What Happened in the Market This Week?

Market Insight for 30th May - 6th June 2022

Global equity markets continued their recovery last week, with countries like India , Hong Kong and Japan all rising over 3.0%. The S&P 500 index posted a second weekly gain after declining for seven consecutive weeks. The consumer discretionary and technology sectors which have performed the worst so far this year led the way higher.

These are some of the key developments we are watching:

- The U.S. Savings Rate has fallen to its lowest level in 12 years as consumers struggle to keep up with inflation.

- $6.5 trillion of U.S. government bonds are maturing and will probably need to be rolled forward at significantly higher rates.

- Panelists at the World Economic Forum voiced concern over the challenges the global economy is facing.

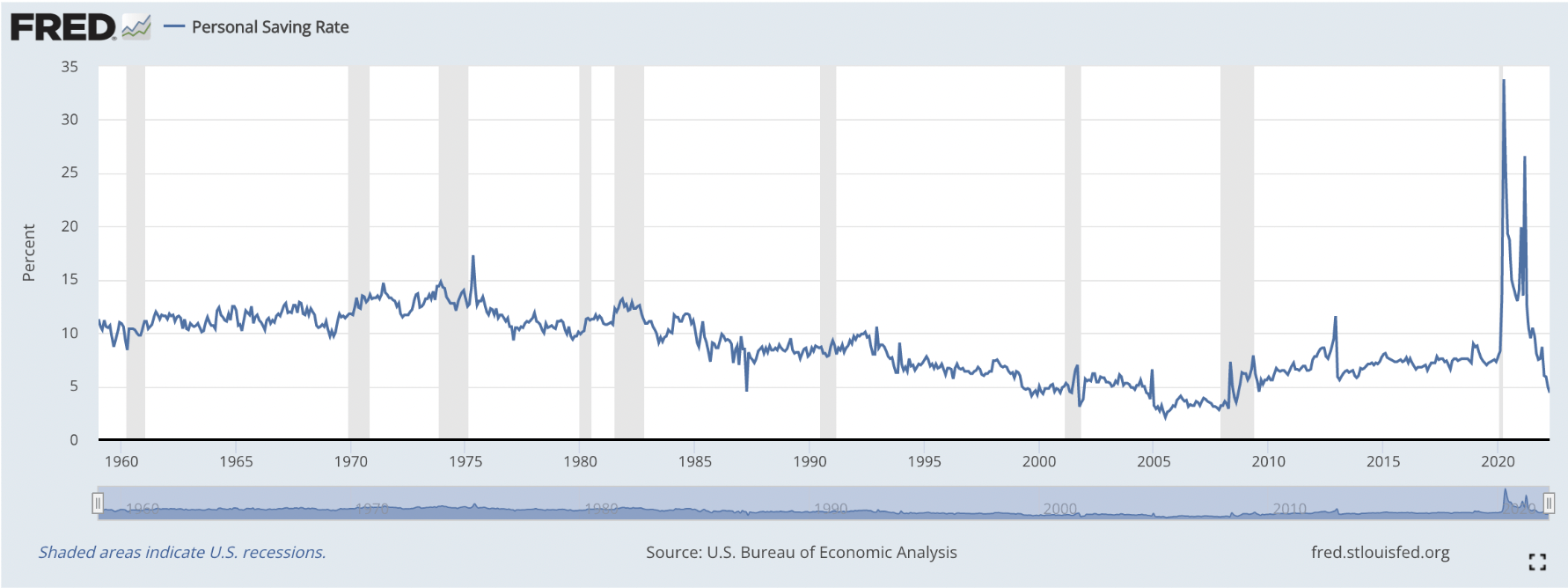

U.S. Savings Rate Falls to Lowest Level in 12 Years

The U.S. Personal Savings Rate (PSR) has fallen back to 4.4%, its lowest level since 2009. The savings rate reflects the average percentage of disposable incomes that are not spent each month. In April 2020, the PSR rose to a record high of 33.8% (the previous record was 17.3% in 1975) as social distancing protocols and travel restrictions prevented spending on travel, hospitality and entertainment.

The decline in the savings rate can be partly attributed to a return to normal life as the pandemic fades — but inflation is clearly playing a major role too. Besides rising food, transport and energy prices, homeowners are also facing mortgage rates that have risen 70% in the last 12 months . Fixed 30-year mortgage rates were 5.09% last week, compared to 2.99% a year ago.

The Insight: Rising prices mean consumers are having to devote more of their monthly budgets to essential expenses like mortgages, food and energy — leaving less for discretionary spending.

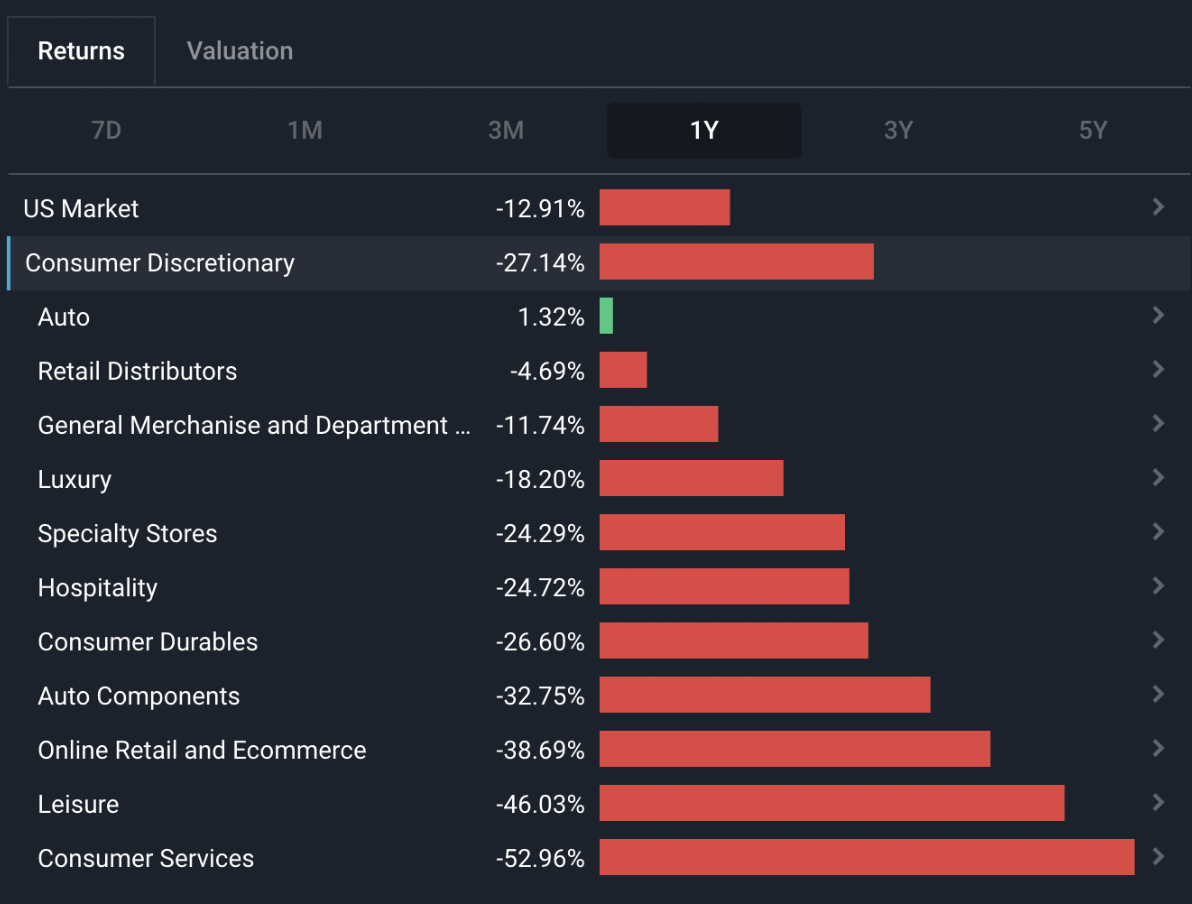

The consumer discretionary sector is the second worst performing sector (behind Telco), down 27% over the last 12 months. If tight consumer budgets persist, the underperformance may continue.

While consumer staples have performed better relatively speaking ( flat for the past year ), they too have seen their bottom lines impacted by inflation as their expenses have risen faster than they could increase prices.

Source: U.S. Consumer Discretionary Sector 1Y Performance ( Simply Wall St .)

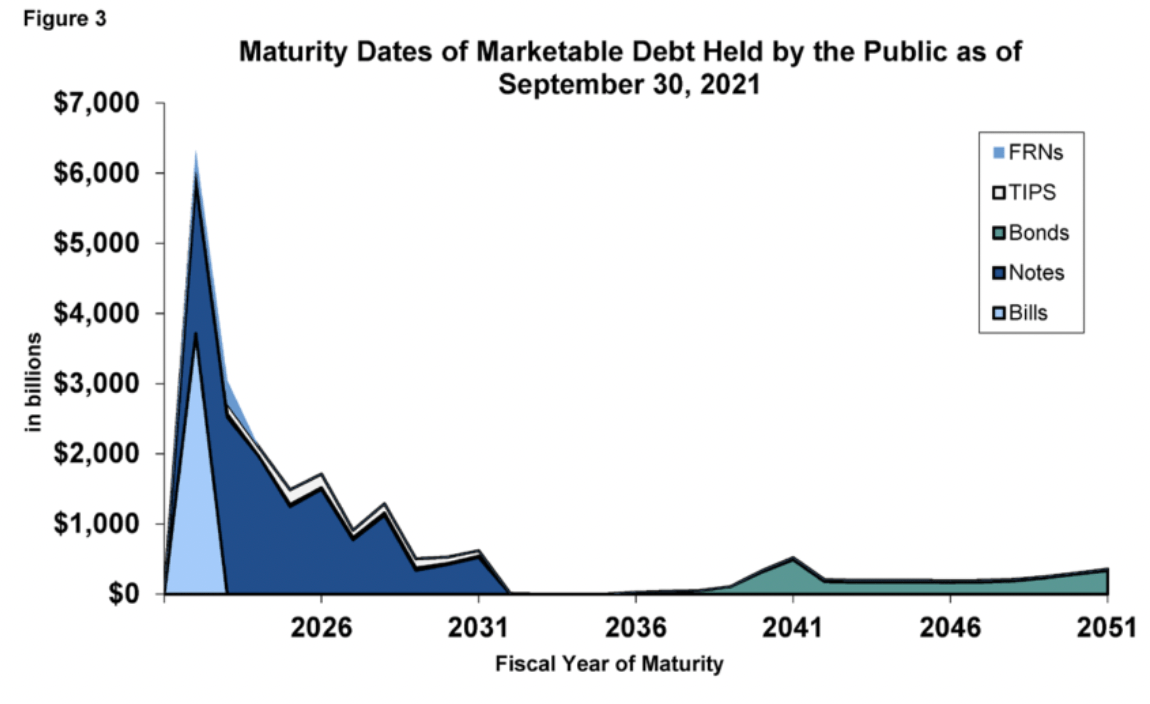

Maturing U.S. Government Debt Needs to Be Rolled Forward

Around $6.5 trillion of the $30 trillion of U.S. government bonds are maturing in the next 12 months, and just under $13 trillion are maturing within 4 years. When a bond matures, its par value, or principal, must be paid to the bondholder. The U.S. government (or technically the U.S. Treasury) can either pay the principal from tax receipts, or roll the position forward by selling a new bond. Considering the U.S. government ran a $2.8 trillion budget deficit in 2021 (spent more than it made), it will likely need to sell new bonds to afford to repay the principal.

Many of the bond holders will need to replace the maturing bonds in their portfolios, so the Treasury doesn't actually need to find new buyers for all $6.5 trillion of bonds - though some holders may elect not to reinvest. The bigger challenge is the fact that the bonds will need to be rolled over at interest rates that are substantially higher than the rate on the maturing bond. This will result in higher annual interest payments for the US Treasury.

To complicate matters, the Federal Reserve began its process of balance sheet normalization last week . Over the last two years, the Fed has been buying bonds to provide liquidity to the financial system. To normalize its balance sheet, the Fed will now gradually sell these bonds. This means that while the Treasury is selling bonds to replace maturing bonds, the Fed will also be selling bonds to reduce its balance sheet.

When stock prices fall rapidly, bond prices often rise due to their status as a lower risk investment. This hasn’t happened this year as stock and bond prices have fallen together. The prospect of all these bond sales by the Fed and the U.S. Treasury is certainly a contributing factor.

The Insight: U.S. Bond yields are still rising which indicates that investors still don’t see value in bonds relative to other asset classes (because they’re selling bonds and yields rise as prices fall). Over the next year, we will find out the yield at which investors are prepared to absorb these bond sales, and how much the U.S. interest bill will increase. The stock market has been particularly sensitive to interest rates over the last few months, so if we see further volatility in the bond market, it is likely to flow into the equity market.

World Economic Forum Panelists Voice Concern Over Global Economy

At the World Economic Forum in Davos, the tone was somber as panelists warned about the many challenges facing the global economy. These include the war in Ukraine, supply chain challenges and rising food prices .

Kristalina Georgieva, the managing director of the International Monetary Fund (IMF), emphasized that despite the economic headwinds, the IMF is not forecasting a recession — though a recession is not out of the question. In April, the IMF forecast for global economic growth was 3.6% (down from 4.9% previously expected), though inflationary forces have risen since then. The new forecasts could be even lower.

Georgieva also pointed out that a rising oil price dampens demand which could play a part in stopping the price rising. However, demand for food is less elastic, and can lead to food price shocks and food insecurity.

The WEF’s Chief Economists Outlook from May 2022 cited “ the perfect storm ”, and listed 6 expectations for the future of the global economy:

- Higher inflation alongside lower real wages globally

- Food insecurity in developing economies

- More localization, diversification and politicization of supply chains

- Greater rollback of globalization in goods, labor and technology than services

- Sanctions effective in dampening the economic outlook for Russia

- Continued dominance of the US dollar as a global reserve currency

Additionally, the report cites that it is an incredibly complex environment for policy makers around the globe to navigate, specifying there are tough trade-offs to make. They are:

- Balancing the risks of inflation and contraction

- Balancing the risks of food, fuel and inequality crisis with higher debt and the risk of default

- Balancing the risks of continued fossil fuel use against the shift to green energy

- Balancing national priorities with long-term, global goals

In April, the WEF downgraded its forecasts on 143 countries , representing 86% of global GDP, and noted that in the short period of time since then, the situation has worsened. Kristalina Georgieva laid out what is needed from both central banks and policy makers to avoid a global recession.

The Insight: While a lot of commentators are predicting a recession, the IMF’s most recent forecast of global GDP growth for 2022 is still 3.6%. However, since they acknowledged that a lot has happened since their latest forecasts, we should take those latest forecasts with a grain of salt.

For those unfamiliar, a recession is defined as two consecutive quarters of negative GDP growth.

Market Outlook Next Week

This week, the Australian and European central banks will be announcing their decisions on interest rates. In Australia, economists expect an increase from 0.35% to 0.6%. Similarly, the ECB is expected to signal a tightening monetary policy, though no change to the interest rate is expected this week.

The U.S. and China will be publishing balance of trade reports which may give investors an indication of how consumer spending patterns are being affected by inflation, and whether or not supply chain delays are easing.

On Friday, the U.S. consumer inflation data for May is due to be published. The Core CPI rate is expected to slightly fall to 8.2% from 8.3% in April. The Michigan Consumer Sentiment index will also be released on Friday — similarly expected to fall from 58.4 to 56.9.

The current U.S. earnings season is winding down, and just a few smaller companies are still due to report their first quarter financials. A few notable ones are:

- Campbell Soup ( NYSE:CPB )

- FuelCell Energy ( NASDAQ:FCEL )

- DocuSign ( NASDAQ:DOCU )

- Coupa Software ( NASDAQ:COUP )

- Lovesac ( NASDAQ:LOVE )

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.