Last Update 14 Dec 25

OFX: Global Corporate Card Expansion Will Drive Long-Term Upside Potential

Analysts have nudged their price target for OFX Group slightly higher to reflect modest upward revisions in discount rate and future earnings multiples, while maintaining a broadly unchanged view of the company’s fair value and long term fundamentals.

What's in the News

- OFX Group deepens its partnership with Thredd to underpin its global cards, payments and FX platform, integrating card issuing, spend management, FX solutions and payments into a single offering for SMB and corporate clients (Client Announcements).

- Following successful rollouts in Australia, Canada and Europe, OFX is expanding its integrated corporate card and payments solution into the United States and select APAC markets, targeting broader international coverage for business customers (Client Announcements).

- Thredd supports OFX with processing infrastructure, compliance expertise and in-market support to help scale secure, multi-currency corporate card programmes globally (Client Announcements).

- OFX has adopted Thredd's fraud transaction monitoring tools, adding real-time spend controls and automated expense management to enhance risk management and cash flow visibility for clients (Client Announcements).

Valuation Changes

- Fair Value: unchanged at A$0.93 per share, indicating no revision to the analyst estimate of intrinsic value.

- Discount Rate: risen slightly from 7.34 percent to 7.40 percent, reflecting a modestly higher required return applied to future cash flows.

- Revenue Growth: effectively unchanged at around 4.76 percent, suggesting no material shift in medium term top line expectations.

- Net Profit Margin: effectively unchanged at around 4.75 percent, indicating stable assumptions for underlying profitability.

- Future P/E: unchanged at 21.1x, indicating the same multiple applied to forecast earnings.

Key Takeaways

- Pivot to B2B and investment in new platform with multicurrency accounts aim to increase revenue through enhanced client retention and service offerings.

- Global rollout and strategic use of analytics and technology could boost non-FX revenue, improving margins and capturing new, localized market opportunities.

- Delayed interest rate changes and macroeconomic uncertainty have impacted OFX Group's earnings, active client retention, and revenue growth in key markets.

Catalysts

About OFX Group- Provides international payments and foreign exchange services in the Asia Pacific, North America, Europe, the Middle East, and Africa.

- OFX is pivoting to B2B with a focus on spending management solutions, which could enhance revenue by attracting clients seeking comprehensive financial services rather than just FX transactions.

- The company is investing in its new client platform with multicurrency accounts and card functions, potentially increasing revenue through higher customer retention and usage of additional services beyond FX.

- Expanded offerings of subscription, interchange, and merchant fees through the new platform could boost non-FX revenue, positively impacting net margins due to higher-margin products.

- A global rollout, starting with Canadian and UK markets in fiscal year '25, aims to capture new clients and grow revenue by providing more competitive, localized financial service solutions.

- OFX is leveraging analytics and technology to optimize pricing and manage cash balances efficiently for interest income, which could improve earnings by sustaining strong NOI margins.

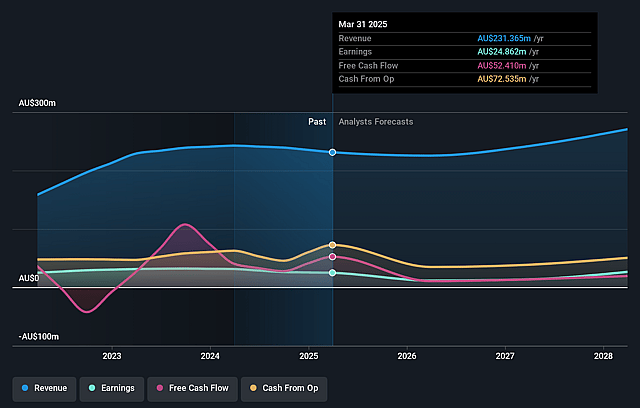

OFX Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OFX Group's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.7% today to 9.8% in 3 years time.

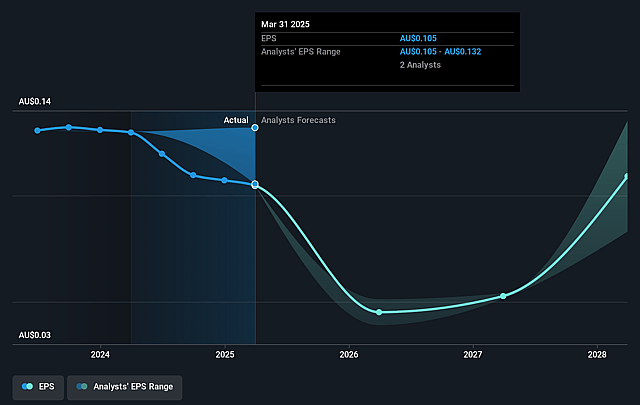

- Analysts expect earnings to reach A$26.5 million (and earnings per share of A$0.11) by about September 2028, up from A$24.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$30.7 million in earnings, and the most bearish expecting A$20.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 7.7x today. This future PE is lower than the current PE for the AU Diversified Financial industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 2.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

OFX Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The unexpected macroeconomic conditions in the first half of FY '25, particularly the delayed interest rate easing in the U.S. and not starting in Australia, impacted corporate confidence and led to deferred high-value transactions, affecting revenues in key markets like Canada and the U.K.

- Corporate Average Transaction Values (ATVs) decreased by 13.5% globally in September, with significant declines of 9.4% in Canada and 19.5% in the U.K., potentially reducing overall earnings.

- The company experienced a 3.5% revenue growth in the Corporate segment, which was below expectations and suggests possible future risks to revenue if macroeconomic challenges persist.

- Net profit after tax decreased by 32.3%, primarily due to a $2.2 million non-cash fair value loss on contingent consideration for Paytron, hinting at potential volatility and unpredictability in net earnings.

- Active client decline in the Corporate segment in the first half, coupled with a revenue decline in the High Value Consumer segment by 3.6%, may signal ongoing risks to revenue growth and client retention.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.223 for OFX Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.63, and the most bearish reporting a price target of just A$0.94.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$270.7 million, earnings will come to A$26.5 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$0.82, the analyst price target of A$1.22 is 33.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on OFX Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.