Key Takeaways

- Rising industry digitalization, ESG requirements, and circular economy trends threaten Perenti's market size, future contracts, and long-term revenue prospects.

- Heavy reliance on high-risk regions and capital-intensive operations exposes Perenti to geopolitical disruptions and persistent margin pressures.

- Diversified operations, focus on underground and gold mining, technology investment, geographic expansion, and disciplined capital management position Perenti for stable long-term growth and profitability.

Catalysts

About Perenti- Operates as a mining services company worldwide.

- As the mining industry undergoes rapid digitalization and increased automation, large mining companies are expected to increasingly internalize advanced technology solutions rather than outsourcing to contractors, reducing the future addressable market for Perenti and directly pressuring long-term revenue growth and contract win rates.

- The global acceleration of ESG-driven regulations and societal pressure for sustainable mining is set to shrink the market for certain commodities, especially coal and other high-emission metals, potentially leading to a reduction in mining project pipelines and directly impacting Perenti's future sales and profitability.

- Persistent geographic concentration in high-risk regions such as Africa and Australia leaves Perenti exposed to severe geopolitical and jurisdictional risks, so any political instability, regulation shift, or adverse local developments could abruptly disrupt operations and erode stable recurring revenue.

- The capital-intensive nature of maintaining and upgrading specialized mining fleets, paired with rising input cost inflation for labor, consumables, and fuel, is likely to structurally compress net margins during prolonged periods of weaker commodity prices or subdued sector investment cycles.

- Growing global adoption of resource recycling, material substitution, and circular economy practices diminishes the demand for primary extraction and specialist mining services over time, resulting in a structurally declining market and lower visibility on long-term revenue and cash generation for Perenti.

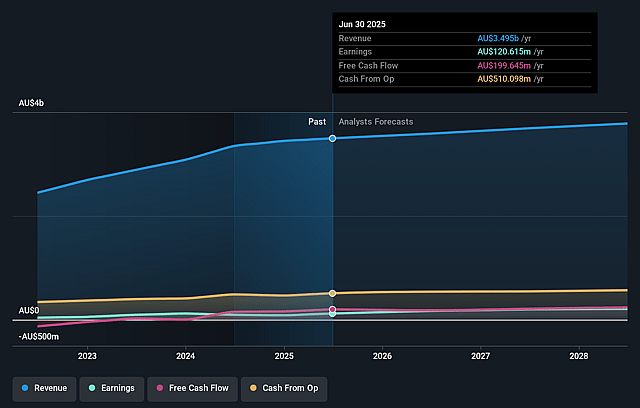

Perenti Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Perenti compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Perenti's revenue will grow by 5.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.5% today to 5.2% in 3 years time.

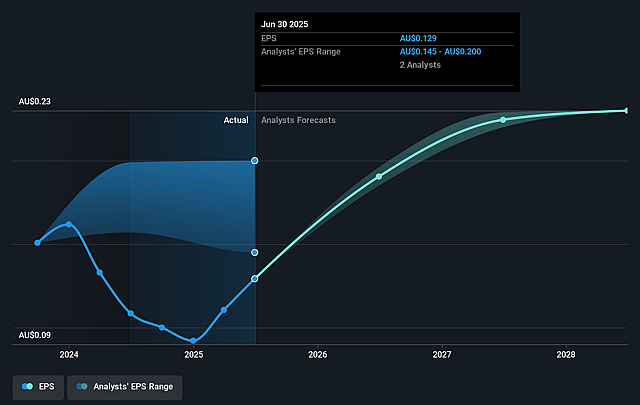

- The bearish analysts expect earnings to reach A$211.0 million (and earnings per share of A$0.29) by about August 2028, up from A$87.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, down from 19.0x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 13.4x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Perenti Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Perenti's resilient and diversified operating model, spanning contract mining, drilling, and mining services across multiple continents, positions it to weather commodity and mining cycles, which supports revenue and earnings stability over the long term.

- The company is capitalizing on the secular shift towards underground mining and gold, both areas with rising long-term demand and higher barriers to entry, which should underpin consistent cash flow and support long-term revenue and profit growth.

- Continued investment in technology, safety systems, digitalization, and operational efficiency (such as through the integration of Idoba and synergies from the DDH1 acquisition) is likely to deliver cost savings and margin expansion, positively impacting net margins and overall profitability.

- Strategic expansion into North America and further diversification into surface mining, and a $16 billion pipeline and $4.7 billion work in hand, gives Perenti visible avenues for future contract wins and revenue growth, reducing dependence on any single project or geography.

- Strong balance sheet discipline-highlighted by healthy free cash flow generation, reduced net leverage, active debt management, and a formal capital management framework including dividends and buybacks-elevates shareholder returns and financial resilience, supporting sustained earnings and dividend growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Perenti is A$1.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Perenti's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.96, and the most bearish reporting a price target of just A$1.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$4.1 billion, earnings will come to A$211.0 million, and it would be trading on a PE ratio of 7.2x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$1.78, the bearish analyst price target of A$1.3 is 36.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Perenti?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.