Key Takeaways

- Strategic partnerships and proprietary technology position Hazer for accelerated commercialization and margin expansion in the growing low-carbon hydrogen market.

- Multiple revenue streams, including synthetic graphite, and a robust global project pipeline enhance revenue growth and support a validated, scalable business model.

- Heavy dependence on external funding, limited current revenues, scale-up risks, optimistic projections, and rising competition jeopardize Hazer's profitability and long-term growth.

Catalysts

About Hazer Group- Operates as a clean technology development company in Australia.

- The strategic alliance with KBR, a global engineering leader with a dominant market share in ammonia and methanol, gives Hazer access to a vast network of industrial clients, accelerating technology licensing and commercialization, which will likely increase both top-line revenue and recurring earnings.

- Intensifying global demand for low-carbon hydrogen, combined with greater regulatory pressure and carbon pricing mechanisms, is expanding the addressable market for Hazer's clean hydrogen technology, supporting higher long-term revenue generation as decarbonization mandates take hold.

- Hazer's scalable, low-cost production method-using proven fluidized bed reactor technology-positions it as a cost-competitive alternative to both traditional and green hydrogen, supporting a sustainable expansion in margins as it achieves larger scale and economies of scale through commercial rollout.

- The dual revenue streams from both hydrogen and high-value synthetic graphite, amid rising concerns about supply chain security for critical minerals, enable Hazer to capitalize on premium pricing and strong demand, materially boosting its revenue growth potential and potentially enhancing net margins.

- Robust project pipeline (>45 global leads, growing portfolio across North America, Europe, Asia, and Australia) and early revenues from initial licensing projects (e.g., Canada) demonstrate a validated business model with momentum-creating significant potential for a step-change increase in revenue and earnings as more paid studies, feasibility agreements, and licenses are secured.

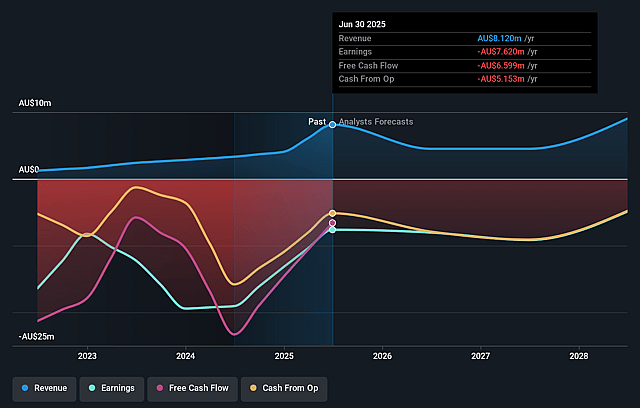

Hazer Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hazer Group's revenue will grow by 3.7% annually over the next 3 years.

- Analysts are not forecasting that Hazer Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Hazer Group's profit margin will increase from -93.8% to the average AU Chemicals industry of 6.2% in 3 years.

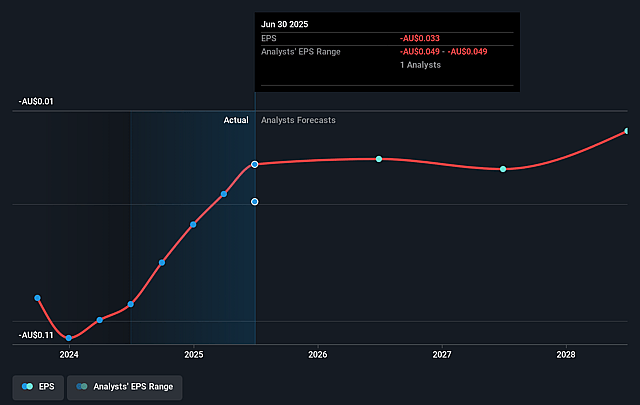

- If Hazer Group's profit margin were to converge on the industry average, you could expect earnings to reach A$558.4 thousand (and earnings per share of A$0.0) by about September 2028, up from A$-7.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 490.3x on those 2028 earnings, up from -12.0x today. This future PE is greater than the current PE for the AU Chemicals industry at 55.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

Hazer Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hazer remains heavily reliant on government grants, subsidies, and strategic investor funding to sustain operations, indicating that any reduction or withdrawal of public policy support or a tightening macro funding environment could directly impact cash flow and prolong the timeline to profitability, affecting both net margins and solvency.

- The company's revenue base is currently very limited, with initial revenues in Canada described as "not a lot," and significant future earnings are predicated on successful execution of a licensing business model and the signing of multiple large-scale commercial projects, creating risk of delayed, unpredictable, or insufficient revenue ramp-up.

- Commercialization depends on successful scale-up from demonstration to production scale, as well as the seamless integration of Hazer's technology with partner KBR; any technical hurdles, project delays, or issues with fluidized bed reactor scaling could lead to extended timelines and increased operational expenses, reducing earnings and potentially requiring further dilutive capital raises.

- Hazer's optimistic financial projections-such as licensing value of over $100 million per plant and large graphite market contributions-are grounded on conservative to bullish assumptions about graphite pricing, volumes, and robust demand; failure to secure stable, premium offtake agreements for graphite, or a deterioration in graphite market conditions, would materially impact potential revenues.

- Intensifying global competition in clean hydrogen (including alternative green hydrogen production from electrolysis using renewables) and ongoing industry consolidation could favor larger, established players or new technological breakthroughs, undermining Hazer's market share prospects and long-term revenue growth despite current first-mover claims.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.7 for Hazer Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$9.0 million, earnings will come to A$558.4 thousand, and it would be trading on a PE ratio of 490.3x, assuming you use a discount rate of 6.9%.

- Given the current share price of A$0.35, the analyst price target of A$0.7 is 50.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.