Last Update 29 Nov 25

Fair value Decreased 0.93%HUB: Index Inclusion And Stable Outlook Will Guide Performance This Year

Analysts have slightly adjusted their price target for HUB24, lowering the estimated fair value from $108.36 to $107.35 per share. This change reflects modest shifts in discount rate, revenue growth expectations, and profit margin projections, which have tempered the outlook.

What's in the News

- HUB24 Limited (ASX:HUB) has been added to the FTSE All-World Index (USD) (Key Developments)

Valuation Changes

- Consensus Analyst Price Target: decreased marginally from A$108.36 per share to A$107.35 per share

- Discount Rate: increased slightly from 7.71% to 7.71%

- Revenue Growth: increased modestly from 17.23% to 17.38%

- Net Profit Margin: decreased fractionally from 26.83% to 26.76%

- Future P/E: decreased slightly from 61.46x to 60.81x

Key Takeaways

- Strategic positioning as a market leader and growth in technology solutions could enhance customer satisfaction and expand revenue growth potential.

- Expanding adviser network and ongoing innovations are likely to boost earnings and attract a broader customer demographic.

- Increased competition, market volatility, rising costs, and technological demands may pressure HUB24's margins and growth prospects amidst economic uncertainties.

Catalysts

About HUB24- A financial services company, provides integrated platform, technology, and data solutions to wealth industry in Australia.

- The strategic positioning of HUB24 as a market leader with strong growth in funds under administration (FUA) suggests potential for ongoing revenue growth, as indicated by a 4-year CAGR of 42% in group revenue. This is complemented by a substantial increase in market share from 6.6% to 7.9% over the last 12 months.

- Enhancement and integration of technology solutions, such as the launch of Engage and improvements in compliance features, aim to improve operational efficiency and customer satisfaction, potentially increasing net margins by reducing costs and enhancing service offerings.

- The significant increase in the adviser network, with 361 net additions, indicates an expanding customer base, which is likely to boost future earnings. With the average FUA per adviser doubling over four years and further potential for growth, revenue from this segment is poised to increase.

- Planned innovations and strategic alliances to introduce new investment opportunities and retirement solutions are set to cater to a broader customer demographic. These enhancements can lead to higher revenue streams as they attract more clients and assets under management.

- Automation and AI investments aimed at improving operational quality and service delivery could enable further cost savings and scalability, translating into improved net margins and increased earnings as operations become more efficient and less human resource-intensive.

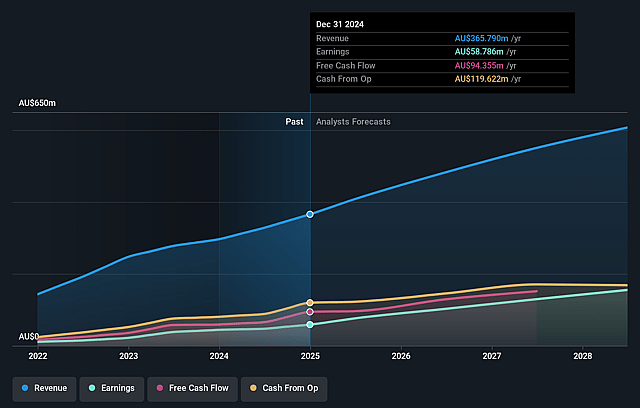

HUB24 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HUB24's revenue will grow by 16.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.7% today to 26.6% in 3 years time.

- Analysts expect earnings to reach A$168.7 million (and earnings per share of A$2.05) by about September 2028, up from A$79.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$187.7 million in earnings, and the most bearish expecting A$135.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 58.9x on those 2028 earnings, down from 103.0x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.58%, as per the Simply Wall St company report.

HUB24 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive landscape may intensify with new entrants or existing players potentially lowering prices to capture market share, potentially impacting HUB24's revenue margins.

- Any significant downturn in equity markets could adversely affect funds under administration (FUA) growth and platform revenues, given the sensitivity to market movements.

- Increasing operational expenses may outpace revenue growth if headcount expands significantly to service growth, which could impact net margins and overall profitability.

- Advancement in technology by competitors or insufficient innovation from HUB24 might pressure HUB24's margin as they may need to increase investment in technology to sustain their market position.

- Dependence on continued favorable market conditions and investor sentiment for high net inflows mean unexpected economic downturns could reduce earnings and growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$99.751 for HUB24 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$125.0, and the most bearish reporting a price target of just A$42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$635.3 million, earnings will come to A$168.7 million, and it would be trading on a PE ratio of 58.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$100.77, the analyst price target of A$99.75 is 1.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on HUB24?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.