Last Update 31 Oct 25

Fair value Decreased 1.45%The analyst price target for Santos has been modestly reduced from A$7.88 to A$7.76. Analysts are factoring in adjusted expectations for revenue growth and profit margins following the withdrawal of the XRG takeover proposal and continued focus on future project execution.

Analyst Commentary

Bullish Takeaways- Bullish analysts highlight potential share price upside following the withdrawal of the XRG consortium's takeover offer. This has restored focus on Santos's standalone prospects.

- Delivery of major projects such as Barossa and Pikka is expected to unlock significant free cash flow over the next five years. This is seen as supportive of positive earnings momentum.

- Valuation is viewed as attractive, with upgrades triggered by a favorable risk-reward balance at current prices.

- Analysts anticipate that disciplined execution on upcoming projects could further enhance profitability and long-term growth potential.

- Some analysts express caution about execution risks associated with large-scale projects. These risks could impact the timeline for realizing expected cash flows.

- Profit margins and revenue growth forecasts may be vulnerable to operational delays or cost overruns in key developments.

- Uncertainties in commodity markets could affect Santos's sales and earnings, presenting downside risk to current valuation assumptions.

What's in the News

- XRG Consortium, Abu Dhabi Developmental Holding Company PJSC, and The Carlyle Group canceled their proposed AUD 28.8 billion acquisition of Santos Limited on September 17, 2025 (Key Developments).

- Santos announced the resignation of CFO Ms. Sherry Duhe and the appointment of Mr. Lachlan Harris as Acting Chief Financial Officer. Mr. Harris previously served as Treasurer and Deputy CFO (Key Developments).

- Santos Limited declared an ordinary fully franked dividend of USD 0.1340 per security for the six months ended June 30, 2025. Record date is September 3, 2025, with payment on October 1, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has declined modestly from A$7.88 to A$7.76. This reflects the latest updates in forecasts.

- Discount Rate has increased slightly from 7.00% to 7.02%. This suggests a marginally higher perceived risk or cost of capital in current estimates.

- Revenue Growth forecast has tapered from 9.68% to 9.39%. This indicates a slight reduction in near-term growth expectations.

- Net Profit Margin projection has softened from 23.03% to 22.65%. This points to lower anticipated profitability on future earnings.

- Future P/E ratio has risen from 12.68x to 12.95x. This reflects adjustments in expected earnings relative to current share prices.

Key Takeaways

- Accelerated production growth and strong long-term LNG contracts position Santos for stable revenue, improved margins, and earnings resilience amid rising energy demand.

- Advancements in carbon capture and efficiency drive ESG improvements and cost reductions, unlocking new revenue streams and boosting free cash flow potential.

- Exposure to commodity cycles, regulatory and environmental risks, and rising ESG pressures threaten earnings stability, growth prospects, and access to capital for Santos.

Catalysts

About Santos- Explores, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea.

- Near-term production growth is set to accelerate with the imminent ramp-up of major projects (Barossa LNG and Pikka Phase 1), positioning Santos to benefit from structurally rising global LNG and natural gas demand, especially in emerging Asia; this should boost future revenue and operating margins.

- Strong momentum in securing long-term, oil-linked LNG contracts-92% of portfolio contracted and 80% oil-linked through 2029-enhances revenue visibility and pricing power amid ongoing geopolitical-driven energy security concerns, supporting stable and growing earnings.

- Santos' rapid progress and delivery in carbon capture and storage (CCS), highlighted by the Moomba CCS project already storing over 1 million tonnes of CO2e, positions the company to leverage the global transition to lower-carbon energy; this not only helps reduce emissions intensity and improve ESG credentials, but may also unlock new premium revenue streams and support higher net margins.

- Company-wide focus on operational efficiency, project self-execution, and continued cost reductions (targeting sub-$7/boe unit costs) is likely to improve free cash flow generation and net margins as new projects come online and CapEx cycles moderate.

- A robust pipeline of backfill, infill, and expansion projects (across PNG, Alaska, Beetaloo, and Western Australia) integrated with existing infrastructure increases long-term growth optionality and underpins sustained production and revenue expansion, supporting higher long-term earnings resilience.

Santos Future Earnings and Revenue Growth

Assumptions

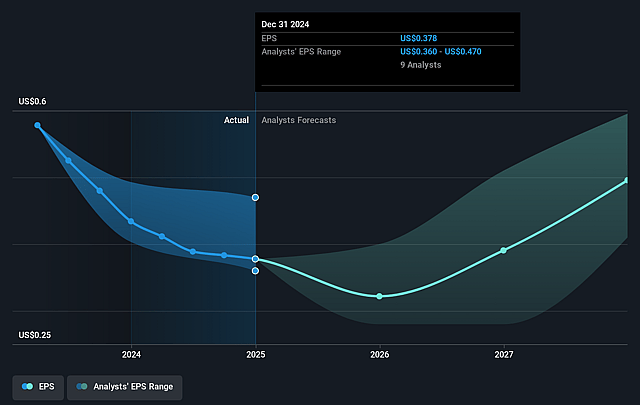

How have these above catalysts been quantified?- Analysts are assuming Santos's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.6% today to 23.2% in 3 years time.

- Analysts expect earnings to reach $1.6 billion (and earnings per share of $0.51) by about September 2028, up from $1.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 16.1x today. This future PE is lower than the current PE for the AU Oil and Gas industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Santos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Large capital expenditure requirements for major development projects like Barossa and Pikka increase exposure to commodity price cycles and project execution risk, which could negatively impact net margins and result in potential asset impairments.

- Decommissioning and remediation liabilities for retiring assets, such as those arising in mature fields and demonstrated by ongoing decommissioning campaigns, require substantial future provisioning and could place downward pressure on future earnings and free cash flow.

- Concentrated asset portfolio in politically and environmentally sensitive regions (such as Papua New Guinea and Northern Australia) exposes Santos to regulatory, operational, and environmental risks, potentially disrupting production and impacting revenue stability.

- Growing global decarbonization policies, accelerating renewables adoption, and stricter emissions targets may erode long-term demand for LNG and gas, creating structural headwinds for Santos' core business and putting pressure on both revenue and long-term earnings growth.

- Increasing scrutiny from investors and higher ESG-related expectations or requirements can raise the company's cost of capital and restrict access to funding or insurance for fossil fuel-related projects, limiting growth opportunities and putting strain on net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.511 for Santos based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.42, and the most bearish reporting a price target of just A$7.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.9 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of A$7.83, the analyst price target of A$8.51 is 8.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.