Key Takeaways

- Tyro is set to outpace competitors through integrated payments, digital banking innovation, and first-mover strength in health sector digitalization, expanding its market share and revenue.

- Embedded finance, open banking, and strategic acquisitions position Tyro for stronger customer retention, multi-product growth, and profitability beyond current market estimates.

- Mounting competition, regulatory pressures, and operational challenges threaten Tyro Payments' margins, growth prospects, and ability to differentiate in a maturing, commoditized payments market.

Catalysts

About Tyro Payments- Engages in the provision of payment solutions to merchants in Australia.

- Analyst consensus views Tyro's investment in integrated payments and modern banking as a means to access a larger share of Australian card payments, but this may be understated given Tyro's accelerating cross-sell across its network and a post-implementation uplift from its Constantinople partnership, setting up the company to take meaningful share from less technologically agile incumbents, resulting in outsize revenue growth and expanding addressable market.

- Analysts broadly agree that Tyro Health's rapid growth is a positive, but current expectations likely underestimate both the velocity of digitalization across healthcare and Tyro's first-mover advantage in omnichannel claims and payments, which could drive a step-change in share of wallet and multiply transaction volumes, translating to a sustained acceleration in both gross profit and net margins.

- Tyro is uniquely positioned to benefit from the rise of embedded finance and open banking in Australia, with new banking product launches-enabled through BaaS infrastructure-facilitating stickier, multi-product merchant relationships, deepening monetization per customer and reducing churn, which will result in structurally higher lifetime value and improved earnings quality.

- The accelerated shift from cash to digital payments, coupled with the expansion of e-commerce and omnichannel retail, is likely to drive a multi-year uplift in payment volumes for Tyro-specific verticals such as hospitality, health, and retail, laying a foundation for double-digit compounded top-line growth well above current market estimates.

- Tyro's robust capital position and management's explicit intent to pursue inorganic growth and sector consolidation signal the potential for value-accretive acquisitions or strategic partnerships, which could rapidly scale the business, generate synergy-driven margin expansion and deliver a step-up in profitability beyond what the market is currently pricing in.

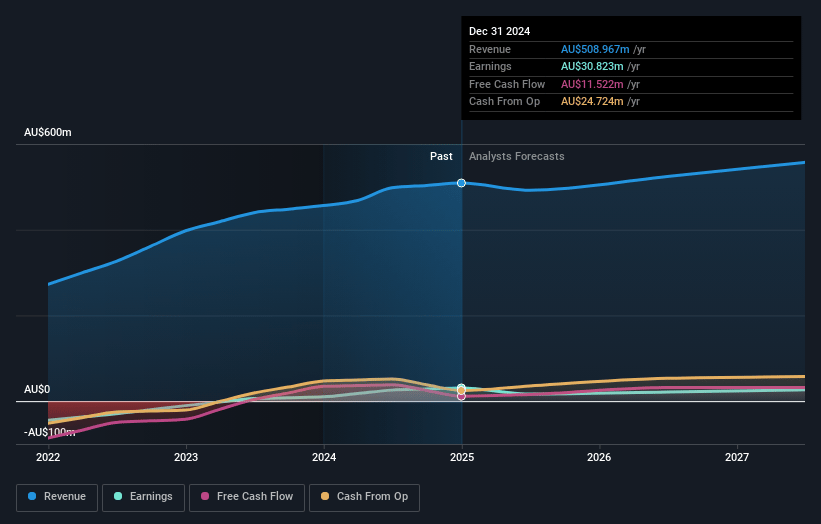

Tyro Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tyro Payments compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tyro Payments's revenue will grow by 3.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 6.1% today to 3.6% in 3 years time.

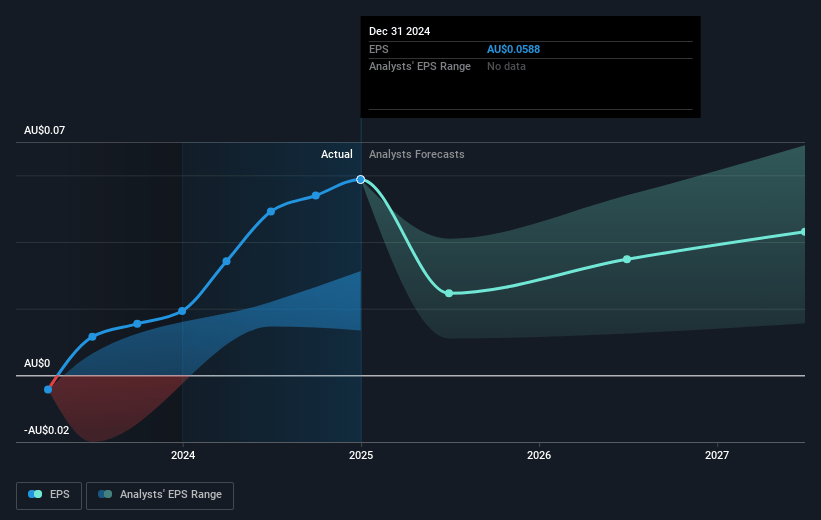

- The bullish analysts expect earnings to reach A$20.4 million (and earnings per share of A$0.04) by about July 2028, down from A$30.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 51.9x on those 2028 earnings, up from 16.5x today. This future PE is greater than the current PE for the AU Diversified Financial industry at 23.7x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

Tyro Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Escalating competitive threats from larger, well-capitalized global fintechs and technology providers, as well as ongoing consolidation in the payments sector, may erode Tyro Payments' market share and put long-term pressure on its revenue and gross margins.

- The intensifying trend toward commoditization and embedded/invisible payments, particularly with new entrants like tech giants and buy now pay later firms, threatens to reduce Tyro Payments' transaction margins and limit its ability to differentiate, undermining sustainable growth in both revenue and earnings.

- Increasing regulatory scrutiny and tightening compliance requirements, including future changes from the RBA's payments review and the global regulatory environment, could materially increase compliance and operational costs over time, reducing Tyro Payments' net margins and capital flexibility.

- Persistently high customer churn rates, especially in the discretionary segments and the ongoing underperformance of the Bendigo book, reflect challenges with client retention and elevated business closures, risking further revenue stagnation or decline despite recent gains in operational efficiency.

- Heightened customer acquisition costs due to reliance on direct sales, as well as ongoing technology investments and the risk of further impairments (such as the write-down of internally built banking software), may cause operating expenses to rise faster than revenue in a maturing SME market, squeezing net margins and slowing earnings growth in the years ahead.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tyro Payments is A$1.65, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tyro Payments's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.65, and the most bearish reporting a price target of just A$0.82.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$567.5 million, earnings will come to A$20.4 million, and it would be trading on a PE ratio of 51.9x, assuming you use a discount rate of 7.2%.

- Given the current share price of A$0.97, the bullish analyst price target of A$1.65 is 41.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.