Key Takeaways

- Replacement cycles, service contract shifts, and consumable adoption may drive stronger recurring revenue and margin growth than currently anticipated.

- Advancements in manufacturing, global compliance trends, and product innovation could enable Nanosonics to outperform expectations in margins, adoption rates, and market positioning.

- Heavy dependence on a single product, customer concentration, and slow pipeline diversification increase vulnerability to disruption, margin compression, and regulatory or competitive market changes.

Catalysts

About Nanosonics- Operates as an infection prevention company globally.

- Analyst consensus sees upgrades and expansion in North America as a revenue and profitability driver, but this likely understates the potential as the replacement cycle of over 10,000 aged units, rapid shift of service contracts from GE to Nanosonics, and untapped consumable ecosystem (currently used by only 30 percent of the installed base) could fuel an outsized acceleration in annuity and service revenue for multiple years, significantly boosting both top-line growth and gross margins.

- While consensus expects new US manufacturing to improve margins, the true impact could be far greater: local production sharply reduces logistics costs, mitigates tariff risk, enables rapid scaling for future products like CORIS, and positions the company to pass on savings as higher margins or competitive pricing, all of which may drive sustainable net margin expansion ahead of expectations.

- Nanosonics stands to benefit disproportionately from global regulatory tightening and rising infection control standards, as these secular trends make its automated, validated solutions essential for compliance, potentially driving a structural step-change in global adoption rates and longer-term revenue visibility.

- The company's sizable cash balance and stated focus on M&A and pipeline broadening, at a time when scale and product breadth are emerging as key differentiators in infection prevention, positions Nanosonics for transformational accretive acquisitions or innovative product launches that can escalate both top-line growth and earnings diversification beyond analyst expectations.

- The onward digitization of healthcare and focus on smart, sustainable infection prevention practices creates opportunities for Nanosonics' connected, low-chemical devices and digital traceability solutions to command premium pricing and sticky service contracts, supporting both durable revenue growth and margin resilience in a shifting industry landscape.

Nanosonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nanosonics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nanosonics's revenue will grow by 13.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.0% today to 18.2% in 3 years time.

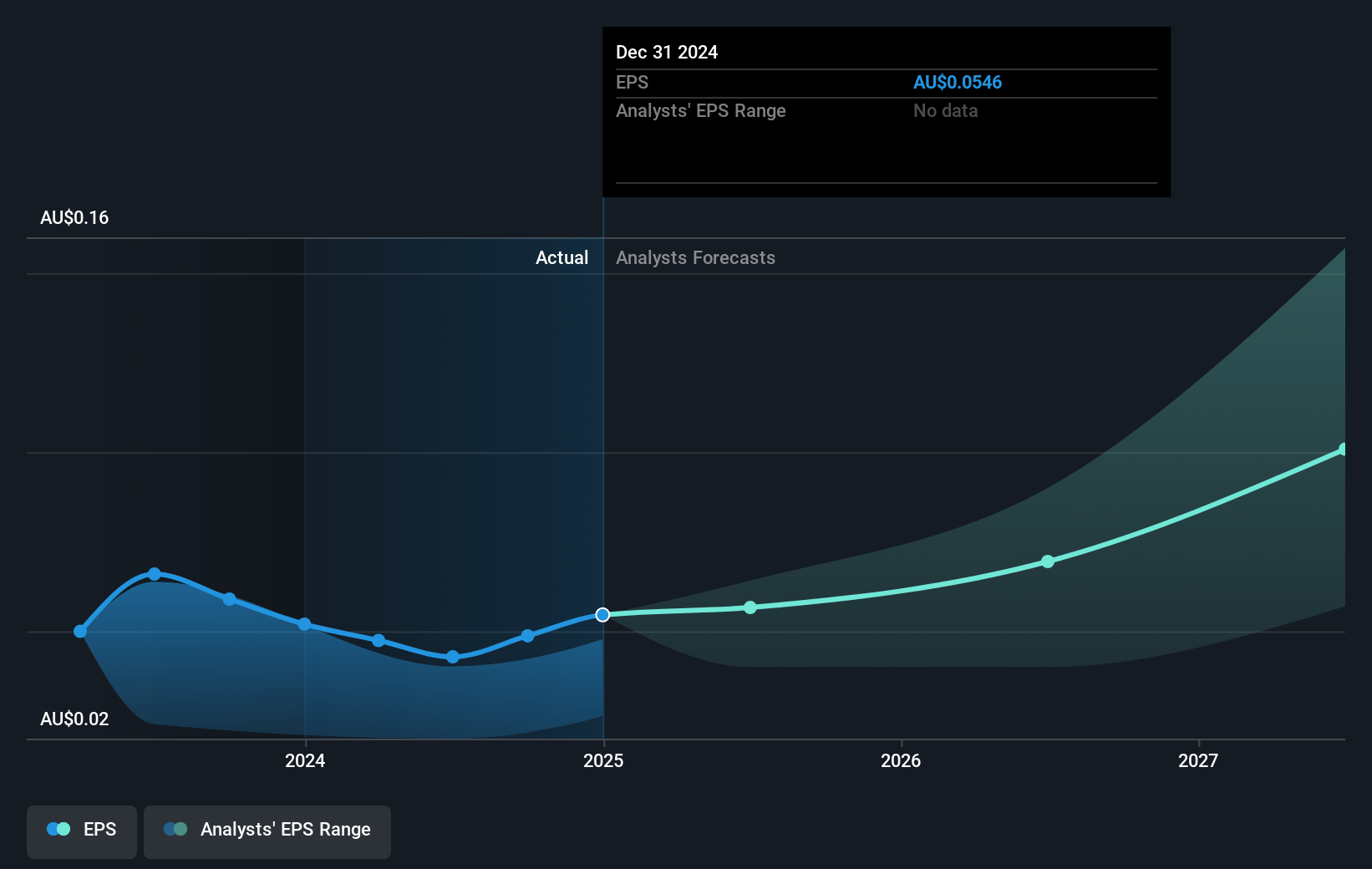

- The bullish analysts expect earnings to reach A$49.2 million (and earnings per share of A$0.16) by about July 2028, up from A$16.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 46.6x on those 2028 earnings, down from 69.1x today. This future PE is greater than the current PE for the AU Medical Equipment industry at 40.2x.

- Analysts expect the number of shares outstanding to grow by 0.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Nanosonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nanosonics remains heavily reliant on its trophon product, and despite mentioning some pipeline expansion, the slow diversification increases long-term risk of revenue stagnation or decline if market adoption plateaus or if newer technologies disrupt current standards, directly threatening both future revenue growth and gross margins.

- Significant customer concentration in North America, where thousands of facilities make up the majority of core installed base and recurring revenues, exposes the company to the risk of contract loss or pricing renegotiation with large customers or group purchasing organizations, which could cause pronounced earnings volatility and pressure on net profit.

- Intensifying competitive pressures and commoditization in medical disinfection, as referenced by stable pricing and increased ecosystem and service focus to maintain growth, could drive margin compression as low-cost or technologically advanced substitutes enter the market, negatively impacting both gross and net margins over time.

- Regulatory risks and healthcare austerity in Europe and other developed healthcare markets, which the text highlights through unpredictable and "phased" capital purchasing patterns, may result in diminished capital equipment demand and delayed adoption, weighing on long-term top-line revenue expansion.

- Delay in meaningful revenues from new products, especially CORIS which remains subject to complex, uncertain FDA and global regulatory approvals, combined with increasing R&D and launch costs, could result in higher operating expenses and lower profitability in the face of slow pipeline commercialization and longer payback periods, putting future net margins and cash flow at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nanosonics is A$5.98, which represents two standard deviations above the consensus price target of A$4.64. This valuation is based on what can be assumed as the expectations of Nanosonics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.0, and the most bearish reporting a price target of just A$3.75.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$269.8 million, earnings will come to A$49.2 million, and it would be trading on a PE ratio of 46.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$3.77, the bullish analyst price target of A$5.98 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.