Key Takeaways

- Structural demand shifts toward renewables and increased regulatory pressures threaten Woodside's revenue stability, profit margins, and ability to secure new project approvals.

- High exposure to costly fossil fuel projects, underinvestment in renewables, and growing stakeholder scrutiny heighten financial and strategic risks amid the global energy transition.

- Growth in Asian demand, strategic partnerships, project expansions, and diversification into low-carbon solutions are set to drive Woodside's stability, scale, and long-term profitability.

Catalysts

About Woodside Energy Group- Engages in the exploration, evaluation, development, production, marketing, and sale of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe.

- Global decarbonization efforts and the rise of renewable energy technologies are likely to result in a structural decline in long-term oil and gas demand, which threatens Woodside's ability to sustain or grow core revenues and could drive future asset impairments as the industry faces a systemic shift away from fossil fuels.

- Increasing regulatory pressure, including the potential for new carbon taxes or emissions trading schemes, will likely elevate Woodside's operational costs and erode profit margins over the coming years, particularly as its asset base remains heavily concentrated in Australia where project approvals are already slow and unpredictable.

- Heavy, sustained capital investment in large-scale projects such as Scarborough, Pluto Train 2, and Louisiana LNG exposes Woodside to significant risk of cost overruns and schedule delays; if returns on these projects disappoint or pricing power weakens, this will negatively impact free cash flow, increase net debt, and potentially lower long-term return on invested capital.

- Relative underinvestment in renewables and slow progress in low-carbon or new energy business diversification, compared to global oil and gas peers, risks Woodside's future competitiveness and limits its ability to offset declining LNG and oil demand, placing long-term revenue and EBITDA at risk as energy markets transition.

- Persistent societal, legal, and investor scrutiny of fossil fuel producers-including rising climate-related litigation, increasing demands from institutional investors to divest, and possible operational disruptions from extreme weather-could materially increase Woodside's cost of capital, insurance expenses, and regulatory burden, further pressuring net earnings and cash generation through the energy transition.

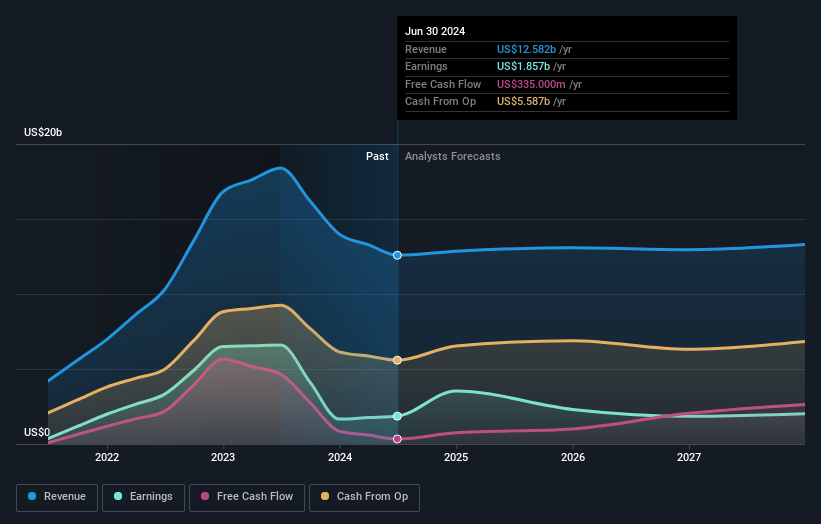

Woodside Energy Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Woodside Energy Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Woodside Energy Group's revenue will decrease by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 27.1% today to 7.4% in 3 years time.

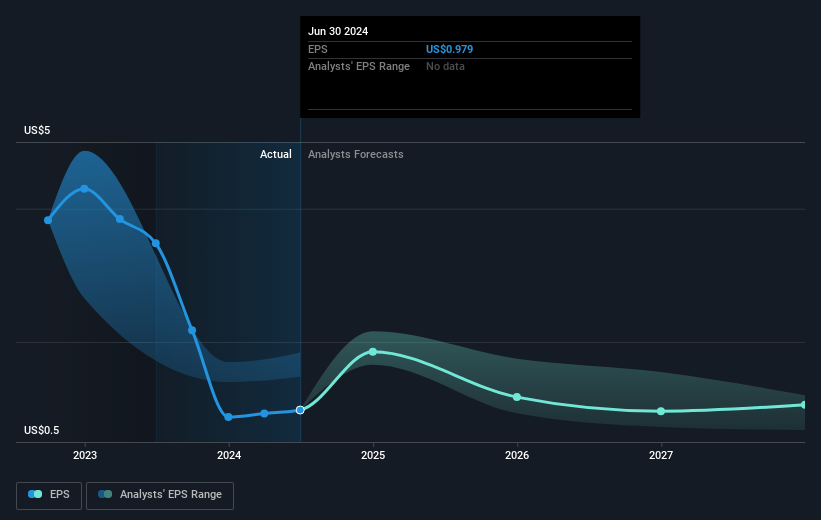

- The bearish analysts expect earnings to reach $859.6 million (and earnings per share of $0.45) by about July 2028, down from $3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 37.7x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the AU Oil and Gas industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.75%, as per the Simply Wall St company report.

Woodside Energy Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing global population growth and economic development in Asia is expected to drive strong, long-term demand for LNG and gas, supporting higher sales volumes and stable or growing revenue for Woodside over the coming decades.

- Successful execution and ramp-up of major growth projects like Scarborough and Pluto Train 2 are anticipated to significantly boost Woodside's LNG production capacity, leading to scale benefits and margin expansion, which may lift net earnings and free cash flow once these projects come online.

- Strategic partnerships and new long-term supply contracts with major Asian customers (including Japan and China) provide revenue visibility and reduce earnings volatility, strengthening cash flow predictability even during cyclical downturns in commodity prices.

- Woodside is diversifying into new energy solutions including low-carbon ammonia, carbon capture and storage, and hydrogen, positioning the business to benefit from energy transition trends and securing alternative EBITDA streams as decarbonization accelerates.

- The industry context of underinvestment in global oil and gas production, alongside project delays globally, may lead to structurally tight LNG markets and strong pricing for competent producers like Woodside, supporting robust top-line revenue and sector-leading profitability over the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Woodside Energy Group is A$21.32, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Woodside Energy Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$40.24, and the most bearish reporting a price target of just A$21.32.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $11.7 billion, earnings will come to $859.6 million, and it would be trading on a PE ratio of 37.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of A$25.21, the bearish analyst price target of A$21.32 is 18.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.