Quote of the Week: “For the majority of businesses, focus on building applications using agentic workflows rather than solely scaling traditional AI. That's where the greatest opportunity lies.” – Andrew Ng

Companies across the globe are beginning to pay attention to agentic AI. It’s also a term you’re likely to hear a lot during earnings season. In fact, it came up 26 times during ServiceNow’s earnings call.

Yes, it’s a bit of a buzzword, but it is actually quite a big deal. This week we are taking a look at what exactly agentic AI is, how it differs from generative AI , and what it means for companies. Next week we’ll take a look at what it might mean for the global economy.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube! (Released each Monday by 5pm AEST).

What Happened in The Markets this Week?

Here’s a quick summary of what’s been going on:

✈️ LVMH affiliated PE firm invests in Flexjet ( Forbes )

- L Catterton , the private equity firm backed by LVMH is leading an $800 million investment in Flexjet, implying a $4 billion valuation.

- LVMH itself might not have direct exposure to the deal, which would only amount to a fraction of its market cap. However, the investment will no doubt make LVMH’s luxury brands part of the Flexjet experience.

- Private jet fleets are arguably a better investment than airlines, as they tend to offer higher margins and aren’t exposed to the same pricing wars and route volatility that commercial carriers face. Berkshire Hathaway bought NetJets outright in 1998. Unfortunately there aren’t many around.

- It makes a lot of sense for luxury goods companies to diversify into luxury services , which benefit from ongoing annual spending rather than sporadic shopping trips.

🔋 US Hits Chinese Graphite With 160% Tariff ( Bloomberg )

- The Commerce Department announced a preliminary 93.5% anti-dumping duty on Chinese graphite, bringing the total effective tariff to 160%. This comes after a petition from US producers claiming unfair competition, and a final ruling is expected by December.

- EV makers and battery suppliers reliant on Chinese imports are reeling, with Tesla and Panasonic opposing the move. While domestic producers like Syrah Resources and Westwater Resources surged, analysts warn the added cost could wipe out profits for Asian battery makers and delay the buildout of U.S. energy storage.

- The US is drawing a red line on critical minerals, and the impact will ripple through EVs, batteries, and the renewable energy transition.

💊 Trump Eyes Tariffs on Semiconductors and Pharma ( The Economist )

- Donald Trump is preparing sweeping new sector-specific tariffs , with semiconductors and pharmaceuticals next in line.

- The president has pledged a “low” tariff on drugs by month’s end, followed by a steep hike, and electronics duties are expected after national security probes conclude.

- These targeted levies could disrupt global supply chains and squeeze margins for companies like Nvidia , Intel, Pfizer, and Novartis . Countries like Taiwan, Singapore, and Japan, all major exporters in these sectors, are bracing for impact, with Barclays warning of “effective tariff hikes” that dwarf previous rounds.

- Unlike country-level duties, these industry-wide strikes may prove stickier and more damaging for global tech and healthcare firms.

🧠 Meta Raids Apple’s AI Team for Superintelligence Labs ( Bloomberg )

- Meta has hired Apple AI veterans Mark Lee and Tom Gunter, shortly after securing their former boss, Ruoming Pang, in a multiyear deal which could see Pang take home over $200 million.

- All three were central to Apple’s Foundation Models team, and will now join Meta’s newly formed Superintelligence Labs, where Mark Zuckerberg has promised to invest “hundreds of billions” in compute and top-tier talent.

- The aggressive hiring spree is capitalizing on internal chaos at Apple, which is reportedly considering ditching its own models for ChatGPT or Claude to power Siri. Meta, meanwhile, is positioning itself as a magnet for elite AI talent by offering multiyear compensation packages in the nine-figure range, far outpacing rivals.

- Zuckerberg is building the most talent-dense AI team on the planet, and he’s putting his wallet (and desk space) where his mouth is.

🪓 Intel Cuts 15% of Workforce Amid Strategic Reset ( Reuters )

- Intel is laying off 15% of its global workforce, as new CEO Lip Bu Tan pushes a cost-cutting plan aimed at reversing years of underperformance. The company will reduce headcount to 75,000 by year-end through layoffs and attrition, while eliminating half of its management layers.

- Intel is also pulling back on its factory buildout, slowing work in Ohio and scrapping plans for new facilities in Poland and Germany. It’s consolidating chip packaging operations in Vietnam and Malaysia, breaking from its former multi-region model.

- A shakeup in strategy could see Intel exit its 14A manufacturing process altogether unless it secures major external demand. Tan said the company will now only invest where there’s a clear economic case, “no more blank checks.”

- Despite a revenue beat, Intel posted a larger-than-expected Q2 loss and projected even steeper Q3 losses. With Nvidia and AMD dominating AI chips, Intel remains on the defensive as it struggles to regain relevance.

🤖 Tesla Bets Big on Robotaxis to Offset Slumping Sales ( Reuters )

- Tesla is doubling down on autonomous driving as core EV sales slump, with Elon Musk promising robotaxi launches across several U.S. states by year-end. But progress has been slow, with the only current fleet operating in Austin and limited to internal use.

- California regulators confirmed Tesla hasn’t applied for key permits to operate fully driverless services. By comparison, Waymo spent nearly a decade logging millions of miles and securing seven permits before going commercial. Tesla has logged only 562 test miles in California since 2016.

- Investors are growing wary. Tesla’s shares dropped more than 8% after earnings, as revenue disappointed and full autonomy timelines continued to shift. Musk said robotaxis could be “material” by the end of 2025, but offered few specifics.

- Without affordable new models or clear regulatory wins, Tesla’s $1 trillion valuation is looking stretched. Robotaxis may be the future, but the road to get there is filled with red tape.

🤖 The Agentic AI Revolution: Are Your Investments Ready for the Next Tech Paradigm Shift

In April GitHub ranked the top 10 new open source projects on the platform. While all 10 were AI related, 8 of the 10 projects exist to help AI agents integrate, communicate or collaborate with other agents or applications.

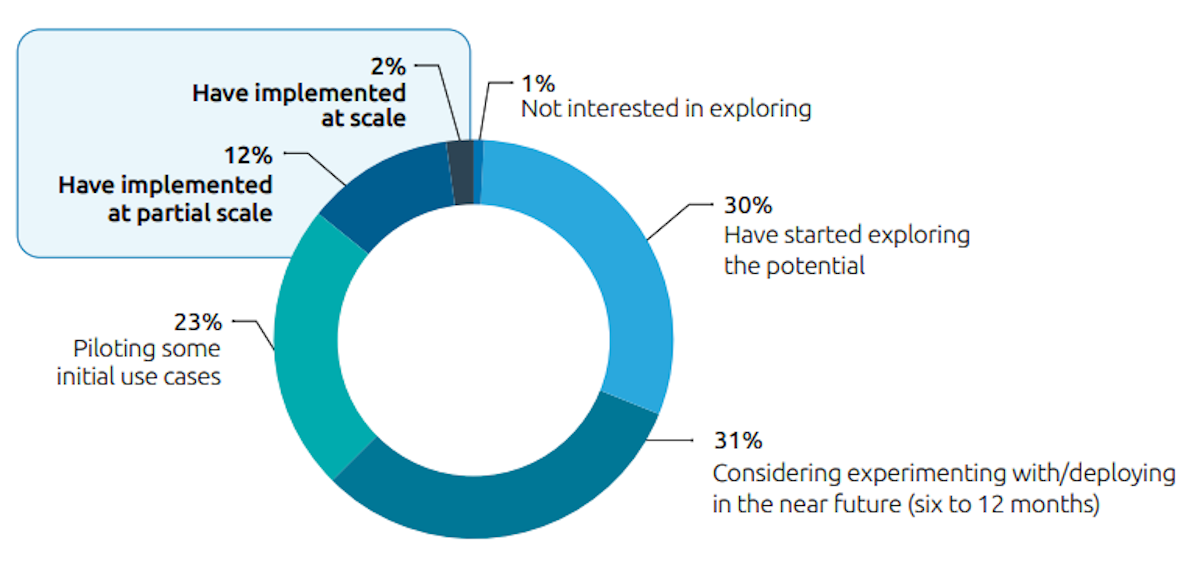

A recent report by Cap Gemini includes the following stats from organizations:

- 2% have implemented AI agents at scale.

- 12% have been implemented at partial scale.

- 23% are piloting initial use cases

- 61% have started exploring the potential/are considering experimenting or deploying in 6-12 months.

❗ The bottom line : It’s still early, but there’s a lot of experimenting, tinkering, testing and piloting that’s happening.

Before we get into the opportunities, challenges and risks of agentic AI, a few definitions and explanations may help….

Firstly, how does Agentic AI relate to Generative AI?

- 🗣️ Generative AI models like ChatGPT can create content in the form of text, audio, images or video.

- 🦾 AI Agents are systems built upon these generative AI models that can make decisions and take action. Agentic AI refers to the broader field, while the agents are the individual components of an agentic system .

So, while a generative model can help you draft a response to an email, an AI agent might be able to use generative AI to go through your inbox and let you know which emails need urgent attention. A fully autonomous agent would be able to go ahead and reply to certain emails, while marking others for your attention.

The two key differences are:

- 💽 AI agents typically have access to data, resources and tools that models like ChatGPT didn’t previously, until just recently when they dropped agent mode .

- ⚖️ Decisions and actions taken by agents have and additional layer of consequences compared to generative AI responses - hopefully positive but potentially negative.

Agentic AI isn’t new. Machine learning (ML) has been used to optimize systems for years.

Adding generative AI to the mix has opened up a new frontier for AI agents:

- 🧠 Powerful Large Language Models (LLMs): Models like GPT-4 and Google's Gemini provide the "brain" for these agents, allowing them to reason, plan, and understand complex, ambiguous instructions.

- 🛠️ Tool Usage: Agents can now access and use other software and APIs. This allows them to search the internet, send emails, manage a calendar, or even interact with a company's internal software.

- 🔁 Self-Correction: Advanced agents can analyze their own work, identify errors, and try different approaches to achieve their goal, much like a human would.

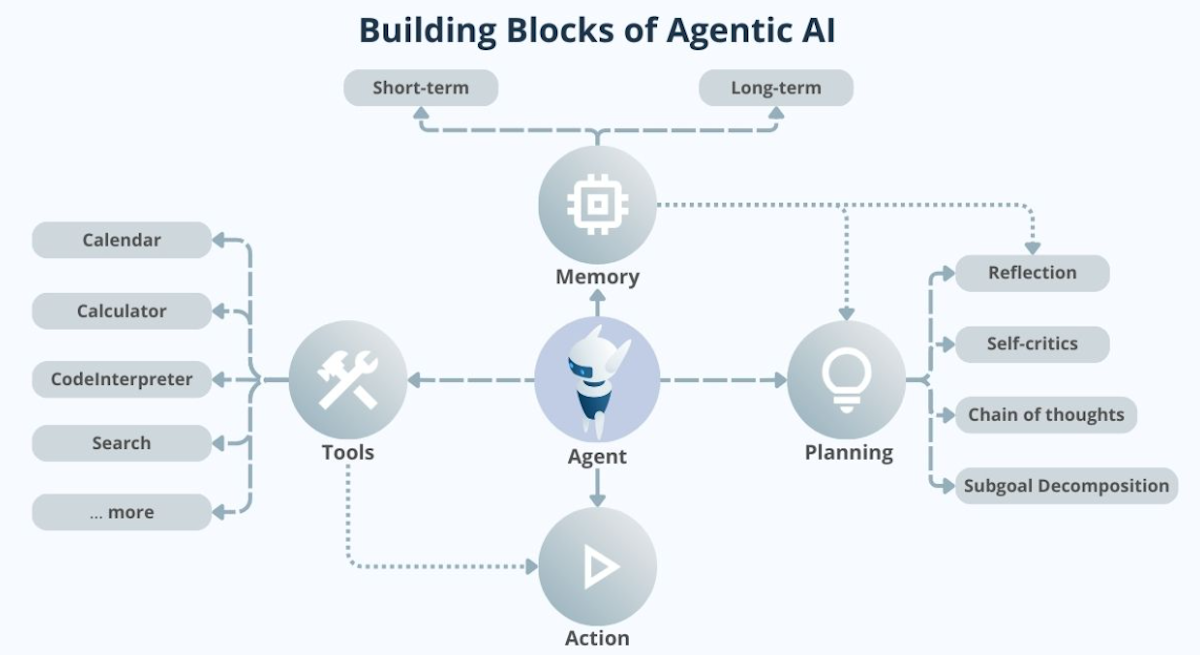

🔌 The Components of AI Agents

The key components of an agent include:

- 🧠 The reasoning and decision making component

- Agents can include one or more AI models.

- Models can be general purpose, external LLMs like GPT-4, or finely tuned models that are hosted internally.

- 💾 Memory and context

- LLMs have broad knowledge of the world, which is referred to as semantic memory .

- Context refers to the instructions given to an agent, as well as other data provided to conduct the current task.

- Learning agents also have long term memory which includes the results and feedback from previous tasks.

- 🛠️ Tools

- Agents can access internal and external tools and resources.

- Examples include database access, internet search, communication tools, and other agents.

- 🛡️ Guardrails

- To avoid disaster, many agents include a human-in-the-loop step. This requires human intervention or approval in all or in certain cases.

- Automatic barriers are also used to prevent agents from “ going rogue” .

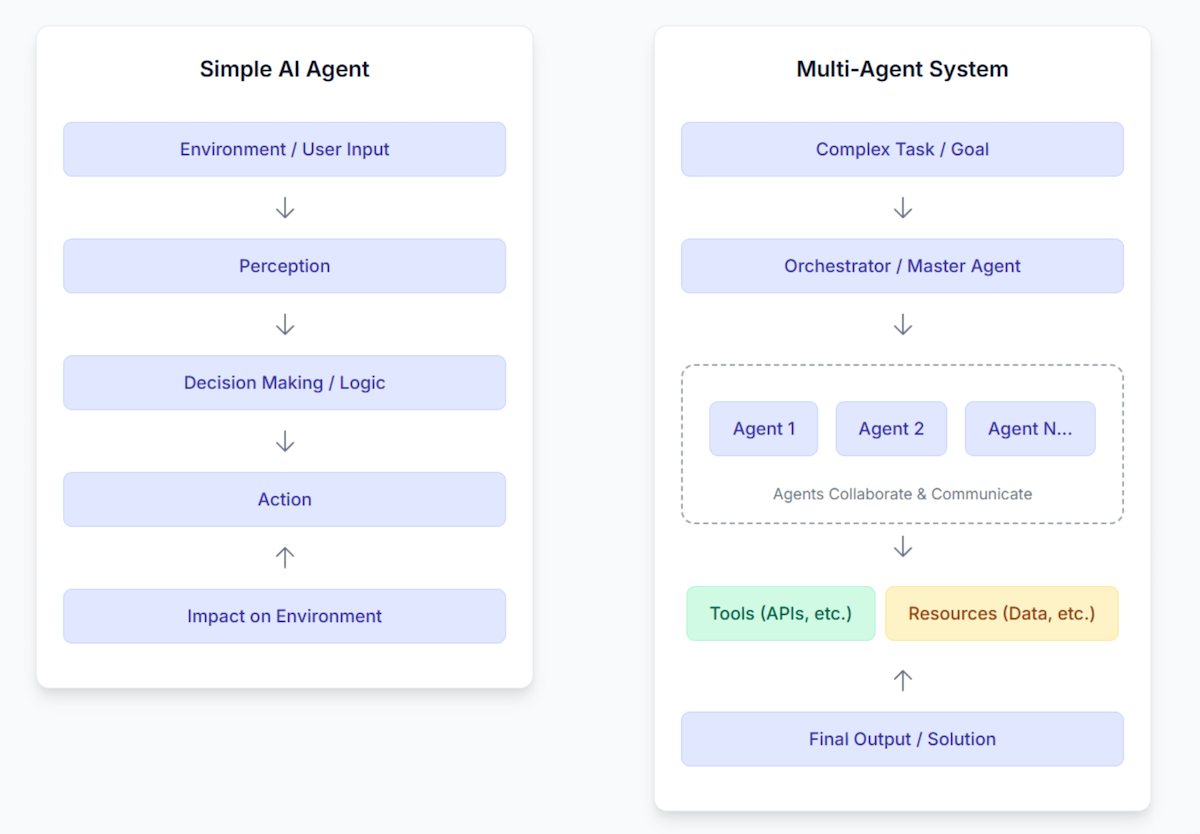

Agentic systems are becoming increasingly complex. Multi-agent systems typically consist of a supervisory agent delegating tasks to specialist agents.

Developers have found that agents are more effective when they are finely tuned to complete specific tasks.

If you interact with a customer service chatbot there’s a chance you’re actually talking to several specialized agents. The full context of the conversation is passed from agent to agent, so the experience (hopefully) appears to be seamless.

🌍 Real-World Revolution: Where Agents are Already at Work

Agentic AI is already very real, though most of the success stories fall into a handful of categories:

- 💬 Customer service chatbots

- 🛡️ Cybersecurity agents autonomously monitor networks to detect threats.

- 📈 IT Ops agents monitor systems to detect downtime and anomalies.

- 🏭 In the manufacturing industry, agents analyze operational data to forecast maintenance before breakdowns occur.

- 💻 And lastly, we have the coding agents ….

💻 Is Vibe Coding the Killer AI App?

AI tools are having a particularly big impact on software development. This started out with ‘coding assistants’ that are able to complete lines of code (much like predictive text) and generate larger blocks of code.

This has progressed to AI native code editors like Cursor, Windsurf and Anthropic’s Claude Code.

Vibe Coding refers to the process of using an AI code editor to create software. In other words, let the model do its thing and see where you end up. The reality is that complex applications require carefully thought out architecture - so vibe coding hasn’t taken over just yet.

Nevertheless, AI coding tools are quickly becoming a standard part of the arsenal for developers. Uber recently mentioned that they were saving thousands of developer hours each month just by using AI to write code tests.

Anysphere (the company behind Cursor) recently raised capital at a $9.9 billion valuation. OpenAI was due to buy Windsurf for $3 billion before Alphabet poached the key personnel.

Evidently Silicon Valley sees value in AI code assistants.

🏢 What does Agentic AI Mean for Companies?

Agentic AI is being compared to the advent of electricity or the internet in terms of the potential impact it could have. There’s no doubt about the opportunities it could create, but it also comes with equally significant challenges that will face companies across almost every industry.

So how can companies win in the age of Agentic AI?

The obvious way to implement AI is by automating current processes. This allows companies to reduce their headcount and costs.

That approach will work as long as competitors also stop at that point. But there’s a lot more a company can do to leverage the full potential of agentic systems:

-

🤝 Embrace AI as a Collaborative Workforce: Rather than impacting company morale with job displacements, winners will see agentic AI as a powerful extension of their existing workforce. This means re-skilling employees to manage, audit, and improve AI agents, focusing on uniquely human skills like complex problem-solving, emotional intelligence, and creative strategy. Think: AI handles routine tasks, freeing humans for higher-value work.

-

🏗️ Build AI-Native Processes: Rather than bolting AI onto existing workflows, processes can be redesigned around the strengths of agentic AI. This allows for end-to-end automation, reduced bottlenecks, and optimized decision-making.

-

📊 Emphasizing Data Ecosystems : Agentic AI craves data. Companies that can securely gather, clean, synthesize, and (where appropriate and compliant) share data – both internal and external – will have an advantage. This includes building internal data platforms and participating in data marketplaces or consortiums.

-

🔄 Customize, Iterate, and Simulate: One of the biggest advantages of AI is the ability to run countless simulations, iterate on product improvements, and customize the customer’s experience.

-

🚧 Prioritize AI Safety and Ethics: There have already been a few embarrassing incidents as companies race to release new features. There will probably be lots more. The companies that show they are committed to AI safety and ethical practices will be able to build trust.

⚠️ The Challenges and Risks

As mentioned, agentic AI comes with consequences, particularly when things go wrong:

- 🔒 Data leaks: This can occur when data is given to LLMs, which can lead to large fines and reputational damage. Data breaches can also occur when AI development processes create vulnerabilities. Unsurprisingly, data and cyber security experts are in demand.

- 🗄️ Data Silos : Agentic AI will be starved by companies with fragmented, inaccessible data. If data is locked in legacy systems, poorly formatted, or subject to internal bureaucratic hurdles, they won't be able to effectively train and deploy agents.

- ◼️ Over-Reliance on "Black Box" AI: Using pre-packaged AI solutions without understanding their underlying mechanisms or biases can lead to costly mistakes and reputational damage. Using off-the-shelf AI software is unlikely to create a competitive edge.

- 🎓 Training : AI is creating a structural problem in the workforce. There’s a shortage of AI experience and skills, and there will soon be an oversupply of the skills being replaced by agents. Companies will need to proactively provide training to ensure that employees can get the most out of the technology.

Many of these challenges and risks are also opportunities for those who can solve them. We’ll get into that next week….

💡 The Insight: Don’t Expect a Linear Path

Many of the most successful tech companies of the last decade have managed to increase revenue and earnings year after year at a steady pace. This has been the nature of cloud and SaaS businesses that earn subscription revenue.

With agentic AI it might be quite different, both for tech companies and others that embrace, or resist, agentic AI.

Here are a few reasons that might be the case:

- If a company only uses AI to cut costs, it could earn higher margins, or it could undercut its competition and win market share. But, a competitor might fully embrace AI and come back with a much better value proposition a few years later. This isn’t specific to agentic AI, but it’ll be a common reason we see it in the near future.

- Companies that invest heavily in AI will have the opposite experience. Margins will be lower in the medium term, but the investments may pay off later.

- The companies that really manage to leverage the potential of agentic AI could experience exponential growth - but again, that might happen later.

The bottom line is that simply extrapolating recent trends into the future might not be good enough. When you’re creating and monitoring a narrative, try to identify qualitative benchmarks so you know the company is still executing on its plan.

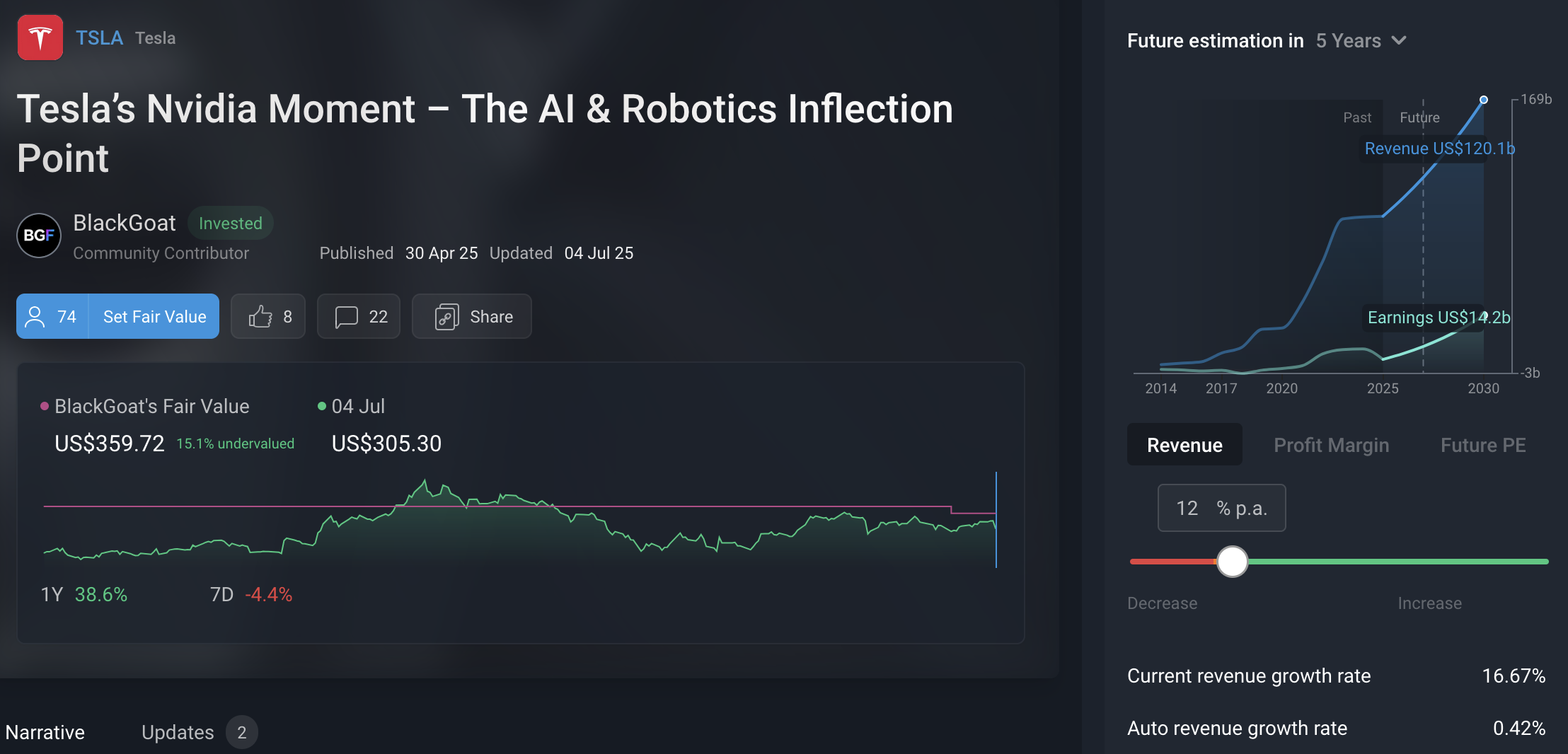

Tesla, below, is a company where AI is already a key catalyst:

Key Events During the Next Week

Tuesday

- 🇺🇸 JOLTS Job Openings

- 📈 Forecast: 7.3M (Previous: 7.769M)

- ➡️ Why it matters : A decline in job openings would signal a cooling labor market, something the Fed is closely watching as it assesses whether inflationary pressures are easing.

Wednesday

- 🇩🇪 Germany GDP Growth Rate YoY (Flash)

- 📈 Forecast: 0.1% (Previous: 0.4%)

- ➡️ Why it matters : The eurozone’s largest economy is barely growing. This reading will shape expectations for ECB policy and broader EU economic health.

- 🇺🇸 US GDP Growth Rate QoQ (Advance)

- 📈 Forecast: 2.5% (Previous: -0.5%)

- ➡️ Why it matters : A sharp rebound would reaffirm the US economy’s resilience and may influence future Fed policy decisions.

- 🇨🇦 Bank of Canada Interest Rate Decision

- 📈 Forecast: Hold at 2.75%

- ➡️ Why it matters : Markets expect a pause, but any hawkish language could shift expectations for cuts later in the year.

Thursday

- 🇺🇸 Fed Interest Rate Decision

- 📈 Forecast: 4.5% (Previous: 4.5%)

- ➡️ Why it matters : While no change is expected, attention will be on the statement and press conference for clues on when the Fed might begin cutting rates.

- 🇯🇵 Bank of Japan Interest Rate Decision

- 📈 Forecast: 0.5% (Previous: 0.5%)

- ➡️ Why it matters : The BOJ remains an outlier globally. Any hint of tightening could have ripple effects across global bond and currency markets.

- 🇺🇸 Core PCE Price Index MoM

- 📈 Forecast: 0.3% (Previous: 0.2%)

- ➡️ Why it matters : This is the Fed’s preferred inflation gauge. A hotter-than-expected reading could delay rate cuts.

Friday

- 🇨🇳 Caixin Manufacturing PMI

- 📈 Forecast: 50.8 (Previous: 50.4)

- ➡️ Why it matters : This private survey is seen as a bellwether for China’s smaller manufacturers. A rise above 50 implies expansion and could ease global growth concerns.

- 🇺🇸 Non-Farm Payrolls

- 📈 Forecast: 110K (Previous: 147K)

- ➡️ Why it matters : A slowdown in job growth could signal weakening momentum in the labor market, reinforcing expectations of Fed easing.

- 🇺🇸 Unemployment Rate

- 📈 Forecast: 4.2% (Previous: 4.1%)

- ➡️ Why it matters : A tick higher in unemployment may give the Fed more confidence that inflationary wage pressures are subsiding.

It’s the biggest week of earnings season with four of the Mag 7 and a few other mega-caps reporting:

- Visa

- Procter & Gamble

- UnitedHealth Group

- Spotify

- Starbucks

- Microsoft

- Meta

- Arm Holdings

- Apple

- Amazon

- Berkshire Hathaway

- Exxon Mobil

- Waste Management

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.