Key Takeaways

- Intensifying competition from Big Tech and fintechs, along with alternative payment methods, threatens Tyro's market share and legacy revenue streams.

- Rising compliance costs and limited pricing levers are eroding margins, stalling growth opportunities, and weighing on long-term profitability.

- Expansion in healthcare payments, investments in integrated solutions, efficiency gains, and strong customer retention could drive sustainable profit and revenue growth despite industry competition.

Catalysts

About Tyro Payments- Engages in the provision of payment solutions to merchants in Australia.

- Tyro faces an accelerating threat from large technology firms and embedded finance solutions entering the payments space, which could bypass traditional payment providers entirely and materially shrink Tyro's core addressable market, resulting in structural headwinds for revenue growth over the long term.

- Increasing compliance, regulatory costs, and ongoing requirements-from cyber-security investments to regulatory reforms such as the RBA payments review-will continually drive operating expenses higher, eroding net margins and placing persistent downward pressure on future earnings.

- The company's reliance on the Australian SME market exposes it to domestic economic downturns and limits growth opportunities, while a lack of meaningful differentiation versus larger or more technologically advanced global fintechs increases the risk of price-based competition, ultimately compressing gross profit and slowing top line expansion.

- Fee compression from intense competition, especially by neobanks, fintechs, and Big Tech, will continue to reduce transaction-based revenue per merchant; this, combined with growing adoption of alternative payment methods such as Buy Now Pay Later and account-to-account payment rails, threatens to cannibalize Tyro's legacy revenue sources and impact total payment volume.

- While Tyro has delivered recent margin expansion through pricing transformation, this opportunity is largely exhausted; without further pricing levers and with terminal modernization CapEx still elevated, cost-to-income improvements are likely to stall, making it difficult to sustain margin growth and driving down long-term return on equity.

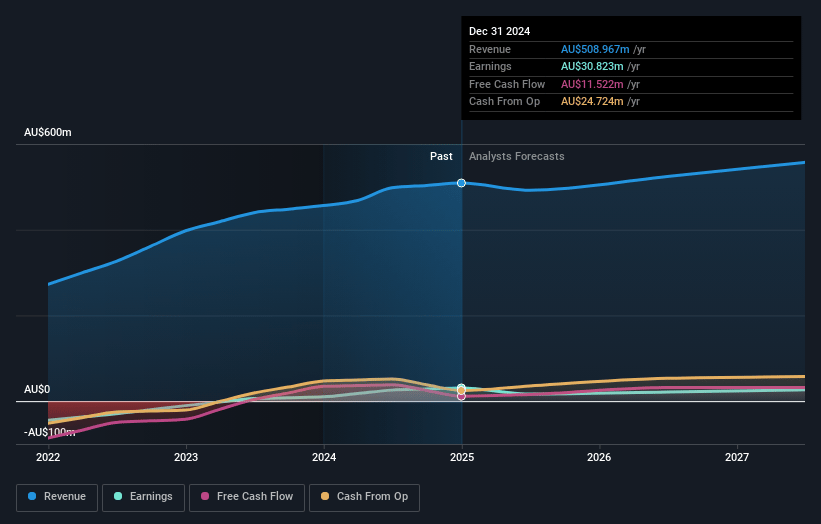

Tyro Payments Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tyro Payments compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tyro Payments's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.1% today to 2.5% in 3 years time.

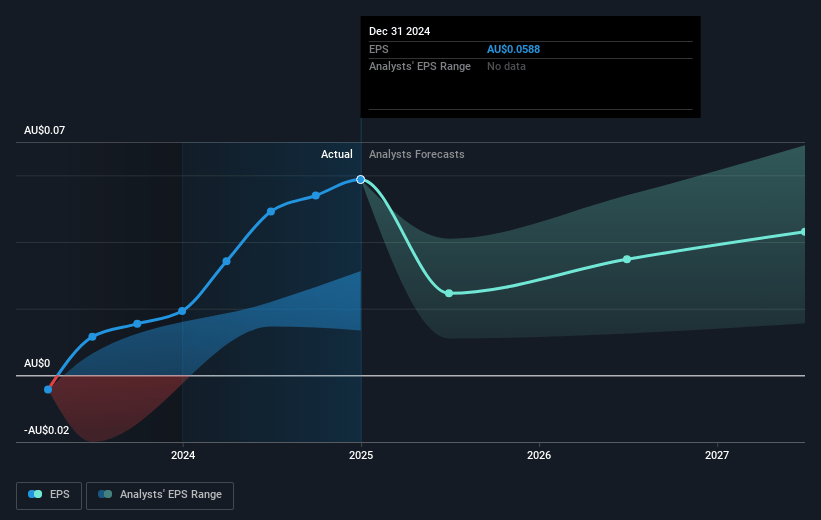

- The bearish analysts expect earnings to reach A$13.0 million (and earnings per share of A$0.02) by about July 2028, down from A$30.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.7x on those 2028 earnings, up from 16.5x today. This future PE is greater than the current PE for the AU Diversified Financial industry at 23.7x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

Tyro Payments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated growth of Tyro Health, which has significantly outpaced sector growth and is gaining market share in a large, fast-growing healthcare payments sector, can provide a long runway for revenue and earnings growth even if core discretionary sectors remain subdued.

- Tyro's ongoing investments in modern, integrated hardware and software payment solutions, including omnichannel capabilities and embedded finance through partnerships like Constantinople, position the company to benefit from secular trends like digital payment adoption and to diversify and expand gross profit sources.

- Persistent improvements in operating efficiency and a demonstrated ability to expand EBITDA margin-from 4% to over 29% in three years-reflect scale-driven cost advantages that can underpin rising net margins and profitability as transaction volumes and banking customers grow.

- Successful price transformation initiatives, disciplined margin management across merchant segments, and reduced cost of funding for banking operations have directly boosted gross profit and are likely to continue supporting both top line and margin expansion if sustained.

- High customer satisfaction and stickiness, especially as more merchants adopt integrated banking and lending products resulting in lower churn and higher lifetime value, can drive resilient and recurring gross profit and earnings, strengthening Tyro's financial outlook even as industry competition intensifies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tyro Payments is A$0.86, which represents two standard deviations below the consensus price target of A$1.35. This valuation is based on what can be assumed as the expectations of Tyro Payments's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.65, and the most bearish reporting a price target of just A$0.82.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$518.5 million, earnings will come to A$13.0 million, and it would be trading on a PE ratio of 42.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of A$0.97, the bearish analyst price target of A$0.86 is 12.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.