Key Takeaways

- Aggressive physical store expansion brings risks of market saturation, store cannibalization, and exposure to shifting consumer habits toward online and digital-native brands.

- Heightened sustainability concerns, volatile input costs, and changing fashion trends threaten margin stability and earnings through increased expenses and inventory risks.

- Aggressive global expansion, high profitability, strong financial health, and continued investment in digital and omnichannel initiatives support sustained growth and resilience against market challenges.

Catalysts

About Lovisa Holdings- Engages in the retail sale of fashion jewelry and accessories.

- As Lovisa expands its global store network at a rapid pace, the risk of market saturation and store cannibalization is rising, particularly in established regions such as Europe and North America, which could lead to diminishing returns on capital, weaker revenue growth from new stores, and eventually lower overall earnings growth.

- Intensifying consumer scrutiny on sustainability and ethical sourcing threatens the appeal of fast-fashion jewelry, forcing Lovisa to either absorb rising supply chain and compliance costs or risk losing market share among increasingly eco-conscious shoppers; either scenario could result in shrinking net margins and higher costs of doing business.

- With the ongoing global shift toward digital-native brands and online shopping, Lovisa's heavy reliance on physical store rollout as its main growth driver exposes the company to declining foot traffic and flattening same-store sales growth, especially if digital execution fails to compensate, directly impacting like-for-like sales and future revenue growth.

- Rising cost pressures related to global inflation, labor, rent, and freight, combined with Lovisa's value-focused product positioning, constrain the company's ability to consistently pass costs onto consumers without sacrificing sales volumes, placing downward pressure on gross and net margins over the longer term.

- Dependence on a narrow product range focused on affordable trend-based jewelry leaves Lovisa vulnerable to abrupt changes in consumer preference and fashion cycles, increasing inventory risk and the potential for markdowns and write-downs, undermining gross margin stability and ultimately earnings quality.

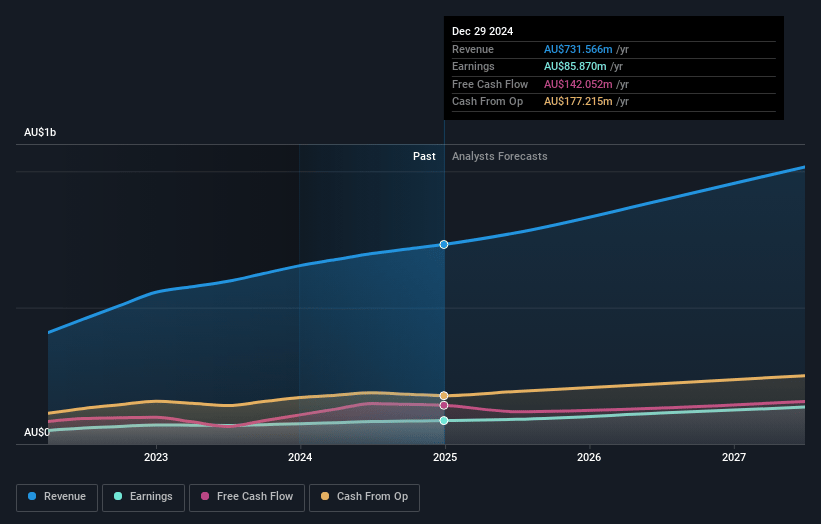

Lovisa Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lovisa Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lovisa Holdings's revenue will grow by 14.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.7% today to 11.6% in 3 years time.

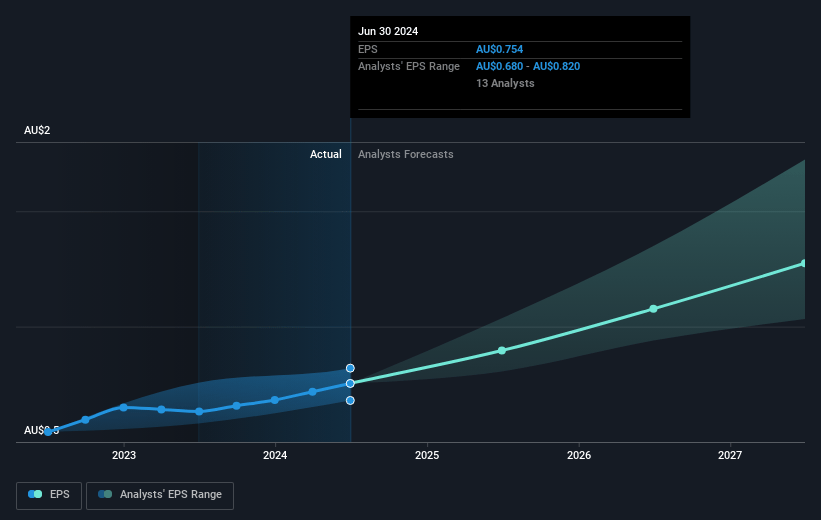

- The bearish analysts expect earnings to reach A$127.5 million (and earnings per share of A$1.16) by about July 2028, up from A$85.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.2x on those 2028 earnings, down from 41.5x today. This future PE is greater than the current PE for the AU Specialty Retail industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Lovisa Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lovisa is demonstrating robust international expansion, with 57 new stores opened in the half and an accelerating rollout pipeline, especially across Europe and the Americas, which is likely to drive continued growth in revenue as the addressable market increases.

- Gross margins are at an all-time high of over 82%, supported by disciplined inventory, supply chain efficiencies, prudent pricing, and careful promotional activity, which collectively are improving profitability and helping to offset cost inflation, thereby supporting net margin expansion.

- Strong cash flow generation and a solid balance sheet, including net cash and significant undrawn debt facilities, position Lovisa well to fund future growth and invest in further expansion without taking on financial strain, supporting long-term earnings.

- Ongoing investments in digital innovation, omnichannel capabilities, and customer experience (such as new warehouses and e-commerce marketplace expansion) provide structural advantages in reaching new customers and driving both store and online sales, which could lead to higher sales and market share growth over time.

- Management is confident about significant global white space still available for rollout, with scalable infrastructure in place and demonstrated ability to generate strong returns in diverse markets, suggesting long-term revenue and profit growth potential remains intact despite near-term market or regional challenges.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lovisa Holdings is A$22.87, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lovisa Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$35.0, and the most bearish reporting a price target of just A$22.87.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$1.1 billion, earnings will come to A$127.5 million, and it would be trading on a PE ratio of 25.2x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$32.2, the bearish analyst price target of A$22.87 is 40.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.