Narratives are currently in beta

Key Takeaways

- BHP's investments in potash and copper, combined with operational excellence, promise long-term revenue and margin growth through strategic developments and increasing global demand.

- Sustainability efforts align BHP with global decarbonization trends, potentially enhancing revenue through market positioning and premium pricing for sustainable products.

- Challenges in commodity markets, nickel operations, and exposure to China's economy threaten BHP's revenue, margins, and environmental regulatory compliance.

Catalysts

About BHP Group- Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally.

- BHP's ongoing investment in the Jansen potash project, which is ahead of schedule, is expected to begin production in late 2026 and create long-term value, potentially boosting revenue and operating margins significantly once operational.

- The company's strong copper production growth, including recent strategic acquisitions and developments in Copper South Australia and Chile, promise to enhance BHP's earnings. This is due to increasing global demand for copper, which is projected to continue rising, potentially improving revenue and profit margins.

- BHP's focus on operational excellence, underpinned by record production in Western Australian Iron Ore and other assets, enables it to maintain low costs and high-efficiency operations, potentially enhancing net margins and cash flow.

- Strategic joint ventures, such as the one with Lundin Mining in Argentina, pave the way for expanding BHP’s copper portfolio, which could provide significant long-term revenue growth as these projects mature.

- BHP's commitment to sustainability and greenhouse gas emission reduction, alongside growing demand for future-facing commodities like copper and potash, aligns with global trends toward decarbonization, potentially supporting revenue through strengthened market positioning and enabling premium pricing for sustainable practices.

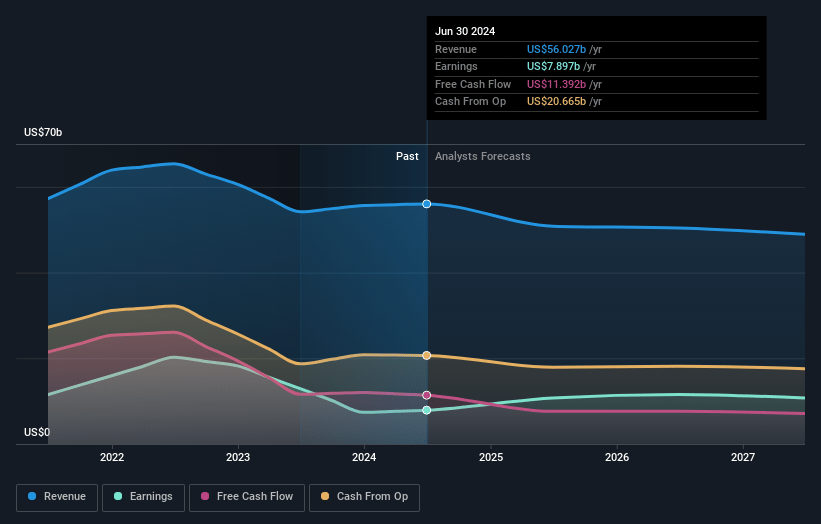

BHP Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BHP Group's revenue will decrease by -4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.1% today to 21.9% in 3 years time.

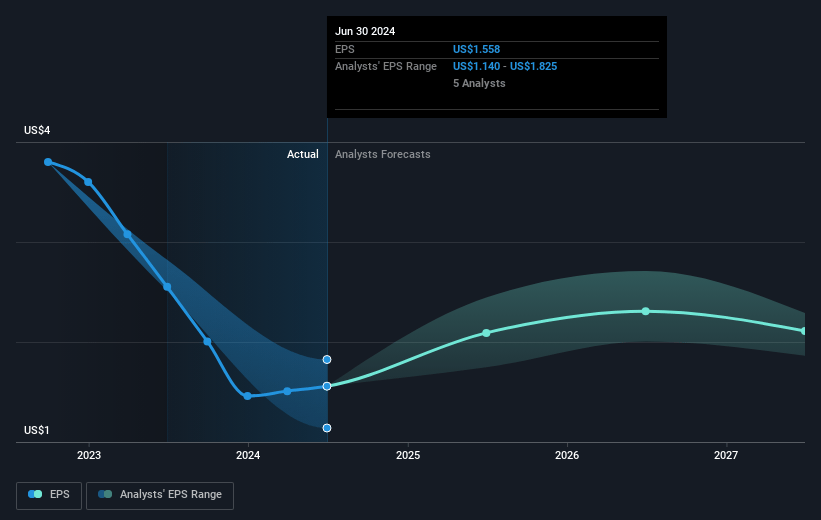

- Analysts expect earnings to reach $10.7 billion (and earnings per share of $2.11) by about January 2028, up from $7.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $11.9 billion in earnings, and the most bearish expecting $8.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, up from 15.6x today. This future PE is greater than the current PE for the US Metals and Mining industry at 12.4x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

BHP Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The temporary suspension of the Western Australia Nickel operations due to tough market conditions and significant global oversupply indicates challenges in the nickel industry, which could affect BHP's future revenues and earnings.

- The noncash impairment of the Western Australia Nickel business and the substantial charge for the Samarco dam failure resulted in significant net exceptional charges, impacting the company’s net margins and overall profitability.

- Continued market volatility and potential mild surplus in commodity supply could affect prices and revenue consistency for BHP's key products, thereby influencing future earnings.

- BHP's significant exposure to China's economy, which is experiencing uneven recovery and property market pressures, poses a risk to its revenue growth depending on the effectiveness of China’s pro-growth policies.

- The temporary increase in operating emissions despite the commitment to greenhouse gas reductions could pose a risk to operational costs and margins in the face of potential stricter environmental regulations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$44.32 for BHP Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$48.74, and the most bearish reporting a price target of just A$39.68.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $48.9 billion, earnings will come to $10.7 billion, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$39.13, the analyst's price target of A$44.32 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives