Key Takeaways

- The shift toward low-fee, self-service investment products threatens Netwealth's traditional adviser-centric model and pressures its fees and client retention.

- Rising competition, regulatory costs, and disproportionate operating expenses risk eroding profit margins and undermining long-term earnings growth.

- Strong organic growth, strategic diversification, and technology-driven efficiencies position Netwealth for scalable profitability, market share gains, and resilient long-term earnings in wealth management.

Catalysts

About Netwealth Group- A financial services company, engages in the wealth management business in Australia.

- The accelerating adoption of low-fee, passive investment products is undermining the value proposition of intermediaries like Netwealth, which is likely to lead to sustained declines in platform fees and revenue as clients increasingly shift to cheaper alternatives.

- Growing consumer demand for direct investment and self-service platforms is beginning to erode the traditional adviser-centric wrap model that powers Netwealth's growth; this structural change risks both client attrition and sharply lower net flows in coming years.

- Intensifying competition from major incumbents and nimble fintechs is already resulting in pricing pressure, forcing Netwealth to reduce cash rates offered and review its fee structure, with the ongoing shift to larger and more powerful adviser clients likely to compress operating and net margins further.

- Rising regulatory scrutiny and tightening data privacy and cybersecurity rules will impose higher compliance costs and operational risks, requiring expensive continuous investment that may outpace revenue growth, thus reducing future profitability and operating leverage.

- Heavy and increasing investment in technology and headcount, exemplified by the ramp-up in OpEx growth well above revenue growth, risks driving negative operating leverage if the market for traditional platform services and adviser inflows softens or stalls, putting long-term earnings growth at risk.

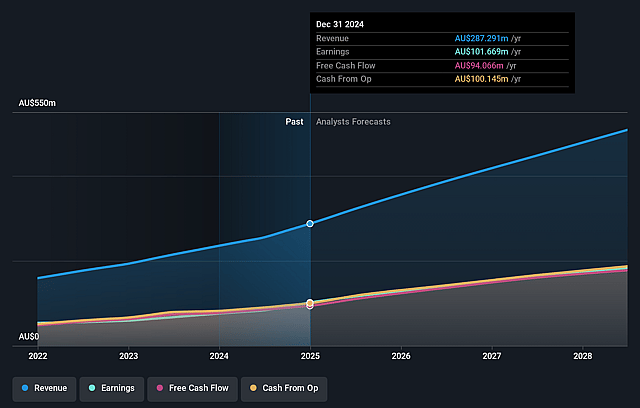

Netwealth Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Netwealth Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Netwealth Group's revenue will grow by 18.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 35.4% today to 35.7% in 3 years time.

- The bearish analysts expect earnings to reach A$171.3 million (and earnings per share of A$0.7) by about July 2028, up from A$101.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.5x on those 2028 earnings, down from 88.5x today. This future PE is greater than the current PE for the AU Capital Markets industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Netwealth Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Netwealth has demonstrated robust and accelerating fund inflows, achieving record quarters with an 80% year-over-year increase in net flows and expanding its funds under administration to over $100 billion, which suggests ongoing organic growth and the potential for continued revenue expansion.

- Operational efficiency and disciplined cost management have driven EBITDA margin above 50%, with a Rule of 40 score exceeding 76, positioning the company with industry-leading profitability and high-quality recurring cash flow, supporting strong net margins and earnings sustainability.

- Strategic expansion into new markets and client segments, including high net worth, mass affluent, and institutional markets, combined with successful integration of technology acquisitions like Xeppo and Flux, are broadening Netwealth's addressable market and diversifying sources of future revenue.

- Continuous investment in proprietary platform features, automation, and AI-driven efficiency initiatives are enhancing advisor and client experience, which is likely to improve client retention, attract incremental flows, and further support operational leverage and margin improvement.

- The ongoing industry transition from legacy systems to modern, transparent platforms-as well as robust adviser network expansion and consolidation within Australia's wealth management industry-point to additional market share gains and scalable growth, underlining the resilience of Netwealth's earnings and revenue base over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Netwealth Group is A$16.45, which represents two standard deviations below the consensus price target of A$30.3. This valuation is based on what can be assumed as the expectations of Netwealth Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$40.0, and the most bearish reporting a price target of just A$12.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$480.2 million, earnings will come to A$171.3 million, and it would be trading on a PE ratio of 29.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$36.74, the bearish analyst price target of A$16.45 is 123.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.