Key Takeaways

- Rapid digital adoption and AI-driven efficiency boost margins, sales growth, and sustained profit gains beyond market expectations.

- Expansion and capital redeployment focus on high-return regions, positioning the company for strong network growth and resilient earnings.

- Shifting consumer preferences, rising costs, regulatory demands, and overdependence on key brands threaten Collins Foods' growth, margins, and long-term revenue stability.

Catalysts

About Collins Foods- Engages in the operation, management, and administration of restaurants in Australia and Europe.

- While analyst consensus focuses on digital channel growth, it likely understates the step change possible as kiosk penetration in Australia approaches full rollout and digital channel sales, already at 34 percent locally and over 60 percent in Europe, continue to drive both higher average checks and labor savings, unlocking further margin expansion and revenue acceleration beyond current expectations.

- Analyst consensus highlights German expansion, but with exclusivity in high-population regions and industry-leading per-store economics already in place, accelerated new builds and potential bolt-on M&A could drive group-level revenue and EBITDA CAGR significantly above historical levels, transforming Germany into the company's most profitable growth pillar within five years.

- The market is underestimating the earnings power created by advanced use of AI-powered labor and demand forecasting tools, which Collins has begun trialing-these tools unlock ongoing productivity gains, translating into sustained operating margin uplift and net profit growth that compounds over time.

- Persistent shifts in consumer behavior toward convenience, affordability, and digital ordering play directly to Collins Foods' operational strengths, positioning the business for consistent same-store sales growth and defensive, resilient earnings throughout economic cycles.

- Strategic divestment from Taco Bell and disciplined redeployment of capital into higher-return core QSR markets, combined with strong cash generation and a robust balance sheet, create the capacity to aggressively accelerate its store network and pursue high-ROI inorganic growth, further amplifying future EPS and return on equity.

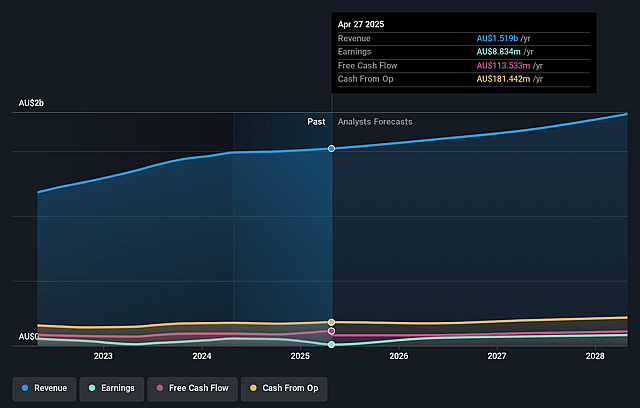

Collins Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Collins Foods compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Collins Foods's revenue will grow by 7.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.6% today to 5.7% in 3 years time.

- The bullish analysts expect earnings to reach A$107.3 million (and earnings per share of A$0.88) by about September 2028, up from A$8.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 140.5x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.63%, as per the Simply Wall St company report.

Collins Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term consumer shift towards health and wellness presents a structural risk to Collins Foods, as demand for traditional fast food and fried menu items may stagnate or decline, directly limiting same-store sales growth and reducing long-term revenue potential.

- Significant increases in labor costs, highlighted by a 30% rise in the Netherlands over three years and ongoing labor market tightening, threaten to substantially elevate operating expenses and compress net margins, particularly in developed markets like Australia and Europe.

- Over-reliance on the KFC brand and franchising agreements with Yum! limits Collins Foods' pricing power and exposes the business to royalty increases or adverse changes, which could put persistent pressure on earnings and net margins in the future.

- The company's heavy expansion strategy, especially in mature markets like Australia, increases the risk of market saturation and potential cannibalization of existing store sales, which could erode same-store sales growth and dampen future revenue expansion.

- Rising regulatory scrutiny (such as wage compliance in Australia and sustainability requirements in Europe) and potential future taxes on unhealthy foods will likely drive up compliance and ESG-related costs, posing risks to profit margins and potentially harming brand reputation if targets are not met.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Collins Foods is A$13.59, which represents two standard deviations above the consensus price target of A$10.85. This valuation is based on what can be assumed as the expectations of Collins Foods's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$14.0, and the most bearish reporting a price target of just A$8.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$1.9 billion, earnings will come to A$107.3 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 9.6%.

- Given the current share price of A$10.52, the bullish analyst price target of A$13.59 is 22.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Collins Foods?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.