Key Takeaways

- Accelerated store expansion into new global markets and enhanced omnichannel strategy position Lovisa for significant revenue and market share growth.

- Sustained margin improvements, innovative product cycle, and digital engagement drive brand relevance and support structurally higher profitability.

- Reliance on physical store expansion amid rising sustainability concerns, inflation, and shifting consumer behaviors poses significant risks to growth, margins, and brand longevity.

Catalysts

About Lovisa Holdings- Engages in the retail sale of fashion jewelry and accessories.

- Analyst consensus views the global store rollout as a steady revenue growth driver, but this potentially understates the scale and runway remaining; Lovisa has significant 'white space' in underpenetrated developed and emerging markets across Europe, North America, and Asia, and management guides to an acceleration in store openings above prior years, pointing to the potential for an inflection in topline revenue growth as the brand moves from hundreds to potentially thousands of stores worldwide.

- Analysts broadly agree gross margin improvements are sustainable, but this may be a base-case scenario; with continued gains from tighter inventory management, robust supplier cost control, dynamic localized pricing, and further expansion of direct distribution centers, Lovisa could surpass historical gross margin levels and deliver structurally higher net margins-especially as scale increases in key markets drive overhead leverage.

- Lovisa's differentiated, high-velocity product design and refresh model alongside deep data analytics fosters stronger brand relevance among fashion-forward Gen Z and Millennial consumers; this supports higher transaction frequency, higher conversion rates, and stronger repeat customer economics, laying the foundation for outperformance in both revenue and earnings growth.

- The aggressive expansion of omnichannel offerings, including deeper integration on third-party online marketplaces and increased use of influencer-driven social commerce, significantly enhances customer acquisition and engagement while giving Lovisa a data-driven edge over less digitally capable peers, translating to higher revenues and potential e-commerce margin upside as scale builds.

- Market consolidation in the global value accessories sector-in part due to pressure on legacy retailers and smaller chains-positions Lovisa to capture market share, enjoy increased pricing power, and drive above-market revenue and earnings growth as competitors exit, especially amid rising discretionary spending from the growing global middle class in urban centers.

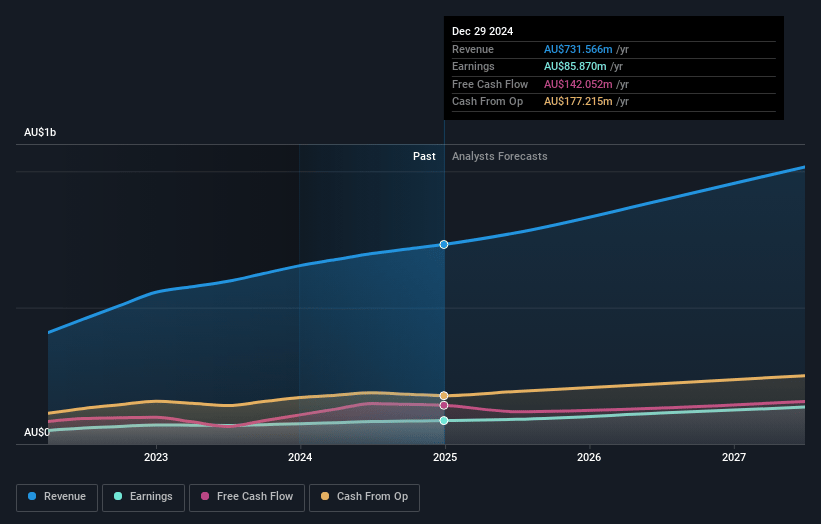

Lovisa Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lovisa Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lovisa Holdings's revenue will grow by 19.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.7% today to 12.7% in 3 years time.

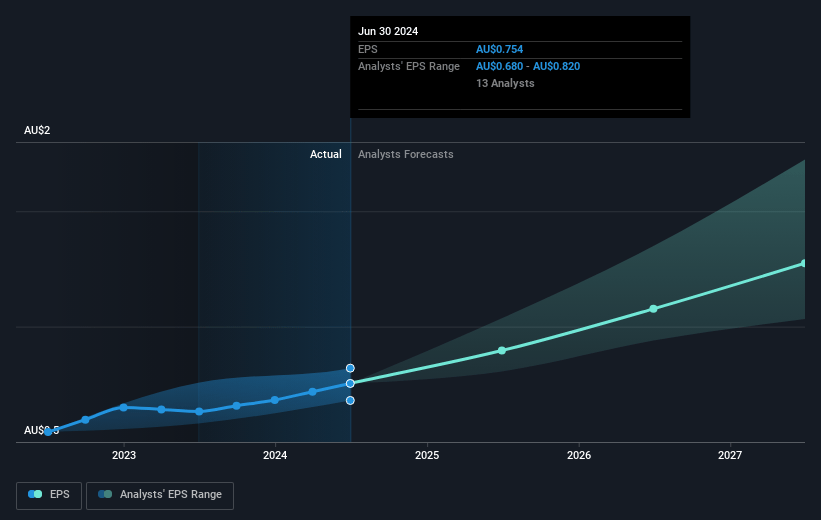

- The bullish analysts expect earnings to reach A$160.2 million (and earnings per share of A$1.45) by about July 2028, up from A$85.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.7x on those 2028 earnings, down from 41.6x today. This future PE is greater than the current PE for the AU Specialty Retail industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

Lovisa Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Flat comparable store sales growth and reliance on new store openings to drive overall sales highlight the risk of market saturation and weakening organic demand, which could weigh on future revenue growth if expansion opportunities contract.

- The company's business model-centered around affordable, trendy jewellery-faces rising long-term risks from global anti-fast fashion sentiment and increasing consumer demand for sustainability, potentially eroding brand reputation and reducing both sales volume and customer retention.

- Lovisa's international expansion, particularly into new and developing markets, brings increased geopolitical, regulatory, and operational complexities that could drive up fixed costs, compress margins, and threaten long-term earnings resilience if market entry strategies underperform.

- Elevated cost-of-living pressures and ongoing inflationary trends may dampen discretionary spending on non-essential items like fashion accessories, which could constrain same-store sales recovery and diminish overall gross and net profit margins in future periods.

- Heavy dependence on physical retail stores exposes Lovisa to long-term declines in mall and retail foot traffic, especially as younger shoppers shift towards online and experiential spending, which may undermine store productivity and increase operational costs, putting persistent pressure on earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lovisa Holdings is A$35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lovisa Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$35.0, and the most bearish reporting a price target of just A$22.87.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$1.3 billion, earnings will come to A$160.2 million, and it would be trading on a PE ratio of 30.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$32.24, the bullish analyst price target of A$35.0 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.