Last Update 26 Aug 25

Fair value Increased 7.83%The increase in nib holdings’ analyst price target reflects improved revenue growth forecasts and a modestly higher future P/E multiple, lifting fair value from A$7.49 to A$7.96.

What's in the News

- nib holdings limited announced an increased ordinary cash dividend of AUD 0.16 per share for the six-month period ended June 30, 2025, fully franked.

Valuation Changes

Summary of Valuation Changes for nib holdings

- The Consensus Analyst Price Target has risen from A$7.49 to A$7.96.

- The Consensus Revenue Growth forecasts for nib holdings has significantly risen from 3.7% per annum to 4.7% per annum.

- The Future P/E for nib holdings has risen slightly from 18.60x to 19.33x.

Key Takeaways

- Broadening into preventative care, digital initiatives, and adjacent industries is improving customer retention, operational efficiency, and reducing dependence on traditional health insurance.

- Partnerships and tech-driven operational improvements are managing healthcare cost pressures, supporting stable claims ratios and sustainable long-term profitability.

- Rising claims inflation, high policy lapses, reliance on volatile international segments, execution risks, and shifting industry dynamics threaten revenue stability and long-term profitability.

Catalysts

About nib holdings- Engages in the underwriting and distribution of private health, life, and living insurance to residents, international students, and visitors in Australia and New Zealand.

- Ongoing strong policyholder growth, supported by an ageing population in Australia and New Zealand as well as rising consumer awareness of health, is expected to drive sustained revenue growth in nib's core and adjacent markets (health, international students/workers, NDIS).

- Accelerated digital transformation through AI and machine learning initiatives (over 50 in production) is improving customer engagement, streamlining operations, and supporting reductions in the group operating expense ratio-expected to enhance net margins and profitability over the medium to long term.

- Expansion of health management and preventative care offerings (telehealth, wellbeing programs, in-home care, no/known gap networks) is broadening revenue streams, improving customer retention, and actively managing claims inflation-positively impacting both top-line growth and future claims ratios.

- Diversification into adjacent businesses-such as international health insurance, NDIS plan management, and travel-reduces reliance on traditional PHI, provides exposure to high-growth and resilient niches, and underpins revenue and earnings growth even as traditional segment growth moderates.

- Strategic multi-year partnerships with large hospital groups and provider networks are enabling nib to better manage healthcare cost inflation, improve affordability, and deliver more predictable claims and margin outcomes-supporting sustainable long-term earnings.

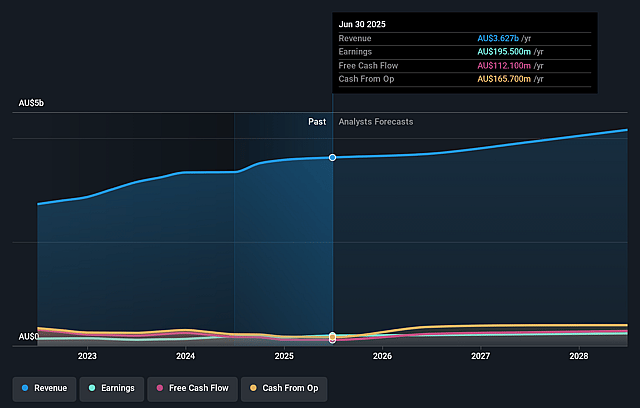

nib holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming nib holdings's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 5.7% in 3 years time.

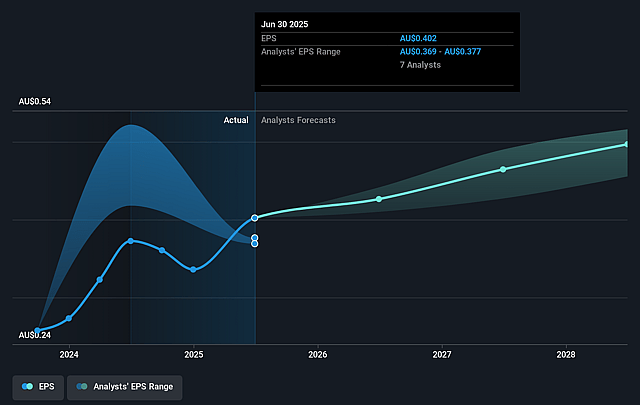

- Analysts expect earnings to reach A$238.1 million (and earnings per share of A$0.5) by about September 2028, up from A$195.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as A$211 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.9x on those 2028 earnings, up from 18.6x today. This future PE is about the same as the current PE for the AU Insurance industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

nib holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent high claims inflation in New Zealand, with utilization rates remaining elevated at 15% and total claims inflation around 21%, introduces uncertainty regarding the sustainability of profitability and challenges in restoring historic net margins; this may negatively impact earnings and net margins in the NZ segment over the medium-to-long term.

- Ongoing high lapse rates (approaching 15%) and increasing downgrading in arhi (core Australian health insurance), driven by affordability pressures and consumer response to premium increases, indicate heightened churn and risk of policyholder base erosion, potentially constraining future revenue growth and impacting net margins.

- Reliance on strong performance in international students and workers segments exposes nib to external risks such as changing migration policies, reduced international student intakes, or shifting government regulations, any of which could lead to volume headwinds and revenue instability in these higher-margin segments.

- Continued heavy investment in digital transformation, productivity initiatives, and recent acquisitions (e.g., Instacare, full ownership of Honeysuckle and Midnight Health) involves significant execution risk; failure to achieve expected efficiency gains or successfully integrate new businesses may suppress returns on equity and compress group earnings.

- Evolving industry dynamics, including rising medical and hospital indexation costs, potential regulatory reforms affecting premium setting, and growing competition from both traditional and insurtech players, could pressure claims costs and limit the ability to pass through premium increases, ultimately impacting both revenue growth and long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.077 for nib holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$8.9, and the most bearish reporting a price target of just A$5.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$4.2 billion, earnings will come to A$238.1 million, and it would be trading on a PE ratio of 19.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$7.46, the analyst price target of A$8.08 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.