Key Takeaways

- Rising regulatory demands and client concentration expose the company to higher costs and volatile revenue, threatening margin stability and earnings predictability.

- Shifting investor preferences and stronger fintech competition risk eroding core revenue streams unless significant innovation and platform relevance are achieved.

- Ongoing technology upgrades, strong product adoption, cost synergies from acquisitions, and increasing recurring revenue support sustained profitability and long-term earnings growth.

Catalysts

About Praemium- Provides advisors and wealth management solutions in Australia and internationally.

- Increasing regulatory burdens and the risk of heightened compliance requirements threaten to escalate operating costs for Praemium, potentially offsetting operational leverage and resulting in long-term contraction of net margins and profitability.

- The ongoing trend of investors favoring passive and self-directed investment options over advisor-mediated platforms directly endangers Praemium's core revenue growth, as future funds under administration (FUA) may stagnate if platform solutions like Praemium's lose relevance among key demographics.

- Rapid generational shifts toward digital-native financial services, including fintech disruptors and neobanks, could erode Praemium's addressable market among younger investors, leading to long-term revenue stagnation unless significant, sustained technology upgrades are made-a risk heightened by the company's current focus on large advice groups and incremental platform enhancements.

- Intensifying competition from larger, vertically integrated fintech and wealth platforms with broader product suites or more aggressive fee structures may force Praemium into discounting its services or engaging in higher R&D spend, eventually compressing net margins and putting pressure on long-term earnings.

- Ongoing dependency on several concentrated client relationships, particularly with large advisory and broking groups, introduces key revenue volatility risks; any material loss of these clients or their insourcing/outsourcing to scale competitors could drive unpredictable and significant declines in both FUA and recurring revenue.

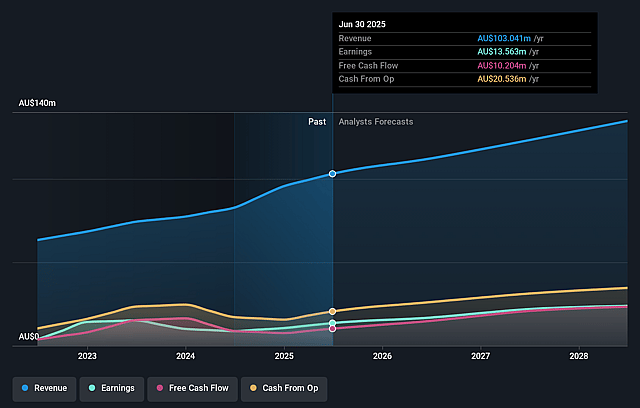

Praemium Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Praemium compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Praemium's revenue will grow by 7.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.2% today to 16.2% in 3 years time.

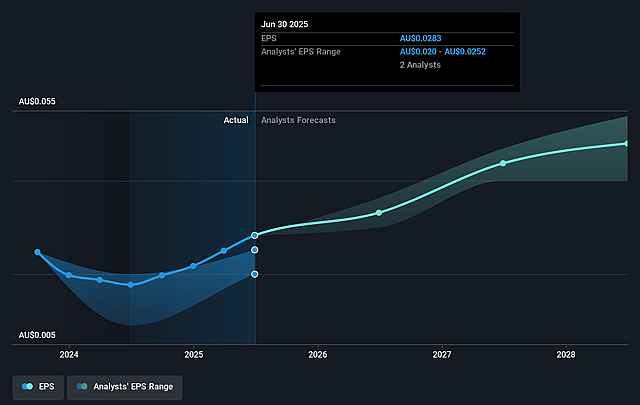

- The bearish analysts expect earnings to reach A$20.8 million (and earnings per share of A$0.04) by about August 2028, up from A$13.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 28.2x today. This future PE is lower than the current PE for the AU Software industry at 29.3x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Praemium Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing technology investment and platform enhancements, particularly in AI and superannuation administration, could drive greater automation and scalability, leading to cost efficiencies and improved net margins over the long term.

- The successful launch and growing adoption of Spectrum as a core platform product, along with recent large client wins and a robust sales pipeline, provide a foundation for continued double-digit revenue growth and higher potential earnings.

- Integration of acquisitions like OneVue, combined with expected realization of cost synergies and supplier consolidation, are likely to further reduce expenses, supporting EBITDA and expanding profitability.

- Secular demand tailwinds-including the shift toward digital, transparent, adviser-driven investment solutions for high-net-worth clients-are expected to sustain platform adoption and recurring revenue growth in Praemium's target markets.

- A disciplined approach to capital allocation, strong liquidity, and ongoing shareholder returns via buybacks and fully franked dividends signal healthy cash generation, reinforcing the company's ability to reinvest and drive long-term earnings per share growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Praemium is A$0.78, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Praemium's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.21, and the most bearish reporting a price target of just A$0.78.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$128.3 million, earnings will come to A$20.8 million, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$0.8, the bearish analyst price target of A$0.78 is 2.3% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Praemium?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.