Key Takeaways

- Rapid client adoption of new digital platforms and regulatory wins are expanding market share and strengthening revenue diversification in key growth regions.

- Investments in AI and platform integrations are deepening customer loyalty, positioning OFX as a trusted choice for cross-border SMEs amidst rising competition.

- Rising costs, regulatory pressures, competitive threats, and macroeconomic uncertainty are suppressing margin expansion and threaten OFX's revenue growth and earnings stability.

Catalysts

About OFX Group- Provides international payments and foreign exchange services in the Asia Pacific, North America, Europe, the Middle East, and Africa.

- While analyst consensus expects growth from pivoting to B2B spending management and expanded platform offerings, the 94% increase in total addressable market validated by independent research suggests that market share gains and ARPC expansion could be far larger and occur more rapidly, positioning OFX for a step-change in revenue and EBIT growth by fiscal 2028.

- Analysts broadly agree the launch of the new client platform will drive higher-margin, non-FX revenue; however, client adoption rates and cross-sell metrics are already outpacing initial expectations, with early evidence of doubled conversion rates and rapid uptake of multi-product bundles, pointing to even stronger net margin expansion and customer lifetime value than modeled.

- OFX's global expansion is underpinned by regulatory wins (such as Central Bank of Ireland approval) and first-mover advantages (e.g., first nonbank Visa issuer in Canada), unlocking unique access to high-growth cross-border trade corridors, especially in North America and Europe, which can structurally accelerate overall revenue diversification and earnings resilience.

- The deepening digitization and globalization of commerce, combined with SMEs' growing willingness to switch to fintechs-as evidenced by over three-quarters still being with legacy banks-creates a runway for sustained double-digit client acquisition and transaction volume growth, which will directly boost top-line revenue.

- OFX's ongoing investments in AI-driven invoice recognition, cybersecurity certifications (e.g., ISO 27001), and accounting platform integrations uniquely position it to become the trusted platform of choice for cross-border SMEs, reinforcing customer stickiness and fortifying its long-term margin profile against competitive and regulatory headwinds.

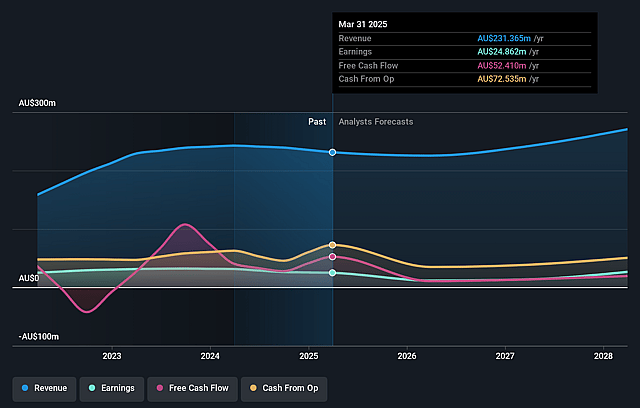

OFX Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on OFX Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming OFX Group's revenue will grow by 8.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 10.7% today to 10.5% in 3 years time.

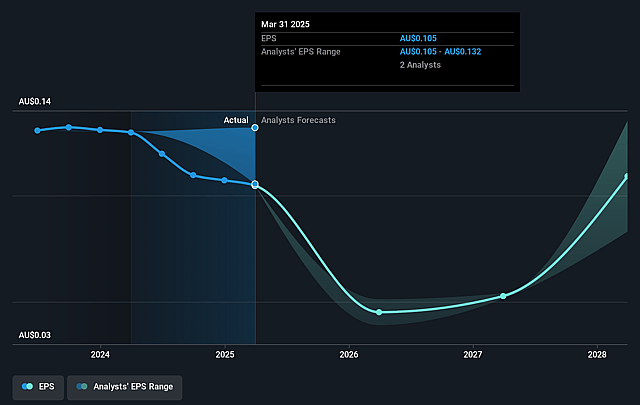

- The bullish analysts expect earnings to reach A$31.2 million (and earnings per share of A$0.14) by about September 2028, up from A$24.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from 8.3x today. This future PE is lower than the current PE for the AU Diversified Financial industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 2.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

OFX Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- OFX's revenues and margins remain highly sensitive to global macroeconomic volatility, such as political instability and trade tariffs, which have led to unpredictable and weaker business confidence, especially among SME clients-this volatility could continue to reduce revenue growth and compress earnings over time.

- Persistent competitive pressure from banks and fintechs is leading to declining margins and active client numbers in lower-revenue segments, while OFX's ability to grow high-value clients is only in the mid-single digits; this dynamic limits top-line growth and threatens overall net margin expansion.

- The company is committing to accelerated investment and higher operating expenditure in the next two years without targeting operating leverage until after fiscal year '27, increasing the risk that profitability and net margins will remain subdued in the medium term, especially if anticipated revenue growth is delayed or does not materialize.

- The increasing regulatory scrutiny and need for significant investment in compliance, cyber security, and payment infrastructure introduce growing costs and operational complexity, which may eat into net margins and generate higher earnings volatility if regulatory requirements continue to intensify or if there are any breaches.

- OFX's continued heavy dependence on transaction-based revenue and global SME activity places it at risk if deglobalization trends, protectionism, or the adoption of central bank digital currencies reduce international trade volumes or disintermediate traditional cross-border payment platforms, directly impacting both future revenues and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for OFX Group is A$1.63, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of OFX Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.63, and the most bearish reporting a price target of just A$0.94.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$297.3 million, earnings will come to A$31.2 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$0.88, the bullish analyst price target of A$1.63 is 45.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.