🏛️ The Winners and Losers From The Stablecoin GENIUS Act

Reviewed by Bailey Pemberton

Quote of the week: "A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower government borrowing costs and help rein in the national debt. It could also onramp millions of new users across the globe to the dollar-based digital asset economy." - Treasury Secretary Scott Bessent

The Senate just passed the “ GENIUS Act ” to finally regulate these crypto-dollar tokens (yep, that’s really the name, we’ll explain what it stands for).

When you hear “stablecoins,” just think digital dollars on a blockchain. Whether you’re a crypto newbie or a battle-hardened market veteran, it’s worth knowing about the consequences of this development.

If it gets through the Republican-led House and to the President’s desk, it will get signed into federal law.

So this week, we’re unpacking what stablecoins are, why Washington cares so much about them, and who the big winners and losers might be.

Most importantly, we’ll connect the dots to investment decisions, from the stocks that could benefit to the risks you should watch.

Let’s dive in!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube ! (Released each Monday by 5pm AEST).

What Happened in Markets this Week?

- 🚀 Bezos and Blue Origin Try to Capitalize on Trump-Musk Split ( WSJ )

- The Trump-Musk split has cracked open a rare opportunity for Jeff Bezos to pitch Blue Origin as the new go-to space partner.

- With SpaceX dominating NASA and military contracts, Blue Origin is angling for a bigger slice, backed by cozy chats with Trump and a PR blitz featuring weddings and White House visits.

- If Bezos can flip Trump’s favor, expect future contracts to shift, especially lunar and Mars-linked projects. But Blue Origin must first prove it can match SpaceX’s launch tempo and reliability.

- A political pivot could give Blue Origin lift-off, but performance will decide who gets the next billion-dollar launch, not charm.

- 🏦 Federal Reserve Releases Plan to Relax Key Bank Capital Rule ( Bloomberg )

- The Fed is proposing to ease capital requirements for big banks, trimming the enhanced supplementary leverage ratio from 5-6% down to 3.5-4.5%.

- The move could free up over $200 billion at bank subsidiaries, potentially boosting their Treasury market activity, though the Fed says it won’t let that capital flow straight to shareholders.

- This could support liquidity in Treasuries and help stabilize bond markets during stress. But critics warn it heightens systemic risk and weakens banks' loss buffers.

- Loosening capital rules may help banks buy more Treasuries and keep bond markets running smoothly, but it also means they’ll have less of a cushion if things go wrong. So there’s a trade-off between stability and flexibility.

- 🇺🇸 U.S. plans crackdown on allied chip plants in China ( WSJ )

- The U.S. is weighing up the removal of waivers that let Samsung, SK Hynix, and TSMC ship U.S. chip tools to their China plants without case-by-case licenses.

- If revoked, this could disrupt global chip supply chains and complicate U.S. trade and defense relationships with key allies like South Korea and Taiwan.

- Investors in chipmakers should watch for supply bottlenecks, higher costs, or plant slowdowns.

- If the U.S. tightens chip rules, expect global supply chain turbulence, especially for memory and logic chips, and a scramble by allies to protect their China operations.

- 💸 SoftBank's Son pitches $1T Arizona AI hub ( Bloomberg )

- Masayoshi Son wants to build a $1 trillion AI and robotics hub in Arizona, modeled after China’s Shenzhen, and is pitching TSMC, Samsung, and the Trump administration to get on board.

- The plan, dubbed " Project Crystal Land, " would centralize manufacturing for AI hardware and robots, potentially catalyzing U.S.-based high-tech supply chains.

- SoftBank is renewing its aggressiveness, and possibly big funding rounds or asset sales to finance it. Watch for opportunities in AI hardware startups, U.S. factory developers, and SoftBank-linked firms.

- If Son’s mega-hub moves forward, it could reshape AI manufacturing in the U.S..

- Watch SoftBank’s asset sales, partner firms, and potential startup plays tied to robotics and AI infrastructure.

- ☁️ Nvidia threatens tech giant profits with move into cloud computing ( WSJ )

- Nvidia is stepping deeper into cloud computing with its DGX Cloud service and investments in AI cloud startups like CoreWeave, rattling giants like Amazon, Microsoft, and Google.

- Though Nvidia’s cloud business is still small, its $10.9B in multi-year agreements and control over 80% of the AI chip market give it serious leverage.

- Nvidia’s pivot means new long-term recurring revenue streams, while big cloud players face margin pressure and growing chip independence risk.

- Nvidia’s deeper play could erode their cloud dominance over time, so monitor how fast DGX Cloud scales and how rivals react with custom AI chip rollouts.

- 👟 Nike says tariffs will cost it $1 billion before price increases, supply chain shifts ( CNBC )

- Nike says tariffs will cost it $1 billion in FY26, prompting supply chain shifts and price hikes to offset the hit.

- The company is cutting China exposure (now 16% of its supply chain) and reinvesting in wholesale, store sales, and sports-focused innovation under new CEO Elliott Hill.

- This signals a leaner, more diversified Nike, but one still battling margin pressure and uneven regional demand.

- Keep an eye on North America resilience, China recovery, and wholesale partnerships like Amazon for upside.

🤔 Stablecoins 101: Digital Dollars

Stablecoins are simply a crypto token that is pegged 1:1 to a fiat currency (most are to USD). In plain English, 1 USD-backed stablecoin should always be worth $1 USD.

To keep that stable value, reputable issuers hold real assets in reserve for every token issued. Typically, this means cash or ultra-safe investments like U.S. Treasury bills .

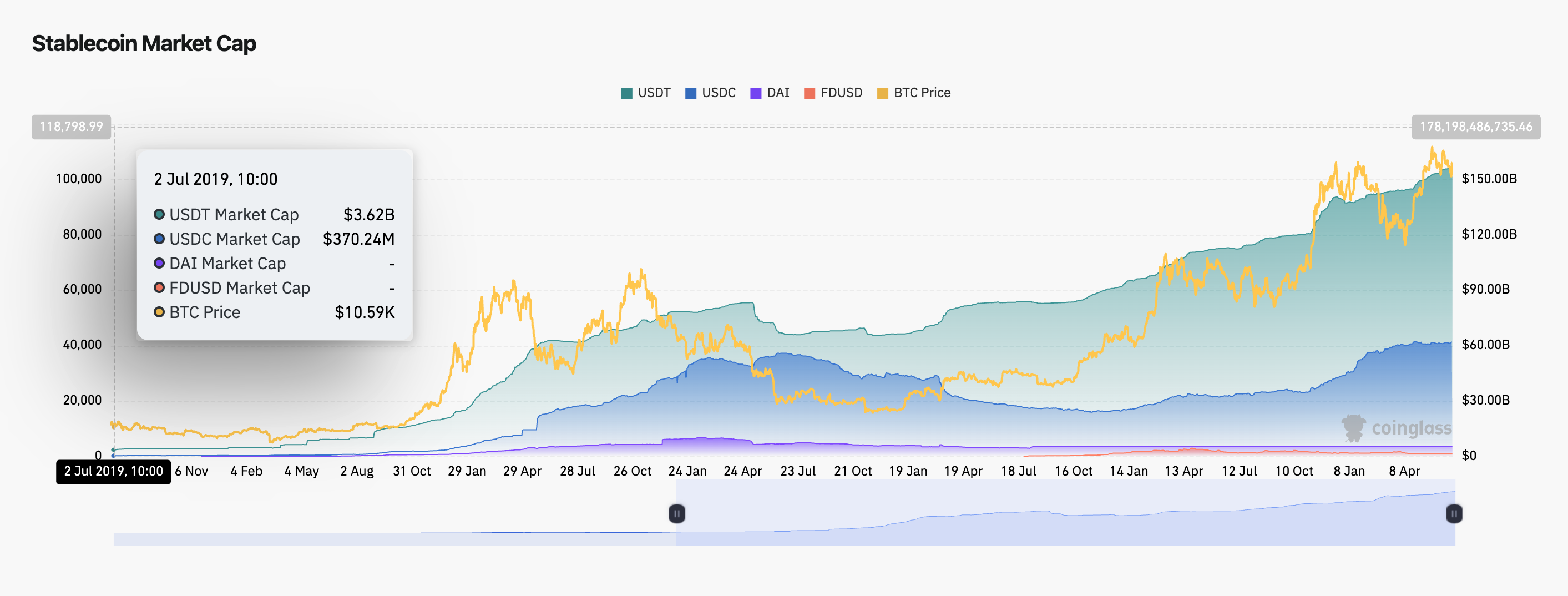

For example, Tether and Circle – issuers of the two biggest stablecoins (USDT and USDC) – together hold about $166 billion in U.S. Treasuries to back their respective tokens.

If you own a stablecoin, you’re essentially holdi ng a digital IOU for a dollar, which yo u can usually redeem or cash out with the issuer.

Stablecoins market Cap - Coinglass (Green: Tether’s USDT. Blue: Circle’s USDC, Yellow: Bitcoin price)

People use stablecoins because they combine the stability of the US dollar with the speed and reach of crypto .

More and more, businesses and individuals are using stablecoins for cross-border payments and remittances . You can send money overseas in minutes, 24/7, often for pennies in fees, bypassing the slow, costly bank wires.

In countries with unstable currencies, people even use USD stablecoins to store savings and protect against inflation. Yes, the USD also faces inflation, but compared to currencies like the Turkish lira, Argentine peso, and many others, it’s still the most stable of the bunch.

Stablecoins are becoming the digital cash of the internet economy.

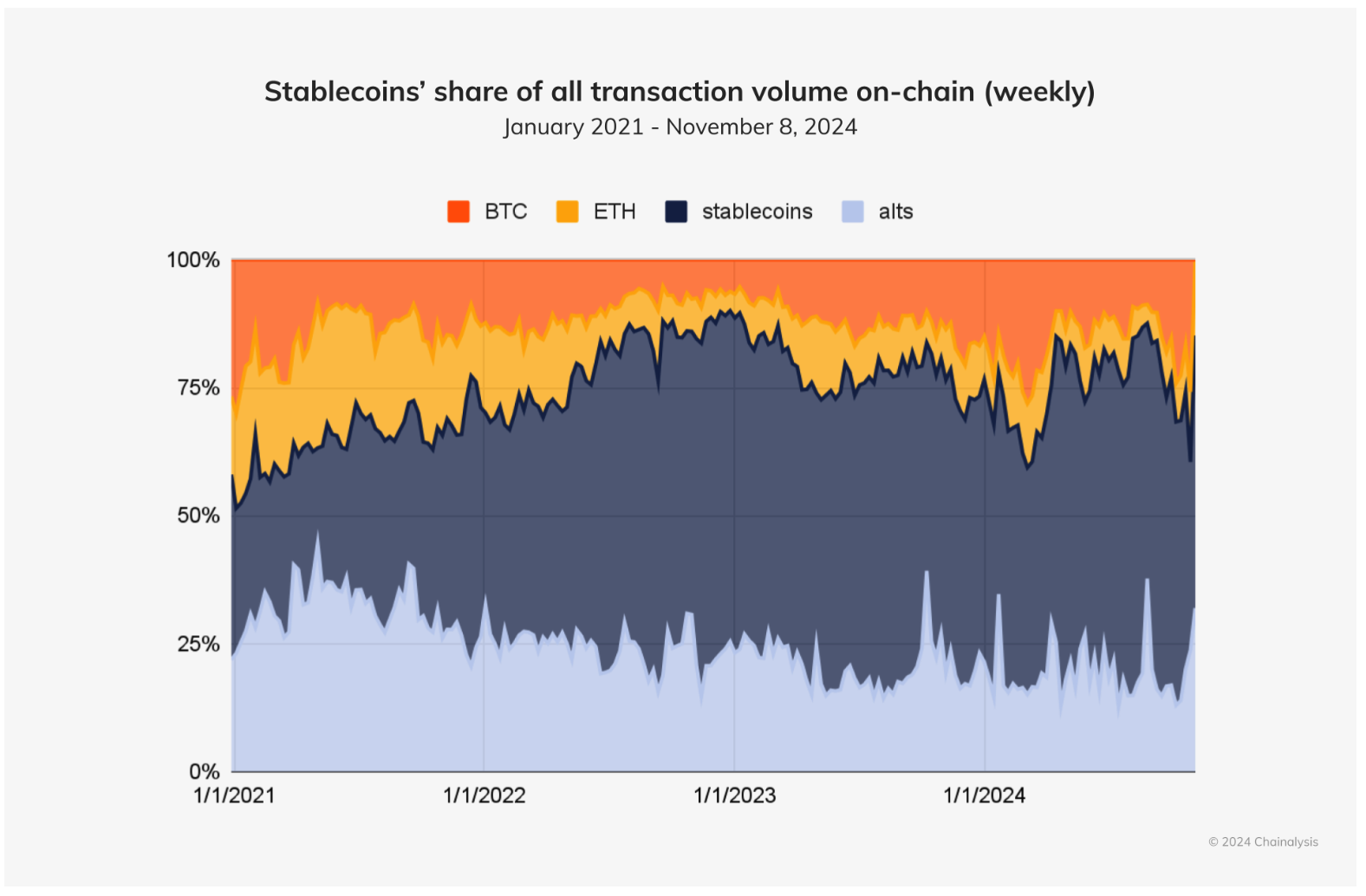

Their rise has pumped liquidity into crypto (they account for more than two-thirds of crypto transaction volume ) while also creeping into mainstream finance.

Stablecoins 101 - Chainalysis

According to Deutsche Bank, stablecoin transactions hit $28 trillion last year , which is more than Mastercard and Visa networks combined.

Some major U.S. Banks, Amazon, and Walmart are all discussing issuing their own stablecoin, while the likes of PayPal have already done so with PYUSD.

U nderstanding stablecoins’ use cases gives us a better idea of why they’re growing in popularity. With this much interest, this niche is poised to get much bigger, and that’s where the GENIUS Act comes in.

🏛️ The GENIUS Act: A New Sheriff in Stablecoin Town

The catchy name stands for the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025 , (Congress loves their acronyms).

This landmark legislation is the first comprehensive U.S. framework for stablecoins. In a nutshell, it’s about bringing stablecoins out of the regulatory gray zone and into a supervised, legitimate market.

Legal firm Arnold & Porter did a comprehensive breakdown of the bill , but here’s what it does (and doesn’t do):

- 🔐 Who can issue: Only regulated, approved entities can issue payment stablecoins now.

- That includes banks (via their subsidiaries) and licensed non-bank companies that apply for a special OCC license . In other words, no more “anyone with a website can mint a stablecoin”. Issuers must be vetted and get a green light from regulators .

- 💱 Fully backed reserves: Every stablecoin must be 100% backed by safe, liquid assets , mainly U.S. currency or short-term Treasuries (90-day T-bills or less).

- No bitcoin or dodgy tokens as reserves, and definitely no algorithmic funny business (like the ill-fated Terra USD that wasn’t fully collateralized). This essentially outlaws algorithmic or unbacked stablecoins by requiring a dollar in the bank for every token.

- 🔎 Transparency: Issuers must publish monthly reserve reports detailing what’s backing the coins, and get those reports audited by an independent accountant .

- CEOs and CFOs even have to attest to the numbers, under penalty of law. Talk about skin in the game. This is meant to give investors and regulators confidence that a stablecoin is truly stable and won’t collapse due to hidden risks.

- 🚫 What’s not allowed: The Act pointedly forbids stablecoin issuers from paying interest or yield on the coins .

- This is a BIG one, and was probably to prevent stablecoins from competing with bank deposits (more on that in the macro section). Banks can also tokenize their own deposits outside this Act’s rules (that’s explicitly excluded), which was a concession to keep banks in the game. In short, stablecoins are to be used as a payment medium, not as interest-bearing accounts.

- ⚖️ Fed eral & state oversight: The GENIUS Act sets up a federal oversight regime (with the Fed, OCC, FDIC, etc., divvying up supervision) but also lets states keep regulating smaller issuers.

- It’s a bit of a two-tier system. Big stablecoin issuers (over $10B in coins) will fall under federal watch , whereas smaller ones can operate under state regimes that meet minimum standards. Unlike the House’s version (the STABLE Act), the Senate’s GENIUS Act doesn’t completely preempt state laws. This compromise helped get broader support.

- 🛡️ Enforcement teet h: Issuing a stablecoin in the U.S. without approval becomes illegal.

- Unauthorized issuers can face civil penalties up to $100k per day that their stablecoins are circulating, which is a massive deterrent. Regulators can also shut down issuers, issue cease-and-desist orders, and generally act like bank regulators to snuff out violations. The era of “wildcat” stablecoins is essentially over. Issuers need to comply or get out.

✨ For the first time, the U.S. is officially recognizing and codifying stablecoins as a part of the financial system. This clarity is expected to spur growth because legitimate players now have a rulebook to follow.

Imagine previously interested institutions (big fintechs, banks, corporations) saying, “ We’d use stablecoins if we knew we weren’t breaking laws. ” Now they have the green light, which could trigger a wave of adoption. Regulatory risk premium goes down , investment and usage go up.

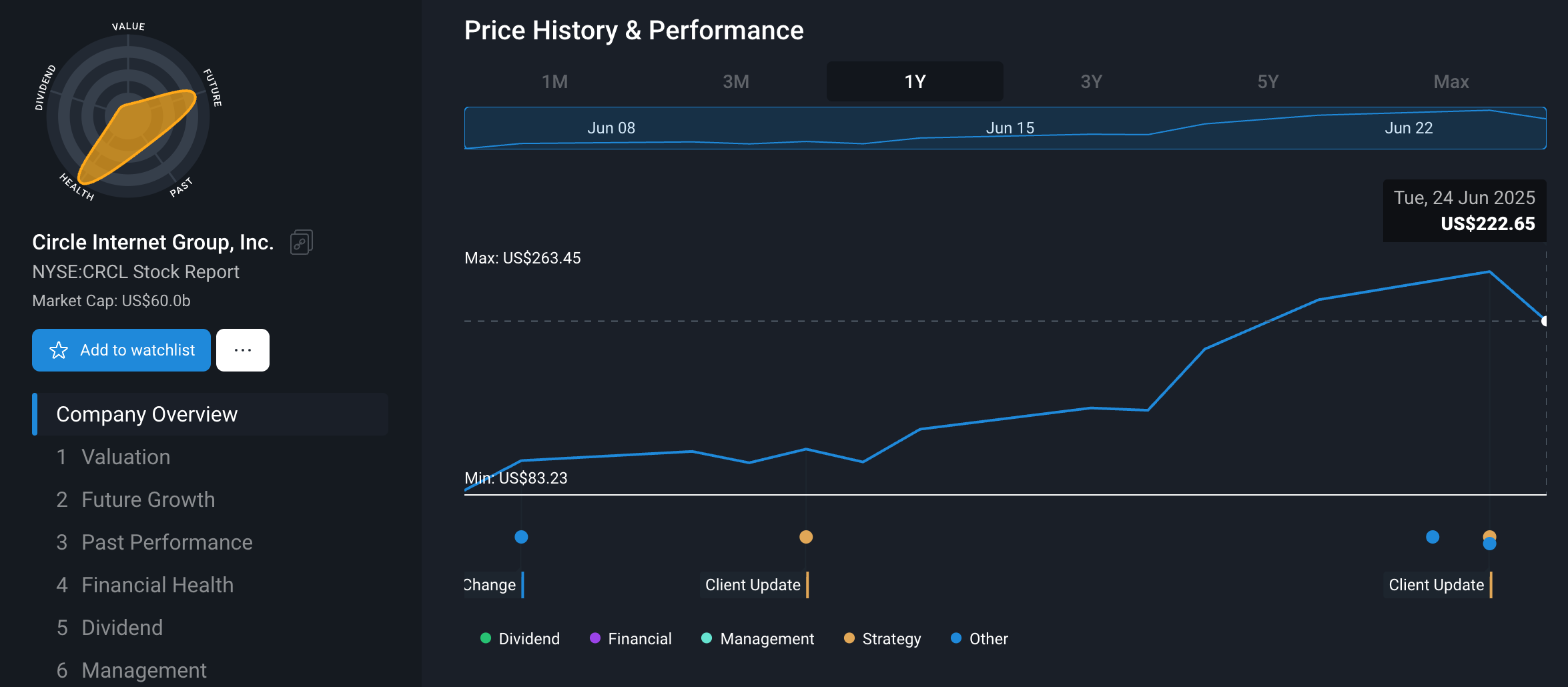

What’s important here is that clarity reduces uncertainty. Companies like Circle (which just IPO’d) saw their stock jump on the Senate bill’s passage . And that was even after a stellar run from a $31 IPO price on June 5th to $143 by the 17th of June.

Price History and Performance for Circle Internet Group - Simply Wall St

In practical terms, we’ll likely see more traditional firms announcing stablecoin projects (as Fiserv did, inking a deal with PayPal and Circle right after the bill passed ).

The competitive landscape might shift quickly, and that brings opportunities and risks, depending on who adapts. But why pass stablecoin legislation now?

🏦 The Goal: Boost Demand for the Dollar, Protect Banks

Well, beyond consumer protection, lawmakers had two big goals with this legislation:

- 💵 Strengthen the U.S. dollar and Treasury market

- 🏦 Shield banks from disruption

The Act is trying to engineer a win-win: grow the pie (of dollar usage) without knocking over the table (of financial stability).

Let’s start with the first point.

By creating a regulatory framework for USD-backed stablecoins, the U.S. is making it easier to export digital dollars globally, reinforcing the dollar’s reserve status. Since reserves must be held in Treasuries or cash, stablecoin growth naturally boosts Treasury demand.

- 🏛️ Bank of America estimates that for every $1 moved from deposits to stablecoins, ~$0.90 goes into Treasuries.

- 🤑 In April, JP Morgan research noted that stablecoin issuers may become the 3rd largest buyers of Treasuries in a few years.

- 💵 There is an expectation of a treasury surge later this year due to the government's refinancing needs. Treasury Secretary Scott Bessent needs as many buyers as they can get, and he’s a fan of stablecoins .

✨ That demand could help lower borrowing costs and reduce reliance on foreign or Fed buyers. It’s a rare case where crypto growth serves government financing.

Now, as for protecting banks, that’s probably anchored more around protectionism and stability, rather than innovation.

Stablecoins may drain bank deposits, reducing cheap funding for them and pressuring banks to raise rates or lend less. To limit this, the GENIUS Act bans interest on stablecoin balances. No yield means less incentive to fully exit the banking system.

Meanwhile, banks can still issue their own tokenized deposits (like JPM Coin) outside the Act’s rules, allowing them to compete without being handcuffed by legislation. It seems banks got their money’s worth with their lobbyists on the hill.

✨ The message is clear: regulators want innovation and dollar demand, but not at the expense of bank stability.

As you can imagine, this benefits some and hurts others.

🏅 The Winners & Losers Of Stablecoin Growth

The GENIUS Act and the rise of regulated stablecoins are creating tailwinds for some players and headwinds for others . Here’s a look at who’s smiling and who’s sweating in the stablecoin era:

🥳 Stablecoin Winners: Those Who Are Smiling

- 🪙 Major Stablecoin Issuers (Circle, Tether, etc)

- The top stablecoin providers stand to gain a flood of new users and capital now that the rules are clear.

- Circle (issuer of USDC) recently went public and jumped 15% after the bill passed because, well, legitimacy looks good on them. With Standard Charter suggesting the stablecoin market could 8x to $2T by 2028 , Circle and Tether ( who hold $166bn in Treasuries between them ) are poised to scale even further.

- More coin demand = more Treasuries bought = more interest income earned.

- Regulatory clarity favors compliant players like Circle, while opaque operators like Tether risk losing U.S. ground. These firms are evolving into fintech institutions (hefty asset bases earning interest income) with serious earning power.

- For example, Tether earned $14bn in profit last year , which is more than Pfizer, Tesla, or BlackRock, and it only has 150 employees. So that’s $93m in profit, PER employee… Talk about efficiency.

- 💱 Crypto Exchanges & Fintechs (Coinbase, PayPal, Fiserv)

- Stablecoins fuel trading volume and fee revenue.

- Coinbase co-founded USDC with Circle and earns interest income. PayPal launched PYUSD, and Fiserv saw its stock rise after a stablecoin announcement. Card networks may save costs by settling transactions via stablecoins on weekends.

- Anyone building on or riding the new payment rails is well-positioned.

- 🧑💻Big Tech & Global Businesses (Meta, Uber, Amazon, Walmart, etc.)

- Stablecoins promise fast and cheap global payments.

- Meta could revive stablecoin plans for WhatsApp and Instagram. Uber could cut payout costs by paying drivers in stablecoins. Emerging market businesses may use stablecoins to avoid FX risk.

- Expect efficiency gains (higher margins) and new revenue streams for global firms that embrace them.

- 🇺🇸 U.S. Government & Treasury

- As mentioned, s tablecoin issuers are set to become major Treasury buyers, potentially reducing borrowing costs and extending U.S. dollar dominance.

- Tether was the 7th largest buyer of US treasures in 2024, ahead of Canada, Norway, and many others. As of Q1, it held 1.5% of all U.S. Treasuries. The U.S. benefits geopolitically, too.

- These firms are helping entrench the dollar’s role in the digital era, outpacing rivals like China’s digital yuan.

😞 Stablecoin Losers: Those Who Are Sweating

- 🏢Remittance Giants (Western Union, MoneyGram)

- With near-instant, low-cost transfers, stablecoins undercut their business model.

- App downloads are already down 22% for Western Union . Unless these firms adopt crypto tech (reports are that they’ve started), expect shrinking market share and margins.

- Reinvention is possible, but profitability will likely take a hit if they adopt these cheaper rails for consumers.

- 🏦 Banks (Especially Smaller Ones)

- Even without offering yield, stablecoins may pull deposits due to utility.

- That pressures banks to raise the rates that they offer or improve digital services. Large banks can adapt; smaller ones may lose low-cost funding, impacting lending and profits.

- Those banks that embrace stablecoins (custody, transfers, or issuance) could find opportunities that offset the downside.

- 💳 Card Networks (Visa, Mastercard – Long-Term Risk)

- Some argue the selloff in these names is overblown since t hey’re hedging their risks by partnering with crypto projects. But if stablecoins enable direct payments that bypass their rails, 2–3% interchange fees could erode.

- P2P and B2B transfers are most at risk. The disruption risk is there (think streaming vs. cable), but these firms still have time to evolve, and they’ve been preparing for this for years.

- As an investor, keep an eye on any metrics or commentary from these companies about blockchain-based payment volumes . That will signal whether they’re capturing the stablecoin opportunity or getting left behind.

- 🏛️Lagging Regulators & Non-USD Economies

- Countries slow to regulate risk losing fintech innovation to the U.S.

- And if citizens adopt USD stablecoins over local currencies, it weakens domestic monetary policy, which is “digital dollarization” in action.

- Those central banks and governments will need to respond by being more financially responsible (i.e. less money printing and less censorship) so that locals WANT to own the local currency.

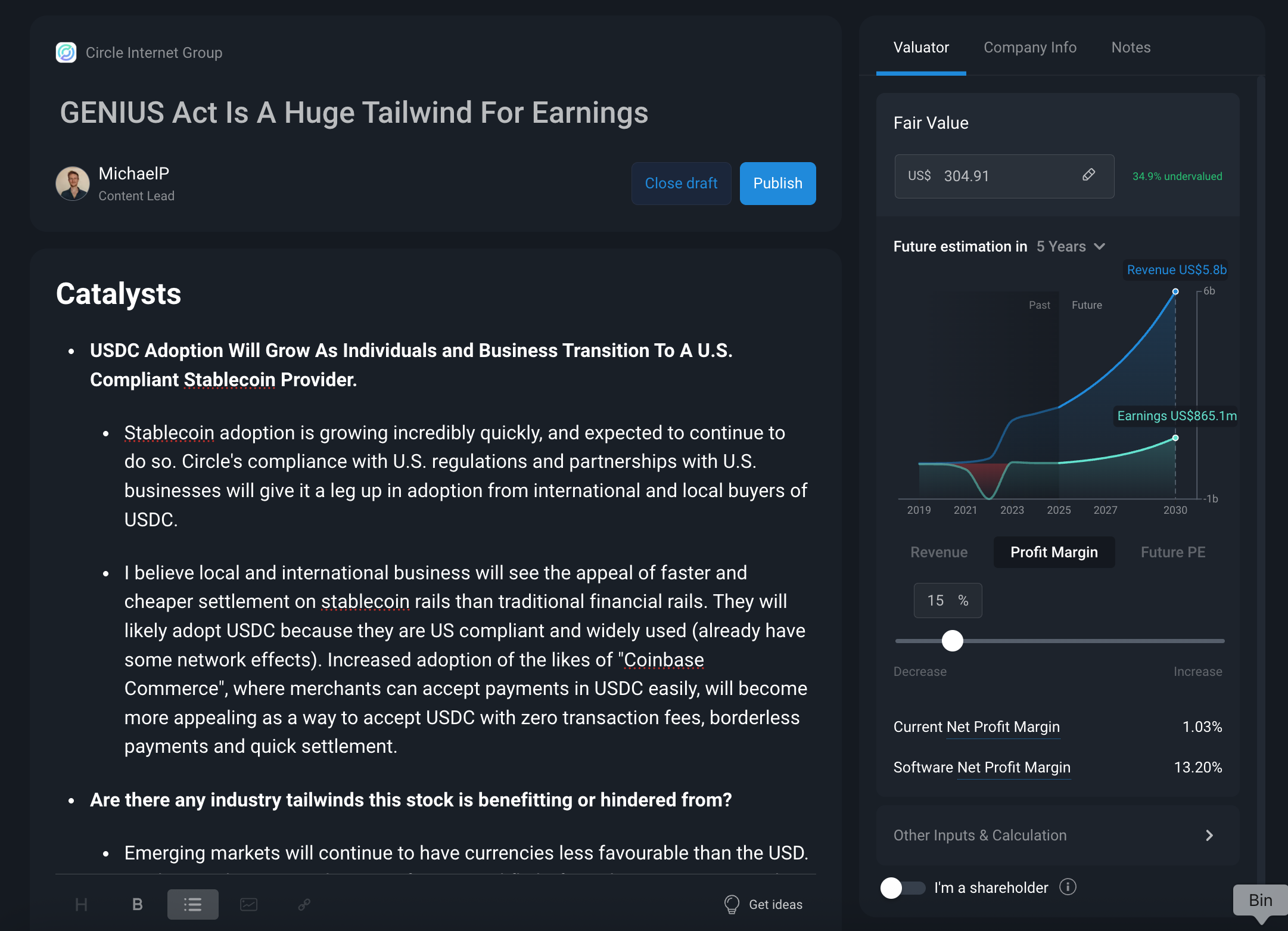

💡 The Insight: New Catalysts Require Updated Narratives

The passing of the GENIUS Act was a significant development.

For investors, that means both fresh opportunities and evolving risks. The impact of this bill has likely invalidated some outdated market assumptions from only a few months ago.

So, if you are invested or interested in any of the companies that are impacted by stablecoins (positively or negatively), your narrative will need an update.

Here are some questions to answer in your narrative to update your assumptions:

- 📈📉Will the legislation increase or decrease this company’s revenue prospects?

- If the company operates directly in this space, it’s probably fair to assume that its revenue prospects are better now (i.e., Circle, Coinbase, etc).

- However, if the company is an incumbent or subject to disruption (Western Union) and shows little signs of adapting, then it’s probably fair to assume its revenue will suffer or that investors will pay a lower PE multiple for it.

- 📊 Will the legislation increase or decrease this company’s profit margins?

- If the company is a multinational or just subject to plenty of payment fees (interchange fees, processing fees, scheme fees, etc), their margins could benefit greatly IF they transition to using cheaper stablecoin infrastructure for those same transactions and transfers.

- Alternatively, if the company’s business model is reliant on taking a cut in the legacy financial plumbing, their margins could shrink due to less transaction volume on their networks, or by adopting stablecoins, which can’t charge as high a fee.

Example Circle Internet Group Narrative - Simply Wall St

You can use our provided templates to create your narrative on any stock in just minutes! Then, keep an eye out for valuable feedback from other investors in the community to help sense check your thinking!

Key Events Next Week.

Tuesday

- 🇯🇵 Tankan Large Manufacturers Index

- 📉Forecast: 10. Previous 12

- ➡️ Why it matters: A drop suggests Japan’s industrial giants are turning cautious—bad news for business investment and yen sentiment.

- 🇨🇳 Chinese Caixin Manufacturing PMI

- 📈 Forecast: 49.8. Previous 48.3

- ➡️ Why it matters: A move closer to 50 signals stabilisation in China’s factory sector, which is key for commodities and regional growth.

Wednesday

- 🇺🇸 ISM Manufacturing PMI

- 📈 Forecast: 50 Previous: 48.5

- ➡️ Why it matters: A return to expansion could spark optimism around US industrial activity and broader economic momentum.

- 🇺🇸 JOLTs Job Openings

- 📉 Forecast: 7.1M Previous: 7.39M

- ➡️ Why it matters: Fewer job openings point to a cooling labor market and growing case for Fed easing.

Thursday

- 🇦🇺 Balance of Trade

- Forecast: $6.6B Previous: $5.41B

- ➡️ Why it matters: A strong surplus supports Aussie dollar strength and signals resilient demand for Australian exports.

- 🇨🇦 Balance of Trade

- Forecast: -$1.5B. Previous: -$7.14B

- ➡️ Why it matters: Although it's an improvement, a persistent trade gap adds pressure on Canada’s economy and may influence BoC policy direction.

We’re at the tail end of earnings season, so there are only a few large companies reporting this week:

- Woodside Energy

- Constellation Brands

- MKDWELL Tech Inc.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.