Key Takeaways

- Heavy reliance on a single product and difficult regulatory environments create significant risks for revenue growth and long-term earnings stability.

- Intensifying competitive, cost, and operational pressures may delay profitability gains, especially without faster product adoption and revenue diversification.

- Heavy dependence on a single flagship product, regulatory hurdles, pricing pressures, and supply chain risks threaten sustainable growth and earnings stability in key international markets.

Catalysts

About Medical Developments International- Manufactures and distributes emergency medical solutions in Australia, Asia, Europe, the United States, and internationally.

- Although the extension of the Penthrox pediatric label in Europe and expected national regulatory approvals could substantially expand the addressable market and drive significant volume growth from FY '27 onward, the actual ramp-up may be constrained by slow adoption in conservative public health systems and the persistent need for extensive behavioral change among clinicians, resulting in a delay before anticipated revenue growth materializes.

- While global demand for non-opioid pain management and emergency care is set to increase due to the aging population and efforts to reduce opioid use, Medical Developments International remains heavily reliant on Penthrox as its flagship product. This concentration risk means any regulatory setbacks, adverse safety data, or emerging alternative therapies could have a pronounced negative impact on revenue and long-term earnings.

- Despite a stable balance sheet, strong cash position, and improved operating efficiencies this year, the company's medium-term profitability faces headwinds from rising input costs, inflation, and new tariff challenges in the U.S. respiratory segment, which may pressure gross margins and introduce further earnings volatility until a more diversified revenue base is established.

- Although international partnerships in France and Switzerland should allow lower-cost market access and higher long-term volumes, expected near-term revenue and margin softness-combined with variable partner performance and contractual uncertainties-could temper the pace of margin improvement and delay meaningful earnings uplift.

- While underlying demographic and healthcare infrastructure trends support the long-term relevance of MVP's products, accelerated R&D spending and the need to generate continual evidence for behavioral change in hospital adoption expose the company to potential inefficiencies, sunk costs from unsuccessful initiatives, and lower operating leverage if scaling does not occur as projected, ultimately constraining medium-term net profit growth.

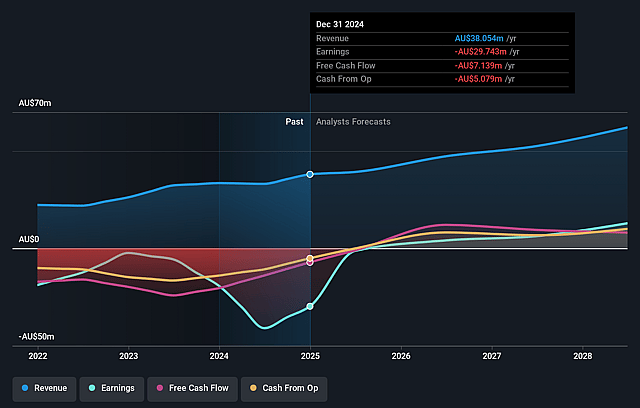

Medical Developments International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Medical Developments International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Medical Developments International's revenue will grow by 12.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.2% today to 2.3% in 3 years time.

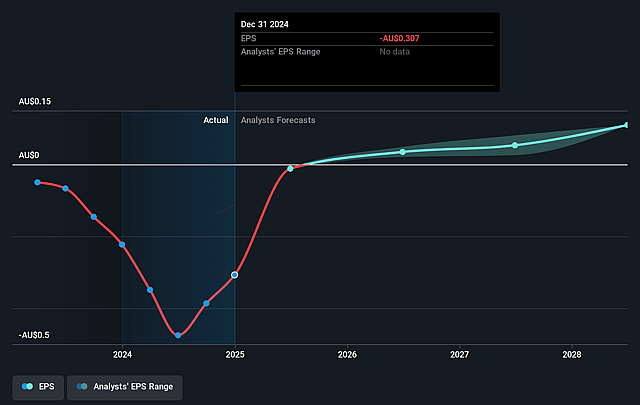

- The bearish analysts expect earnings to reach A$1.3 million (and earnings per share of A$0.01) by about September 2028, up from A$94.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 84.1x on those 2028 earnings, down from 707.1x today. This future PE is greater than the current PE for the AU Pharmaceuticals industry at 14.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Medical Developments International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a heavy reliance on Penthrox as the flagship product, which exposes the company to concentration risk; any regulatory delay, adverse safety finding, or loss of exclusivity could significantly impact revenue and net profit.

- While international expansion is a core growth driver, ongoing challenges in scaling across diverse regulatory environments and adapting to local market dynamics may slow market penetration and lead to higher-than-expected operating costs, thereby constraining earnings growth.

- Intense pricing pressures from global health systems and payers, along with the need to pass on inflationary and tariff-related costs (especially in the U.S. Respiratory segment), may limit the company's ability to maintain or grow margins and can create volatility in operating profits.

- The company faces execution risk in shifting behavioral patterns to embed Penthrox as a standard of care in targeted hospital and emergency department settings; slow uptake or failure to achieve the necessary behavioral change could stunt volume growth and restrict long-term revenue upside.

- Ongoing trade tensions, changing tariff regimes, and supply chain vulnerabilities-such as the U.S. increasing tariffs on respiratory product imports from Taiwan-could erode profit margins, disrupt product availability, and create earnings uncertainty for the company in key markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Medical Developments International is A$0.8, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Medical Developments International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.73, and the most bearish reporting a price target of just A$0.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$55.0 million, earnings will come to A$1.3 million, and it would be trading on a PE ratio of 84.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$0.59, the bearish analyst price target of A$0.8 is 26.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.