What Happened in the Market This Week?

Market Insight for 20th June - 27th June 2022

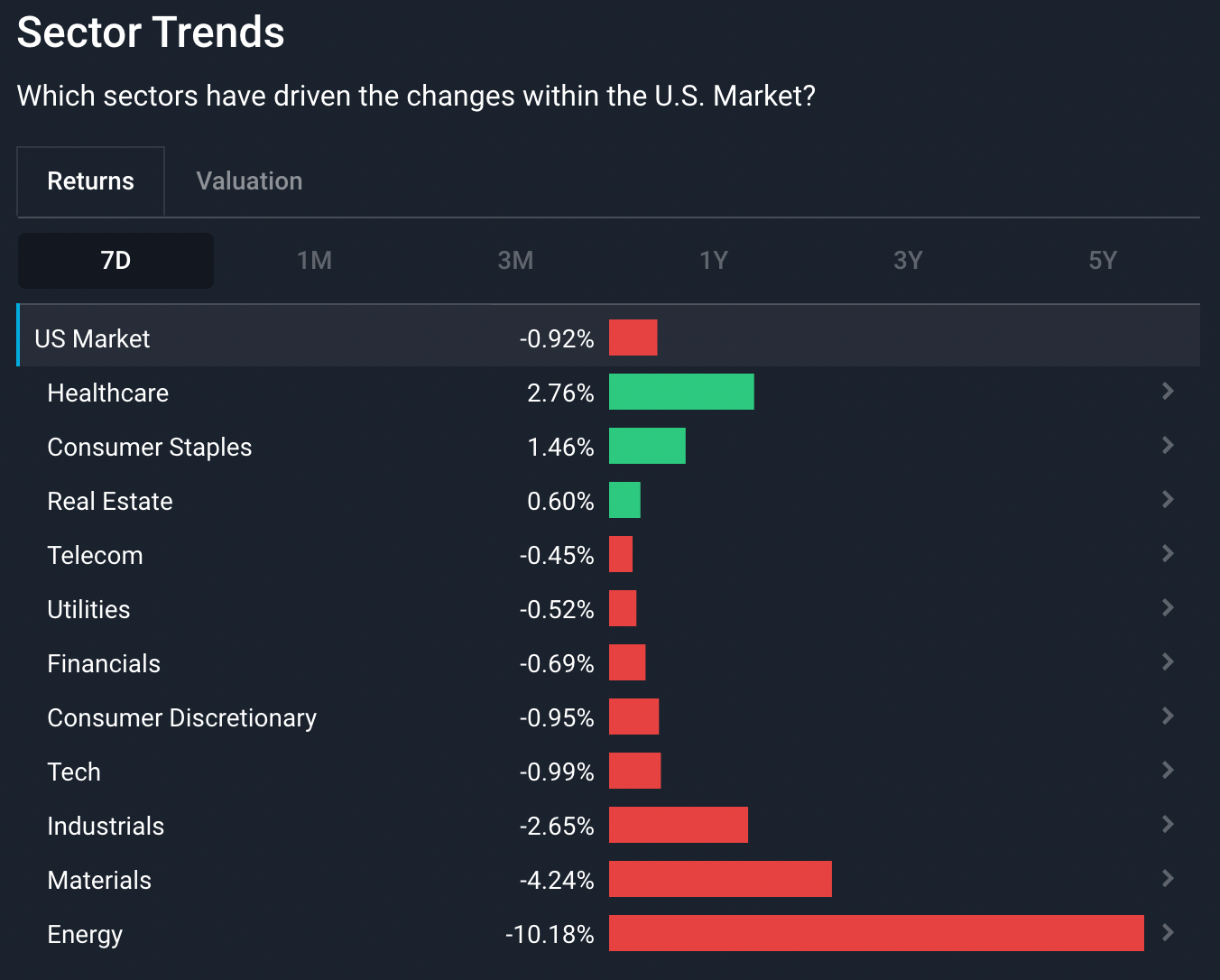

Equity markets are consolidating as investors weigh up the outlook. The energy sector remains under pressure as energy prices are beginning to factor in the lower demand that a recession might bring.

These are some of the developments we are watching:

- Worldwide concerns of a recession have increased with several economists predicting a U.S. recession in late 2022 or early 2023.

- Real estate sales have fallen to their lowest level since 2020 in several countries as rising mortgage rates discourage buyers.

- Australia's energy market was thrown into crisis in a case of market failure, resulting in soaring prices and fears of blackouts.

U.S. Sector 7D Performance - 24th June 2022 - Simply Wall St

Growing Concerns of a Worldwide Recession

The probability of a recession later this year or early in 2023 is growing, according to economists and analysts. Central banks around the world are hoping they can raise rates just enough to bring inflation down, but not at a level high enough to cause a recession. This is often referred to as a “ soft landing ”. While a recession is not inevitable, it’s still more likely in many countries with such aggressive rate hikes happening in key economies.

The selloff in equity markets so far is about as deep as corrections get when there isn’t a recession. However, the bear markets that are accompanied by a recession are often quite a lot deeper. Some analysts believe around 18 to 23% more downside in the S&P 500 index is possible if the U.S. does slip into a recession.

What is a Recession?

Technically, a recession occurs when GDP growth is negative for two consecutive quarters, but this economic data is only published after the fact, so it’s of little help to investors. In fact, in many instances, by the time a recession becomes ‘official’, stock prices have already begun to recover based on newer improved sentiment about the future.

Is a Recession Inevitable?

So far, the data signals that usually precede a recession are mixed. The yield curve suggests there is still some way to go before a recession is very likely. But other economic data indicates that the U.S. economy is becoming stressed. Initial jobless claims would only need to rise by about 30,000 to sound the alarm bell for some analysts.

The Insight: Companies in defensive sectors like the consumer staples , healthcare and utilities sectors do often perform relatively well during a recession because they have more consistent cash flows. However, investors often make the mistake of switching to defensive stocks too late in the cycle, and then missing out on the recovery in the blue chip stocks that they have sold.

In the long run, it’s generally a better idea to stick to high quality stocks that can survive a recession , and hold them through the entire cycle. That said, owning some defensive stocks throughout the cycle can reduce portfolio volatility.

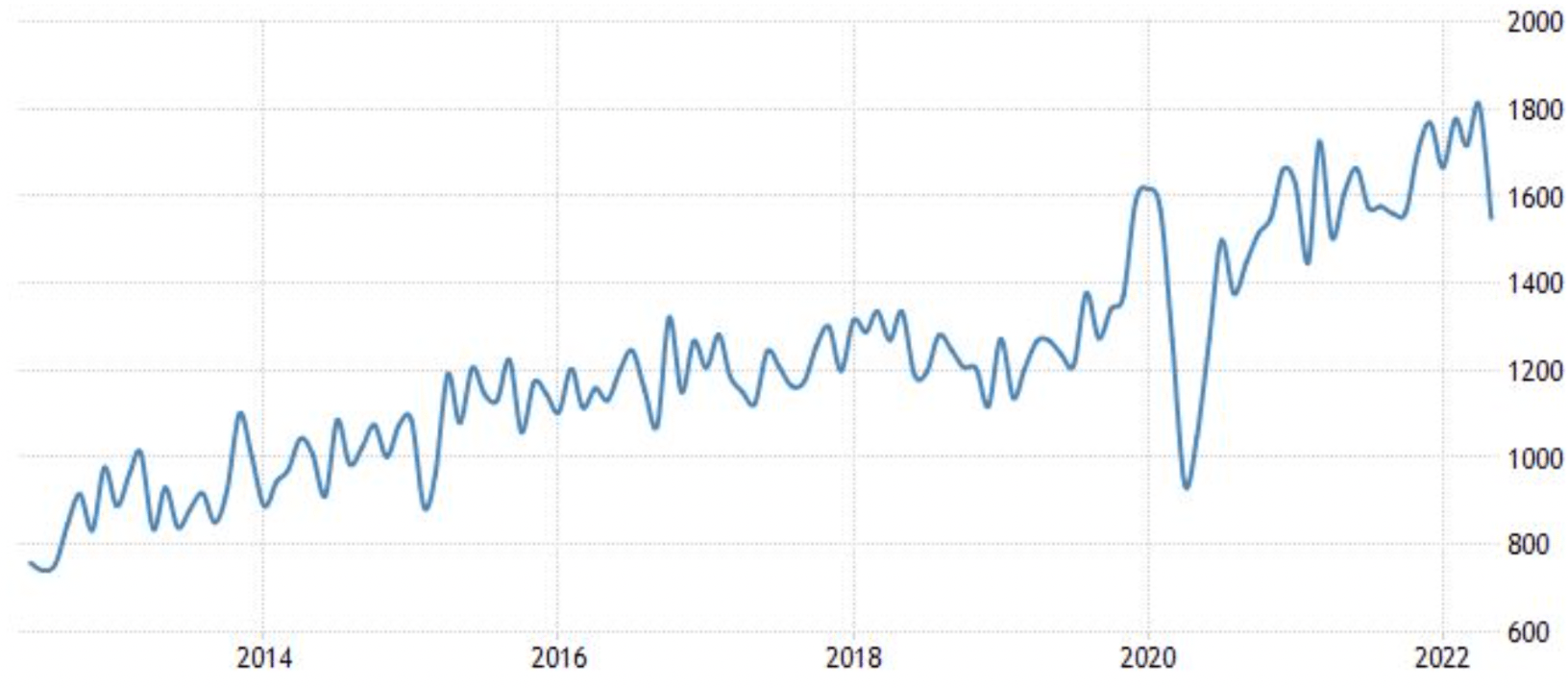

Real Estate Sales at Lowest Level Since 2020

Real estate markets around the world have slowed as rising mortgage rates have discouraged home buyers. House prices have been rising for the last decade as low interest rates have made mortgages more affordable than ever. Now, data from countries like the U.S, Canada and New Zealand indicate that the market has slowed dramatically .

In the U.S., housing starts fell 14.4% from April to May, the largest monthly decline since the start of the pandemic. (The term housing starts refers to new homes being constructed and reflects the level of confidence in the growth of the housing market).

U.S. Housing Starts 2012 to 2022 (1,000s) - tradingeconomics.com

Real estate is less liquid than the stock market, and homeowners don’t tend to ‘panic sell’ their homes when the market weakens. The result is that a weak housing market usually results in less activity rather than prices falling significantly. Many countries also have a shortage of supply, so house prices may not fall much unless there is a severe recession or if mortgage rates increase past what homeowners can afford.

The Insight: For most homeowners, the value of their home represents a large portion of their wealth. Even if house prices don’t fall very much, a slowing housing market and high mortgage rates do tend to weigh on consumer confidence and lending. A slowing housing market is also likely to weigh on some parts of the real estate sector , and the stocks in the construction and building industries.

Energy Failure in Australia

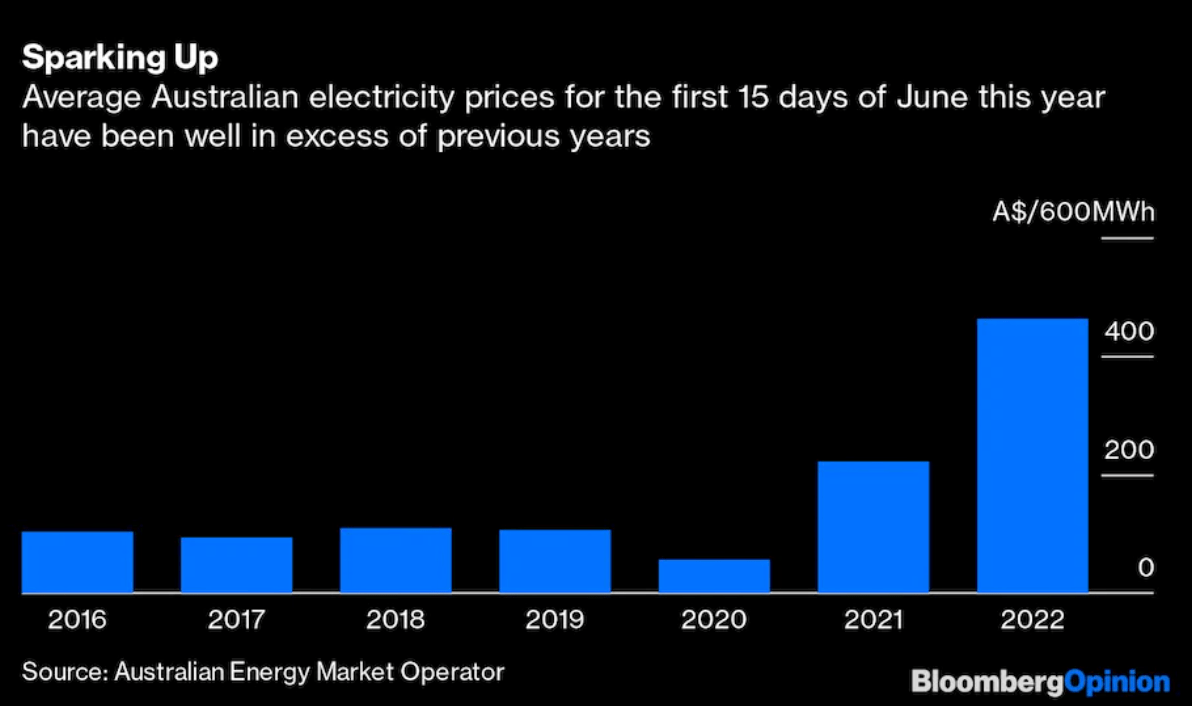

A crisis has erupted in Australia’s wholesale energy market over the last two weeks, resulting in soaring electricity prices and fears of blackouts in some parts of the country.

Is there an Energy Crisis in Australia?

Under normal market conditions, Australia’s power generators sell power to the national grid in continuous and ongoing auctions. Over the last two weeks, several factors resulted in an imbalance between supply and demand: some coal-fired generators were offline for maintenance, a cold snap resulted in increased demand, and the price of coal and natural gas have continued to rise since Russia's invasion of Ukraine.

With increased demand and reduced supply, prices rose until the Australian Energy Market Operator (AEMO) was forced to step in and cap the price generators could charge . On Wednesday, the operator removed the cap as more generators came back online.

Some companies were also accused of deliberately turning off generators to throttle supply and increase the margins they could earn from other generators. This wouldn’t be the first time that electricity providers and traders have been accused of manipulating a market. In the 1990s, Enron (the company that later collapsed) used various schemes to manipulate the electricity market in California .

Countries that import commodities to produce electricity have very little control over the prices that consumers pay for power. This makes them particularly vulnerable to inflation shocks.

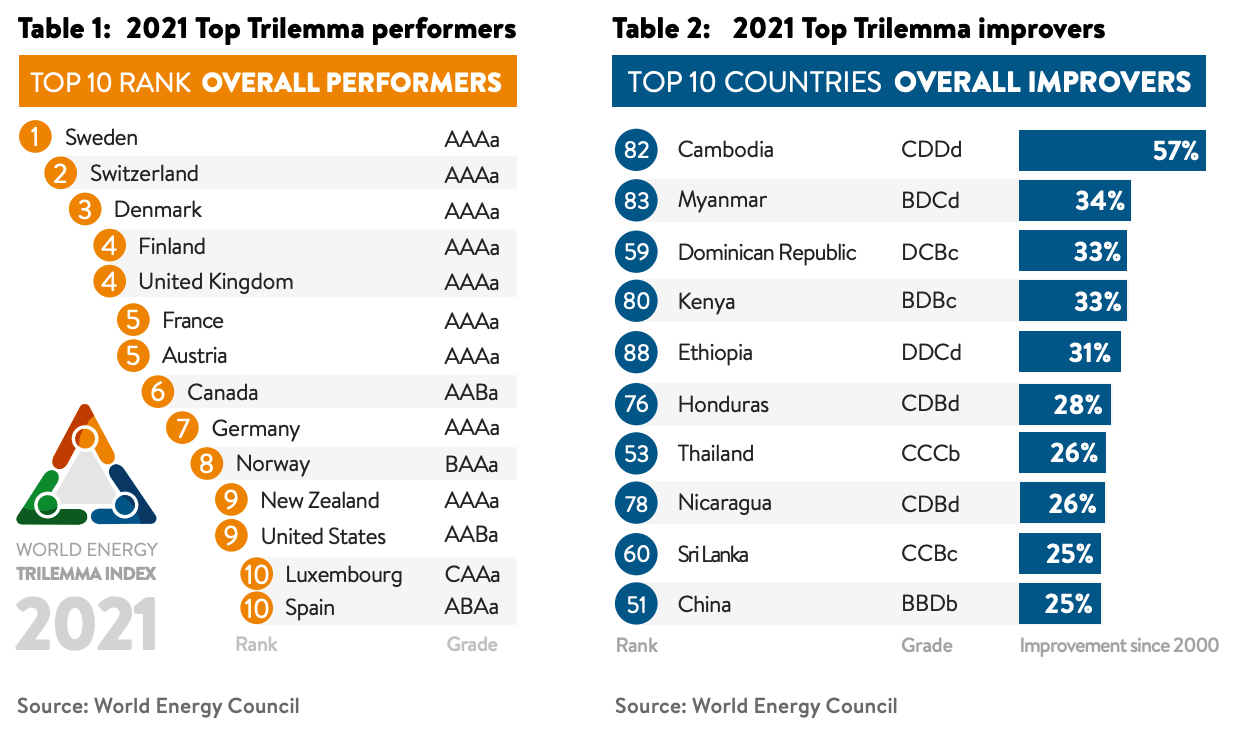

The World Energy Council (formed in 1923) has produced a “ World Energy Trilemma Index ” for the last 12 years which ranks countries based on their energy security , energy equity and environmental sustainability of their energy systems.

The top ranking countries for this index in 2021 include Sweden , Switzerland and Denmark with ratings of AAAa.

Australia ranks 18th on that list last year, with a rating of AACa, and the C represents the third element of environmental sustainability. This is because 65.7% of Australia’s grid is powered by coal. While wind, hydro, gas and solar only make up 13.1%, 8.6%, 6.9% and 5.3% of Australia’s power grid respectively. With such concentration in one energy source, and one third of that source offline, it was a recipe for a crisis.

The Insight: Free market dynamics are supposed to, and usually do, encourage competition and ultimately reduce prices for consumers — but market failures can occur. Crises like this are likely to be an ongoing challenge for energy markets as the world transitions to renewable energy. The fact that solar and wind are intermittent power sources adds to this challenge as alternative sources are required to fill in the gaps. Critical industries like power generation do require oversight and regulation to mitigate against these market failures.

The current Labor government in Australia wants to achieve 82% renewable energy by 2030 . Considering the Australian market is currently 75% fossil-fuel powered, that’s an ambitious goal and will require significant investment into those new cleaner energy sources. It also means coal-powered plants aren’t as incentivized to “play nice” since they know they’re on the way out.

Market Outlook Next Week

It’s a relatively quiet week for economic data this week. Nevertheless, there are some data releases that may give some clarity on inflation and the health of several economies.

In Europe, the inflation rates for the Eurozone, France and Germany will be published. Last May’s inflation rate for the Eurozone was published at 8.1%, a historical all-time high.

Consumer confidence data is also due in the U.S., Germany, and Japan . Last month’s figures for the U.S. were 50.20, which is down 41% a year ago at 85.50. If this month’s figure comes in at an even lower level, that means there will likely be even less economic activity in the market in terms of consumer spending.

Manufacturing PMI data will also be released for the U.S. and China. And finally, U.S. personal income and personal spending data will be released on Thursday.

There are a few consumer goods companies due to report first quarter results next week. They include:

- Bed Bath & Beyond ( NASDAQ:BBBY )

- General Mills ( NYSE:GIS )

- Walgreens Boots ( NYSE:WBA )

- Constellation Brands ( NYSE:STZ )

- Nestle ( SWX:NESN )

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.