Key Takeaways

- Global brand repositioning and targeted premium offerings are likely to drive outsized revenue growth, margin expansion, and rapid international market share gains, surpassing analyst expectations.

- Strong production capabilities, effective storytelling, and financial flexibility position LARK for long-term profitability, digital growth, and potential M&A activity amid rising global demand for premium spirits.

- LARK faces margin pressure from increased distributor reliance and premiumization risks, while global expansion and high capital needs may strain growth, cash flow, and competitiveness.

Catalysts

About LARK Distilling- Engages in the production, marketing, distribution, and sale of craft spirits.

- While analyst consensus sees the brand restage leading to improved brand equity and sales, they may be underestimating its transformational impact on international pricing power and consumer demand as LARK's globally differentiated luxury positioning opens the door for premiumization beyond current expectations, likely producing a step-change in revenue growth and margin expansion.

- Analysts broadly agree international expansion, particularly in Asia, will underpin revenue growth, but this view may be too conservative as LARK's targeted new launches, bespoke limited editions for key markets (such as Chinese New Year bottlings), and unmatched provenance could catalyze outsized, multi-year export sales acceleration and rapid market share gains, materially enhancing top-line performance.

- LARK's expanded and automated production capacity at Pontville allows for rapid, scalable output increases with minimal additional capital, positioning the company to take full advantage of rising global demand for craft and premium whisky with significant operating leverage, which should drive both sustained revenue growth and improving net margins.

- The ongoing global shift toward premium, authentic, and locally-produced spirits means LARK's strong Tasmanian branding, award-winning product quality, and storytelling will increasingly resonate with both millennial and high-net-worth consumers worldwide, supporting both volume growth and sustained price premiums, which will flow through to higher gross profits and long-term EBIT growth.

- LARK's robust balance sheet, significant Whisky Bank inventory, and demonstrated capital discipline create optionality for future M&A (either as acquirer or target), fast-tracked NPD rollouts, and direct-to-consumer digital scaling-all of which can yield step changes in both strategic value and earnings, accelerating investor returns well beyond the market's current base case.

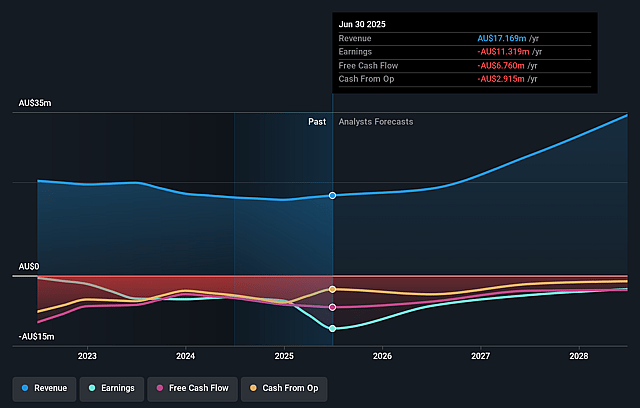

LARK Distilling Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LARK Distilling compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LARK Distilling's revenue will grow by 28.3% annually over the next 3 years.

- Even the bullish analysts are not forecasting that LARK Distilling will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate LARK Distilling's profit margin will increase from -65.9% to the average AU Beverage industry of 16.3% in 3 years.

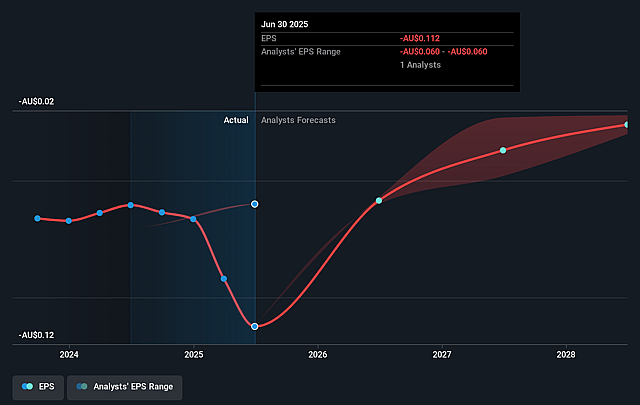

- If LARK Distilling's profit margin were to converge on the industry average, you could expect earnings to reach A$5.9 million (and earnings per share of A$0.06) by about September 2028, up from A$-11.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 63.3x on those 2028 earnings, up from -7.3x today. This future PE is lower than the current PE for the AU Beverage industry at 89.9x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

LARK Distilling Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A long-term industry trend toward premiumization may expose LARK to shifts in consumer preferences, such as increasing health consciousness and a rising anti-alcohol sentiment; over time, this could result in decreased demand and slow or reverse revenue growth for luxury spirits.

- LARK's international expansion ambitions face risks from limited global distribution capabilities and weaker brand recognition compared to much larger established global competitors, which may constrain the company's ability to achieve sustained margin expansion and may cap top-line growth.

- Ongoing shifts toward distributor-led sales models, while helping costs, are already resulting in declining gross profit margins, a trend expected to persist as LARK relies increasingly on third-party distributors internationally; this will likely continue to compress net margins as the business scales.

- The company remains highly reliant on premium price points and a relatively narrow product portfolio within a consolidating industry where larger players with greater scale, broader portfolios, and more marketing resources could erode LARK's market share and bargaining power, potentially pressuring both revenue and earnings.

- High inventory levels and continued investment in marketing, production capabilities, and global brand building require significant capital outlays and the maturation of whisky stocks, which may strain free cash flow in the coming years and delay the achievement of sustainable profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LARK Distilling is A$2.9, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LARK Distilling's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.9, and the most bearish reporting a price target of just A$0.89.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$36.2 million, earnings will come to A$5.9 million, and it would be trading on a PE ratio of 63.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$0.77, the bullish analyst price target of A$2.9 is 73.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.