What Happened In The Market Last Week?

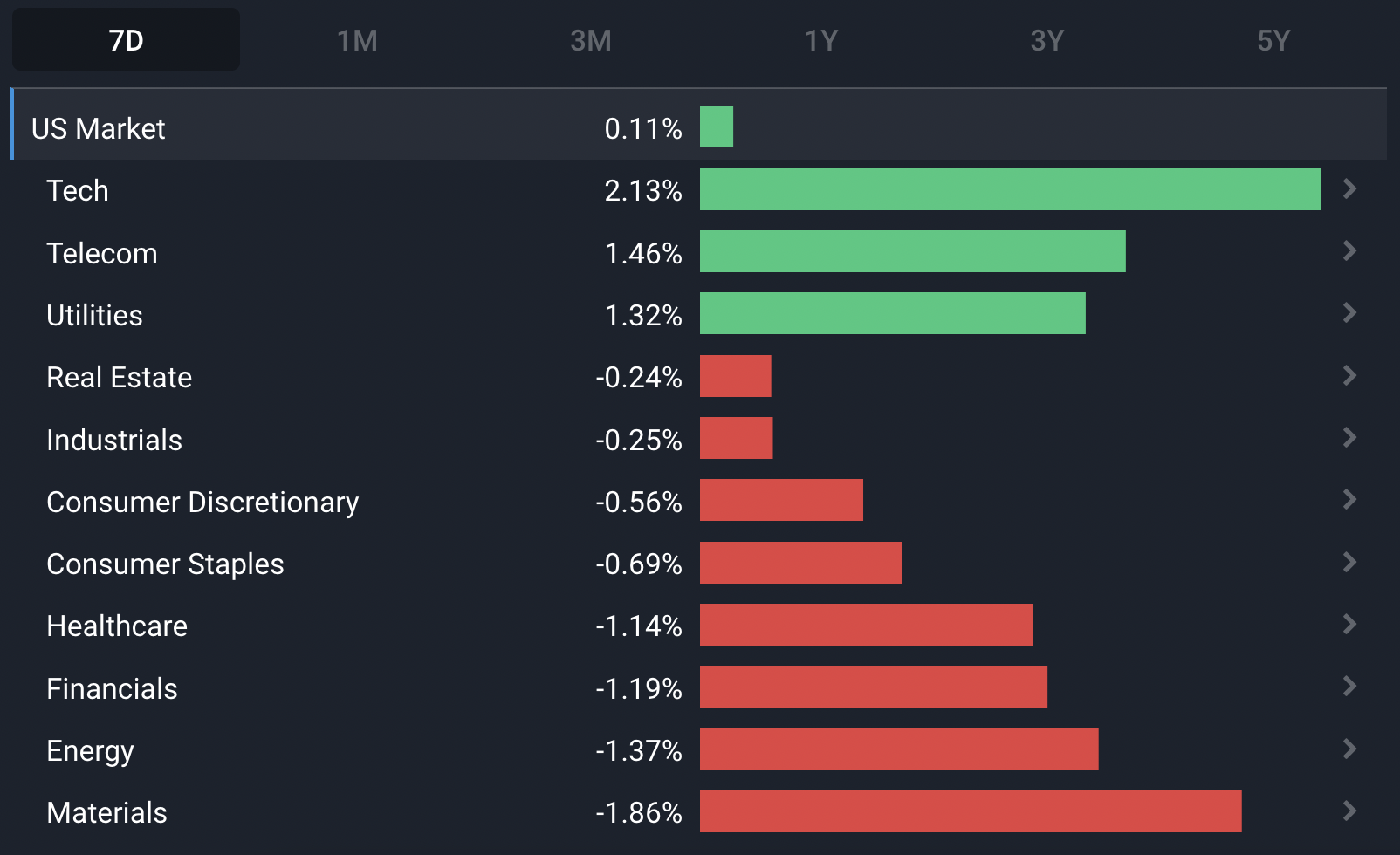

The US equity market was mostly flat for the week after Fed Chair Jerome Powell said interest rates are likely to be higher than previously anticipated . While most US sectors were in the red, the US Materials , Healthcare , Financials and Energy losing the most ground.

The US Tech sector carried the market as investors sought the ‘relative’ safety of the largest companies in that sector, and Telco and Utilities climbed.

Some of the developments we have been watching over the last week include:

- Short term bond yields hit new 15 year highs as the likelihood of re-accelerating rate hikes is rising.

- Investors are holding stocks for far shorter periods than they used to , implying that they are focussing on short term news and trends rather than long term valuations.

- Tech companies are having to rethink their strategies in the face of a slowing growth.

Short Term Bond Yields Hit A 15 Year High

Short term yields hit a new high before and after Fed Chair Jerome Powell testified before a US congressional hearing. He said that ‘economic data had come in stronger than expected’, and that if ‘the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.’

His comments weren’t really a surprise considering recent inflation and jobs data. Both the benchmark Libor rate (the London Interbank Offered Rate), and US 2-year Treasury yields breached 5% for the first time since 2007 before Powell’s testimony.

💡 The Insight: Rate Hikes Could Accelerate Again

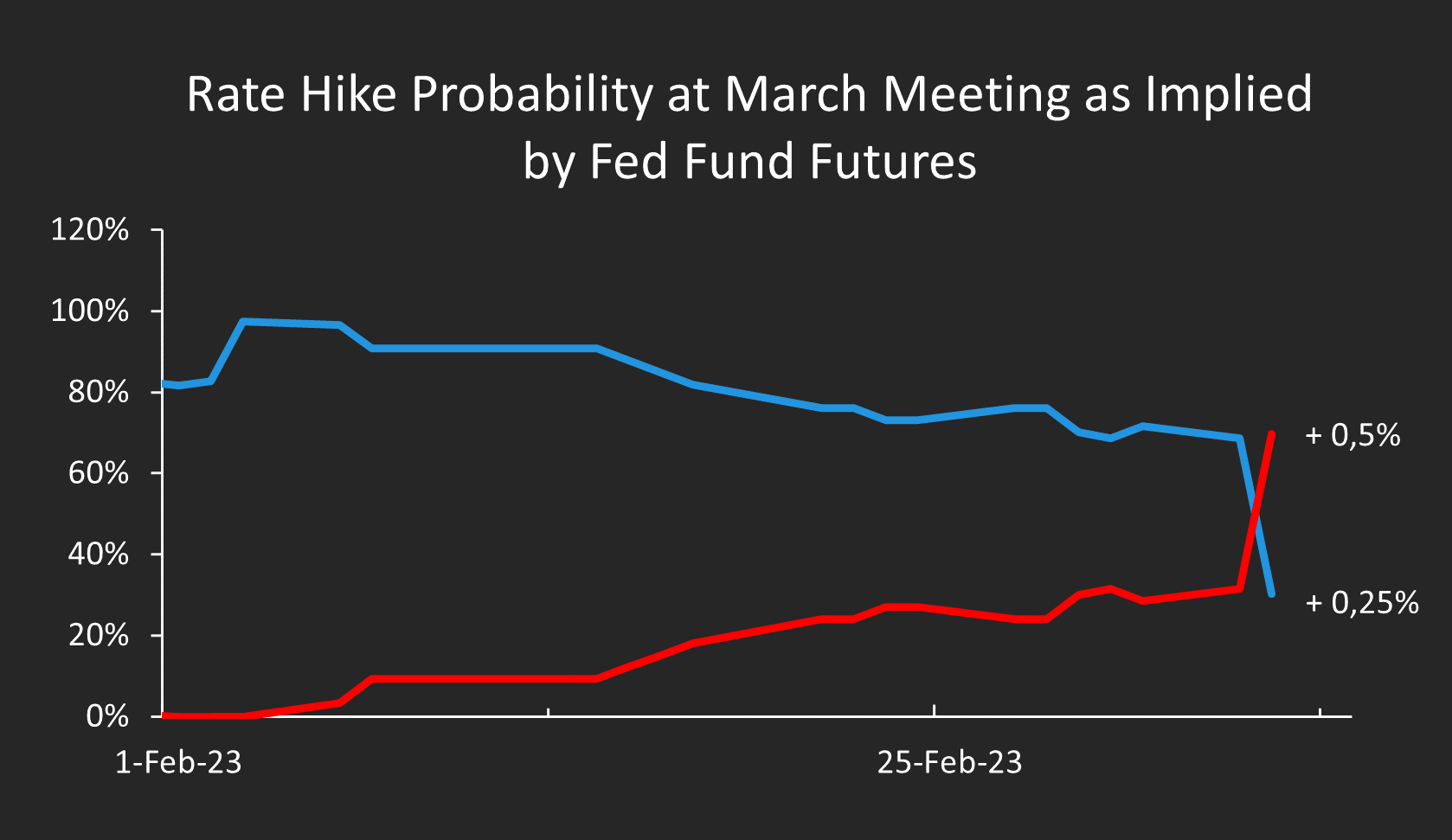

When Jerome Powell announced the last rate hike at the beginning of February he implied that the market may be too optimistic about interest rates. Since then, 2 and 10-year bond yields have risen every week as employment data remained stronger than expected.

At the beginning of February, the probability of a 50 basis point (0.5%) rate hike at the Fed’s March 20th meeting was less than 1% - as implied by Fed Fund futures prices. By the end of February the probability had risen to 30%, and after Powell’s comments they were at 75%.

That doesn’t mean a 50 basis point hike is certain, but the bond market is implying it’s very likely.

For Short or Medium-Term Investors (< 5 years)

Powell, and officials at the European Central Bank, have always said they would react to the data with regard to inflation expectations and interest rates. We have all seen the strong employment data over the last few weeks but the equity market has been slow to react.

The USD is strengthening again as the likelihood that the differential between US and European rates will remain increases. Last year the strong USD acted as a drag for companies earning revenue outside the US - and that will happen again IF the USD remains strong.

For Long-Term Investors (5+ years)

Eventually higher rates should bring inflation down, however, they may not come back to the near zero levels of the recent past. Rate cuts are used to stimulate, and if inflation is reduced somewhat and the economy doesn’t need stimulation, rates are likely to “normalize” at higher levels compared to 2020/2021. In January we covered an essay by Howard Marks in which he said that it might be difficult to get inflation down to 2% , which would mean rates would have to remain at higher levels than they’ve been over the last decade.

If rates do remain elevated, “lofty” valuation metrics may be a thing of the past because future earnings are worth less in today’s dollars, it’ll be harder for companies to secure ultra-cheap financing, and any company with debt will have higher interest expenses.

We’ve mentioned this before, but it’s worth repeating: make sure you have a margin of safety, you may need to build a slightly higher discount rate into your valuation for an investment.

Average Investor Holding Periods Have Fallen From 5 Years To 10 Months

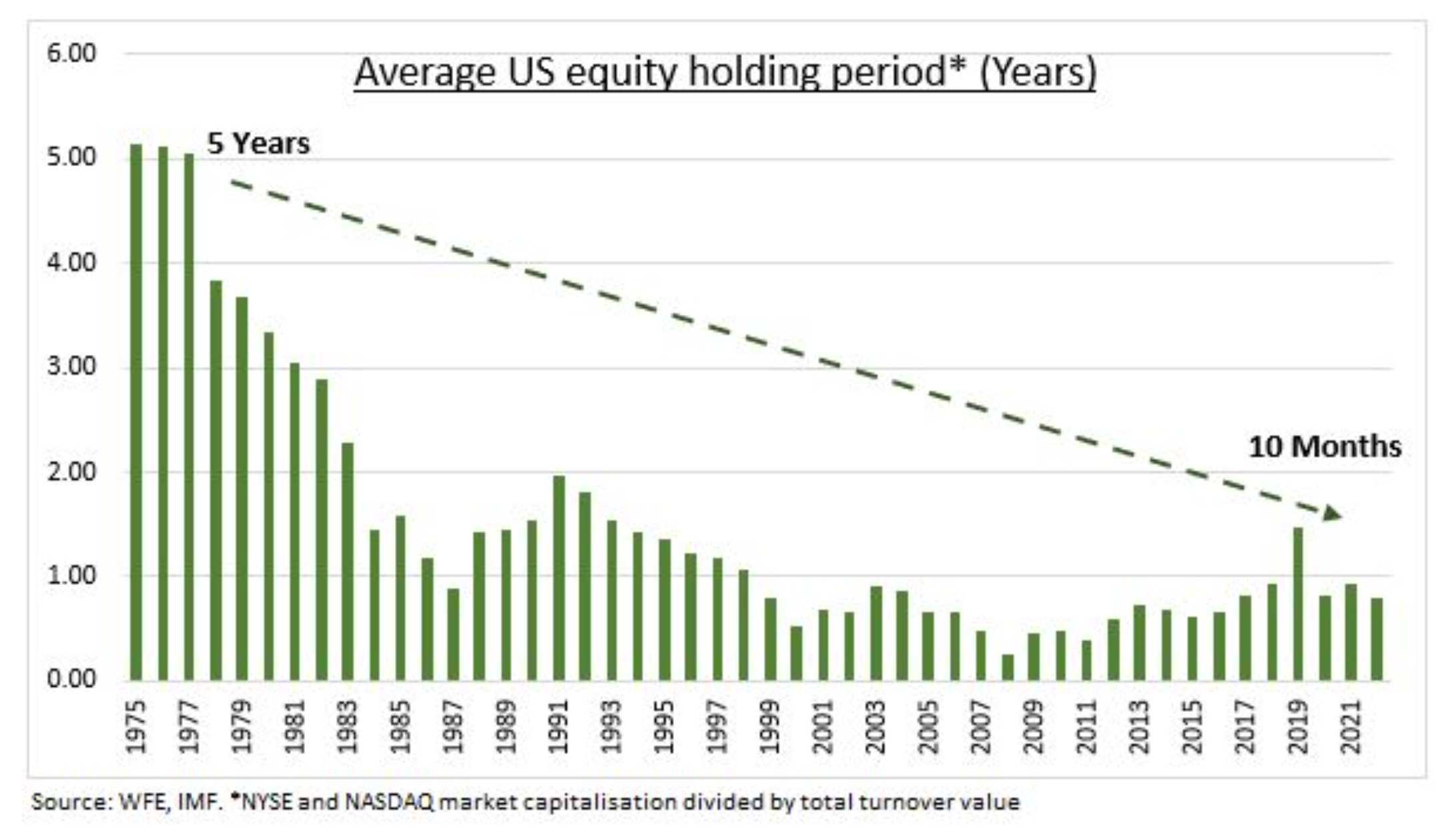

Last week we covered Warren Buffett’s letter to shareholders . One of the key points he made was that most of his best investments have compounded over a very long period of time. However, as Ben Laidler at eToro recently pointed out , most investors appear to be holding stocks for very short periods.

The chart below doesn’t reflect actual holding periods, but market value divided by annual turnover - which pretty much amounts to the same thing. Over the last 47 years, it’s fallen from 5 years in 1975 to as low as 10 months in 2022.

This trend has no doubt been influenced by derivative trading, hedge fund activity, and more recently by high frequency trading. But it does seem that a lot of retail investors are holding shares for far shorter than they used to thanks to virtually unlimited access to news and information, and easier and cheaper trading.

💡 The Insight: Value Creation Isn’t Linear

Shorter holding periods imply that investors are chasing short term trends and trying to time the market, rather than focussing on the underlying fundamentals that allow companies to create value over the long term.

In essence, companies create long term shareholder value by efficiently delivering increased value to their customers over time. This can be through developing new and improved products or services, better distribution channels, or better prices. To do this they have to go through investment cycles which affect margins, and they have to experiment with new products and ideas that don’t always work out. Almost every company that turns out to be a great long term investment goes through challenging periods.

What This Means For Investors

Investors with s horter investment time horizons are susceptible to acting irrationally on large price swings as the market overreacts to both good and bad news. On the other hand, investors who focus on the long-term will see these volatility swings “smoothed out” as the intra-day swings matter less and more focus is put into the company’s performance on a timescale measured in years.

The focus for these investors isn’t about finding the right time to sell, but about formulating narratives around where the company will be in years to come, and making decisions on that instead of short term price movements.

This does mean you’ll have to tolerate volatility - which will be easier to do if you focus on the valuation rather than the share price.

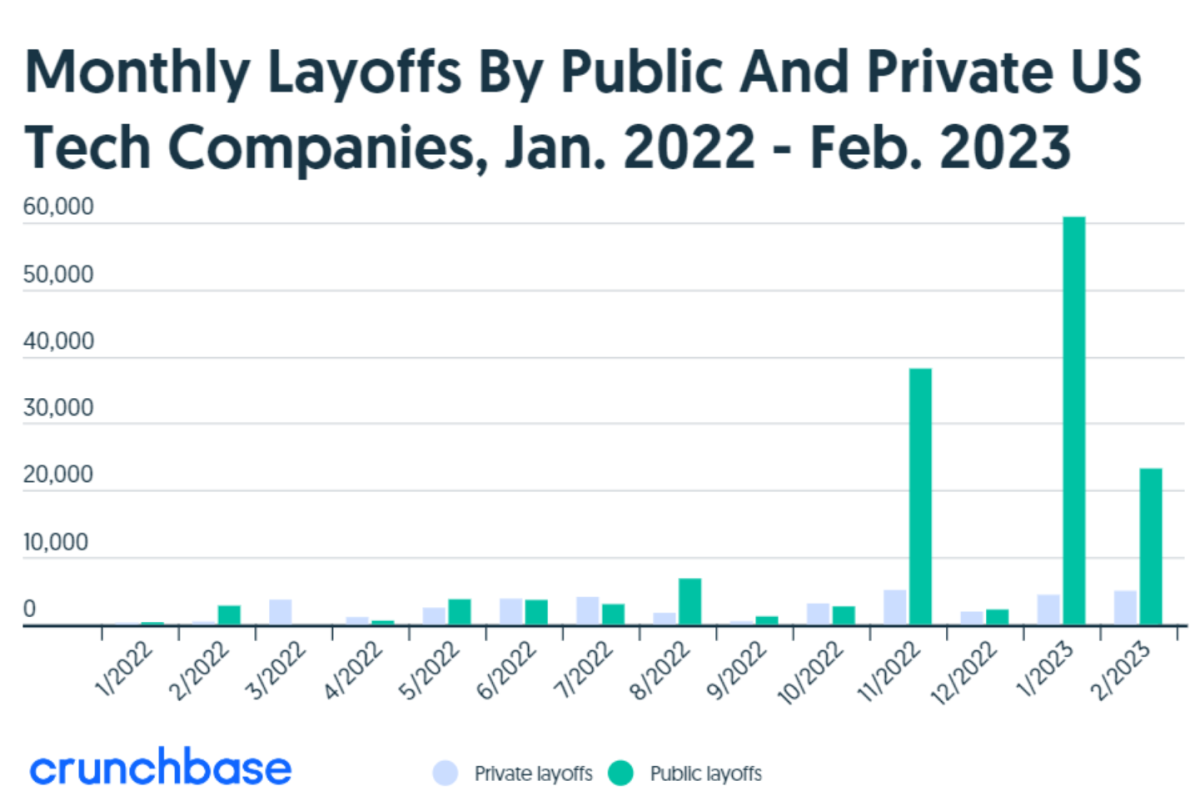

Tech Companies Are Working With A New Playbook

Tech companies are being forced to rethink their strategies as investment in technology products and services has slowed dramatically in the last year. Most major tech firms have already announced headcount reductions and we’ve seen that the major focus during earnings calls has shifted to cost cutting, profitability and margins. During Meta’s ( Nasdaq:META ) earning’s call Mark Zuckerberg reportedly used the word ‘efficiency’ more than 90 times .

Companies are also accelerating their share buybacks and returning excess cash to shareholders. This is both a consequence of having fewer opportunities to reinvest, and in the case of big tech, regulators preventing potential acquisitions .

💡 The Insight: Reducing Costs Is The Only Option If You Can No Longer Buy Growth

For most of the last decade, tech investors were focussed on growth over and above everything else. This meant tech companies were incentivized to put growth ahead profitability. Some of that growth came via acquisitions, and some probably came via sales that weren’t really viable to begin with (ie spending $100 to make a sale worth $90). And, when the focus is on growth, there’s also likely to little attention to cost management either.

Until investment in tech products and services picks up again, companies will have to keep focussing on reducing costs if they are going to improve their earnings. Some of the large companies probably have a lot of excessive spending they can work with - so they may be able to still increase EPS with lower revenues. It will be more difficult for the smaller, younger companies that need significant capital investment to grow and reach the scale they need to be profitable.

What This Means For Investors

If you are assessing a tech company, try to work out whether its growth is really economic - ie can it grow revenue faster than expenses. A useful way of doing so is by assessing how it has grown over the previous years. Has it been largely organic growth? Or have acquisitions been the main driver behind its improving financials? Also, can it cut costs and improve margins without losing business.

Another thing to consider is the extent to which a company will be affected by cost cutting elsewhere in the industry. As companies rationalize their budgets they will cancel services that aren’t essential which will impact other businesses.

Key Events During the Next Week

After the interesting commentary from Jerome Powell and the Fed, investors will be keeping a keen eye on some important financial data being released over the next week..

In the US consumer inflation rate will be released on Tuesday, and on Wednesday producer price data is out. For those who are interested, US retail sales will also be published on Wednesday, which can help us learn about consumer sentiment. Additionally, US building permits data is being published on Thursday and that’ll give us insights into demand in the US housing market and potential future performance of the US construction industry.

Turning towards the United Kingdom and the Eurozone, the UK’s employment rate will be released on Tuesday and the ECB’s rate decision will be announced on Thursday.

Earnings season is just about over, but there are a few companies still due to report:

- Gitlab (Nasdaq:GTLB)

- SentinelOne (NYSE:S)

- Skillz Inc (NYSE:SKLZ)

- Dollar General (NYSE:DG)

- Signet Jewelers (NYSE:SIG)

- Fedex (NYSE:FDX)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.