The Impacts Of OPEC's Oil Production Cut and JPM's CEO's Take On The Economy

Reviewed by Michael Paige

What Happened in the Market Last Week?

🎧 Prefer to listen to these insights? Check out the audio recording on Spotify !

Equity markets kicked off this week on a continued winning streak as investors assessed the implications of the trade data which was released last week.

Investors also digested the latest job openings report that suggested the Federal Reserve’s efforts to cool the red-hot labor market might finally be working. In February, the number of available positions fell below 10 million for the first time in nearly two years .

US Energy stocks once again tracked the oil price higher, and Financials continued to recover after its beatdown over the last few weeks, but performance was still subdued compared to the rest of the market. While all major sectors exhibited gains this week, the Industrials , Consumer Staples and Materials sectors lagged.

This week we are having a look at where things stand as we head into the second quarter:

- The oil cartels announced a surprise cut to oil production, which isn’t great for inflation fighting efforts

- The CEO of America’s largest bank, Jamie Dimon, gives his insights into the global economy. He sees plenty of challenges ahead, but provides some suggestions which could spur growth.

OPEC Announces A Surprise Oil Production Cut

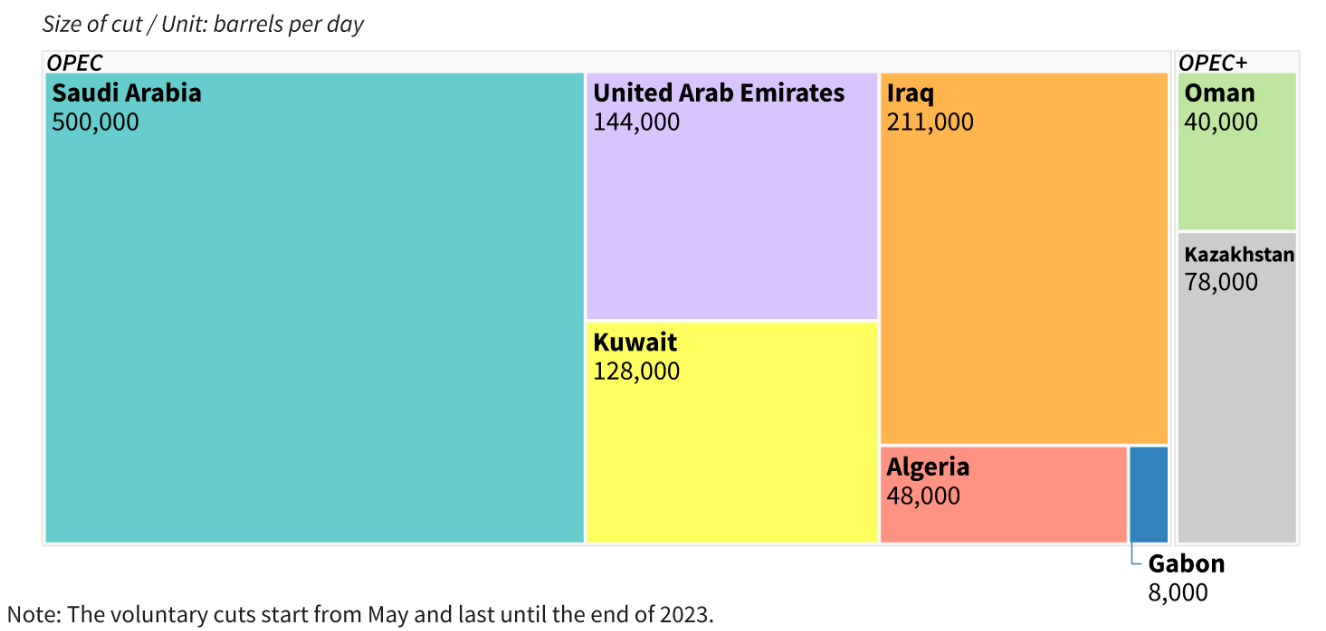

Oil prices surged following a surprise announcement from the Organization of the Petroleum Exporting Countries (OPEC) detailing a cut of more than 1 million barrels of oil a day. The decision was led by Saudi Arabia with the aim of bringing pricing stability to the oil market but the move has been widely criticized by western economies, who state that the move could slow efforts to curtail inflation.

According to calculations from Reuters , this latest cut will bring total cuts to 3.66 million barrels per day, or roughly 3.7% of global demand. This might seem like a drop in the ocean, but on a commodity like oil where supply and demand hang in a tight balance, the pricing ramifications could be huge.

Following the announcement of the cut, Goldman Sachs analysts raised their Brent price forecasts for December 2023 up US$5 to US$95 per barrel and the Head of Investing at Pickering Energy Partners said the cut could lift oil prices by US$10 per barrel in the near term.

What Caused The Cut?

The move to cut production has been widely seen as a defensive move from the oil cartel to account for the possibility of a reduction in oil demand. With fears of recessions constantly looming, it was clear that global oil demand could be under threat and so the oil producers preemptively cut supply to try and secure higher prices.

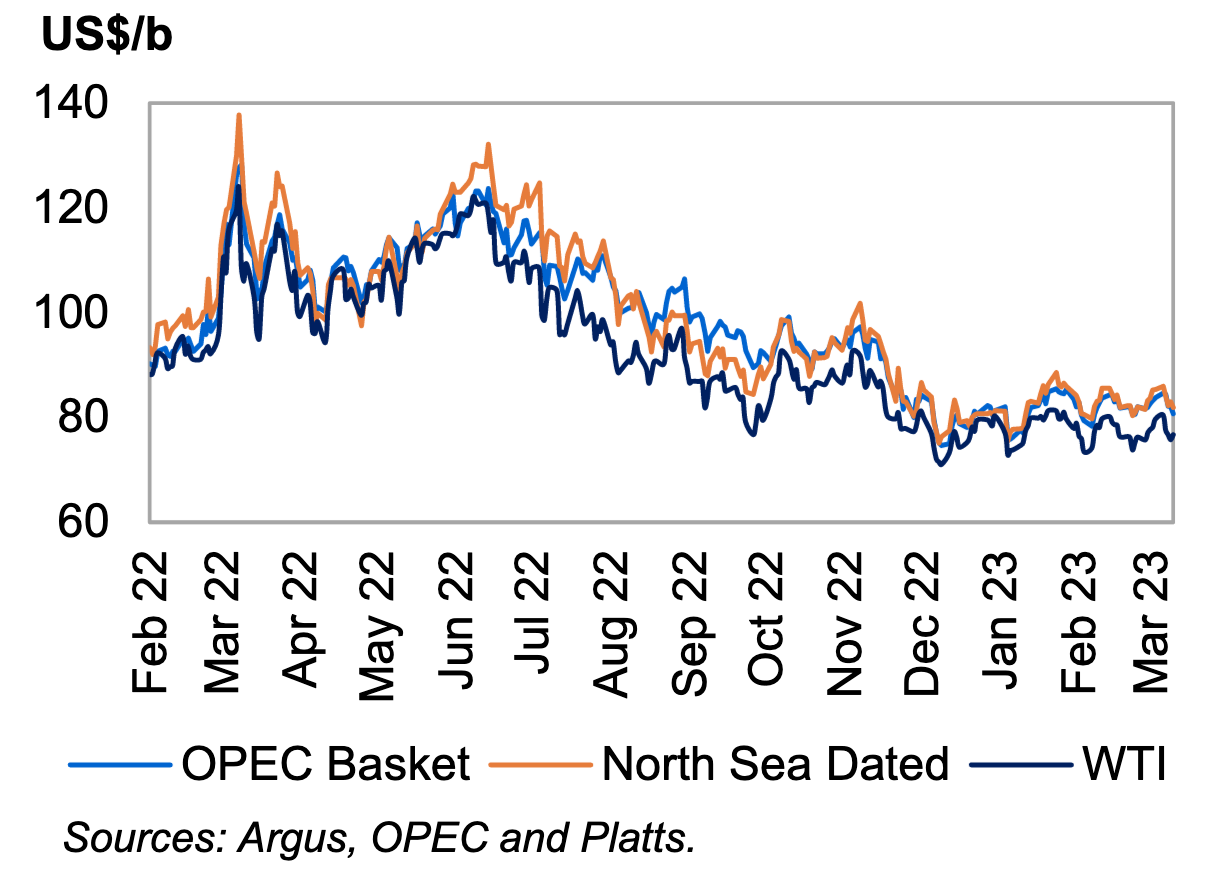

If we look at the context behind the move, we see that oil prices had slowly declined over the last year, hitting a 15 month low in mid-March of around $72 per barrel. While it seems understandable on the surface, it must be acknowledged that even that price lays well above the average price over the preceding 10 years.

Upon the news of the cuts reaching global markets, Brent futures surged 8% to over US$86 per barrel at the commencement of trading on Monday. Although it has traded back down to the low 80s in the days following.

OPEC's decision also came after the United States and France announced releases from their strategic petroleum reserves (SPR). These reserves act as an ‘in case of emergency oil supply’ should there be any disruptions to global oil supply, which happened to be the case when Russian oil supply was cut in the wake of Russia’s attack on Ukraine.

This most recent round of production cuts is a slight annoyance for the US Energy Department, which had begun to buy back oil to replenish its SPR , which had shrunk to its lowest levels since 1984.

💡 The Insight: Not Great For Fighting Inflation, But We’ve Endured Worse

The announcement of the production cut saw an impulsive pricing impact in the short term, but there’s no guarantee the impacts will be long lasting. This move from OPEC was preemptively done to minimize the pricing effects of a possible downturn in oil demand. But demand could come in lower than expected, which will see higher oil prices pull back.

If crude oil prices do remain elevated, it’ll add difficulty to the task of tackling inflation. The price of oil and its refined products are all inputs into the complex equation that determines the Consumer Price Index (CPI). The higher the CPI figures are, the more likely we are to endure continued rate rises in the future.

However, even if Goldman Sachs analysts were on the money with their Brent pricing forecasts and prices were to head back up to around $US95 per barrel, we’d be right back to where we were in October and November of 2022. Not ideal territory, but not unfamiliar territory - and still well below the peak of US$120 per barrel that we saw in June 2022. It’ll be a tougher test than it was previously as households and businesses will have felt the pinch for longer, but it’s something we can endure.

What Does This Mean For Investors?

Whether we like it or not, the price of oil is an input into most goods and services we pay for. Changes in the price of oil have a butterfly effect on the whole market. Logistics costs increase as the fuel powering container ships or cargo planes increases in price too, household energy prices rise and the price we pay at the fuel pump jumps too.

We’re yet to see what the true impact of the recent supply cuts will be, but as always it's important to think long-term about the ramifications. With any significant catalyst like this, there are opportunities for investors who do their research, understand the market and find high quality companies. Earlier in 2022, we had a look at some of the Best Stocks for When Energy Prices Rise and so it could be an opportune time to revisit this to see if there are any companies that catch your eye.

One reminder though, if you're trying to value oil-producers, it's best to be conservative with your estimates on the oil price in your models, just to build in a bit of a buffer and not succumb to overly optimistic predictions.

Markets Expect Sunny Skies, But Storm Clouds Loom Says Jamie Dimon

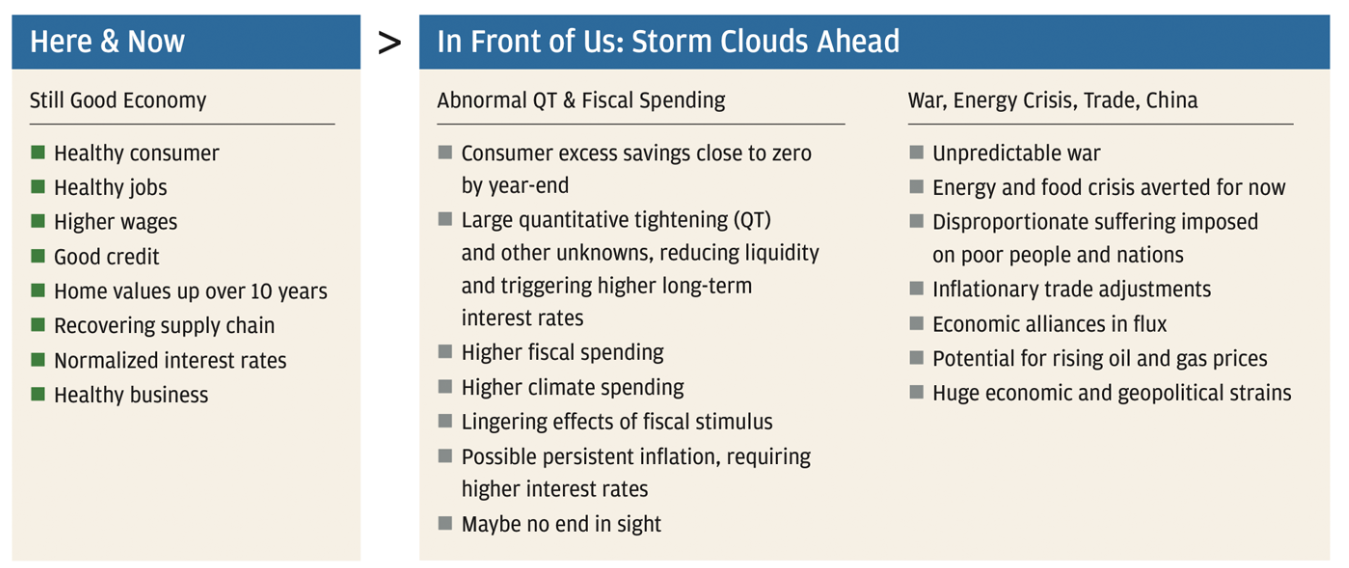

JP Morgan’s Chief Executive has made his address to shareholders , in the company’s 2022 annual report. Investors and the general public alike, anticipate the yearly letter to get an insight into the mind of the bank, hunting for opportunities or learning where to exercise caution. The annual report was rich with weather analogies, as Dimon likened economic forecasting to forecasting the weather: “It is extremely complicated, easy to do in the short term and far more difficult to do in the long run”.

JP Morgan’s previous letter to shareholders foretold “storm clouds ahead” and “hurricanes”, and while some storms definitely hit, perhaps things weren’t as bad as initially thought. However, Jamie Dimon heeds warning to investors that some clouds may still loom.

The Key Takeaways From Jamie Dimon’s Annual Letter

His Take On The Economy And Banking Sector:

- Most indicators were strong: Prior to the collapse of Silicon Valley Bank, the economy was performing adequately, with strong consumer spending and healthy balance sheets. Consumers had been spending 7% to 9% more than in the prior year and 23% more than pre-COVID-19. Additionally, unemployment was low, wages were rising, and supply chains were recovering.

- Uncertainty around consumer spending: The failures of Silicon Valley Bank and Credit Suisse have led to increased market volatility and uncertainty, with the potential for tightened financial conditions. However, it is unclear whether this crisis will significantly slow consumer spending, which accounts for over 65% of the U.S. economy, and the situation is not comparable to the 2008 financial crisis.

The Storm Clouds Dimon Sees Ahead

- Lower savings rates means low buffers: The extraordinary fiscal deficits in recent years, driven partly by the pandemic, have led to inflation and a multiplier effect on spending. With large deficits projected to continue and borrowing for consumption being inflationary, there are concerns about potential recessionary pressures in the future once consumers spend their excess savings.

- Early cracks from Fed’s tightening: The Fed's quantitative easing (QE) over the past 12 years resulted in extraordinary liquidity, driving up prices across various investment classes and increasing bank deposits. Since the Fed has quickly reversed into quantitative tightening (QT) to tackle inflation, the easy access to credit during 2020/21 is becoming a thing of the past, and some banks are experiencing first-hand the consequences of duration risk and interest rate risks in their bond portfolios.

- Unknown longer term impacts of Fed’s actions: The central banks' extensive interventions over the past decade were necessary to address the global financial crisis and the pandemic, but the long-term effects of these interventions are still unknown. The Fed's ability to reverse its strategy through QT is constrained by higher inflation and the current bank failure crisis, making the future course of action uncertain.

- Global Food and Energy Uncertainty: The ongoing war in Ukraine is causing significant disruptions in global energy and food supplies, disproportionately affecting the poor and poorer nations. This conflict, combined with the uncertainties of economic alliances, trade, and national security, contributes to increased risks and potential higher inflation, resulting in an unpredictable and dangerous global economic situation.

His Suggestions For The Future

- Education, Healthcare and Infrastructure for GDP Growth: Between 2000 and 2022, real U.S. GDP grew at an average rate of 2% a year, with poor public policies in various areas such as education, healthcare and infrastructure constraining growth. Improving these policies could accelerate economic growth.

- Economic growth through immigration and deregulation: To address worker shortages and stimulate growth, the focus should be on merit-based immigration, seasonal immigration, reducing trade barriers and decreasing regulations and bureaucracy for small businesses. A bold, comprehensive approach can positively impact economic growth, jobs, inflation and the deficit.

- Expand eligibility to EITC: To improve the living wages of lower-paid workers, expand the Earned Income Tax Credit (EITC) to a larger number of individuals, possibly by eliminating the child requirement and converting it to a negative income payroll tax paid monthly. This would help lift lower-income neighborhoods and likely contribute to GDP growth, as most of the money would be spent on improving families' lives.

💡 The Insight: Banking Executive Knows A Lot About Meteorology

We’ve spoken previously about the accuracy of consensus figures and forecasts from reputable financial institutions and professional investors. While these parties may have strong track records and bountiful experience investing through different economic cycles, they are not perfect. And they never will be.

Just like meteorologists and the weather presenters, we need to use the available data and think in probabilities .

70% chance of a storm? You better take a rain jacket just in case. 70% chance of economic challenges ahead? You’d be wise to have enough cash on hand and quality companies in your portfolio to endure the storm and not get “drenched” if it does pour down.

The biggest determinants of volatility in global markets aren’t the things we can predict. It’s the things that come out of nowhere. The unpredictable nature of these events are what causes stock prices to spike, up or down, as the market scrambles to digest the unpredictable events and reassess expectations accordingly.

However, Dimon raises some great points. While we’ve endured the initial shock of rising inflation, conflict in Europe and tightening fiscal policy, the long term effects are still unknown.

The above all impacted corporate and household budgets with immediate effect, but things get worse the longer we endure this. Cash buffers will inevitably decrease, funding will become scarce and wage growth will stagnate, which will all take its toll on the economy.

What This Means For Investors

The economic conditions that have characterized this difficult period in the market look as though they could linger for a while longer. Investors should remain diligent in understanding their tolerance for risk. While it’s easy to take on riskier positions while the market is on an upward trajectory or there’s excess cash on hand, this could quickly change if your own personal circumstances tighten and the market doesn’t fall your way.

In times like this, investors should exercise a high degree of caution when looking at stocks on the growth end of the spectrum, particularly in companies that aren’t yet cash flow positive. These companies could see their continued operations in doubt if the access to funding dries up.

Investors often turn to dividend stocks when the going gets tough, as the certainty of returned capital in the form of cash is valuable when volatility is high and there is an air of uncertainty plaguing the market.

We encourage you to check out Simply Wall St’s Discover page, where you can begin to discover investing opportunities like our list of Dividend Stocks , or Top Stocks for a Recession .

Key Events During the Next Week

Next week all eyes will be on some key economic data that is scheduled to be reported. Next Wednesday we’ll see the US release its March CPI figures as well as the monthly Treasury Budget Statement. Thursday we’ll also see the latest updates on the Producer Price index (PPI), initial jobless claims and an update on consumer sentiment for the month will follow on Friday.

There’s also some important data being released for a few economies: Australia will see the latest updates to the Consumer Confidence Index published on Tuesday, and Canada will see the Bank of Canada’s Monetary Policy Report come through on Wednesday.

After Easter, we’ll begin to see an influx of large caps report their quarterly earnings, the first figures coming from the 2023 calendar year. Some of the most prominent names include:

- UnitedHealth Inc. ( NYSE:UNH )

- JPMorgan Chase ( NYSE:JPM )

- Wells Fargo ( NYSE:WFC )

- BlackRock ( NYSE:BLK )

- Citigroup ( NYSE:C )

- Progressive ( NYSE:PGR )

- Delta Air Lines ( NYSE:DAL )

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.