So far, it looks like the US Presidential election in November is shaping up to be a Biden vs Trump rematch. 🥊🇺🇸

For what they are worth, the polls have the two candidates just about tied, along with the House and Senate.

This week we are having a look at the US election, whether it matters for the stock market, and what you can do to position your portfolio ahead of it.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

Quote of the Week

“Politicians are like bad horsemen who are so preoccupied with staying in the saddle that they can’t bother about where they’re going.”

― Joseph Alois Schumpeter

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

📈 Temu operator PDD Holdings reports a 123% surge in revenue ( Reuters )

- Our take : Temu’s sales growth was the result of a massive ad campaign that included four, yes FOUR, $7 million Super Bowl spots. The company reportedly spent $2 billion on advertising on Meta’s websites last year, making it the company’s biggest advertiser. Temu also became one of Alphabet’s biggest clients in 2023. It often pays to follow the money and find out who’s benefiting when companies report big numbers like this.

-

🤖 Elon Musk’s xAI open-sources GROK AI model ( Reuters )

- Our take: This seems to be the latest round in the feud between Musk and OpenAI. As the list of open-source models grows, the ‘value’ of closed models becomes more uncertain. We mentioned this in our recent series on generative AI . Still, this isn’t necessarily bad news for Microsoft or Alphabet as their models will be bundled with cloud computing power and all the other services they offer.

-

🍎 Apple in talks with Alphabet to bring Gemini to iPhone ( Business Insider )

- Our take : Apple already earns a reported $20 billion a year for making Google its default search engine, so this arrangement is a logical next step. Some of the ‘hot takes’ point to this plan as proof that Apple is way behind on AI - which may be true. But Apple may just recognize that Google is better resourced to develop AI models, and Apple’s efforts would be better spent focussing on applications and hardware. Apple is developing its own LLM, but a deal with Google means that the model doesn’t have to succeed for the company to succeed with AI.

- Our take : Apple already earns a reported $20 billion a year for making Google its default search engine, so this arrangement is a logical next step. Some of the ‘hot takes’ point to this plan as proof that Apple is way behind on AI - which may be true. But Apple may just recognize that Google is better resourced to develop AI models, and Apple’s efforts would be better spent focussing on applications and hardware. Apple is developing its own LLM, but a deal with Google means that the model doesn’t have to succeed for the company to succeed with AI.

- 🍎 A US Lawsuit Accused Apple Of Creating a Monopoly ( NYT )

- Our Take: The US Justice Department primarily wants the court to " p revent Apple from blocking apps that interact with its iPhones, watches, messaging apps, digital wallets and other tech". If successful, this could result in the "walled garden" that Apple has in its ecosystem to come down, allowing a more open ecosystem and third party software and hardware manufacturers better integration with Apple's ecosystem. Considering this is currently a competitive edge for Apple's offerings, Apple will no doubt fight hard against it, like they have for many similar cases over the years.

And some of the key economic data released recently:

-

🇺🇸 The US Fed kept the benchmark Fed Funds Rate unchanged at 5.25 to 5.50% as expected.

- Fed officials once again pencilled in three quarter percent rate cuts by year-end , but wouldn’t commit to timing.

- Jerome Powell suggested that risks are now balanced between lowering rates too quickly or too slowly. The Fed also plans to slow the pace at which it is reducing its balance sheet.

-

🇯🇵 The Bank of Japan raised rates from -0.1% to a range of 0 - 0.1%.

- This was its first rate hike in 17 years and ended Japan’s era of negative interest rates and yield curve control. Bank officials believe that wage growth will now lead to a virtuous cycle and higher prices after decades of deflation.

-

🇨🇳 China’s retail sales rose at 5.5% in February

- This is down from 7.4% in January and slightly lower than expected.

-

🇦🇺 Australia’s central bank kept rates at 4.35%, also stating that risks were finely balanced.

- RBA governor, Michelle Bullock said it was “ too soon to rule anything in or out, but we are on the path to achieving goals set out on the inflation front ”

-

🇺🇸 US Housing data was slightly better than expected and suggested the housing market is continuing to stabilise.

The Biden vs Trump Rematch 🥊🇺🇸

This has been an unusual market cycle in many ways, and it’s already turning out to be an unusual election year as far as the market is concerned.

Typically election years are quite good for the stock market, but the performance usually only arrives in the second half of the year. So far the S&P 500 is already up 9.5% YTD which is close to average for a full-year return. And, the tech sector which is usually the worst-performing sector during an election year is leading the way in 2024.

The last two elections have been met with some market volatility, and 2024 is another contentious election, so anxiety amongst investors isn’t surprising.

✨ It’s quite likely that we will see some volatility and sector rotation in the months before and after the election. However, on longer time frames, history tells us that overall stock market performance has little to do with who is in the White House, or which party they belong to.

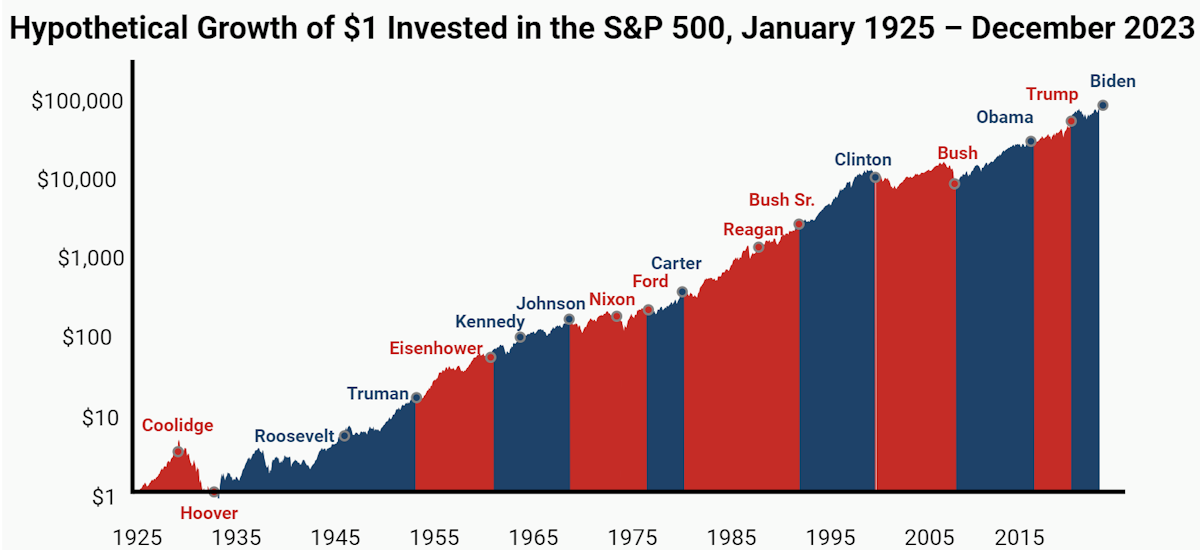

The chart below from Fisher Investments shows that the S&P 500 has continued to rise during most presidencies, regardless of the person or party in power.

S&P 500 by Party and President - Fisher Investments

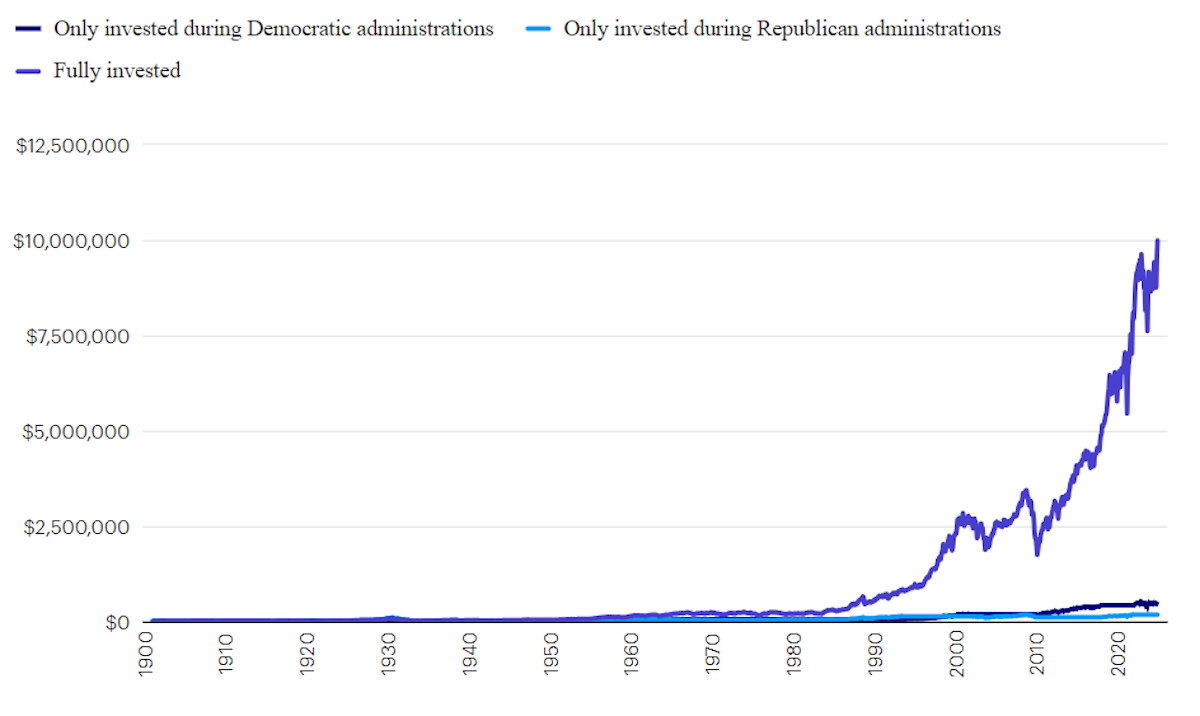

An even more enlightening chart from Invesco below shows how returns would have been impacted if an investor remained in cash when either party held the White House.

✨The principle of “ Time in the market beats timing the market” usually holds true regardless of politics or anything else. Not missing the best days is far more important than avoiding the worst days.

Growth of $10,000 in the Dow Jones Industrial Average since 1896 - Invesco

Gridlock for the Win

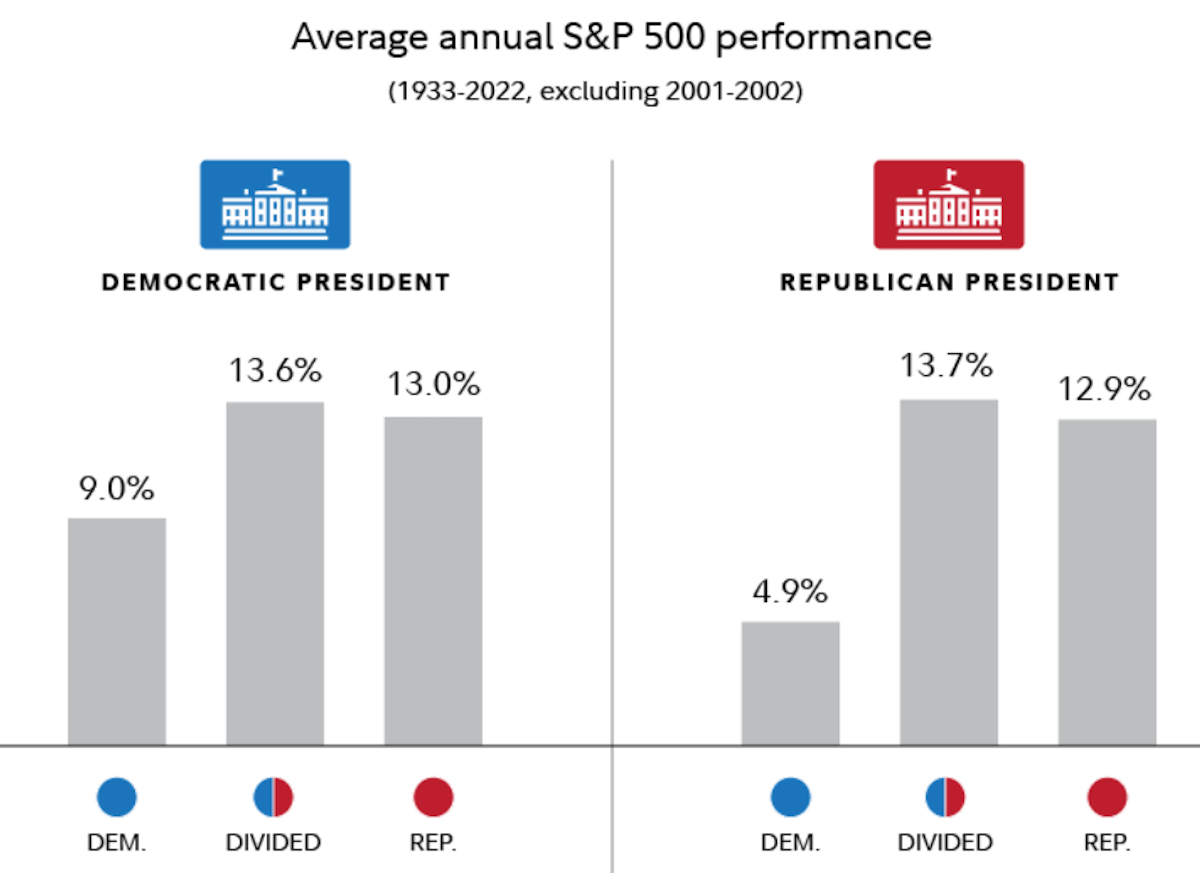

There is one aspect of the US election that does have a meaningful impact on returns for the stock market, and that is: whether Congress and the White House are divided or held by the same party.

This means that the elections for members of the Senate and House of Representatives are arguably more important than the Presidential race.

When either the Senate or House of Representatives is held by a different party than the White House, less legislation can be passed.

Markets like certainty, and less new legislation means more certainty.

Annual S&P 500 Performance by Congress and White House Control - Fidelity

As it stands now, the race for control of the White House, Senate and House are all very close.

This means a clean sweep by one party, or divided control are both possibilities and could lead to substantially different outcomes.

What’s in Play in 2024?

Presidents might have less influence on the overall economy and market than they like to think. But there are always a handful of factors that can affect certain industries and even other countries.

President Biden is the incumbent, so a Biden win really means more of the same, whereas a Trump win leaves more room for change. These are some of the key issues that could impact listed companies:

Tax Cuts

The Trump Administration introduced a range of tax cuts in 2017.

Some of these were permanent, while others expired at the end of 2025. Joe Biden has expressed an interest in raising taxes on corporations while extending some income tax cuts.

Republicans, including Donald Trump, are considering more tax cuts.

Both parties would need control of the White House and Congress to enact their tax policies - so little change is likely without a clean sweep.

Energy

It’s no secret that Donald Trump and the Republican party favor fossil fuels while the Democrats are keen to move to renewable energy faster. So sentiment within the energy sector is likely to shift as polls change in the run-up to the election.

This could create opportunities, as both fossil fuel and renewable energy producers will have a role to play in decades to come.

De-regulation

The Republican Party is also in favor of deregulation, particularly in the financial sector. Again, making major policy changes would depend on Republicans winning a clean sweep.

Trade and Foreign Policy

Donald Trump’s 2016 win was part of a major shift away from globalization.

He has once again talked about increasing tariffs on imports from both China and Mexico. New tariffs and other changes in trade policy could be inflationary for the US - but could have an even bigger impact on other markets.

In the short term at least, a Trump victory is likely to weigh on sentiment (at least in the short term) for emerging markets, and partially for China and Mexico.

While gridlock often works in the market’s favor it could prevent the US from helping to resolve global issues like the wars in Europe and the Middle East.

💡 The Insight: Stick to the Process, Avoid Knee Jerk Reactions

Goldman Sachs recently published a list of stocks that they believe could benefit from a Trump presidency. These include Chevron Corp , Exxon Mobil Corp Wells Fargo & Co , JPMorgan Chase , Peabody Energy Corp (coal) , Axon Enterprise (equipment used in law enforcement), and Fluor Corp (border wall construction).

These types of stocks are very likely to rise and fall with the polls, and would probably respond positively to a Trump victory. But, whenever stocks trade around an event like an election, they tend to trade on sentiment alone, and valuations can become unrealistic.

Volatility may well pick up in the second half of the year as the electioneering ramps up.

Regardless of what happens politically, history has shown that those investors who focus on finding high-quality businesses and paying a fair price for them have performed very well over the longer term.

To help with this, we have a free 6-part series, Invest with Confidence , that takes you from start to finish through this process, from finding companies within your “circle of competence” to figuring out a fair price to pay for them.

Alternatively, if you are already familiar with that process above and are simply looking for stock ideas to research further, check out the new preloaded screeners on the Simply Wall St Discover Page .

You will find a range of screeners for Stable Stock Ideas , including those with stable growth, strong balance sheets and High ROEs .

Stock Screens: Stable Stock Ideas - Simply Wall St

Key Events During the Next Week

As we head into the end of the quarter and Easter weekend, it’s a very quiet week for economic data and corporate earnings.

Thursday

The final estimate for US GDP Growth is expected to remain at 3.2% for the fourth quarter, down from 4.9% in the third quarter.

US personal income, spending and PCE price index data is due to be published, Personal income is expected to be 0.3% higher, down from 1% higher in the prior period. Personal spending is expected to be 0.1% higher for the period.

Friday

France's inflation rate is forecast to fall to 2.8% from 3%.

The prominent companies due to report quarterly earnings this week are:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.