Last Update 18 Dec 25

Fair value Increased 58%PRN: Index Additions Will Highlight Balanced Outlook For Earnings And Risk

Analysts have increased their price target on Perenti from A$1.96 to A$3.10 per share, citing a higher justified valuation multiple, despite slightly softer assumptions for revenue growth and profit margins and a modestly higher discount rate.

What's in the News

- Perenti Limited (ASX:PRN) has been added to the S&P/ASX 200 Materials Sector Index, reflecting its growing scale and relevance within the sector (Key Developments)

- Perenti Limited (ASX:PRN) has also been added to the broader S&P/ASX 200 Index, increasing its visibility among institutional investors and index funds (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has risen significantly from A$1.96 to A$3.10 per share, implying a materially higher fair value estimate.

- Discount Rate has increased slightly from 7.92 percent to 8.30 percent, reflecting a modestly higher perceived risk profile or cost of capital.

- Revenue Growth has been revised down from 5.83 percent to 4.38 percent annually, indicating more conservative top line expectations.

- Net Profit Margin has been trimmed from 7.23 percent to 6.22 percent, suggesting a slightly less optimistic view on profitability.

- Future P/E has expanded sharply from 7.8x to 14.5x, pointing to a substantially higher valuation multiple despite softer operating assumptions.

Key Takeaways

- Perenti is set for material gains in margins and revenue from strong contract pipelines, market expansion, and surging demand for battery metals and mining services.

- Technological investments and North American market entry position the company for sustainable cost reductions, efficiency gains, and significant upside beyond current market expectations.

- Heavy reliance on specific commodities and regions, rising costs, compliance burdens, and slow tech adoption threaten revenue stability, profitability, and competitive positioning.

Catalysts

About Perenti- Operates as a mining services company worldwide.

- Analyst consensus expects cost synergies and margin improvement from Drilling Services, but this could be materially understated; as global exploration returns to cycle highs and Perenti leverages its newfound scale and best-in-class teams, the division could see a significant structural uplift in utilization, pricing power, and margins, supporting a step change in medium-term earnings and free cash flow.

- While analysts broadly recognize $2 billion of near-term contract wins in Contract Mining, they underestimate the potential for Perenti's robust $16 billion pipeline and proven contract rollover rate to not only deliver these wins, but also drive sustained multi-year revenue and margin expansion as large-scale miners continue to outsource and extend life-of-mine contracts.

- Perenti is poised to disproportionately benefit from the accelerating global demand for battery metals and electrification-related minerals, given its established presence in key jurisdictions and technical expertise in hard rock mining and drilling, opening substantial new contract opportunities and underpinning higher long-term revenue growth.

- The company's investments in automation, digital technologies, and fleet optimization are likely to create a positive feedback loop of ongoing cost reductions and operational efficiencies, enhancing EBITDA margins and expanding return on invested capital beyond current market expectations.

- The recent strategic entry into the North American underground market, validated by wins like Goldrush and cross-division synergies with Swick, provides a platform for rapid expansion in the world's largest hard rock mining market; pipeline potential here is likely not reflected in current consensus, providing scope for substantial upside surprise in both revenue and earnings within the next several years.

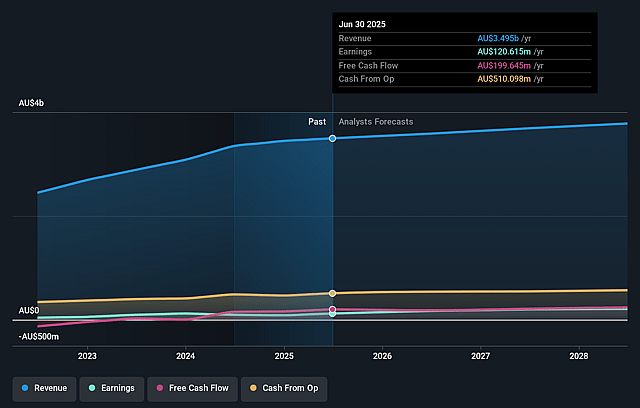

Perenti Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Perenti compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Perenti's revenue will grow by 5.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.5% today to 7.2% in 3 years time.

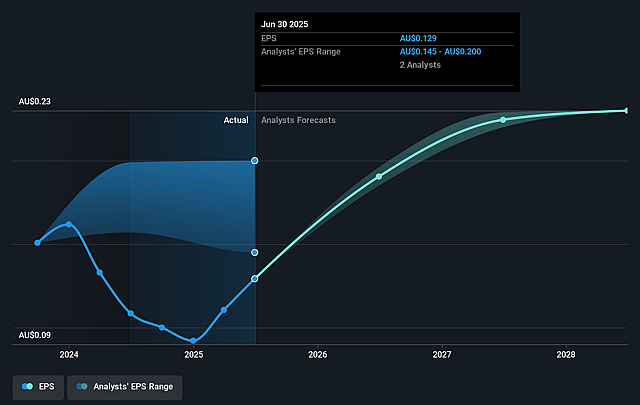

- The bullish analysts expect earnings to reach A$295.2 million (and earnings per share of A$0.4) by about August 2028, up from A$87.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 18.7x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 13.4x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Perenti Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Perenti remains highly exposed to underground gold mining and select commodity types, which heightens vulnerability to long-term shifts such as accelerated decarbonization and reduced demand for traditional mined resources, risking future revenue stability as major mining clients redirect capital away from these projects.

- The company's significant operations in Africa and other emerging markets face heightened ESG scrutiny and growing social license requirements, leading to increased compliance obligations and the risk of project delays or cancellations that could materially impact contract pipeline conversion and future revenue growth.

- Rising input costs for energy, equipment, and skilled labor have already led to margin pressure, as reflected in the recent decrease in EBIT(A) margin; ongoing inflationary trends in the mining services industry may further compress net margins and reduce earnings over time.

- The text highlights delays in BTP fleet utilization and ongoing underperformance at the Zone 5 contract in Botswana, which, when combined with client and geographic concentration in contract mining (72 percent of group revenue and 75 percent of operating profit), create persistent earnings volatility and risk to sustained cash flow.

- While the company touts diversification and scale, management has acknowledged that technological innovation-such as automation or advanced digital solutions-remains a work in progress, raising the risk that Perenti will fall behind more technologically advanced competitors, ultimately eroding market share and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Perenti is A$1.96, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Perenti's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.96, and the most bearish reporting a price target of just A$1.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$4.1 billion, earnings will come to A$295.2 million, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$1.75, the bullish analyst price target of A$1.96 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Perenti?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.