Key Takeaways

- The success of loyalty initiatives and investments in proprietary tech are rapidly boosting margins, revenue scalability, and customer engagement beyond analyst expectations.

- Strategic expansion and alignment with digital fundraising trends position the company for accelerated market share growth, diversified earnings, and increased downside protection.

- Jumbo's growth is threatened by jackpot volatility, rising acquisition costs, regulatory pressures, poor diversification, and competition from disruptive gambling technologies.

Catalysts

About Jumbo Interactive- Engages in the retail of lottery tickets through internet and mobile devices in Australia, the United Kingdom, Canada, Fiji, and internationally.

- While analyst consensus is positive about Jumbo's Daily Winners loyalty program as a tool for engagement, it significantly underestimates the rapid compounding effect; with member uptake surpassing 12-month targets in just 6 months, the program is on track to drive outsized, recurring, high-margin revenue and meaningfully accelerate both ARPU and net margin well ahead of expectations.

- Analysts broadly agree that international expansion will fuel moderate long-term growth, but this view overlooks the inflection potential; Jumbo's disciplined pivot to B2C M&A in the UK and North America could trigger a step-change in earnings growth and market share as these under-penetrated, highly regulated markets digitise more rapidly than forecasts suggest.

- The company is uniquely poised to capture the accelerating shift toward digital and cashless entertainment experiences, leveraging its established brand and product suite to increase customer acquisition, reactivate a far larger share of its 4-million-strong dormant player database, and deliver exponential transactional revenue growth.

- Jumbo's ongoing investment in proprietary technology and automation is set to drive sustained operational leverage, lowering costs per transaction and increasing scalability, which will support persistent expansion in group EBITDA margins even as revenues grow.

- The industry's pivot to digital charitable lotteries aligns perfectly with Jumbo's high-margin SaaS platform, and as more non-profits and government entities adopt digital fundraising, Jumbo stands to unlock stable, rapidly growing streams of recurring revenue, diversifying earnings and providing meaningful downside protection.

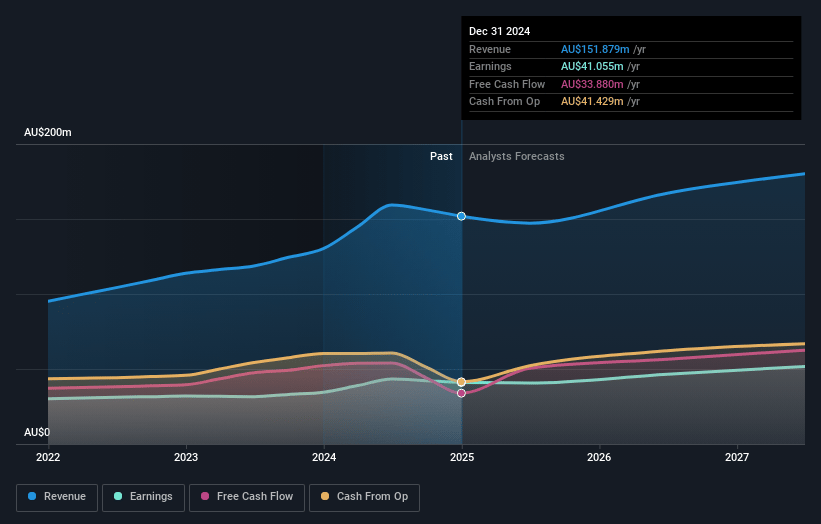

Jumbo Interactive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Jumbo Interactive compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Jumbo Interactive's revenue will grow by 9.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 27.1% today to 32.0% in 3 years time.

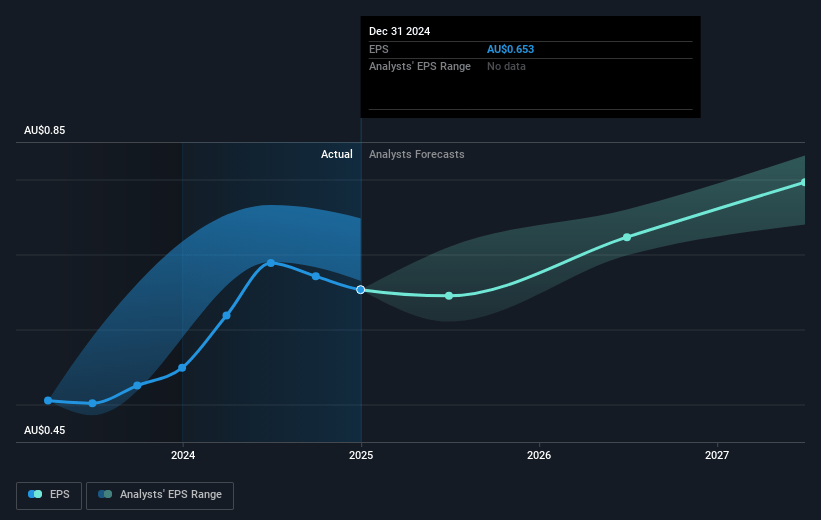

- The bullish analysts expect earnings to reach A$62.8 million (and earnings per share of A$1.01) by about July 2028, up from A$41.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 15.0x today. This future PE is lower than the current PE for the AU Hospitality industry at 32.5x.

- Analysts expect the number of shares outstanding to decline by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

Jumbo Interactive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jumbo Interactive's revenue and earnings remain highly sensitive to the jackpot cycle for core games, as seen in the recent period of subdued jackpots causing double-digit declines in TTV, revenue, and underlying EBITDA, which highlights the risk of long-term earnings stagnation if large jackpot frequency falls or market maturity limits growth in Australia.

- The company faces increasing competition and rising customer acquisition costs in the digital lottery space, demonstrated by the 76% year-on-year increase in cost per lead and the strategic shift to reactivating existing players, pressuring future net margins as more spending is required to maintain or regain market share.

- Regulatory and societal pressures, such as tightening online gambling laws and greater scrutiny over advertising and responsible gaming, could increase compliance costs, restrict marketing activities, and introduce friction in onboarding and retention, ultimately lowering transaction volumes and group revenue.

- Heavy reliance on a concentrated portfolio of major games and limited geographic diversification-evident in the 90% exposure to the top three games and only modest overseas earnings-exposes Jumbo to outsized risk if domestic participation plateaus or declines, weakening revenue growth prospects.

- Sector technology disruption and heightened competition from new, potentially decentralized gambling models or global entrants threaten the relevance of Jumbo's reseller platform, risking structural declines in transaction volume and compression of revenue and margin over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Jumbo Interactive is A$15.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Jumbo Interactive's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$15.3, and the most bearish reporting a price target of just A$11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$196.5 million, earnings will come to A$62.8 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$9.89, the bullish analyst price target of A$15.3 is 35.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.