What Happened in the Market Last Week?

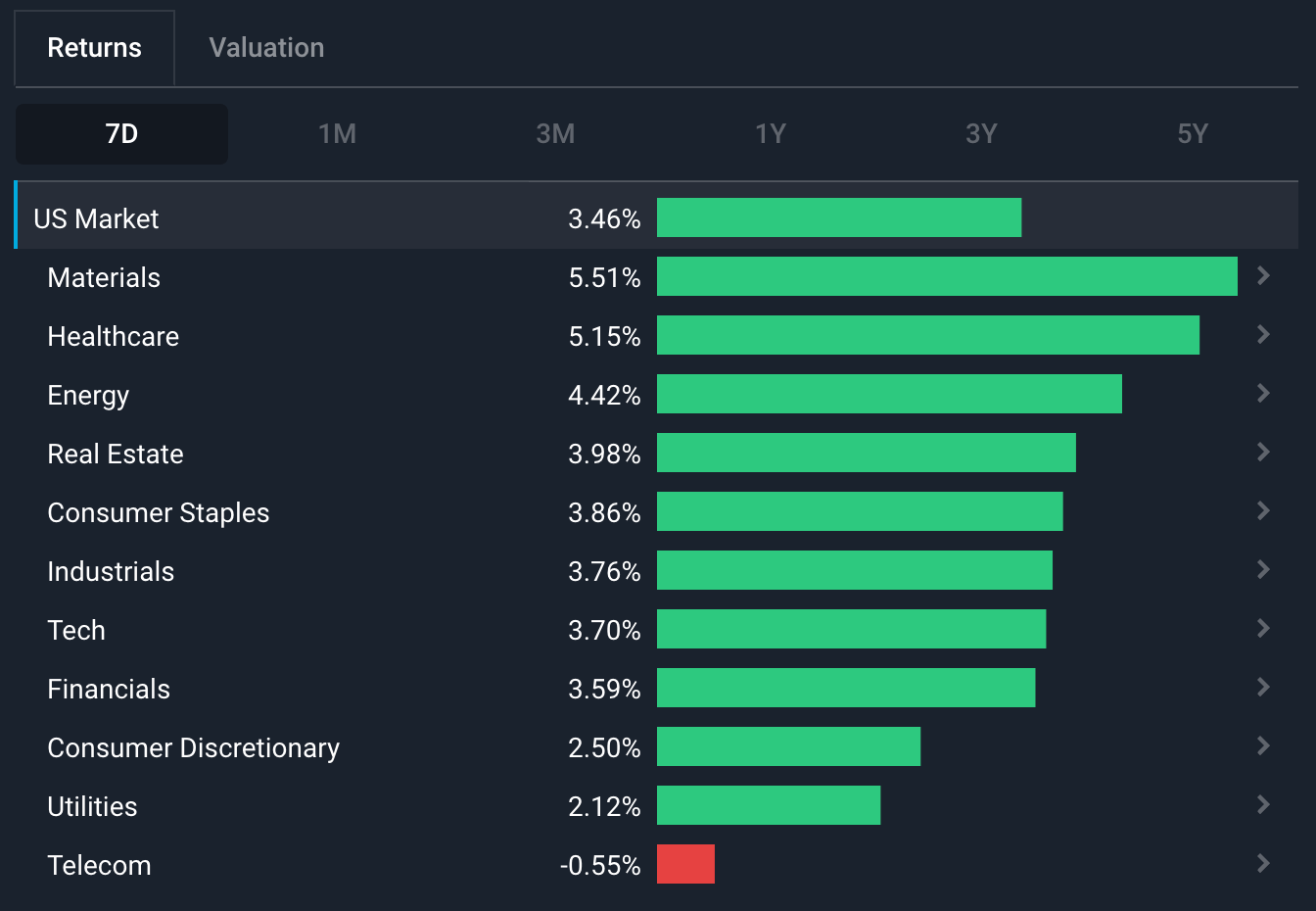

Investor optimism prevailed this past week as equity markets continued their (bear market) rally, with the S&P 500 up as much as 11% from the recent low. This was despite disappointing results from Microsoft and Alphabet. The USD began to weaken which helped energy and materials shares to strong gains.

U.S. Sector 7D Performance - 28th October 2022 - Simply Wall St

Some of the developments we have been watching over the last week include:

- The U.K. has another new Prime Minister, and for now markets are a little calmer than they have been in recent weeks.

- Chinese stocks fell the most since 2008 after President Xi Jinping tightened his grip on power.

- U.S. large cap tech stocks disappointed investors with several third quarter earnings misses.

The U.K. Has Its Third Prime Minister in Less than Two Months

Things continue to move quickly in the U.K., with Rishi Sunak taking over as Prime Minister less than a week after Liz Truss resigned. The Conservative Party has come full circle, from electing a leader seemingly oblivious to market forces, to electing a former hedge fund manager who we presume knows all about markets.

Regardless of Sunak’s background, the role might be a poisoned chalice - the U.K. is facing its biggest challenges in decades. These include:

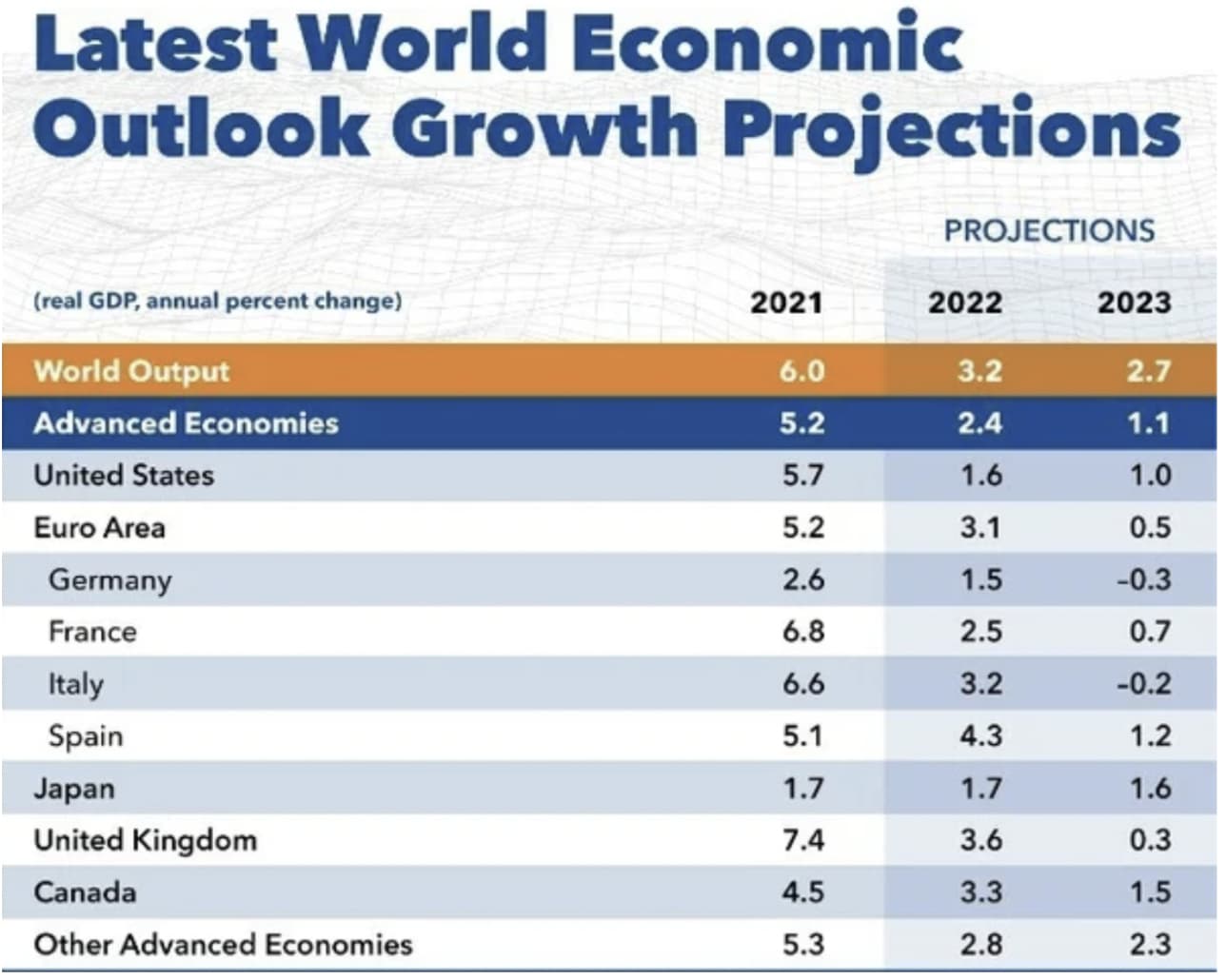

- Economic growth has been evaporating over the last four quarters. One recent survey suggests the economy has already fallen into a recession, and even the more optimistic projections are for growth to be close to zero next year.

- The country is facing record high inflation - partly as a result of the war in Ukraine, but also a result of the weakening currency. This leaves consumers with less for discretionary spending which impacts the economy further.

- The British Pound had plunged to its lowest level against the U.S. Dollar since 1985.

- Government debt is rising, and the cost of servicing that debt is also rising as interest rates rise.

- The consequences of Brexit have made Britain less competitive and is expected to reduce productivity - meaning citizens will on average be poorer.

- The possibility of electricity rationing if Russia cuts off gas supplies .

What can the new PM do to fix the Economy?

It may seem like an impossible task, but economies can and do emerge from situations like this - it’s really a question of how long it takes and how much more damage will be done.

Sunak’s solution may include a combination of spending cuts, higher taxes and deregulation to encourage investment (i.e. less government influence). Until inflation comes under control, there will probably be a focus on austerity (cost cutting), and then if inflation does come down, more expansive policies can be enacted.

How much he gets done will also depend on Sunak overcoming political challenges. Opposition parties are demanding a general election, while his own party is divided and may not back him all the way.

The Insight: The Big Challenge for U.K.’s new PM

Rishi Sunak has two tasks:

- In the short term he needs to restore confidence amongst the public, investors, and businesses. If he can’t do that, his job will also be on the line - and so will most of the Tory MPs as a general election may be inevitable. If he can restore confidence, we would probably see the currency and financial market’s strengthen.

- In the longer term, he’ll need to produce a plan to reignite the UK economy, in the face of rising inflation and debt. This is quite a task, but he will need to restore investor confidence or investors might use any strength as another selling opportunity.

For Short or Medium-Term Investors (< 5 years)

We have mentioned before that U.K. companies focused on the local economy have been worst affected by the country's economic crisis, while global companies fared better because their international revenue came from elsewhere, and are now worth more when brought back to GBP.

The chart below illustrates the point. The red line is the CBOE index of the largest 100 companies in the UK, while the blue line is the index of the 250 companies ranked 101 to 350 by market cap.

Now, if Sunak manages to restore confidence, this outperformance may reverse. Investor confidence would result in a stronger currency, which would also be supported by rising interest rates and any spending cuts that may occur.

Larger companies would then be worth less in GBP terms because their international revenues would also be worth less in GBP. At the same time, if investor confidence improves, it could lead to bargain hunting amongst the smaller companies that have been hammered over the last year.

But, it’s important to stress that any outperformance might be short lived if Sunak can’t deliver on his second task - which is to produce a credible plan to reignite the U.K.’s growth.

For Long-Term Investors (5+ years)

U.K. equities are trading on lower P/E ratios than equities in other developed countries - so if things normalize over time and the UK manages to muddle through the next few years, they have a real possibility to outperform. The most important question investors need to ask themselves when assessing a stock in this market is resilience - can this business survive another few years of challenging economic conditions?

Chinese Stocks’ Lowest Fall Since 2008

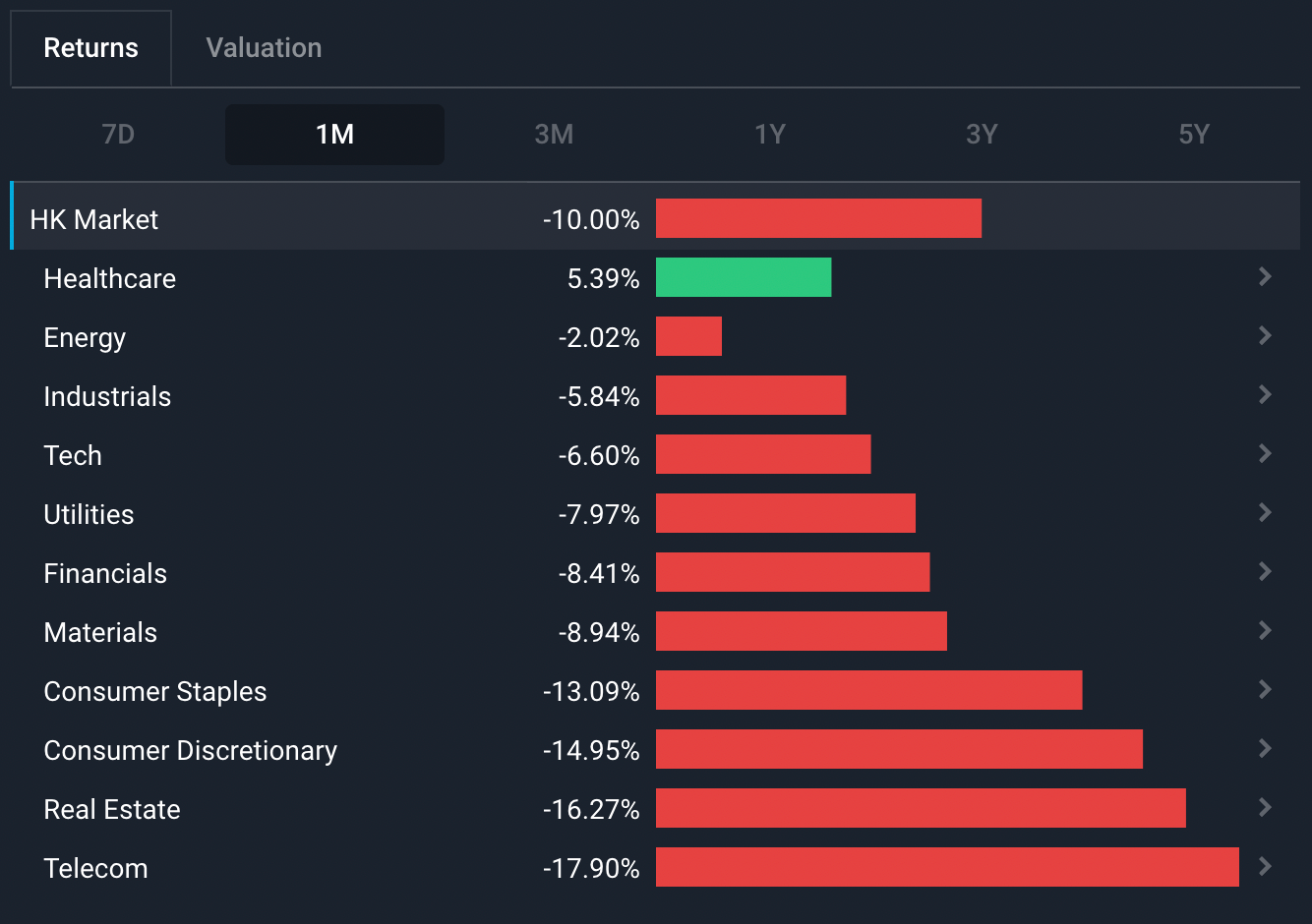

On Monday, stocks in China and Hong Kong plunged after the CCP’s 20th Congress ended. The Chinese Yuan also fell to a new low against the US Dollar, though it recovered later in the week after state banks stepped in to support the currency (they sold USD).

Investors fear that China’s President Xi Jinping has consolidated his power and will continue to prioritize ideology over economic growth or stability. There are also concerns about the appointment of combat-ready generals - and what that might entail. For a more comprehensive rundown on what’s happened, here’s Bloomberg’s take on the Chinese president’s rule and a longer term outlook for the Chinese economy from the Financial TImes.

In August, we looked at some of the cracks appearing in China's economy, and the many reasons investors have to be worried about Chinese investments.

We can summarize these concerns as follows:

- China’s zero-Covid policy, which is slowing the economy due to the endless number of lockdowns.

- The country’s current mortgage and real estate crisis, which could drag the financial sector into an even bigger crisis.

- China’s increasingly hostile relationship with Taiwan.

- The crackdown on Chinese tech and education companies.

- The revival of the ‘Common Prosperity ’ policy and what that means for economic policy.

- Lack of audit transparency for listed companies.

We can add to this list the effect of U.S. controls of semiconductor related companies - and potential retaliation from China. In addition, President Xi’s consolidated power means there is more chance that China will double down on many of the policies that investors believe have failed.

The Insight: China’s Politics Heavily Influence the Markets

The evolving situation has made China-related stocks a proxy for overall investor sentiment, rather than underlying company fundamentals. This is exaggerated by the fact that most institutions outside China have exited these stocks, leaving them to the mercy of retail investors and hedge funds. This is likely to remain the case for a long time, and why some investors have said the market “is uninvestable” .

What does all this mean for investors?

Chinese tech stocks like Alibaba ( NYSE:BABA ), JD.com ( Nasdaq:JD ) and Tencent ( SEHK: 700 ) are widely regarded as trading at bargain prices right now. But price targets and analyst forecasts are falling just as fast as the share prices - as an example, Alibaba’s 12-month price targets have fallen 63% since January last year.

In time, they may turn out to be bargains - but they come with considerable risk. Perhaps it would be prudent for a risk-averse investor to keep any allocation they have to these stocks at a level that won’t break your portfolio. Remember to focus on your personal risk profile and financial objectives to determine if positions like these deserve a seat in your portfolio.

Additionally, it’s not just companies based in China that we need to pay attention to. Lots of multinational companies have some sort of exposure to China. Investors should constantly review their portfolios to see how their stock holdings may be affected, and whether it would be more in-line with their investment objectives to refresh their portfolio holdings.

Two groups of stocks to pay particular attention to are:

- Companies that rely on Chinese consumers for growth - examples include Apple ( Nasdaq:AAPL ), Nike ( NYSE:NKE ), Tesla ( Nasdaq:TSLA ) and Starbucks ( Nasdaq:SBUX ). These companies could be affected by China’s economic slump as well as US/China relations.

- The second group is resource producers that supply iron ore, copper and other commodities to China. Examples include BHP ( ASX:BHP ) and Rio Tinto ( LSE:RIO ).

Key Events Next Week

It’s another Fed Funds week with the U.S. central bank announcing the Fed Funds target rate on Wednesday. It is expected by analysts to rise 0.75% again.

Australia’s central bank is also expected to announce the latest interest rate on Tuesday. Again, expectations are for it to rise, but only 0.25% - lower than the 0.5% hikes in previous months.

In the U.S., the latest trade data will be out on Thursday, and then on Friday, non-farm payrolls and the unemployment rate will be published.

Third quarter earnings season continues with numerous companies reporting. Some of the prominent names include:

- Uber ( NYSE:UBER )

- BP ( LSE: BP )

- Pfizer ( NYSE:PFE )

- Qualcomm ( Nasdaq:QCOM )

- PayPal ( NYSE:PYPL )

- Block ( NYSE:SQ )

- Moderna ( Nasdaq:MRNA )

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.