Key Takeaways

- Regulatory changes, rising labor and supply costs, and sustainability mandates are compressing margins and increasing operational risks for Collins Foods.

- Shifting consumer preferences and growing competition from healthier and digital-first concepts threaten sales growth and heighten single-brand dependency vulnerabilities.

- Robust growth in core and expansion markets, operational efficiency gains, and prudent capital management set the stage for sustained improvement in margins and earnings resilience.

Catalysts

About Collins Foods- Engages in the operation, management, and administration of restaurants in Australia and Europe.

- The ongoing rise in regulatory pressures and sustainability mandates across Australia and Europe, such as stricter limits on single-use plastics, carbon taxes, and increased scrutiny over wage compliance, are likely to drive operating costs materially higher for Collins Foods in the coming years, leading to sustained margin compression.

- Heightened consumer focus on health, wellness, and clean eating is accelerating the shift away from traditional fast food offerings, potentially eroding same-store sales and undermining revenue growth across Collins Foods' core KFC and soon-to-be-exited Taco Bell brands.

- The company's heavy reliance on KFC as the primary revenue driver significantly increases single-brand risk. Should KFC's brand perception or competitive positioning weaken-amid shifting preferences or increased competition from healthier or digital-first QSR concepts-group revenues and earnings could decline.

- Persistent upward pressure on labor costs, especially in Europe where the Netherlands saw over 30 percent wage rate increases in three years, combined with ongoing food ingredient price volatility from factors like Avian flu, are set to erode restaurant-level profitability and depress net margins.

- Intensifying competition from virtual, delivery-only restaurants and fast-casual entrants threatens to undermine transaction growth and pricing power, limiting Collins Foods' ability to deliver top-line expansion and stably grow earnings over the medium to long term.

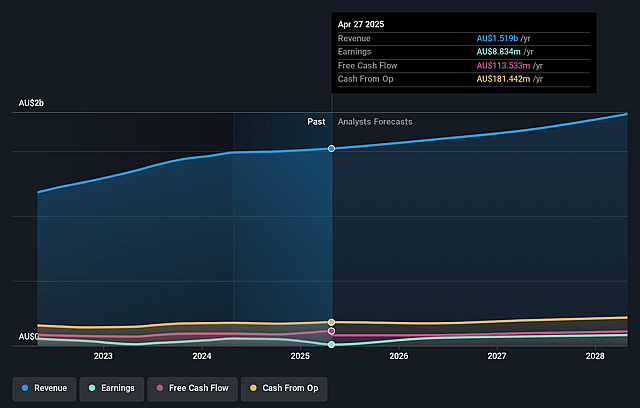

Collins Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Collins Foods compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Collins Foods's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.6% today to 4.8% in 3 years time.

- The bearish analysts expect earnings to reach A$83.5 million (and earnings per share of A$0.71) by about September 2028, up from A$8.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, down from 140.8x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.64%, as per the Simply Wall St company report.

Collins Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is demonstrating strong momentum in KFC Australia, evidenced by record revenues, digital adoption driving 34 percent of sales, and sustained investment in menu innovation and store modernization, which is expected to support revenue growth and margin improvement in future periods.

- Collins Foods has a healthy balance sheet with net debt reduced, strong cash flow generation, and a disciplined capital management approach, which provides significant optionality for further organic and inorganic growth, directly underpinning potential gains in earnings and shareholder returns.

- The company's exclusive agreement with Yum! and strategic focus on rapid expansion in the underpenetrated German market, paired with proven strong average store revenues in Germany, positions the company for long-term store network and revenue growth, creating operating leverage that could lift EPS over time.

- Technological investments in kiosks, digital ordering, and operational productivity tools are already improving labor and operational efficiency across key markets, and ongoing adoption is expected to further lower costs and lift net margins.

- Recent softness in the Netherlands is being addressed aggressively through operational excellence initiatives and a moderated development pace, with management targeting improved profitability in the near term; if successful, this could drive a rebound in net margins and overall earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Collins Foods is A$8.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Collins Foods's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$14.0, and the most bearish reporting a price target of just A$8.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$1.7 billion, earnings will come to A$83.5 million, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 9.6%.

- Given the current share price of A$10.54, the bearish analyst price target of A$8.5 is 24.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.