Key Takeaways

- Over-reliance on the core product and mounting competition from alternative disinfection technologies threatens revenue stability and long-term growth prospects.

- Regulatory, environmental, and industry shifts are increasing costs and pricing pressure, likely compressing margins and constraining international expansion opportunities.

- Expanding recurring revenues, new product rollouts, and manufacturing investments position Nanosonics for long-term growth, margin improvement, and greater resilience to industry trends.

Catalysts

About Nanosonics- Operates as an infection prevention company globally.

- Despite strong recent revenue and annuity growth, Nanosonics faces increasing global government pressure to reduce healthcare costs, which may limit hospital budgets for new equipment and upgrades, ultimately resulting in slower product adoption and muted revenue growth over the long term.

- The company is heavily dependent on its core trophon product line in an increasingly competitive disinfection market; this reliance heightens the risk of significant market share erosion if alternative disinfection technologies (such as UV-C or hydrogen peroxide vapor) achieve greater traction, threatening ongoing revenue streams and expanding the possibility of revenue stagnation or decline.

- Long-term expansion plans may be hampered by heightened regulatory scrutiny and shifting international trade policies, which could delay market entry, force higher compliance costs, and compress net margins in new geographic markets where growth has been assumed in forward-looking projections.

- Rising environmental concerns and evolving regulations around single-use plastics and chemicals are expected to increase manufacturing costs for infection control devices, which could negatively impact gross margins and reduce overall profitability in future years.

- The accelerating consolidation among major hospital groups and procurement entities is likely to enhance buyer power and create more intense pricing pressure, making it increasingly difficult for Nanosonics to maintain premium pricing and placing sustained downward pressure on net margins and future earnings.

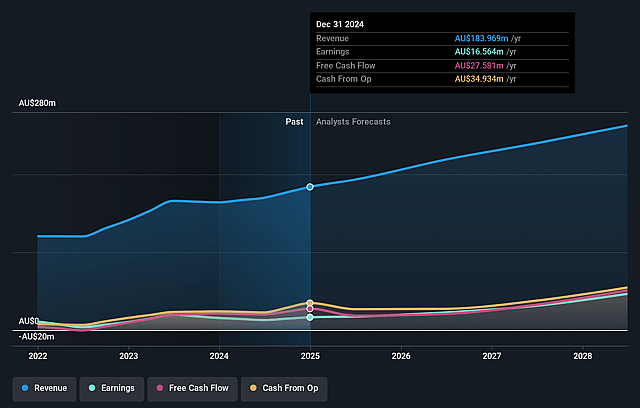

Nanosonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Nanosonics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Nanosonics's revenue will grow by 11.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.0% today to 17.3% in 3 years time.

- The bearish analysts expect earnings to reach A$44.3 million (and earnings per share of A$0.14) by about July 2028, up from A$16.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 32.4x on those 2028 earnings, down from 70.2x today. This future PE is lower than the current PE for the AU Medical Equipment industry at 39.8x.

- Analysts expect the number of shares outstanding to grow by 0.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

Nanosonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growing installed base of Trophon units in North America and Europe is expanding the company's recurring annuity revenues from consumables and service contracts, which meaningfully increases ongoing revenue visibility and supports rising operating leverage and net margins.

- Strong momentum in technical services, ecosystem consumables, and customer value expansion activities-along with low penetration of new ecosystem products among the current installed base-provide substantial multi-year runway for revenue growth and continued margin enhancement.

- Nanosonics' entry into endoscope reprocessing through its CORIS platform, with regulatory approvals and commercialization on track for FY '26, offers potential for a significantly expanded addressable market, diversified revenue streams, and higher long-term earnings growth.

- Strategic investments in regional manufacturing (such as the new U.S. consumables facility) are expected to further improve gross margins, reduce supply chain risks, and enhance resilience to tariff changes, supporting stronger profitability and cash flow.

- Secular trends of increasing infection prevention standards, growing ultrasound use for clinical procedures, and regulatory shifts in favor of advanced, automated disinfection technologies directly align with Nanosonics' product portfolio, positioning the company for sustained top-line growth and improved earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Nanosonics is A$3.75, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nanosonics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.0, and the most bearish reporting a price target of just A$3.75.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$256.4 million, earnings will come to A$44.3 million, and it would be trading on a PE ratio of 32.4x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$3.83, the bearish analyst price target of A$3.75 is 2.1% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.