What Happened in the Market Last Week?

Market Insights for week ending 14th October

Market volatility picked up again last week after the Bank of England said it will end its bond buying on Friday as planned, the IMF cut global growth forecasts, and inflation data suggested rate hikes are set to continue.

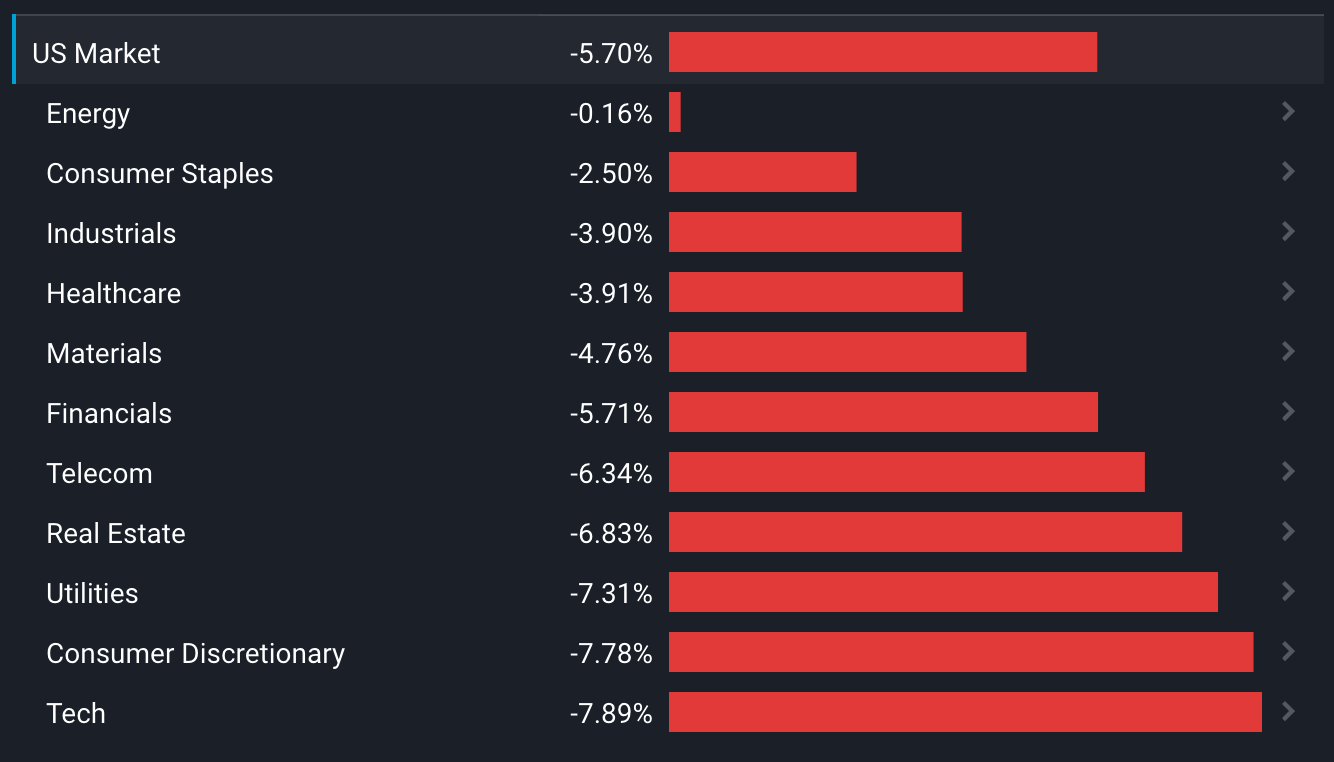

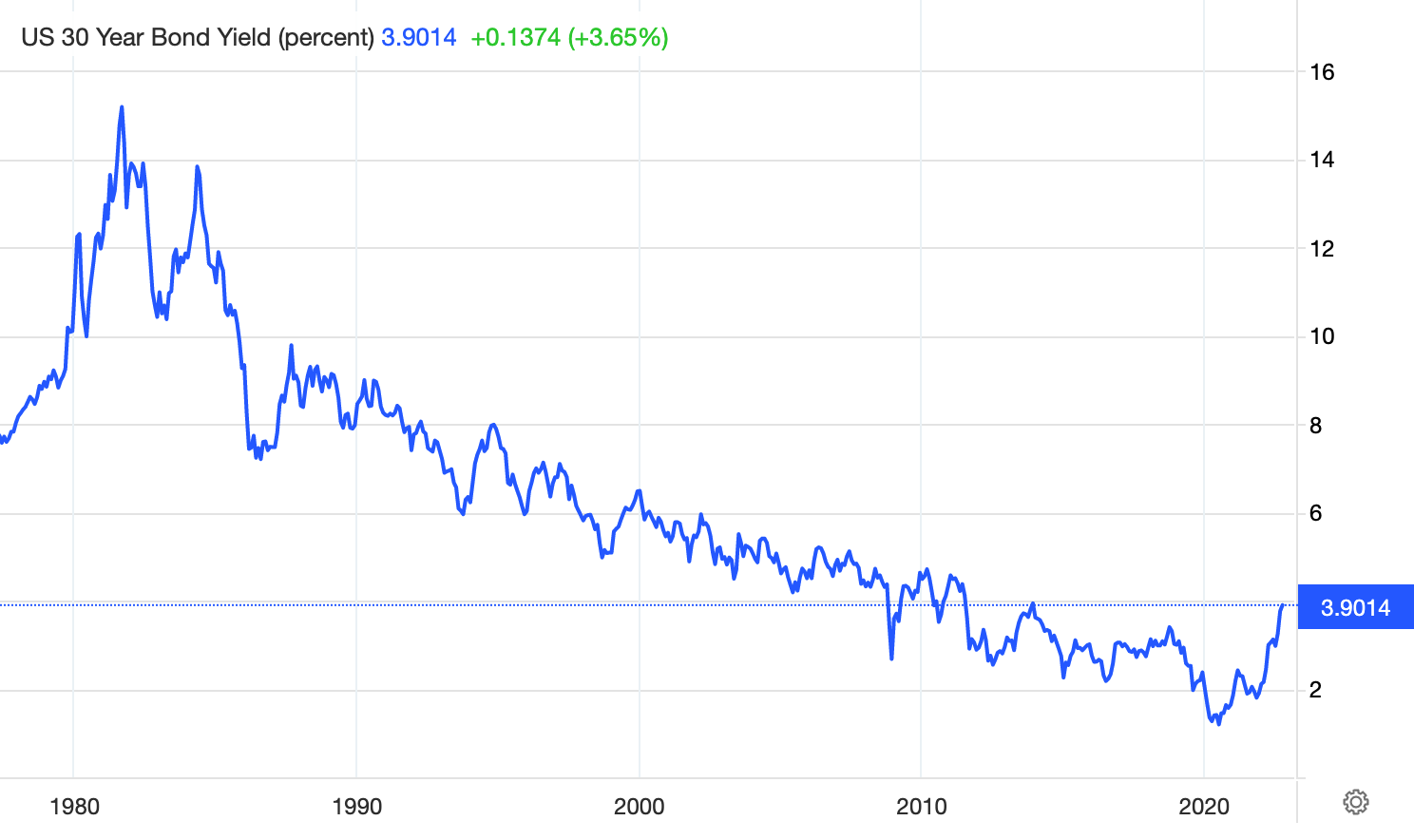

It seems there are few places to hide as the Nasdaq index hit 2 year lows, and the technology, telecoms, and real estate sectors fell to new 52-week lows. Bond yields also traded up to levels last seen more than ten years ago, as selling continued.

U.S. Sector 7D Performance - 13th October 2022 - Simply Wall St

Some of the developments we have been watching over the last week include:

- The UN, Economists and others are warning that rate hikes are going to cause a very deep recession.

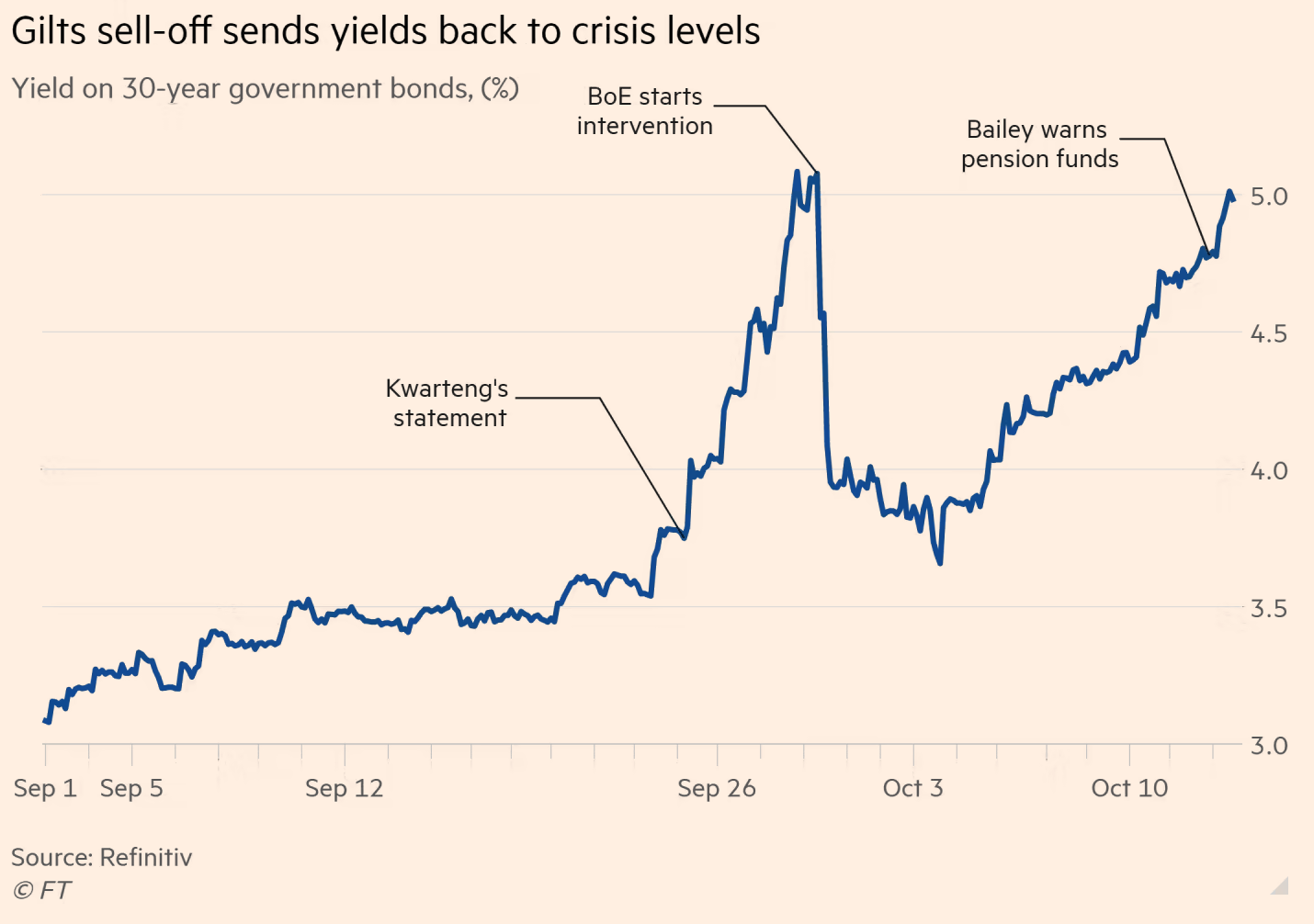

- Fears among UK market sent yields on US, UK and European 30yr bonds higher despite fresh attempts from Bank of England to calm markets.

Is the Fed going to crash the global economy?

Some think so. The UN has urged the Fed and other central banks to stop raising rates, saying rate hikes could lead to a recession worse than that experienced after the global financial crisis. The UN is particularly concerned about the effect a recession could have on developing economies.

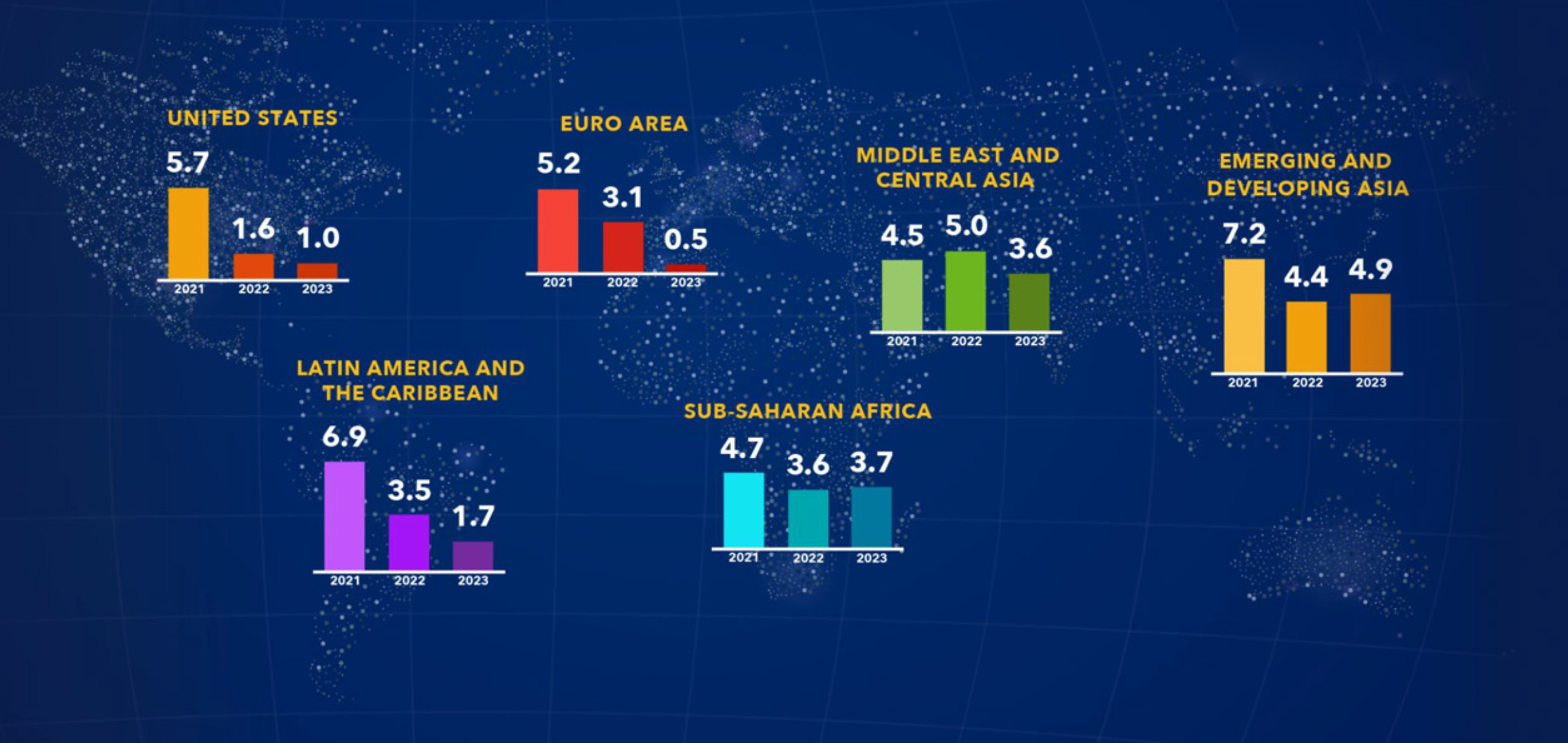

The IMF recently cut its global growth forecast for the third time this year. Beside the war in Ukraine and rising food and energy prices, the IMF now adds high interest rates to the list of reasons it expects at least a third of the world to be in a recession soon. The institution is cautioning central banks against over-tightening.

IMF latest GDP growth projections for 2021, 2022 and 2023 - Image Credit: IMF

ARK Invest’s Cathie Wood has also written an open letter to the Fed warning that the pace of rate hikes could lead to a deflationary bust. She cites falling commodity prices as a leading indicator that shows inflation is already set to fall.

This isn't the 1980s

While inflation is back at levels last seen in the 1980s, the global economy is very different now. Firstly, this round of inflation has more to do with supply (due to the war in Ukraine and supply chain problems that started during the pandemic) than demand. And secondly, the global economy is far more integrated, so central bank action has knock on effects throughout the world.

Why Developing Economies are Worst Affected by Rising Rates

The UN is mostly concerned with the effect of rising rates on developing economies. While rates were at historically low levels during the last decade, loans were made to developing economies. Now lenders will be reluctant to roll those loans forward, and even if they did the higher interest rates could cripple those economies. The currencies of most developing countries have also weakened, meaning debt denominated in foreign currencies will cost more to repay. A recession will also reduce demand for the goods those economies export, leading to rising unemployment.

Sri Lanka’s economy has already collapsed and Turkey is dealing with hyperinflation. The fear is that more countries will suffer similar fates.

Will the Fed Pivot?

A growing number of market pundits and investors are predicting a ‘Fed Pivot’, where the Fed is forced to change course. Bit, if the minutes from the September Fed meeting are anything to go by, the Fed appears to be intent on doing what it takes to reduce inflation.

Clearly central banks are not concerned by falling stock prices either - but extreme volatility or systemic risk might change their stance.

The Fed and other central banks have always acted decisively when the financial system is at risk. This happened after 11 September 2001, during the GFC in 2008, and at the beginning of the Coronavirus pandemic. Central bank actions at these times have often led to asset prices (including the stock market) rising in spite of weak economic conditions.

If market volatility starts to threaten the financial system, central banks would probably change their approach and stop raising (and possibly even cut) rates. Last week we mentioned Credit Suisse and the potential systemic risk banks like it can pose. We’ve also seen the Bank of England buying bonds to protect UK pension funds.

💡 The Insight: Placing Balanced bets

There really are two very different scenarios to consider. On the one hand the Fed might stay the course which could lead to a very severe recession. On the other hand, if systemic risk increases it might change course. But, so far while the UN and a growing number of market pundits are calling for a pivot, markets don’t seem to be buying it.

For Short or Medium-Term Investors (< 5 years)

When navigating your way through the next few months, be careful not to position your portfolio for a single outcome. Investors who are either very bullish or very bearish stand a chance of being very wrong. Investors with a balanced portfolio across different, uncorrelated sectors, plus some cash are likely to reduce any short term downside from being completely wrong.

For Long-Term Investors (5+ years)

If your focus is on the long term you’ll want to make sure most of your portfolio is in companies that can actually survive a severe recession - because that’s definitely still a possibility. In this environment cash is king and companies with good margins and healthy balance sheets are the ones that tend to perform better.

Bond Futures Flash Crash 📉

Futures on US 30-year bonds fell to their lowest level since 2011 on Monday. The bond market itself was closed for Columbus day, and the combination of lower liquidity and volatility in European and UK fixed interest made the futures an easy target for speculators. While bond yields later recovered slightly, they are still at levels last seen more than a decade ago.

A Brief Primer on Bonds

Bonds can be quoted by price or by yield to maturity. The price is expressed as a percentage of the face value of a bond, while the yield is the effective interest rate the bond pays. If you buy a bond at a price of 95 and the bond pays a 3% coupon, the yield is more than 3%. Why? Well you are effectively paying 95 cents for every dollar of principal you’ll get back when the bond matures. So the yield is (roughly) 5% divided by the number of years to maturity plus the 3% coupon. This means that as bond prices fall, yields rise and as they rise, the yield falls.

Bonds with longer maturities usually have higher yields than short dated bonds because investors need to be paid more for taking on risk for longer periods. But the price of longer dated bonds is also more sensitive to changes in yield. This year most of the focus has been on the US 10 year bond yield. Now, as the market comes to term with rates staying higher for longer, 30 year bonds are also under pressure.

The end of the bull market in bonds

Bonds have enjoyed a 40 year bull market that started in 1981 with 30 year yields above 15%. It now seems that the trend has turned and investors are trying to work out what comes next.

US 30 year yields - last 45 years - Image Credit: Tradingeconomics.com

Not only are interest rates rising - which makes bonds less attractive, but the Fed is unwinding its balance sheet. For years the Fed has been buying bonds to provide the financial system with cash. Now the Fed is actively unwinding its balance sheet by selling bonds - which drives prices down and yields up.

💡 The Insight: Bonds are not providing a safe haven

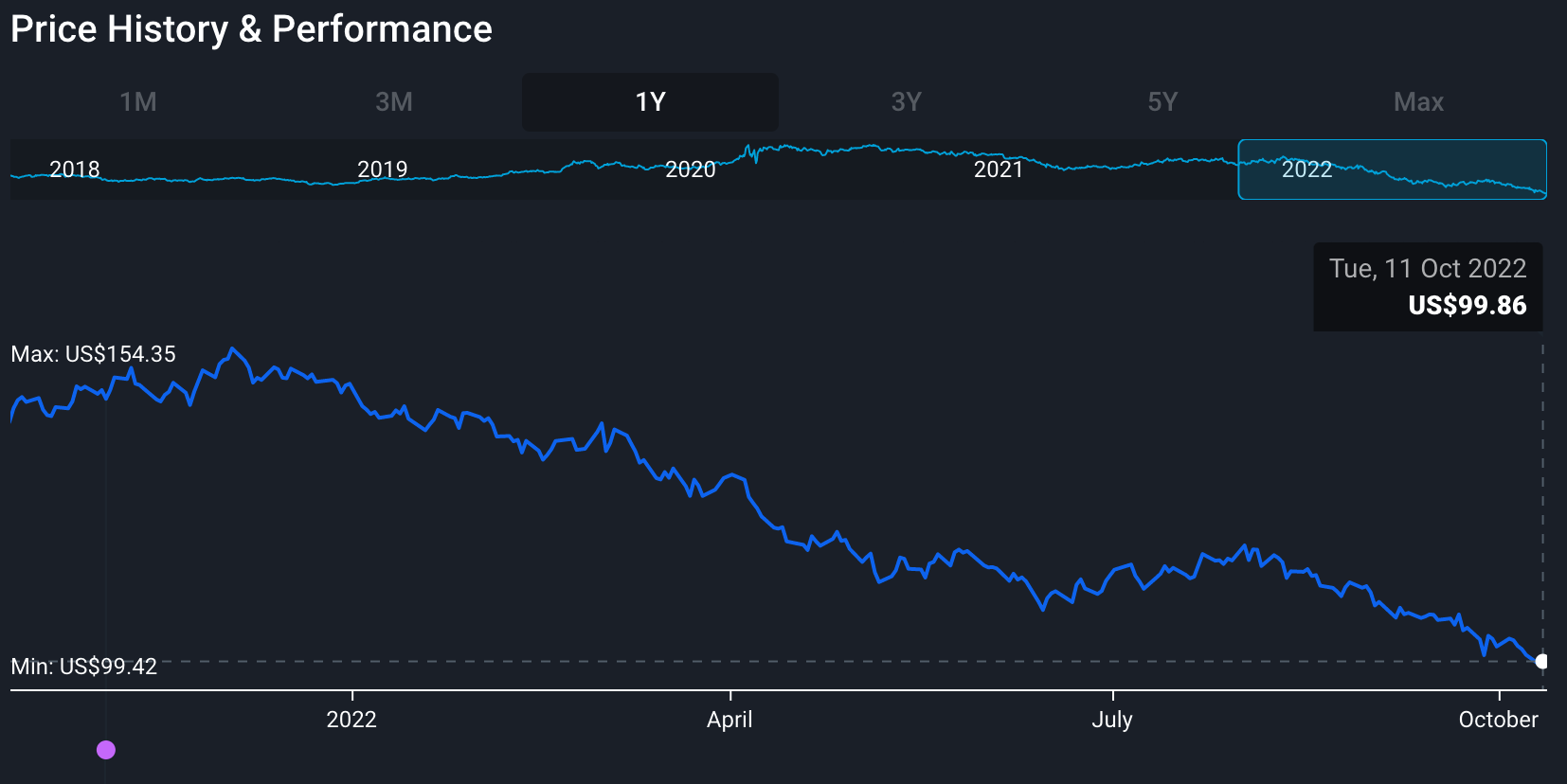

Prior to 2022 bonds have almost always acted as a safe haven during times of uncertainty. But now that the bond market is in uncharted territory it has become anything but safe. Retail investors often use bond ETFs for the ‘safe’ portion of the portfolio. Unfortunately the performance of some of these ETFs has been abysmal over the last 12 months. The long dated iShares 20+ Year Treasury Bond ETF (Nasdaq:TLT) and iShares Euro Government Bond 15-30yr UCITS ETF (LSE:IBGL) are both down more than 31% over the last year. The Vanguard Total Bond Market ETF (Nasdaq:BND) which invests across multiple maturities is down 15% and even the iShares 1-3 Year Treasury Bond ETF (Nasdaq:SHY) which holds short dated bonds is down 4.6%.

iShares Trust - iShares 20+ Year Treasury Bond ETF - Simply Wall St

For Short or Medium-Term Investors (< 5 years)

Very short dated bonds don’t carry the same price risk of longer dated bonds because they can be held to maturity. ETFs like the SPDR Bloomberg 1-3 Month T-Bill ETF (ARCA:BIL) hold T-Bills with very short maturities, and the portfolio can be reinvested at higher rates as interest rates rise. If you want to hold cash, compare the yield on these ETFs to the interest your broker or bank pays.

For Long-Term Investors (5+ years)

With all the uncertainty in the bond market they aren’t the safe haven they once were. This has left investors wondering where to put the ‘low risk’ portion of their portfolio. With inflation above 8%, cash isn’t very appealing either. Until there’s a clearer picture, paying off debt could be a very sensible investment.

Key Events This Week

Third quarter earnings season continues with some large companies outside of the financial sector reporting. Some of the big ones include:

- Abbott Laboratories (NYSE:ABT),

- Tesla Inc (Nasdaq:TSLA),

- Johnson & Johnson (NYSE:JNJ),

- Netflix Inc (Nasdaq:NFLX),

- Procter & Gamble Co (NYSE:PG),

- AT&T Inc (NYSE:T),

- Intel Corp (Nasdaq:INTC), and

- Snap Inc (NYSE:SNAP).

This week the 20th National Congress of the Chinese Communist Party gets under way. Market watchers will be interested to see how this may affect China’s foreign policy going forward. China’s latest GDP growth rate is also due this week which will give us some insight on the health of the Chinese economy.

The UK will remain in focus as the latest inflation rate is due on Wednesday and retail sales numbers will be published on Friday.

In the US, attention returns to the housing market with housing starts and existing home sales due on Wednesday and Thursday.

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.