Key Takeaways

- Transformational brand repositioning, global expansion, and deep inventory could unlock outsized growth and premium brand equity ahead of market expectations.

- Experiential tourism and innovative product development are poised to drive high-margin direct sales and lasting appeal among younger consumers.

- Declining alcohol consumption, weak global brand recognition, fierce competition, and health trends threaten LARK's growth prospects and may strain profitability and cash flow.

Catalysts

About LARK Distilling- Engages in the production, marketing, distribution, and sale of craft spirits.

- Analyst consensus anticipates LARK's brand restage and repositioning will result in long-term revenue and margin uplift, but this notably understates the transformational potential if LARK's push to become the "Tasmanian equivalent of Scotch or Japanese whisky" accelerates category leadership, delivers significant premiumization, and unlocks global luxury pricing much faster, translating into outsized earnings growth well above current expectations.

- While analysts broadly expect growth from direct export expansion-particularly into Asia-the current momentum, repeat reorder activity, and strong in-market execution suggest LARK could see exponential export sales growth, far outpacing consensus, especially if early success in Asia is replicated in underpenetrated markets like Europe and the US, leading to much more robust revenue and brand equity gains.

- LARK's deep "Whisky Bank" of maturing inventory provides exceptional operational leverage not currently captured in valuation, positioning the company to rapidly scale high-margin sales in premium and super-premium categories as global demand for authentic, provenance-driven whisky surges, amplifying both revenue and net margin expansion as more matured product is released.

- The company's strategic focus on experiential, destination-based hospitality and tourism-leveraging secular growth in international travel and spirits tourism-can create a powerful, recurring high-margin D2C channel, while further entrenching LARK's premium brand status and supporting rapid revenue compounding.

- Continuous innovation in new product development, such as the launch of KURIO and personalized gifting, uniquely positions LARK to capture younger, experience-seeking consumer segments worldwide, boosting average selling prices, driving loyalty, and creating sustainable long-term earnings momentum above industry averages.

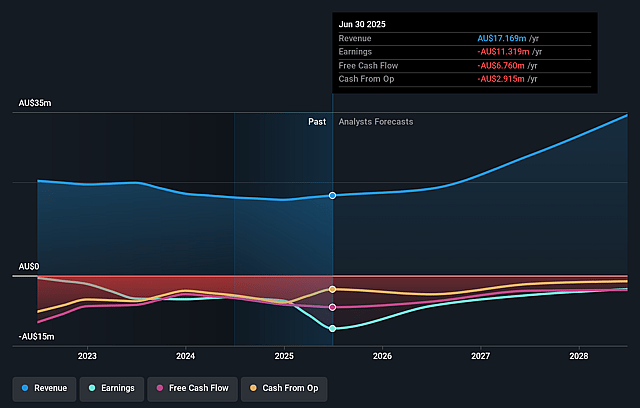

LARK Distilling Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LARK Distilling compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LARK Distilling's revenue will grow by 35.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -33.1% today to 5.6% in 3 years time.

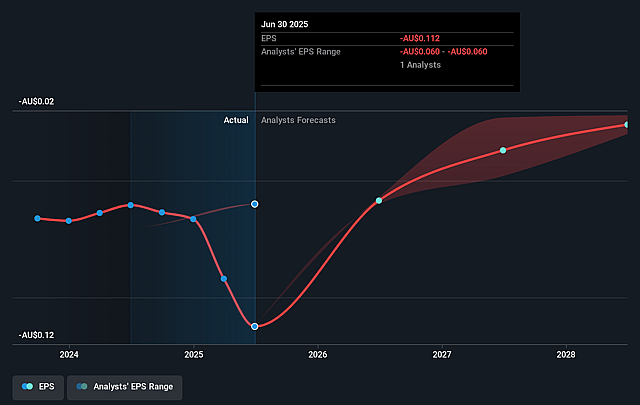

- The bullish analysts expect earnings to reach A$2.3 million (and earnings per share of A$0.02) by about August 2028, up from A$-5.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 184.1x on those 2028 earnings, up from -15.1x today. This future PE is greater than the current PE for the AU Beverage industry at 14.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

LARK Distilling Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global trend of declining alcohol consumption, especially among younger generations and in developed markets such as Australia and Europe, could reduce the long-term customer base for premium spirits like LARK, impacting future revenue growth.

- LARK's limited international brand recognition, when compared to established global whisky competitors, poses a risk that its overseas expansion will face greater challenges, potentially constraining export revenue and long-term earnings capability.

- Heightened competition from both multinational spirits companies and an increasing number of craft distilleries may force LARK to increase marketing spend or offer price discounts, leading to sustained gross margin pressure and reduced net margins.

- The company's ongoing reliance on substantial capital investment in whisky maturation, production facility upgrades, and marketing ahead of revenue realization could increase volatility in earnings and put pressure on free cash flow, especially if sales growth does not accelerate as planned.

- Secular shifts toward health consciousness and the rise of low

- and no-alcohol beverage preferences globally may slow underlying demand for premium spirits, risking stagnation in LARK's top-line growth and ultimate compression of future revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LARK Distilling is A$3.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LARK Distilling's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.3, and the most bearish reporting a price target of just A$1.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$40.3 million, earnings will come to A$2.3 million, and it would be trading on a PE ratio of 184.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$0.76, the bullish analyst price target of A$3.3 is 76.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.