Short-Term Rental Laws Are Pressuring The Housing Market

Reviewed by Michael Paige, Bailey Pemberton

“He who controls the money supply of a nation controls the nation” - James A. Garfield

We’re currently in a property supply crisis. Rising interest rates, increasing population and immigration have created an imperfect storm where housing is harder to come by and more expensive than ever before.

This week we are looking at the risk the short-term rental industry poses to property markets worldwide. We also had a look at money supply trends and what they could mean for inflation.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts!

ABNB: Another Bubble ‘n Bust?

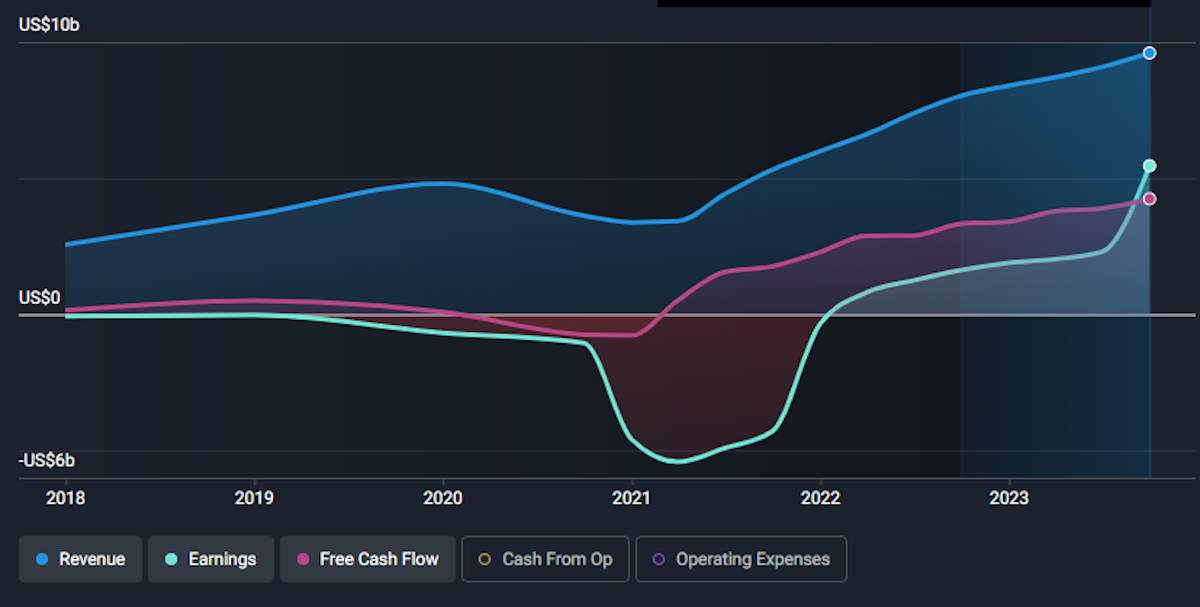

Airbnb recently reported record quarterly numbers, and while they reported a record profit, below the surface concerns are growing about the short-term rental market.

This doesn’t only concern the US market, but many cities around the world.

There are two sides of the coin when it comes to Airbnb’s problems.

- From the perspective of Airbnb operators, the fear is that owners of short-term rental accommodation may become forced sellers due to restrictions 'forcing’ them out of the short-term rental market or simply for financial reasons given the rising interest rates.

- While this wouldn’t be an issue in a buoyant property market, current prices and mortgage rates are beyond the reach of most would-be buyers.

- This could lead to more supply and less demand which would push house prices 📉.

- On the flipside, the increase in people becoming Airbnb operators for profit has seen the supply of long-term rentals dry up as people opt for more lucrative short-term options. We’ll touch on the impacts of this in just a moment.

But how did this all start?

Airbnb revolutionized the short-term accommodation market by giving property owners a platform to monetize spare accommodation. This also gave travellers cheaper alternatives than hotels.

More affordable accommodation made travel cheaper which increased demand. This created a bit of a gold rush as people began buying properties to list on the platform - which was easy to do with rates at historically low levels. For nearly 15 years everyone seemed to be a winner (apart from the hotel industry).

So What’s The Problem With Short-Term Rentals?

The growth of short-term rentals has had numerous consequences. One of the biggest was a shortage of supply of long-term rental accommodation in many cities.

This has driven up rents, which is even more of a problem since home prices are out of reach for many people, and mortgage rates are sky-high.

That’s the big problem, but there are others too.

-

Homeowners associations and body corporates have had enough of noisy guests and many have banned short-term rentals when they can.

-

Other problems have stemmed from the fact that being an Airbnb operator has morphed from renting out a spare bedroom into a full-time business in many cases.

- On top of that, some operators of short-term rentals have tried to cut costs and add extra fees for cleaning.

- What was once a cheap alternative to hotel stays has now become just as expensive without the services that make hotel stays more comfortable.

-

City authorities have had to crack down as many operators have been competing with hotels without paying taxes or registering as businesses.

All of this has resulted in a massive crackdown by cities around the world.

Hosthub lists restrictions that have been put in place on short-term rentals in at least 30 cities around the world . These include limits on the total days per year that a property can be rented, licensing, fees and zoning requirements.

New York’s restrictions have been described as a virtual ban on short-term rentals.

A Perfect Storm?

The restrictions cities have put in place have added some pressure to the short-term rental industry.

But the current crisis has as much to do with the classic end game for any bubble, as well as the current economic roller coaster 🎢. Here are some reasons it was facing headwinds:

- Until recently the number of short-term rental properties was still rising, creating oversupply.

- The post-pandemic surge in travel has lost momentum.

- Short-term rentals are no longer as competitive compared to hotels.

- Owners in some cities are paying higher taxes, and facing restrictions on how many days they can rent their properties each year.

The result of all this is that operators are earning less after taxes and other costs in many cities around the world.

When things were going well, many operators built up portfolios of rental properties financed with mortgages. The danger now is that operators could be forced to sell if they can no longer cover their mortgage payments.

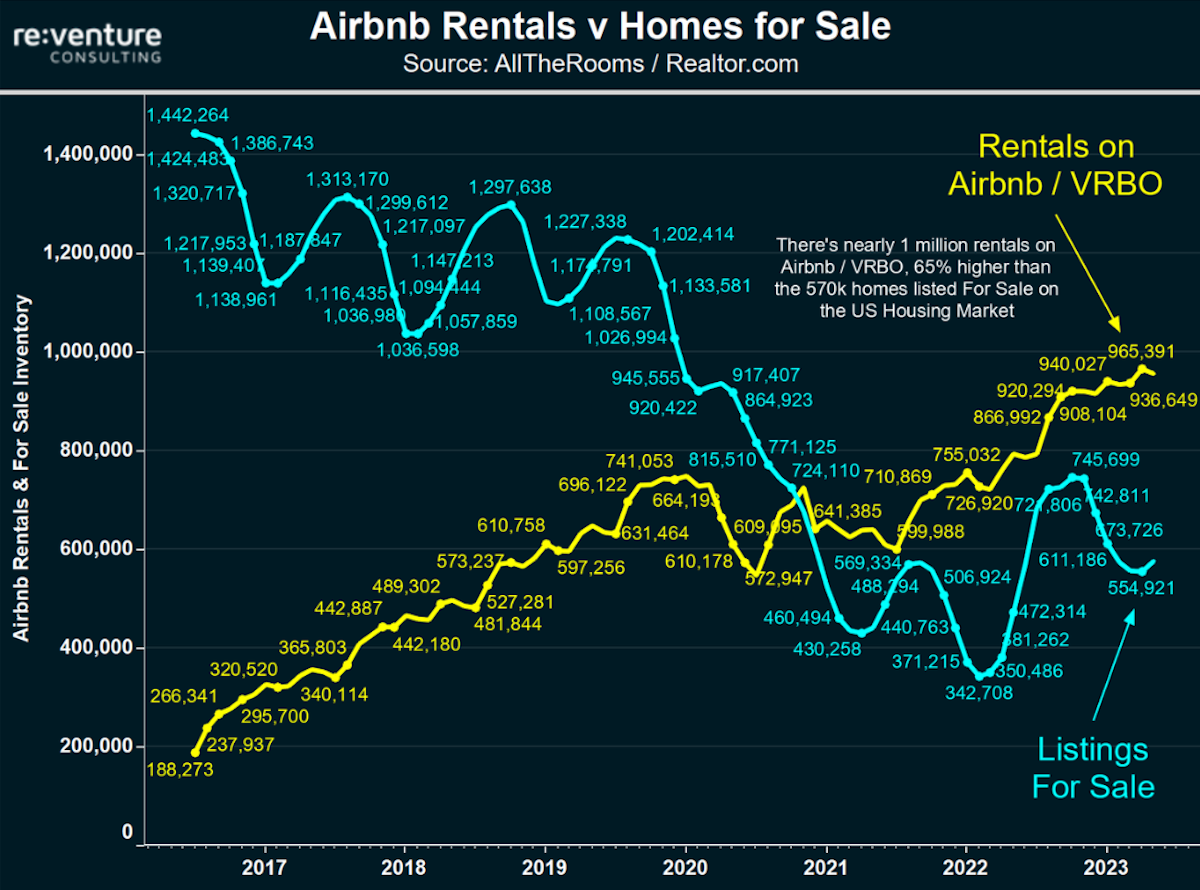

As the chart below reflects, the number of short-term rental properties dwarfs the number of properties listed for sale in the US market:

💡The Insight: The Outcome Will Vary From City To City

Some analysts are predicting an imminent global real estate crash on the back of these developments. In reality, it's likely to vary by country and by city.

For a start, the number of short-term rental properties in each city is very different. Cities that limited these rentals early on may have less of a problem.

It also depends on the local market. Property prices are very sticky and sellers are reluctant to lower their prices unless they become forced sellers.

Whether they have fixed or variable-rate mortgages makes a huge difference. The worst possible position would be paying a variable-rate mortgage while rates are rising and rental income is falling!

We covered this in more depth in February, and this article goes into more detail about the predominant types of mortgages in each country.

So, if you, or the companies you are invested in have exposure to real estate, try to find out how big the short-term rental market is in the relevant cities, and how close operators are to becoming forced sellers.

As for Airbnb? Fortunately for Airbnb, the platform is incredibly well diversified geographically, and it isn’t directly exposed to property prices. Nevertheless, there are some obvious risks that need to be considered.

The current valuation also seems to be discounting no growth in free cash flows for the next few years.

When we are analyzing a company, one useful thing to do is to work out what the current price tells us about the market’s expectations.

The first way to do that is to compare the company’s Price Earnings Ratio to the sector, industry peers, and the company’s own history. You’ll find these ratios in the company report sections 1.2, 1.3 and 1.4.

You can also use the Stock Valuator tool to see what growth rate the current price implies based on the discounted cash flow model:

M2 Money Supply and Inflation

We’ve mentioned a few times that inflation has proven to be ‘sticky’ over the last few months, and it’s been like that in many of the major economies.

- 📉 After peaking in June 2022, the year-on-year US inflation rate fell steadily until June this year.

- 📈 Since then it’s actually risen slightly, stabilizing around 3.7%, which is still nearly double the 2% target.

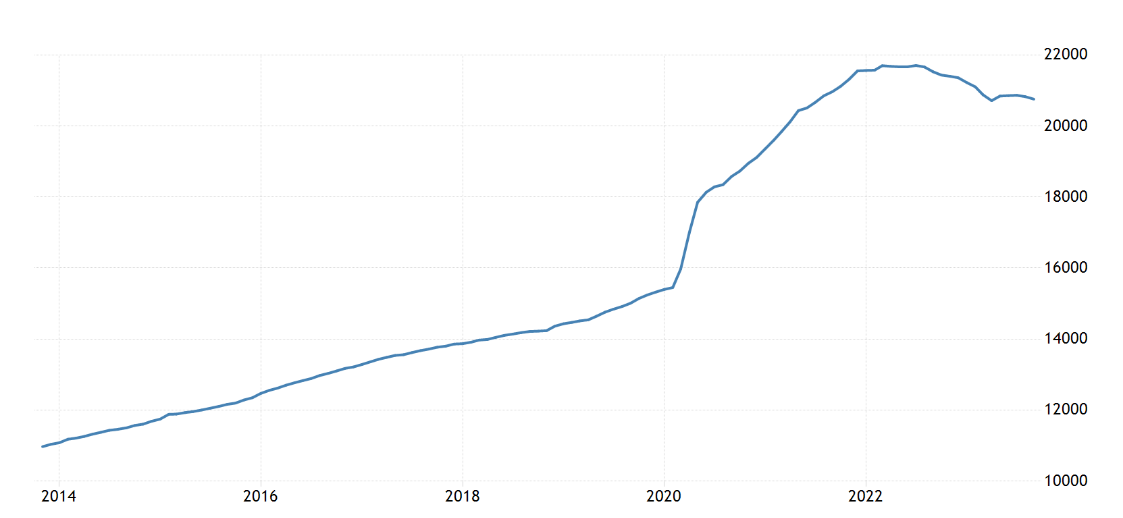

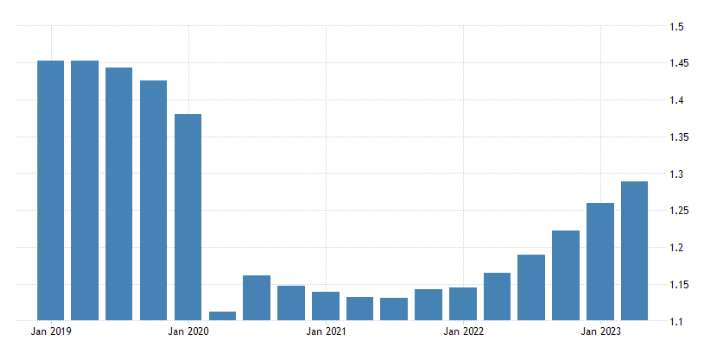

Interestingly, the money supply has followed a similar path. The chart below shows the US M2 money supply, which is the amount of cash in circulation including checking and savings accounts and money market mutual funds.

The money supply increased dramatically in 2020 as stimulus was pumped into the economy - AKA money printing 🖨️.

In 2022 it plateaued between March and June before falling sharply until April. The decline may not look dramatic, but it's not often that money supply declines at all.

The money supply has followed a very similar path to inflation. This isn’t surprising, and some definitions of inflation simply equate it with an inflation of the money supply.

There’s been a similar trend in other countries, including Germany (below), the UK, Australia and New Zealand.

Monetary Velocity Still Below 2020 Levels

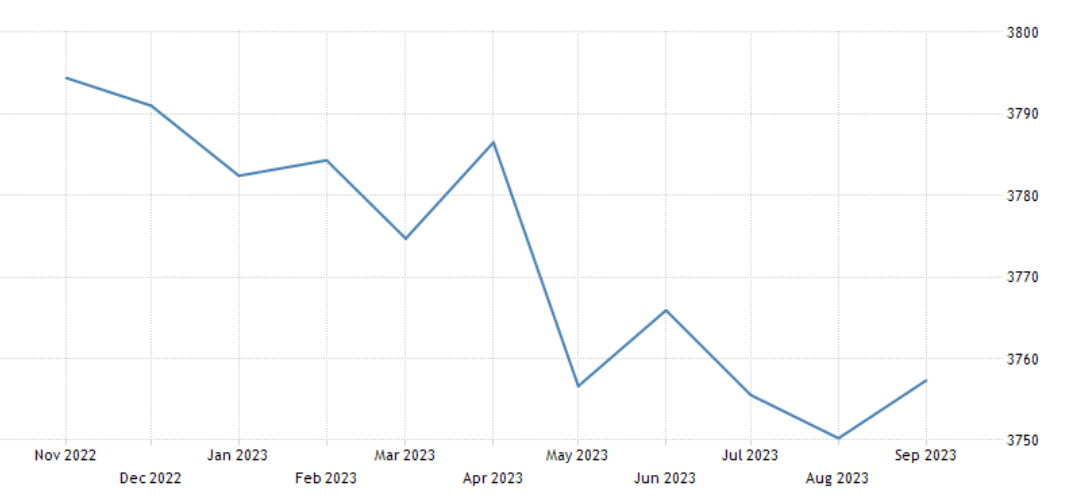

The other piece of the puzzle is the velocity of money, which is the number of times each unit of currency is spent in a year. For a given level of economic activity, increases in money supply and velocity are both inflationary, while decreases are deflationary.

The chart below reflects US M2 money velocity which has increased through most of 2022 and 2023. While money velocity has increased rapidly, it’s still below pre-pandemic levels. So if velocity were to continue to increase, that could create more inflation - unless GDP growth keeps up, or the money supply continues to fall.

If both velocity and money supply fall, we would experience deflation. This would be worse than inflation - but central banks would probably fire up the money printers again if that happened.

This is a good, more detailed analysis of the relationship between money supply, velocity and inflation.

💡The Insight: Inflation Might Not Be Behind Us

Central bankers are now in wait-and-see mode, and a lot of economists believe rates have peaked and inflation is behind us. But it’s worth considering the possibility that inflation could rebound. Remember a year ago, everyone was waiting for the ‘Fed Pivot.’

This is important because a lot of stock prices have accounted for lower rates.

❗ If inflation isn’t done, we may have even higher rates, or it may simply be a case of higher for longer.

Reminder: Stock prices represent the market’s estimate of all its future cash flows, but those cash flows must be discounted back to value them in today’s dollars using an appropriate discount rate. The higher the price-to-earnings ratio is, the longer you’ll probably have to wait for those cash flows, and the more you’ll need to discount them to get to their current value.

If you head to the Markets Page, you can select a country and then view the average P/E ratio and expected earnings growth rate for each sector and industry:

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇨🇳 China’s trade balance fell unexpectedly as imports rose more than expected.

- Exports in the year to October fell 6.4% which was expected. However ,imports rose by 3% which was more than expected.

- That tracks with the recent data showing consumer demand rising while other parts of the economy remain subdued.

- 🇦🇺 Australia's central bank raised the cash interest rate by 0.25% to 4.35% as expected.

- The accompanying statement echoed the US Fed’s stance, saying the next move “will depend upon the data and the evolving assessment of risks.”

- The Bottom line here: No one really knows.

And then, a story we thought was worth noting…

- 📱An interesting story from the fintech world: Intuit will soon be shutting down the budgeting app Mint, which it bought in 2009. Inuit wants users to move to Credit Karma which it also owns.

- Mint allows users to track all their accounts on one app and then set and track budgeting and saving goals. The app had 3.6 million active users but was apparently never profitable.

- Intuit paid $7.1 billion for Credit Karma, which helps customers manage their credit score, amongst other services. The service also recommends credit card accounts and earns referral fees in the process.

- The takeaway: There’s a lot more money in lending than there is in budgeting and saving. Some business models just don’t work, even if the product is popular.

Key Events During the Next Week

US Inflation data is due this week, with consumer price inflation on Tuesday, and producer price inflation on Wednesday. US retail sales are also due on Wednesday.

In the UK employment data is due on Tuesday, followed by inflation numbers on Wednesday and retail sales on Friday.

Data is also due in Japan, with the GDP rate on Wednesday, and trade data on Thursday.

The US earnings season continues with several technology companies and the first batch of retailers:

- Home Depot

- Sea Limited

- Tencent Music

- Cisco Systems

- Palo Alto Networks

- Target Corporation

- JD.com

- SQM

- Xpeng

- Walmart

- Alibaba

- Applied Materials

- NetEase

- Ross Stores

- Foot Locker

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.