Key Takeaways

- Heightened regulation, slow platform migration, and reliance on a few major contracts threaten Nuix's revenue stability, margins, and growth prospects.

- Intensifying competition and software commoditization are eroding Nuix's pricing power, market share, and long-term profitability.

- High recurring revenue, global customer base, and strong adoption of advanced analytics solutions support Nuix's stable growth and industry outperformance potential.

Catalysts

About Nuix- Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

- The ongoing increase in global data privacy regulations and compliance requirements is likely to create additional barriers for Nuix, increasing both the cost and complexity of doing business across jurisdictions. This could significantly drive up compliance costs and reduce the company's ability to serve certain markets, ultimately dampening future revenue growth and pressuring net margins.

- Accelerating technological competition from larger, better-capitalized US and Chinese firms poses a persistent threat to Nuix's ability to maintain pricing power and market share. This heightened competition risks eroding Nuix's differentiated value proposition, which could compress both top-line growth and margins over the long run.

- The migration of customers from legacy components to the Neo platform has been notably slower and more complex than anticipated, with sales cycles lengthening as a result. If this trend persists, Nuix may experience delays in revenue recognition and a slowdown in annual contract value growth, as well as increased customer churn as frustrated clients seek simpler alternatives.

- Revenue concentration among a small number of large enterprise contracts increases vulnerability to significant ACV and earnings volatility. The fact that a single customer or delayed large deal moving into a subsequent period can swing growth by several percentage points signals a lack of diversification that threatens long-term earnings stability.

- As forensic and eDiscovery software becomes increasingly commoditized and hyperscalers like Microsoft and AWS bundle more robust investigative offerings into their platforms, Nuix's ability to command premium pricing will diminish, likely resulting in downward pricing pressure, reduced profitability, and weaker revenue retention over time.

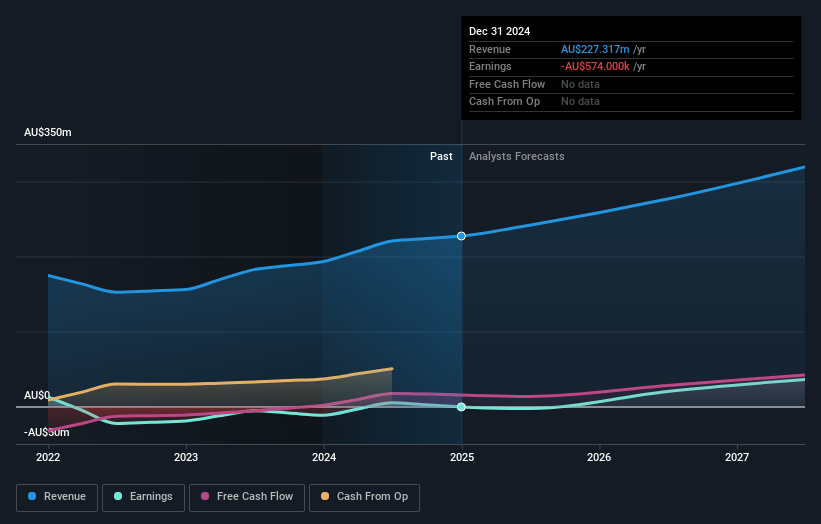

Nuix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Nuix compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Nuix's revenue will grow by 12.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.2% today to 27.9% in 3 years time.

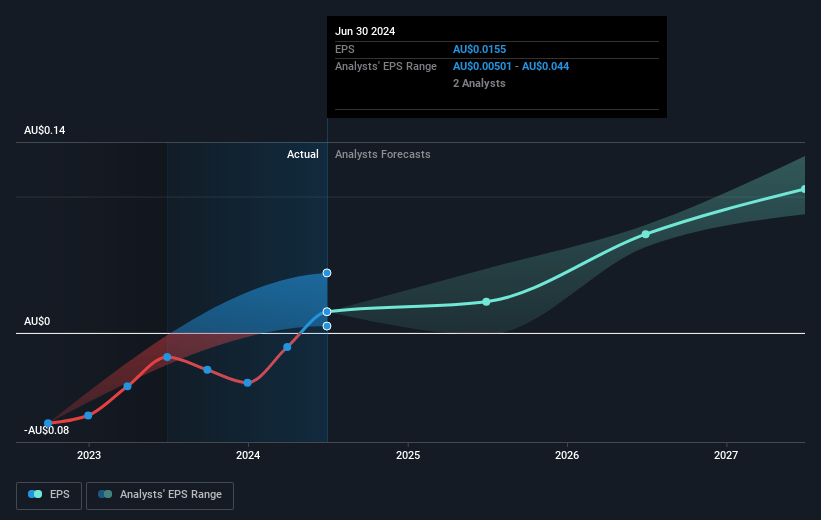

- The bearish analysts expect earnings to reach A$90.4 million (and earnings per share of A$0.24) by about July 2028, up from A$-546.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from -1526.5x today. This future PE is lower than the current PE for the AU Software industry at 73.8x.

- Analysts expect the number of shares outstanding to grow by 2.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Nuix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nuix's sustained growth in subscription annual contract value, with 97% of ACV now recurring and a 13.3% lift year-on-year in this segment, enhances future revenue predictability and stability, strengthening medium

- to long-term cash flows.

- Accelerated uptake and successful roll-out of Nuix Neo, especially among enterprise customers where average deal sizes are two to three times larger than legacy product deals, may materially boost both top-line revenue growth and profitability in subsequent periods.

- Ongoing significant investment in AI, machine learning, and patented deep learning frameworks positions Nuix to deliver premium, differentiated data analytics products that command higher margins and support long-term earnings growth.

- Nuix's diversified and globally distributed client base, with over 80% of ACV from outside Australia and 85% customer retention over five years, limits regional risks and contributes to steady recurring revenues with limited client churn.

- The company's clear alignment with long-term secular trends-such as exponential data growth, complexity in regulatory compliance, and the need for faster forensic and legal investigations-supports enduring demand for Nuix's solutions, potentially driving revenue and cash flow growth well above industry averages.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Nuix is A$2.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nuix's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.09, and the most bearish reporting a price target of just A$2.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$324.0 million, earnings will come to A$90.4 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$2.52, the bearish analyst price target of A$2.5 is 0.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.