Last Update 27 Sep 25

Fair value Decreased 13%Biological And Crop Protection Expansion Will Cultivate Agricultural Sustainability

A lower discount rate has been offset by a notable decline in net profit margin, contributing to the reduction in Nufarm's consensus analyst price target from A$3.55 to A$3.10.

What's in the News

- Nufarm Limited (ASX:NUF) dropped from S&P/ASX 200 Index.

- Nufarm Limited (ASX:NUF) dropped from S&P/ASX 200 Materials Sector Index.

Valuation Changes

Summary of Valuation Changes for Nufarm

- The Consensus Analyst Price Target has significantly fallen from A$3.55 to A$3.10.

- The Discount Rate for Nufarm has significantly fallen from 10.06% to 7.42%.

- The Net Profit Margin for Nufarm has significantly fallen from 3.24% to 2.48%.

Key Takeaways

- Expansion in sustainable and specialty crops, along with product innovation, positions the company to capitalize on industry trends and boost long-term growth and margins.

- Growth in key global regions and ongoing supply chain optimization will lower risk, enhance efficiency, and support improved earnings quality and shareholder returns.

- High financial leverage, challenging market dynamics, and reliance on external funding heighten risks to Nufarm's earnings stability, growth prospects, and shareholder value.

Catalysts

About Nufarm- Develops, manufactures, and sells crop protection solutions and seed technologies in Europe, the Middle East, Africa, North America, and the Asia Pacific.

- Nufarm's accelerating expansion in biologicals and specialty crop segments (e.g., bioenergy traits like Carinata, and plant-based omega-3) aligns with increasing regulatory support and industry-wide demand for sustainable and high-margin agricultural solutions, expected to drive long-term revenue and net margin growth.

- Global food security challenges and rising demand from population growth and climate-related pressures are increasing the need for resilient, yield-enhancing products, supporting robust volume growth in Nufarm's Crop Protection and Seed Technologies-translating into future revenue growth.

- Strategic platform growth in high-potential regions (notably South America, including recent scale-up of hybrid seeds and Carinata) reflects successful global diversification, expected to reduce revenue cyclicality and drive top-line growth as new markets mature.

- Initiatives to optimize supply chain efficiency and execute $50 million in annualized run-rate cost savings by FY25, alongside a shift to lower capital intensity, are set to enhance free cash flow generation and lift profitability, supporting improved earnings and balance sheet health.

- The formal review and potential external capitalization of Seed Technologies could unlock significant value, accelerate commercialization of innovative platforms like omega-3 and bioenergy, and materially reduce leverage, directly supporting higher shareholder returns and improved earnings sustainability.

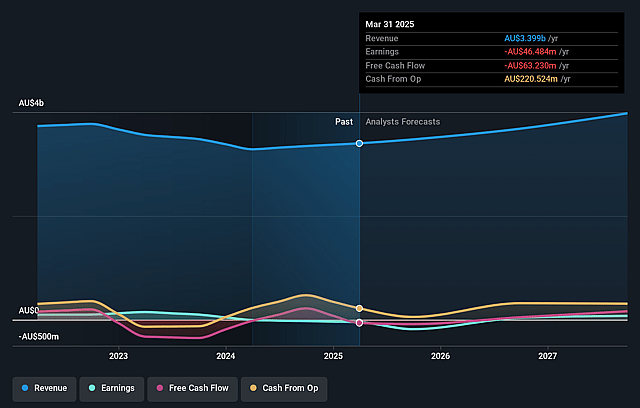

Nufarm Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nufarm's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.4% today to 3.2% in 3 years time.

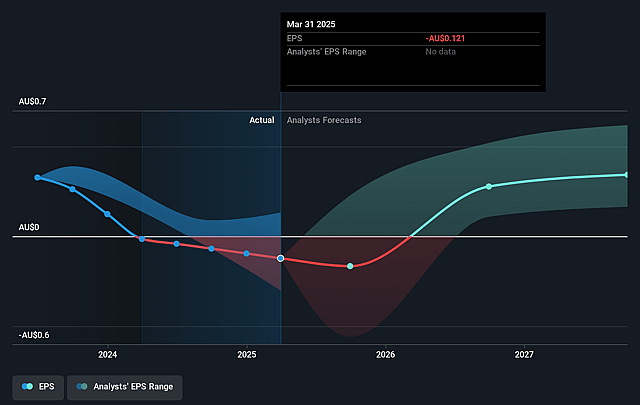

- Analysts expect earnings to reach A$148.4 million (and earnings per share of A$0.54) by about September 2028, up from A$-46.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$180.0 million in earnings, and the most bearish expecting A$58.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from -19.3x today. This future PE is lower than the current PE for the AU Chemicals industry at 55.7x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.06%, as per the Simply Wall St company report.

Nufarm Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained weakness and volatility in the omega-3/fish oil market have resulted in a significant $28 million inventory write-down and a major drag on earnings; if oversupply or subdued prices persist, Seed Technologies' revenue and net margins could remain structurally impaired for years.

- Leverage has increased materially to 4.5x EBITDA (well above target range), net debt is up 12% year-on-year, and the company is not paying a dividend-continued high debt levels or delays in deleveraging would constrain future investment, elevate financial risk, and suppress long-term earnings growth.

- The need for substantial new funding to accelerate Seed Technologies' platforms (omega-3, bioenergy, hybrids), and the pursuit of outside equity/structural changes, signals that Nufarm cannot self-fund expansion; dilution, suboptimal asset sales, or missed growth opportunities could impact future returns for existing shareholders.

- Nufarm's exposure to global trade uncertainties, such as volatile tariff regimes and antidumping duties (notably on China/US, 2,4-D, etc.), presents ongoing risk to both supply chains and revenue stability, especially if current exemptions change or higher input costs cannot be passed through.

- Heavy dependence on weather conditions (e.g., drier Australian seasons, seasonal volatility in North America and Europe) and competitive, commoditized crop protection segments exposes profitability to cyclical and climate-driven shocks, likely translating to suppressed or highly variable earnings and returns over the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.55 for Nufarm based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$7.7, and the most bearish reporting a price target of just A$2.07.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$4.6 billion, earnings will come to A$148.4 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 10.1%.

- Given the current share price of A$2.34, the analyst price target of A$3.55 is 34.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.