What Happened in the Market This Week?

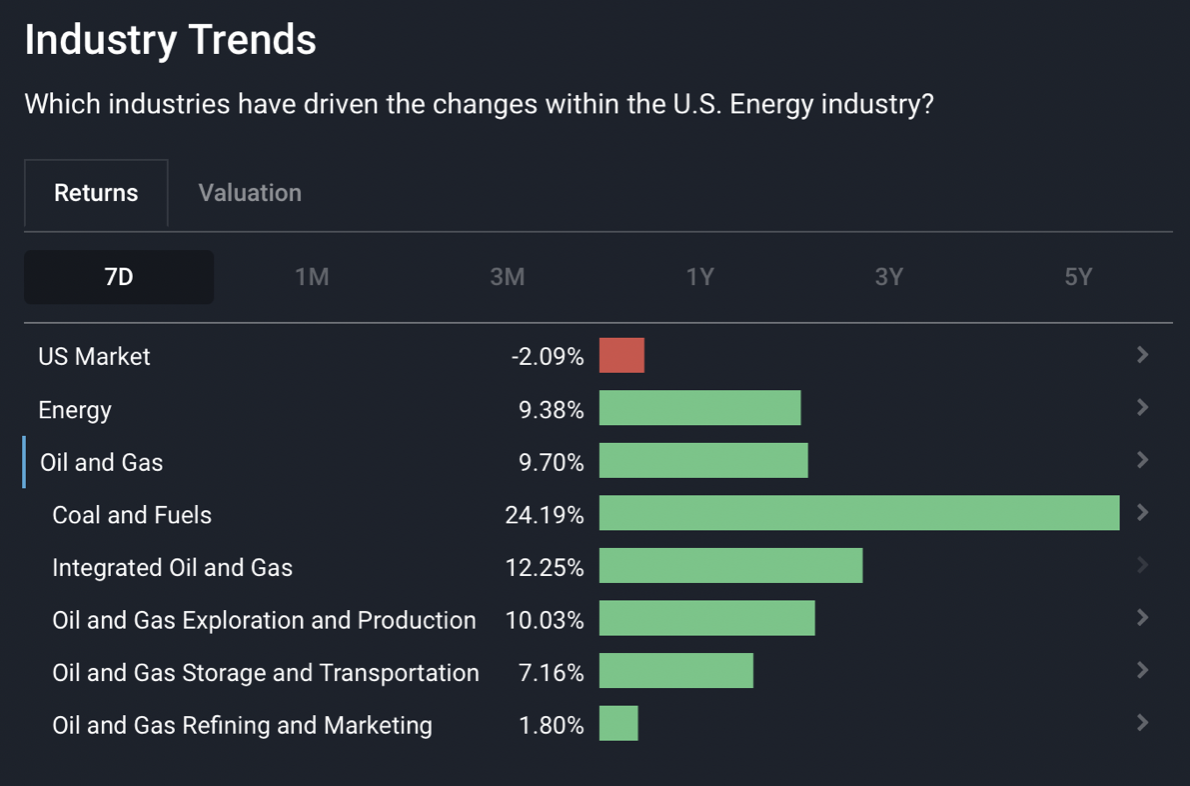

Over the last 7 days, the US market has dropped 2.1%, driven by a loss of 3.9% in the Information Technology sector.

- Russian stocks have plummeted both on the Moscow exchange and other exchanges they’re listed on.

- Commodity prices such as Crude Oil are continuing to rise sharply, which has driven the 9.38% rise in the US Energy Industry over the last 7 days, helped by gains from Chevron (NYSE:CVX) of 13%.

Why did it happen and how can it impact investors?

Russian Stocks

Investors are still under the influence of the Ukraine invasion from Russia and are watching how sanctions are changing the financial outlook of markets and industries.

The Russian market is down over 18% in the last 7 days, and 33% over the last 3 months, driven by severe selling from investors exposed to that market from abroad (including institutional, retail and others). Though the turmoil may continue when the market re-opens, since it's been closed for 4 days now and could be closed even longer.

The shock of the invasion prompted leaders and financial institutions to react in a bid to pacify and punish Russia. Politicians and Central Banks have imposed sanctions and pressures that trickled down to publicly traded companies, which seem to have followed suit and decided to either slow or stop cooperation with the Russian market. Many are acknowledging that these actions can cut both ways, but also state that it is a price worth paying in light of the current situation. Among many other industries, players in the Energy, Auto and Aviation space have made changes to their business relations with the Russian economy. Some of these include:

Energy

- BP p.l.c. ( LSE:BP) announced that they will be exiting their 19.75% stake in Rosneft Oil ( LSE:ROSN).

- Shell ( ENXTAM:SHELL ) said it will exit all Russian operations, while ExxonMobil ( NYSE:XOM ) will exit only those it values above US$4 billion.

Auto

Russia's biggest import are cars, which predominantly come from Japan and Germany.

- Toyota (TSE:7203 ) just announced that it is shutting down production and sales in Russia indefinitely.

- German auto-manufacturers such as Bayerische Motoren Werke ( XTRA:BMW ), Volkswagen (XTRA:VOW3 ), Mercedes-Benz Group ( XTRA:MBG ) have halted activities in Russia.

Aviation

- Boeing ( NYSE:BA ) and Airbus ( ENXTPA:AIR ) have suspended most operations in Russia.

In a way, this is the first major anti-globalization wave the world has experienced in many years. The length and severity of these sanctions from governments and measures by companies themselves will likely be highly correlated with the length and severity of the conflict and the nature in which it is eventually resolved.

Commodities

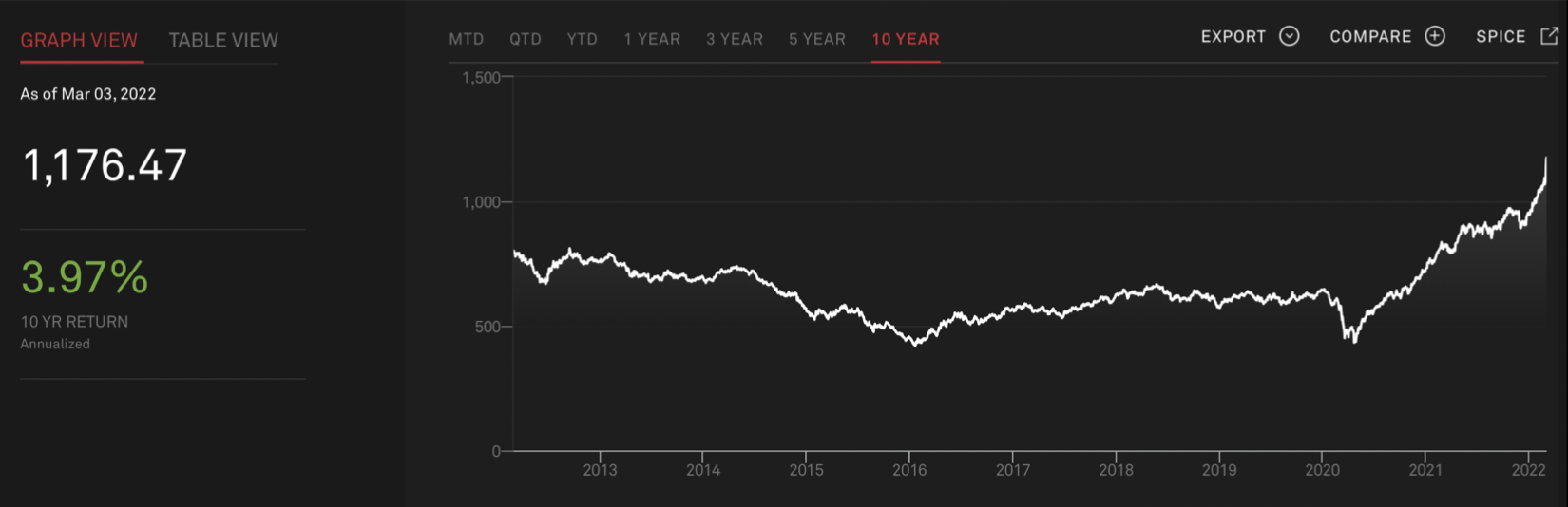

Crude oil and other commodities have spiked since the start of the conflict as buyers have avoided Russian supply given fears around sanctions and logistical issues. The Dow Jones Commodity Index reached a high of 1,176, which greatly benefits producers of those commodities within the index.

As we mentioned last week, Russia produces about 10% of the world's oil. This sent the price of Brent Crude Oil to a 14 year high of $117, but it’s now sitting at around $110 per barrel at the time of writing.

JP Morgan expects that $185/barrel could be a possibility if the Russia supply hit persists. This would positively impact those stocks that are related to oil production, since they largely already have a fixed cost base on the commodities they produce (oil wells, platforms, rigs, etc), and their bottom line (profit) benefits greatly from every additional dollar increase in the price of the commodity they're producing.

As a result, this has driven the need for countries to achieve energy independence and stability. This has been particularly noticed in Germany, which has sent some indications of prolongation of their nuclear shut-down, or even a possible reversal of policy. Some beneficiaries from this shift could be the Renewable energy industry, given the alternative energy sources and large upfront investments required for country-wide projects.

What to watch

These are turbulent times for investors as the situation is changing every day and markets are subsequently trying to digest the new information into stock, commodity and asset prices. As we mentioned last week, to understand how the situation may affect companies in your Portfolio or Watchlist, keep an eye on your Dashboard for announcements, as well as any press releases directly from the company.

As investors, it’s important to try and think long term rather than week to week, because during turbulent times there are largely varying opinions of what might occur for these assets investors are trying to value.

In regards to what we covered this week, it’s important to remember that energy does move the world, and the world’s current sources are primarily from the burning of fossil fuels. Everything from logistics and food production to travel and the creation of plastic relies on oil, which is why it's so important to be aware of the consequences of high oil prices and how it impacts investors and consumers. It’s worth watching the energy industry, and investigating what companies might benefit in the short term (as many countries scramble for current solutions) and what companies might benefit in the longer term (as companies and governments invest in energy projects like renewable energy, etc)

Until next week,

Invest well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.