Key Takeaways

- Reliance on large jackpot cycles and concentrated key contracts creates volatile revenues and exposes the company to heightened operating risk.

- Rising marketing, compliance, and operational costs threaten to compress net margins and hinder sustainable long-term growth despite digital platform strengths.

- Heavy reliance on volatile jackpots, product concentration, rising customer acquisition costs, struggling international growth, and risky M&A strategy all threaten sustainable long-term earnings and margins.

Catalysts

About Jumbo Interactive- Engages in the retail of lottery tickets through internet and mobile devices in Australia, the United Kingdom, Canada, Fiji, and internationally.

- While Jumbo Interactive is well positioned to benefit from increasing digital penetration and the demographic shift towards mobile-first consumers, its heavy dependence on large jackpot cycles introduces significant volatility in revenue and EBITDA, making consistent long-term growth uncertain if subdued jackpot periods persist.

- Although the ongoing expansion of regulatory frameworks supporting online gaming could open new markets for digital lottery operators, Jumbo's concentration in key contracts like Lotterywest and Tabcorp creates exposure to contract renewal or renegotiation risks, which could materially reduce revenues and compress net margins should these relationships deteriorate.

- While the shift to B2C opportunities and success of the Daily Winners loyalty program demonstrate adaptability and have begun to boost engagement and diversify revenue streams, the company faces escalating marketing costs and increased operational expenditure tied to customer acquisition and retention, which may offset operational leverage and limit net margin growth over time.

- Despite a scalable digital platform and investments in proprietary technology, the rising societal focus on gambling harm minimization and tightening of responsible gaming measures could result in stricter regulations or higher compliance costs, directly increasing operational friction and limiting the company's ability to grow active player pools and sustain earnings momentum.

- While international expansion and new SaaS partnerships offer long-term growth potential, slow traction in underpenetrated markets such as Canada and continued SaaS segment margin pressures from product mix and client dynamics pose risks to topline growth and the company's ability to achieve its desired earnings scalability.

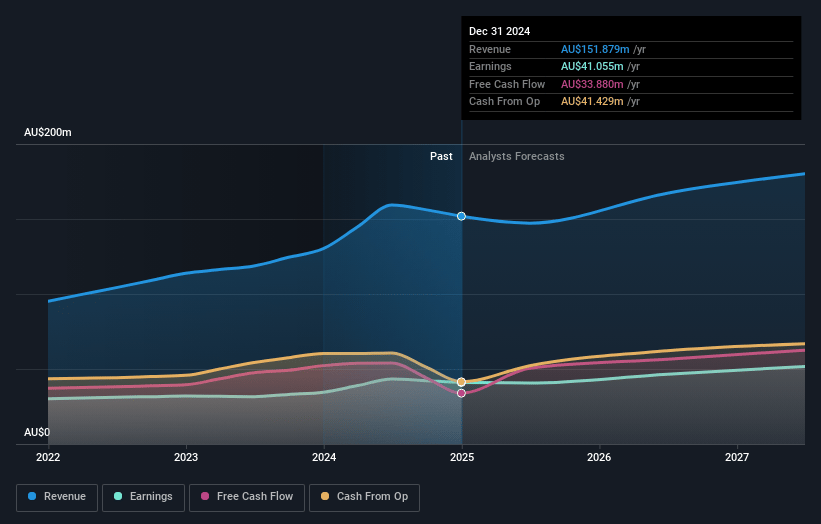

Jumbo Interactive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Jumbo Interactive compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Jumbo Interactive's revenue will grow by 6.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 27.1% today to 26.7% in 3 years time.

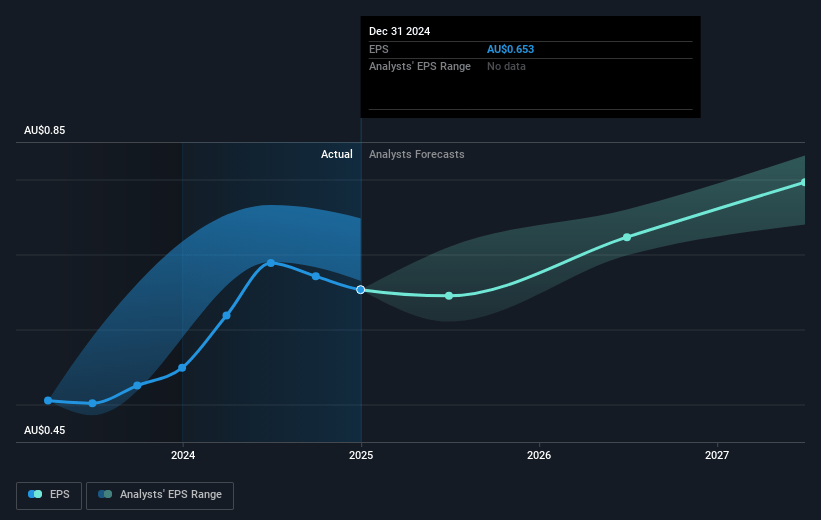

- The bearish analysts expect earnings to reach A$48.5 million (and earnings per share of A$0.77) by about July 2028, up from A$41.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, up from 15.6x today. This future PE is lower than the current PE for the AU Hospitality industry at 32.9x.

- Analysts expect the number of shares outstanding to decline by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.86%, as per the Simply Wall St company report.

Jumbo Interactive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jumbo Interactive's revenue is highly sensitive to jackpot cycles, and periods of subdued or below-trend jackpots resulted in materially lower ticket sales, group TTV, revenue, and EBITDA, which creates ongoing earnings volatility and limits visibility for long-term revenue and earnings growth.

- The company's Lottery Retailing segment remains heavily concentrated in the largest three games, accounting for approximately 90% of portfolio TTV, making the business vulnerable to shifting player trends, jackpot structures, or contract changes related to these few products, all negatively affecting future revenues and gross margins.

- Digital lottery penetration, while showing room for growth, is facing increasing market maturity and heightened competition, which is reflected in a sharply rising cost per lead and escalating marketing costs, putting pressure on Jumbo's ability to efficiently acquire and retain customers and threatening future net margins and profitability.

- Recent declines in international revenues, particularly the 19% decrease in Canadian revenue due to contract transitions or discontinuations, exposes the business to the risk of failed or slow international expansion, which would hinder Jumbo's topline growth ambitions and squeeze future earnings.

- Shifts to a more aggressive B2C M&A strategy reflect both the limited growth observed in B2B SaaS and the challenge of finding and integrating high-growth acquisition targets at appropriate valuations, introducing long-term execution risk, increased investment costs, and the possibility of organic growth underperformance, all of which could negatively impact both earnings consistency and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Jumbo Interactive is A$11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Jumbo Interactive's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$15.3, and the most bearish reporting a price target of just A$11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$181.5 million, earnings will come to A$48.5 million, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$10.28, the bearish analyst price target of A$11.0 is 6.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.