Key Takeaways

- Nuix Neo's rapid enterprise adoption, advanced AI capabilities, and industry positioning are set to drive stronger revenue, margin growth, and long-term customer value.

- Operational restructuring and flexible deployment options boost innovation, efficiency, and new market penetration, supporting sustained margin expansion and higher customer retention.

- Slow Neo platform migration, customer concentration, legal burdens, regulatory costs, and intensifying competition risk Nuix's revenue stability, profitability, and long-term market position.

Catalysts

About Nuix- Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

- Analyst consensus expects Nuix Neo to drive higher-value contracts and steady ACV growth, yet the scale of opportunity is being understated; with Neo sales already averaging two to three times the size of legacy deals and rapid pipeline momentum in large enterprise accounts, Neo could quickly deliver an outsized step-change in both revenue and net margins as adoption accelerates among global clients managing surging unstructured data volumes.

- While consensus views AI and R&D investments as incrementally positive, the recently patented deep learning framework underpins multi-year product leadership in semantic and cognitive AI-a game-changing capability that can establish Nuix as the platform of choice in complex investigative, compliance, privacy, and forensic domains, enabling ongoing product upsell and premium pricing that could structurally enhance long-term profit margins and lifetime customer value.

- Nuix's unique position at the intersection of exploding regulatory scrutiny and global data generation, combined with its proven capability to serve high-value workloads in financial, government, and healthcare sectors, creates a long runway for double-digit ACV and revenue growth as these industries face unprecedented pressure to modernize eDiscovery and compliance through robust, cloud-integrated platforms.

- The operational restructuring, which consolidated global engineering talent and slashed cross-region inefficiencies, is likely to deliver a sustained reduction in R&D overhead and boost innovation velocity, directly supporting future margin expansion and freeing up incremental cash flow for further technology investment or shareholder returns.

- The flexibility of Nuix's deployment-including public cloud, private cloud, and new rapid local deployments-positions the company to unlock new enterprise sales in underpenetrated regions and mid-market segments while maximizing win rates in a consolidating legal tech market, benefiting top-line growth and increasing customer stickiness, which can further drive net dollar retention higher over time.

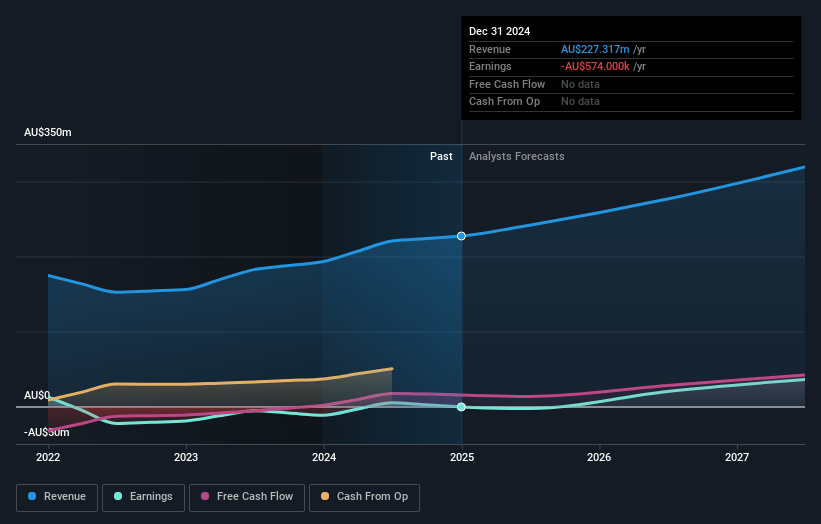

Nuix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nuix compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nuix's revenue will grow by 22.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.2% today to 21.6% in 3 years time.

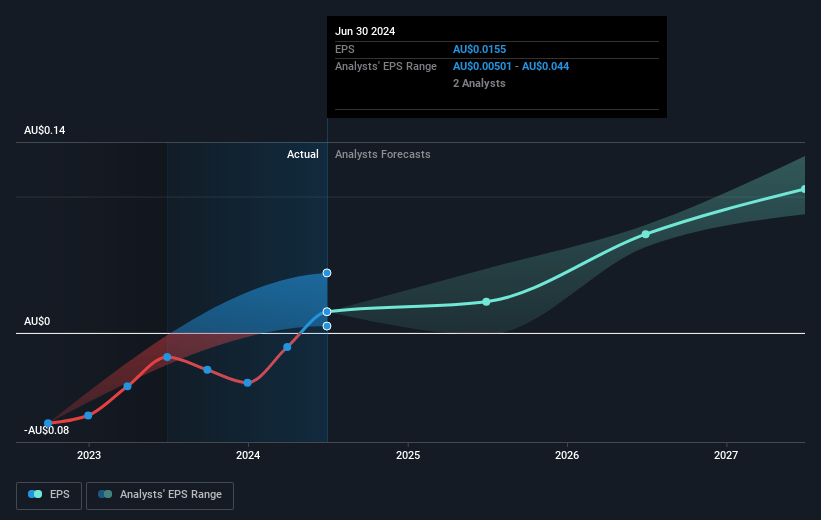

- The bullish analysts expect earnings to reach A$90.7 million (and earnings per share of A$0.24) by about July 2028, up from A$-546.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.8x on those 2028 earnings, up from -1471.9x today. This future PE is lower than the current PE for the AU Software industry at 73.4x.

- Analysts expect the number of shares outstanding to grow by 2.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

Nuix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing migration of existing customers from Nuix's older component-based products to the new Neo platform has been slower and more complex than expected, which risks extending sales cycles and potentially elevating churn, thereby restraining near-term revenue growth and compressing net margins.

- Nuix's heavy reliance on large enterprise and government contracts, with one or two major deals able to swing annual performance by multiple points of ACV growth, leaves revenue and earnings vulnerable to customer concentration risk if a key contract is lost or delayed.

- Persistent nonoperational legal expenses and lingering reputational impacts from historic governance issues continue to weigh on cash flow, risk Nuix's ability to secure high-profile or government contracts, and may suppress long-term earnings growth.

- As global data privacy and localization regulations intensify, Nuix faces rising compliance burdens and may need to operate costlier, regionally fragmented infrastructure, leading to higher operating costs and downward pressure on future profitability.

- Increased competition from larger technology players integrating advanced AI and analytics into their product suites, alongside commoditization and open-source alternatives in digital forensics, could diminish Nuix's pricing power and market share, ultimately threatening recurring revenues and margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nuix is A$6.09, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nuix's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.09, and the most bearish reporting a price target of just A$2.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$420.5 million, earnings will come to A$90.7 million, and it would be trading on a PE ratio of 29.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$2.43, the bullish analyst price target of A$6.09 is 60.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.