The Electric Vehicle Market Faces Challenges as It Goes Mainstream

Reviewed by Bailey Pemberton, Michael Paige

“The overarching goal of Tesla is to help reduce carbon emissions and that means low cost and high volume. We will also serve as an example to the auto industry, proving that the technology really works and customers want to buy electric vehicles.” - Elon Musk

This week we’re covering the two “ E’s ”: Electric Vehicles and Emerging Markets.

There’s been a lot of news flow around slowing demand for electric vehicles, so this week we wanted to take a closer look at what’s happening in that space. Plus, we’re also checking in on why emerging market performance is starting to decouple from China.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

The EV Demand Slump

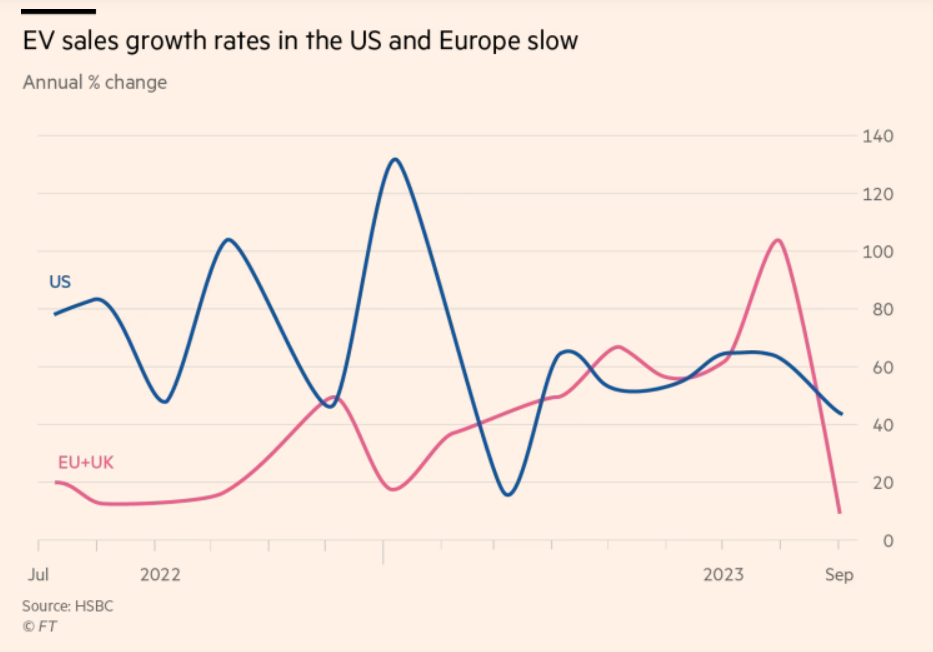

The EV market is facing a slowdown in demand. While sales are at record levels, growth has slowed rapidly in the last year.

The response from automakers suggests they see this slowdown lasting more than a few months. Those that can are cutting prices, and the biggest companies are scaling back their plans to expand capacity.

It appears three major problems are creating uncertainty for the EV industry:

- Firstly, high-interest rate car loans are adding to the already high price tag for electric vehicles.

- Secondly, EV volumes no longer reflect a niche market of early adopters . But electric vehicles are still ~30% more expensive than legacy vehicles, so prices need to drop further to make them affordable for a larger market.

- Lastly, with prices falling, potential buyers are concerned about the resale value of their vehicles , so some would-be buyers are searching for an EV in the used car market instead.

All of this makes for a very uncertain outlook. But it could also create opportunities for investors: ultimately vehicles need to be replaced at some point (unless it’s a Toyota Land Cruiser, those things are indestructible ), and unless emissions targets are abandoned, those vehicles will likely have to be EVs.

However, rather than consumers upgrading to an EV when it would be “a nice to have”, they may only upgrade when it becomes a necessity - meaning slower purchase cycles.

The Next Phase for EVs

The FT pointed out that the market for EVs is now expanding from the early adopter phase to the mass market phase.

Any industry going through this change will face a new set of challenges. Early adopters like to own the latest technologies, even if it means paying a premium. Mass market consumers are more concerned with practicalities like price and in the case of EVs, driving range (read: range anxiety) .

To make electric vehicles more affordable, companies need to achieve massive scale.

Tesla, BYD and some of the legacy automakers are on their way to achieving the level of scale required. For smaller companies though, that point may be further out on the horizon.

If you’re looking at smaller EV makers, an important question to ask is: Will they ever reach the scale where they can economically produce EVs, and if so, what efficiencies and economies of scale will the bigger automakers have by that time?

Economies of scale are a great competitive advantage to look out for. Those businesses that get there first, typically gain a significant edge over those that are further behind.

EV Price Targets and Recommendations

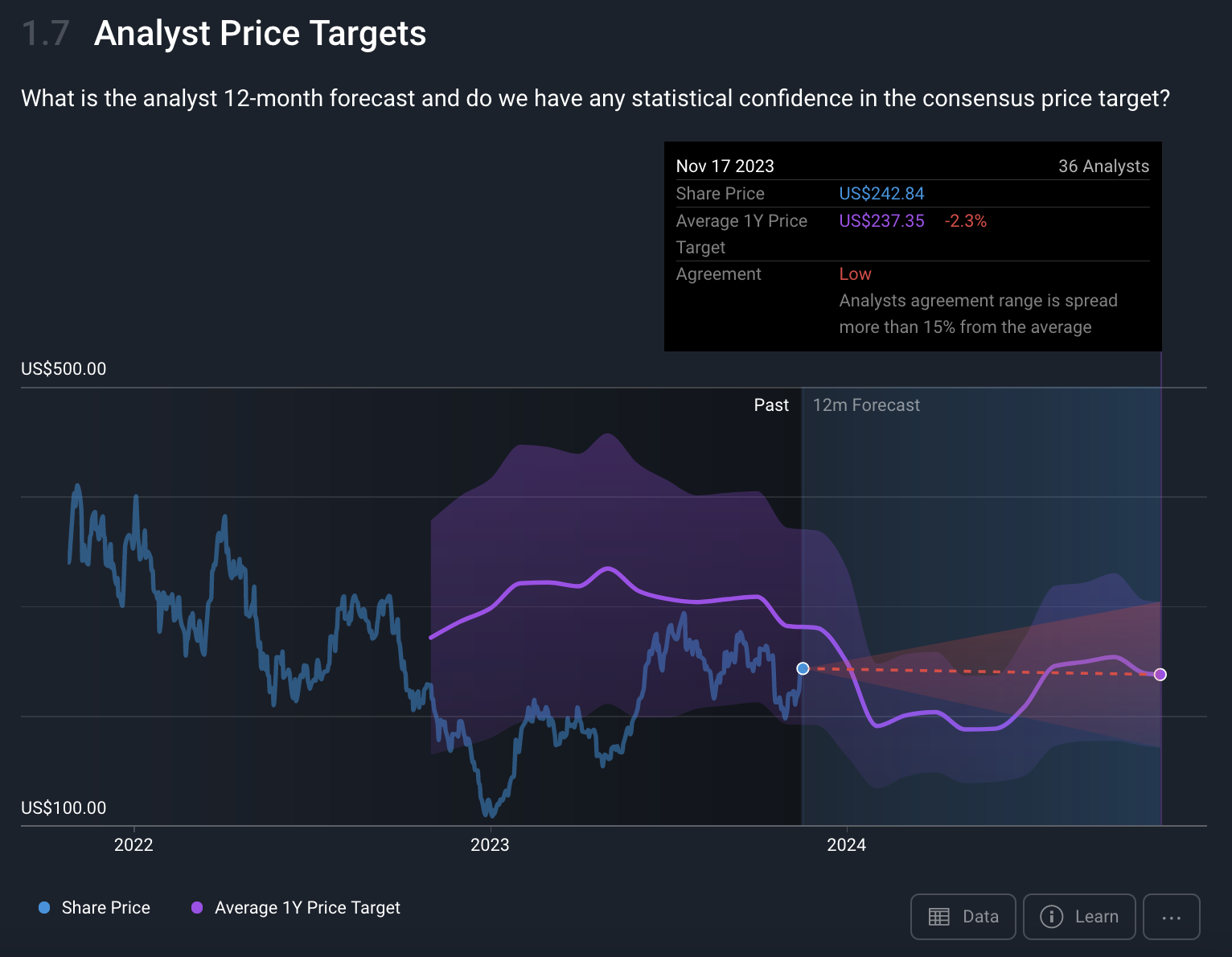

Opinions about Tesla’s stock price are about as wide-ranging as it gets.

In September, Morgan Stanley put a $400 price target on the stock, and last week HSBC said it's worth $146. The problem with these types of calls is they are looking at the company in very different ways.

HSBC is estimating a fair value based on the current business , while Morgan Stanley is looking at what Tesla could become.

Analysts at sell-side firms publish EPS and revenue forecasts, buy, sell and hold recommendations, and price targets. These are useful benchmarks, but they really aren't enough to make an informed investment decision.

- Price targets are usually based on a 12-month view and generally account for valuations, financial forecasts, sector trends, and sentiment.

- Buy and sell recommendations imply that there is some upside or downside ahead, while hold recommendations imply the stock is fairly valued, or that there isn’t enough information to make a call.

If you base your investment decisions on price targets or recommendations, you are relying on the analyst to guide your entry. But, do you know anything about their timeframe, their conviction, and what would make them change their mind?

A better way to arrive at your investment decision is by creating your own narrative. That way, you’re aware of all the factors impacting the stock, and the decision you make on whether to own it or not is grounded in research, and probabilities and anchored by your estimate of fair value.

💡 The Insight: Focus On The Long Term EV industry Catalysts

Simply Wall Street recently launched Narratives , and users will soon be able to create and publish their own narratives! Check out the video below!

If you didn’t watch the above video , what is a narrative?

An investment narrative is a more complete analysis, which helps you understand how catalysts and qualitative factors translate into an estimate of the value of a company.

A narrative is not static either; it can be updated and amended as new relevant facts and information become available and impact the existing assumptions.

You can create your own narrative from scratch, or you can use someone else's narrative as a starting point to create your own. You can then incorporate some catalysts, delete others, and add your own.

The point of a narrative is to identify a set of catalysts that you believe have a high probability of occurring, and quantify how they will affect the value of the company. By doing this you will have conviction in the fair value you estimate, and you will know what to look out for when news or data is released.

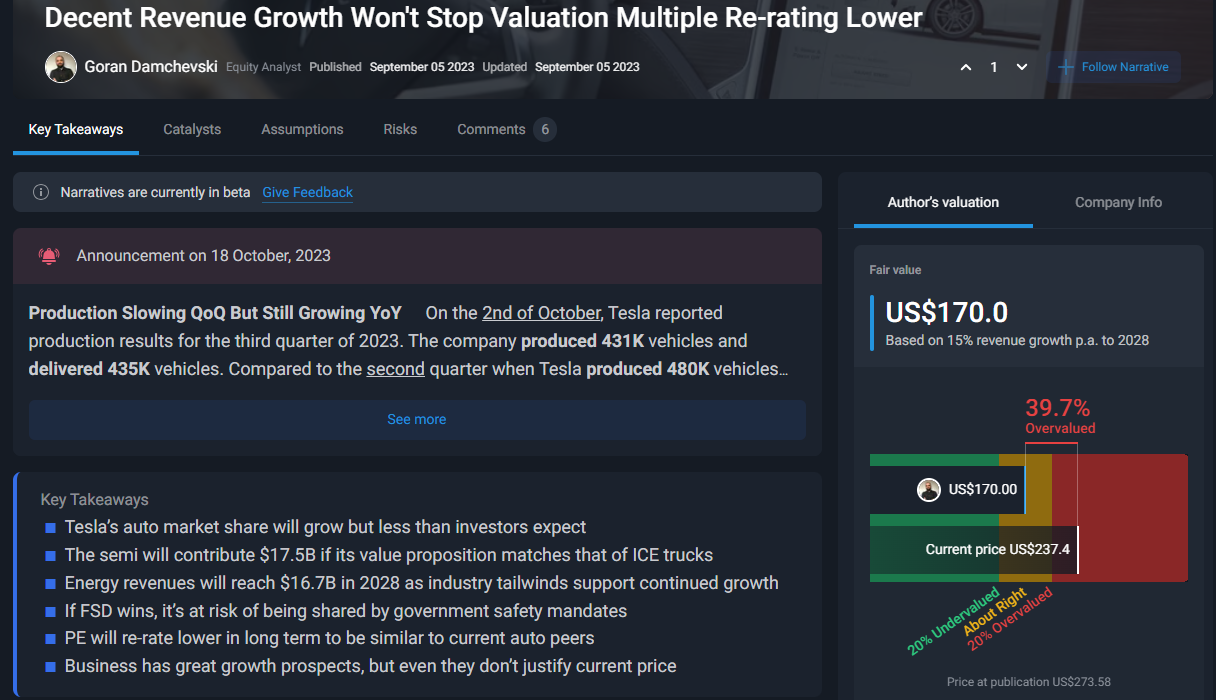

The narrative below considers how the investor believes Tesla’s products, production capacity, and technology will affect revenue and margins, and then the price multiple that investors are likely to pay for the business when it reaches that future.

This is a great starting point to use to develop your own set of catalysts and your own fair value estimate. And if you’d like to ask the investor any questions, you can easily do so in the comments section at the bottom of the narrative!

To create your own EV narrative, there are a few key questions to ask yourself:

- 🏭 Do you think emissions targets will dictate EV demand?

- The Paris Agreement outlined a strict set of emissions guidelines to help the world achieve Net Zero by 2050. Will governments push to ban the sales of internal combustion engines (ICEs) to help speed up this process? To be on target to reach our 2050 goal, 75-95% of new car sales in 2030 would have to be EVs. Is this reasonable?

- 💵 Do you think that EV technology will become cheap enough to compete with ICEs on price?

- One obstacle to greater EV penetration is that petrol-powered vehicles are cheaper to buy outright and can generally provide owners with improved range and operation at a variety of temperatures. Could EV technology improve to the point where ICEs are completely obsolete?

- 🏙️ Do you think we have the grid infrastructure to support a massive increase in the number of electric vehicles?

- A common criticism of the electrification of vehicles is that we don’t currently have the grid infrastructure to support millions of cars charging each night. Do you believe there are alternative solutions or that we’ll overhaul our current infrastructure?

- 🪨 Do we have the resources to support a massive spike in EV demand?

- The production of EVs requires large volumes of Lithium, Nickel, Cobalt, Copper and various rare earth metals, all of which could become supply-limited should EV demand pick up. Do you think there are enough mineral resources to support the expected demand for EVs?

Once you feel comfortable answering these questions, you’ll begin to see what side of the coin you’re on.

If you found yourself answering ‘Yes’ to a lot of these questions, you’re most likely on the bullish end of the spectrum when it comes to EVs, and checking out some of the big EV companies and the industries that support them might be of interest to you.

If you found yourself answering ‘No’ to most of these questions. You’re most likely bearish on the EV market and could perhaps look to research alternatives like hydrogen-powered vehicles!

Remember, if you have your own narrative you’d like to publish, on any automaker or ANY other stock for that matter, we’d love to hear from you! Simply click “ Create Narrative ” at the top of the narrative tile on the company report page to register your interest!

Emerging Markets Delivering Mixed YTD Returns

Emerging market equities have underperformed year-to-date, but then again, so have most indexes that don’t include the 'magnificent seven' big tech stocks.

However, the performance of equities in individual markets has been wide-ranging, from Greece (up over 30%) to Thailand , which is down around 13%.

Performance within each market has also been widely distributed. A lot of the performance has been related to how much of each market has been exposed to energy and utilities, which ended last year in a mini bubble (which has since popped).

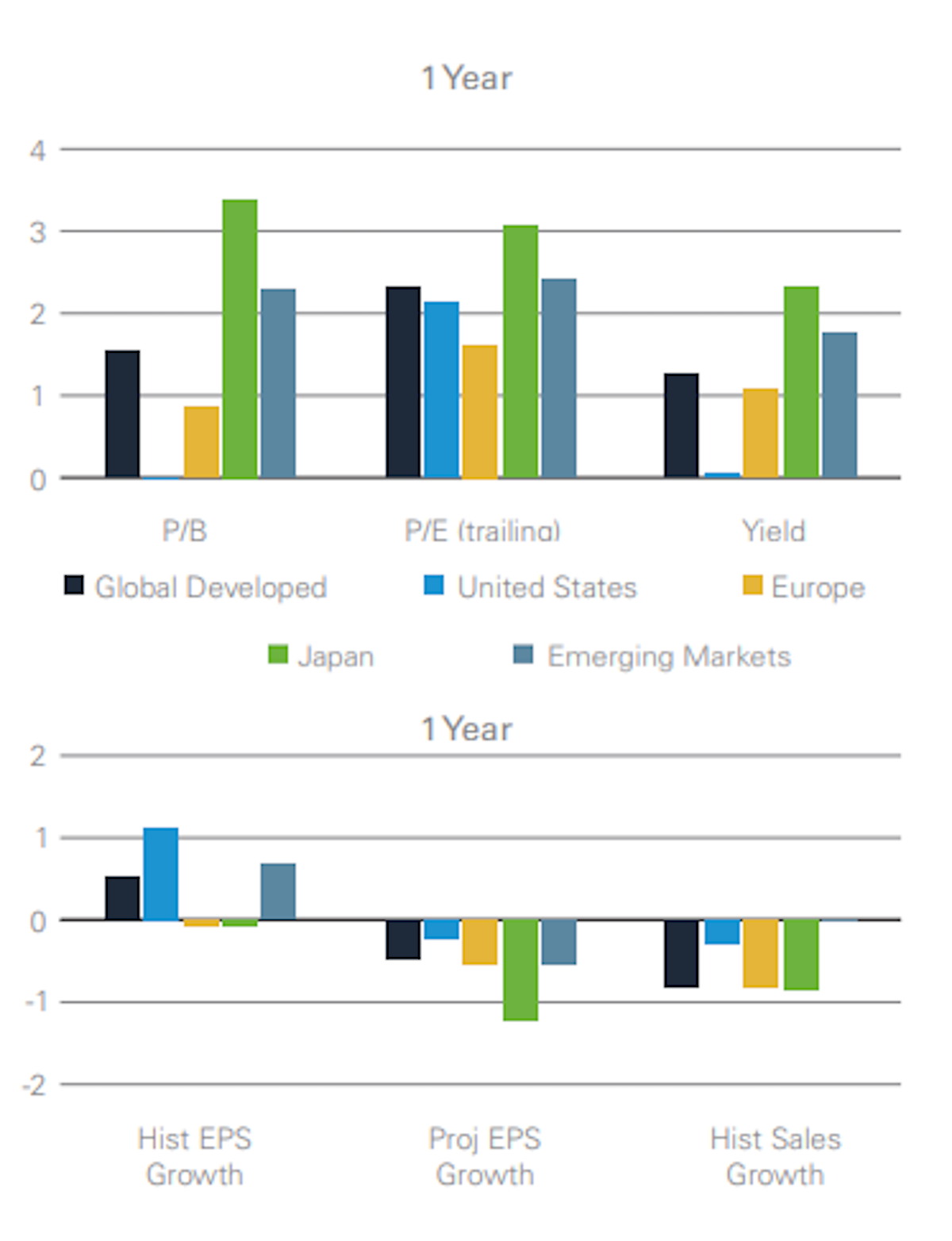

One interesting observation has been the out-performance of emerging market value stocks.

The chart below is from a report by Lazard which reflects the relative performance of different factors across markets. Emerging market companies trading on lower valuations outperformed all other regions except Japan. By contrast, growth stocks in emerging markets were poor performers.

The returns above are nothing to get excited about, but they do suggest value investors see more opportunity in emerging markets.

💡 The Insight: EMs Are Decoupling From China

For the last two decades there has been a very high correlation between China’s economy and market and other emerging markets.

While China was building its economy it became the biggest importer of commodities like iron ore, copper and coal. Most emerging markets (as well as developed markets like Canada and Australia) supplied these commodities, and the revenues flowed through their economies.

We mentioned recently that China’s economy is evolving . It’s becoming more focused on local consumption rather than exports and infrastructure development. China’s real estate market is also under pressure, which means fewer imports for construction.

The chart below shows ETFs tracking the MSCI Emerging Markets ex-China (red), MSCI Emerging Markets (blue) and MSCI China (green) indexes. The correlation between China and other EMs seems to be fading.

China’s economy is evolving, but so are the economies of other emerging markets. Some economies in Eastern Europe could probably be described as developed, Poland was reclassified as a developed market in 2018. But others like India, Brazil, Mexico, and Indonesia have vibrant and growing consumer, financial, and services sectors.

This is good news for investors. Resource-producing businesses are very cyclical, while sectors focused on local consumption can keep growing without relying on what’s happening in China. The fact that many of these countries now exploring these new industries have rapidly growing populations and emerging middle classes means that the growth is compounded. As these sectors continue to grow, economies become less exposed to commodity price cycles.

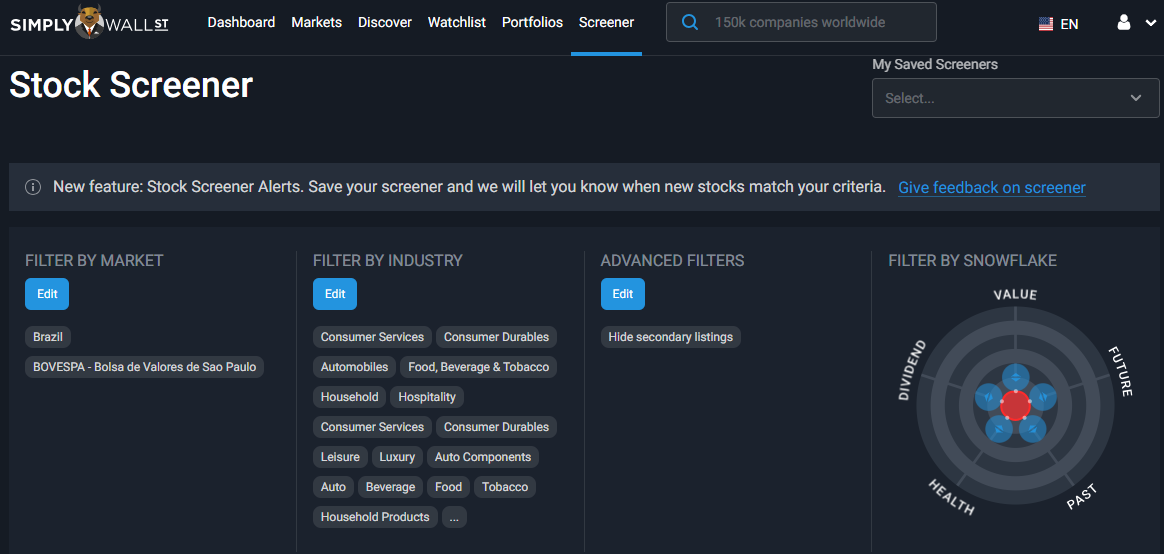

You can use the Simply Wall St Screener to find companies in specific markets and sectors. The example below screens for consumer-focused companies in Brazil. But you could change the country to India, Mexico, or any other country you’d like to invest in.

That will give you a starting point, and then you can narrow the list down according to other factors like market cap, value or growth.

If any companies stand out, you can do more qualitative research and see if you can come up with a compelling narrative that makes the case for investing - just remember, be conservative .

What Else Is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇲 US Inflation data was encouraging , with the official inflation rate reflecting no month-on-month price increases. Consumer prices rose 3.2% over 12 months, lower than expected and down from 3.7% in September .

- 🇺🇲 US Producer prices fell 0.5% in October and rose 1.3% year-on-year . These numbers were also lower than expected.

- 🇺🇲 US retail sales fell 0.1% in October , which was better than the expected drop of 0.3%. This suggests consumer resilience continues.

- 🇬🇧 UK inflation numbers also surprised to the downside. The annual inflation rate fell to 4.6% from 6.7% in September. This is the lowest UK inflation has been in two years.

- 🇬🇧 UK unemployment was unchanged at 4.2% as expected.

And then, a few news items that we thought were worth noting…

-

⬇️ Moody’s downgraded the outlook for its US credit rating , from stable to negative. The rating itself remains at ‘Aaa’, but the negative outlook implies it may well downgrade the rating. The reason for the downgrade is the political polarization which is preventing Congress from tackling the deficit issue.

- The other two major credit ratings agencies, S&P and Fitch, lowered their actual ratings grades in 2011 and earlier this year, and for similar reasons.

- These downgrades have little practical effect because there isn’t a ‘risk-free alternative’ with capacity for 10s of trillions of USD.

- The news from Moody’s reflects the growing urgency, which will eventually lead to government action or a ‘great reckoning.’

-

💰 There has been a lot of commentary about Berkshire Hathaway’s current cash balance, which has reached a record level of $157 billion.

- Some pundits see this as a reflection of Buffett, Munger and the other Berkshire managers’ views on the market. If the company is sitting on so much cash they must be bearish right?

- Context matters. $157 billion is 15.4% of the company’s assets, which is about average going back to 2017. The percentage was actually higher in four out of the last seven years. It was lower in 2022 (13.5%) because the prices of the other assets fell and he spent a record $68bn on stocks that year as bargains emerged.

- That cash balance reflects the fact that Berkshire is struggling to find deals that are big enough to make a difference to a $700 billion company. Plus, Buffett wants Berkshire to be a “Fort Knox” of capital.

-

🚢 A potential curveball to monitor: The Panama Canal Authority has had to reduce the number of ships transiting each day because of the drought affecting the region.

- Typically, up to 36 ships transit each day, but this is now being reduced to 18.

- The longer this continues, the more chance it will have of creating knock-on effects for supply chains and inflationary pressure.

Key Events During the Next Week

Thanksgiving is on Thursday this week, so it’s likely to be a short week for news.

Prior to that, in the US the minutes from the last Fed meeting will be released on Tuesday, and on Wednesday durable goods orders and initial jobless claims will be published on Wednesday.

Australia’s central bank will publish the minutes from the last monetary policy meeting.

In Canada, inflation and house price data are due on Tuesday, and retail sales on Friday.

The UK’s Autumn Statement will be made on Wednesday. This is a ‘mini-budget’ statement outlining the economic outlook and possible policy direction.

Nvidia’s eagerly awaited quarterly results are due on Tuesday. Other prominent companies reporting this week include:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.