide shift to SaaS-based, cloud-driven investment infrastructure and advisor independence is spawning rapid advisor migration to next-generation platforms-Praemium's investment in user experience, architecture openness, and AI-enabled process automation makes it the likely beneficiary of disproportionate wallet share as legacy platforms struggle to keep pace, driving both new client acquisition and increased average revenue per adviser.

- Praemium's intensified investment in proprietary superannuation administration and alternative asset capabilities not only positions it to capture the booming demand for direct, diversified and alternative asset exposures, but also enables full in-house control of core products, leading to higher net revenue retention, improved product margins, and differentiation that will be increasingly hard for competitors to replicate.

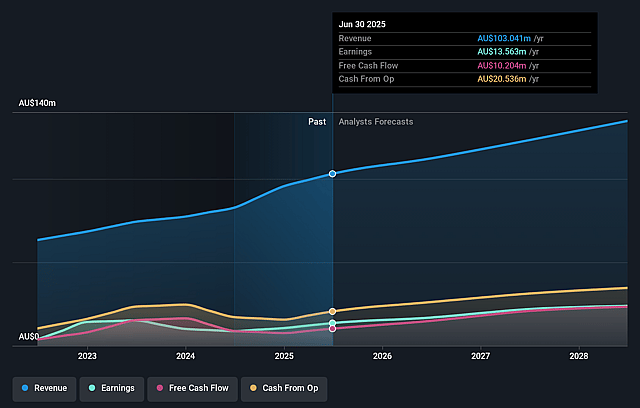

Praemium Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Praemium compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Praemium's revenue will grow by 10.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.2% today to 18.8% in 3 years time.

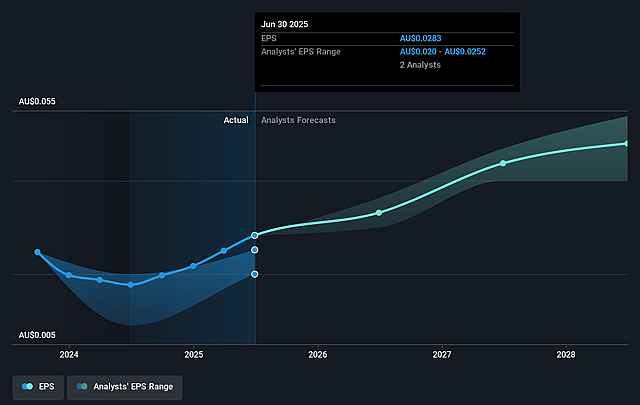

- The bullish analysts expect earnings to reach A$26.3 million (and earnings per share of A$0.06) by about September 2028, up from A$13.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.5x on those 2028 earnings, down from 27.7x today. This future PE is lower than the current PE for the AU Software industry at 33.6x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Praemium Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid industry shifts toward direct-to-consumer investing may bypass Praemium's core high-net-worth adviser channel, potentially reducing future demand for its platform and constraining long-term revenue growth.

- Persistent fee compression and heightened competitive pressure from both larger global incumbents and fintech disruptors could force Praemium to lower its pricing, thereby reducing net margins and earnings sustainability.

- The company's ongoing reliance on legacy technology infrastructure, if not sufficiently modernized despite current investments, may result in higher maintenance costs and slower innovation, putting future operating expenses at risk and threatening its ability to retain or attract clients.

- Heavy dependence on the Australian and UK markets exposes Praemium to region-specific regulatory shifts or economic downturns, leading to possible revenue volatility and stagnating growth if these markets underperform.

- Industry consolidation and M&A among wealth management players may disadvantage Praemium as a niche or smaller platform, threatening its client retention and eroding market share, which would negatively impact both future revenues and operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Praemium is A$1.21, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Praemium's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.21, and the most bearish reporting a price target of just A$0.78.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$140.1 million, earnings will come to A$26.3 million, and it would be trading on a PE ratio of 26.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$0.78, the bullish analyst price target of A$1.21 is 35.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Praemium?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.