Catalysts

About Nufarm

Nufarm develops and supplies crop protection products and seed technologies to farmers globally, with a growing focus on bioenergy and specialty platforms.

What are the underlying business or industry changes driving this perspective?

- Although Nufarm is positioned to benefit from expanding global biofuel mandates through its carinata bioenergy partnership with BP, the pace and consistency of regulatory implementation and feedstock certification could be slower than expected. This may limit upside in seed margins and associated oil sharing and could constrain revenue growth.

- While the shift of omega-3 production to South America aims to lower cost of goods over time, execution risks around new growing regions, customer offtake agreements and volatile fish oil reference prices may delay a return to breakeven and keep the emerging platforms a drag on earnings and net margins.

- Although active ingredient prices and channel inventories have normalized, any renewed input cost inflation from China or supply dislocations could compress the recently improved Crop Protection gross margin and moderate EBITDA growth below current expectations.

- While hybrid seeds have strong IP and growth potential in South America and Australia, ongoing climate variability and regional disruptions such as the prolonged Russia and Ukraine conflict may cap volume growth and require higher working capital buffers. This could limit operating leverage and earnings expansion.

- Despite a disciplined CapEx plan below $200 million and targeted leverage reduction to 2.0 times, higher for longer interest rates and any under delivery on working capital efficiencies would slow deleveraging, increase net financing costs and temper the translation of operational improvements into net profit growth.

Assumptions

This narrative explores a more pessimistic perspective on Nufarm compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

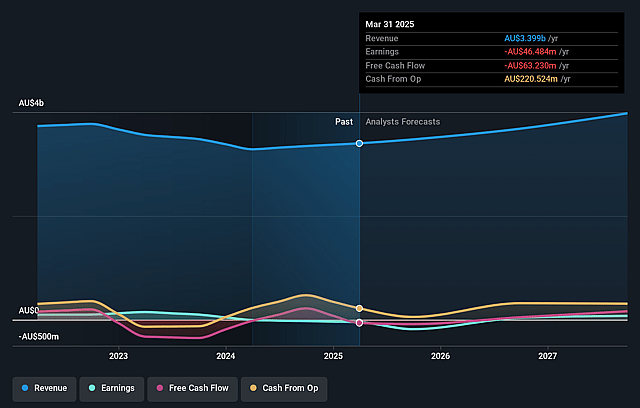

- The bearish analysts are assuming Nufarm's revenue will grow by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -5.4% today to 2.2% in 3 years time.

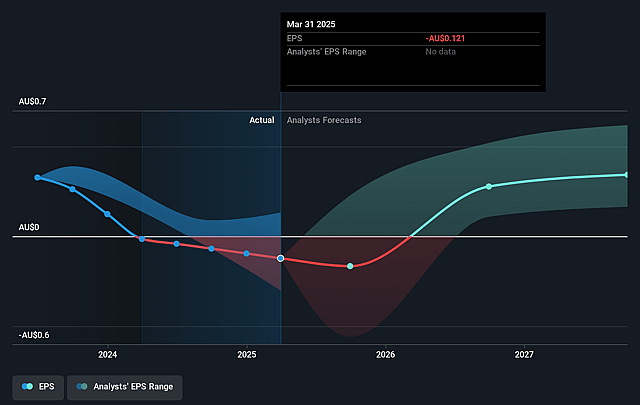

- The bearish analysts expect earnings to reach A$83.6 million (and earnings per share of A$0.23) by about December 2028, up from A$-187.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as A$132.4 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, up from -4.5x today. This future PE is lower than the current PE for the AU Chemicals industry at 50.3x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Stronger than expected structural improvement in Crop Protection profitability, supported by higher margin new product introductions contributing around 15% of revenue and stabilizing active ingredient prices, could drive sustained EBITDA and earnings growth that leads to a re-rating of the share price and an expansion in net margins and return on capital.

- Successful execution of the reprioritized Seed Technologies strategy, with hybrid seeds already generating $67 million of EBITDA and showing growth in South America and Australia, could deliver a long runway of cash generative expansion that lifts group revenue, operating leverage and earnings above current expectations.

- Secular tailwinds from tightening biofuel and Renewable Energy Directive mandates, rising GHG credit values in Europe from about $75 to more than $250 per ton of carbon and expanding carinata plantings under the BP partnership, could create a high growth bioenergy platform that materially enhances long term revenue visibility, seed margins and oil sharing income.

- Disciplined cost out programs, lower CapEx targeted below $200 million, improved working capital efficiency and materially reduced omega-3 cash requirements could accelerate deleveraging from 2.7 times toward 2.0 times, lowering net financing costs and supporting faster growth in net profit and free cash flow than implied by a flat share price.

- A cyclical and structural recovery in omega-3 economics driven by tighter fish oil quotas in North Atlantic and Peru and potential future global deregulation in the 2027 to 2028 window, combined with shifting production to lower cost South American regions, could turn a current loss making platform into a profitable contributor that boosts group earnings growth and improves overall net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Nufarm is A$2.22, which represents up to two standard deviations below the consensus price target of A$2.99. This valuation is based on what can be assumed as the expectations of Nufarm's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.6, and the most bearish reporting a price target of just A$2.22.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be A$3.8 billion, earnings will come to A$83.6 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of A$2.2, the analyst price target of A$2.22 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nufarm?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.