Key Takeaways

- Heightened competition from major banks and fintech disruptors threatens OFX's future transaction volumes, fee structures, and revenue growth.

- Growing compliance, cybersecurity, and investment costs risk compressing margins, even as digital adoption and market expansion increase revenue potential.

- Rapid spending on platform development alongside market weakness, competitive pressure, and unclear revenue outlook threaten long-term profitability and shareholder confidence.

Catalysts

About OFX Group- Provides international payments and foreign exchange services in the Asia Pacific, North America, Europe, the Middle East, and Africa.

- While OFX Group is actively benefiting from the continued globalization of business, expanding total addressable market (TAM) by 94 percent through its new client platform and product integration, the underlying risk remains that large global banks may accelerate direct integration of payments and FX capabilities, limiting independent platforms' future share of transaction volumes and thus constraining long-term revenue growth.

- Despite the accelerating shift toward digital cross-border payments and increased digital adoption-with OFX leveraging rapid feature deployment and innovative products like multicurrency corporate cards to drive client value and higher average revenue per client-there is an ongoing threat that low-cost, highly automated fintech disruptors or neobanks may structurally depress industry transaction fees, which could erode OFX's top-line growth and reduce net operating income margins.

- Although the long-term secular trend of international migration and remote work expands OFX's potential customer base across consumer and SME segments, persistent regulatory tightening, greater compliance obligations, and heightened focus on cybersecurity may push operating costs structurally higher, potentially offsetting gains in net margins even as revenue climbs.

- While ongoing technology investment and the rollout of new products (such as integrated AP systems, cards, and domestic payments capabilities) should allow OFX to further capitalize on digital adoption and potentially increase non-FX revenues to over 10 percent in the corporate segment by FY28, there remains a material risk that the company's elevated operating expenses and delayed operating leverage-due to accelerated investment-could result in margin compression or delayed earnings growth if revenue ramp fails to materialize as projected.

- Despite the successful expansion of ARPC and early evidence of increased cross

- and up-selling to high-value clients, OFX continues to face the risk that, as industry consolidation accelerates, larger and more capitalized competitors may rapidly scale their own integrated offerings, outpacing OFX's technological advantage and ultimately limiting its share of future incremental revenue and earnings growth opportunities.

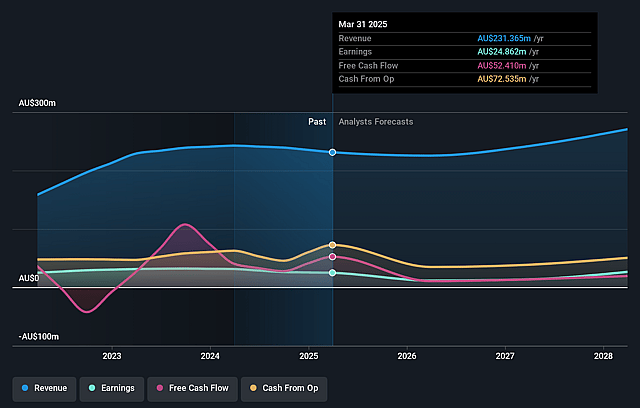

OFX Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on OFX Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming OFX Group's revenue will grow by 4.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 10.7% today to 7.7% in 3 years time.

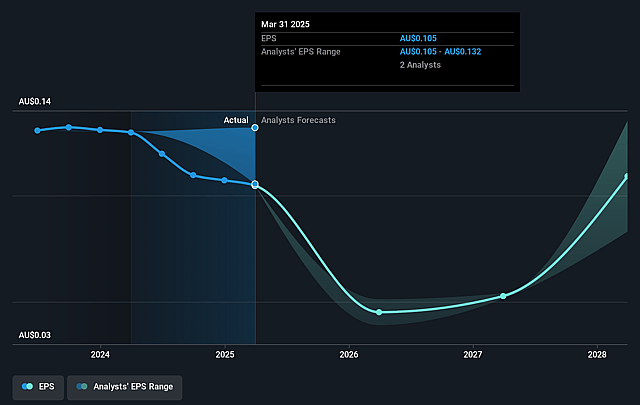

- The bearish analysts expect earnings to reach A$20.5 million (and earnings per share of A$0.08) by about September 2028, down from A$24.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, up from 7.7x today. This future PE is lower than the current PE for the AU Diversified Financial industry at 20.2x.

- Analysts expect the number of shares outstanding to decline by 2.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

OFX Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained weakness in small and mid-sized business (SME) confidence, driven by ongoing political instability, persistent inflation, tariff risks, and uncertain global macro conditions, has caused declines in transaction volumes and average transaction values, which directly threatens OFX Group's ability to grow revenues and deliver on ambitious top-line targets over the long term.

- OFX is undertaking an aggressively accelerated investment program in platform transformation and go-to-market strategies, causing operating expenses and capital expenditures to rise significantly, while explicitly not targeting operating leverage or margin expansion in fiscal years 2026 and 2027, increasing the risk of sustained margin compression and delayed earnings growth.

- There is heightened uncertainty and volatility in OFX's core FX business due to unpredictable interest rates, fluctuating inflation, and tariff-related shocks. Management has acknowledged its inability to provide reliable near

- or medium-term revenue outlooks, which casts doubt on near-term revenue stability and long-term earnings projections.

- Intensifying competition from larger fintechs and incumbent banks, who still dominate the SME market, raises the risk that the new product platform (NCP), despite heavy investment, may struggle to materially win market share, leading to lower-than-expected client growth and average revenue per client, and thus impairing long-term revenue and profit expansion.

- The decision to conserve cash and suspend share buybacks, despite a strong net cash position well above stated working capital requirements, signals a lack of confidence in near-term business performance and market stability, which may undermine shareholder returns and limit options for supporting the share price via capital management.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for OFX Group is A$0.94, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of OFX Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.63, and the most bearish reporting a price target of just A$0.94.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$265.4 million, earnings will come to A$20.5 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$0.82, the bearish analyst price target of A$0.94 is 12.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.