What Happened in the Market This Week?

Market Insights for week ending 9th September

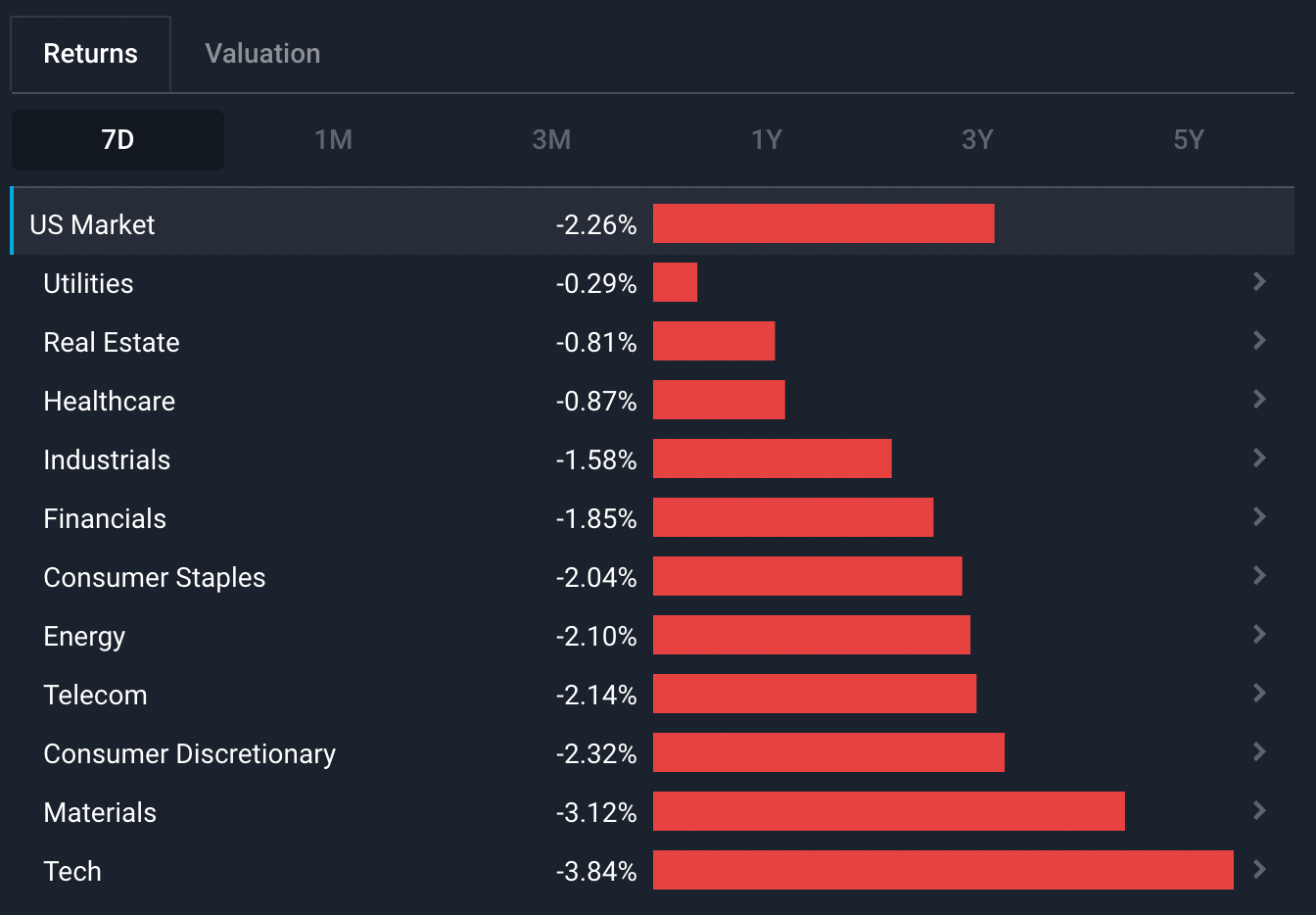

Equity markets in the U.S. opened on Tuesday this week after Monday’s Labor Day, giving U.S. investors a much needed holiday from last week’s Fed-commentary induced drops. Unfortunately the day-off didn’t improve market sentiment, with the Tech , Industrials and Healthcare sectors recording the biggest losses amidst this week’s continued downturn.

The ECB and Australia have also released key interest rate decisions. Australia announced a 50bps increase last Tuesday, bringing the cash rate to 2.35%, in contrast to 0.25% just 6 months ago. The ECB on Thursday hiked rates by 75bps, taking the cash rate from 0.5% to 1.25%.

Some of the developments we have been watching over the last week include:

- Russia has completely cut off its supply of gas to Europe , as retaliation for all the Western sanctions imposed on Russia.

- Denmark is finally moving out of negative interest rates , a decade after it first introduced the concept to the world.

Russia has cut off Europe from all its Gas Supplies

Winter is coming for the northern hemisphere, and Russia had decided to completely cut off its supply of gas to Europe. This decision came last week as a result of all the collective Western sanctions imposed on the country, which included the U.S. banning all Russian oil and gas imports and the U.K. excluding Russian banks from its financial system.

The trigger was finally pulled on the 2nd of September when the G-7 announced on the 2nd of September that they would be capping Russian oil prices in a bid to deplete Russia’s export revenue. Dmitri Peskov, a spokesman for Russia, confirmed this with his statement “ It is precisely these sanctions that the Western states have introduced that have brought the situation to what we see now ”, while also indicating that only a lifting of the sanctions could bring back Europe’s gas supply before winter.

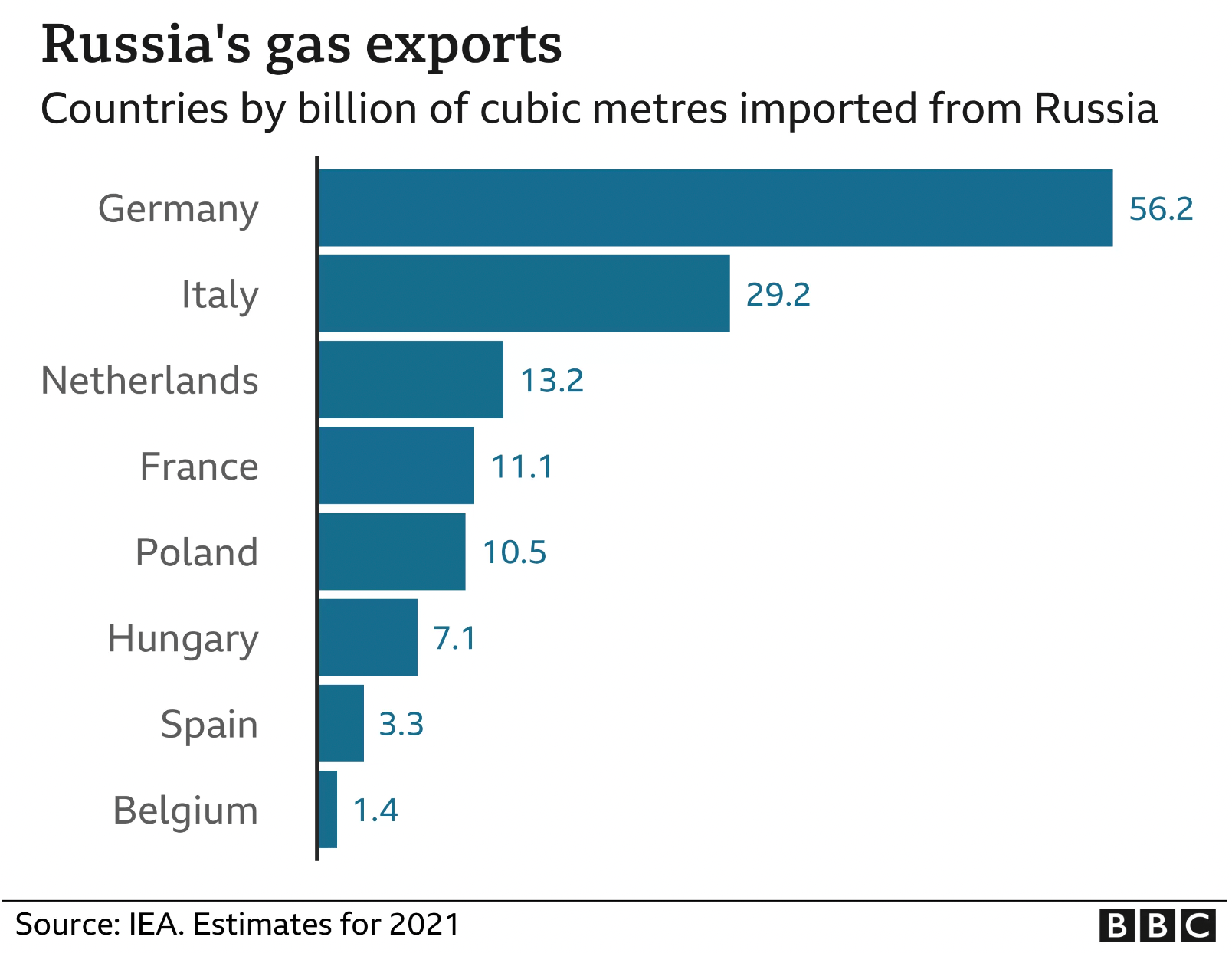

How much of Europe's gas comes from Russia?

Right before Russia completely cut off its supply, the country had already lessened the gas supplied to Europe to just 20% of the agreed-upon volume. As we had mentioned in a previous Market Insight article , this lack of energy supply is the leading cause of the severe inflation that the EU and the U.K. is currently battling with.

Back before the Russian-Ukraine war, gas from Russia accounted for a massive 40% of the European Union’s imports. The war had forced countries in the EU earlier in the year to look at alternative energy suppliers as sanctions against Russia increased. Norway, for example, had planned to increase its gas exports by 8% this year, while some European countries had restarted their coal plants to meet energy demand.

With Russian gas supply now completely gone, the E.U. has had to consider other options such as imposing rations and taking control of energy companies .

Impact of gas shortage on European countries

Analysts from the European Stability Mechanism (ESM), had released a study on what impact a full cut-off of gas supplies would have on the region. The results don’t inspire confidence. Their studies had concluded that a full cut would cause gas rationing in early-2023, with Germany , Austria , Belgium and Italy feeling the most effects. Additionally, euro area GDP is forecast to fall by 2.6%.

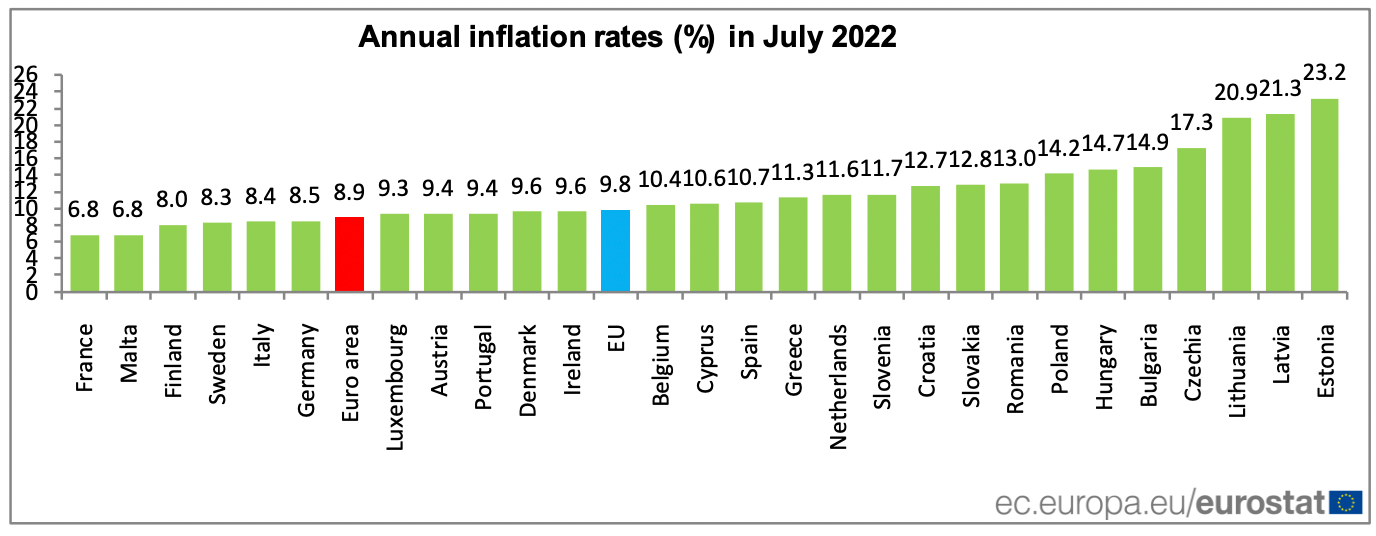

Eurozone and U.K. inflation rates

As previously mentioned, the war had already caused historical inflation levels in the region as the countries grappled with less energy supply that resulted in higher costs. This July, the European Union’s inflation hit 9.8% (year-on-year), compared to 9.6% in June .

In the calculation for inflation (which we covered in our previous Market Insight explaining CPI and PPI ), Energy (38.3%) accounted for the biggest increase year-on-year, compared to food, alcohol & tobacco (10.6%), non-energy industrial goods (5%) and services (3.8%).

With the gas supply now completely cut-off, economists expect the Eurozone’s inflation to increase to at least 10% in the coming months. The ECB’s rate hike of 75bps last week was mainly to keep in-line with inflation levels.

💡 The Insight: Investing with Political Conflicts Happening

First off, we know that investing isn’t probably the first thing you consider when thinking about how to manage your finances during periods of international conflict and uncertainty. It is always wise to build a level of emergency savings before even contemplating any investment in the volatile share market. For those who have some excess liquidity however, it pays to be prudent with where you invest.

For Short or Medium-Term Investors (< 5 years)

Unfortunately, there are no indications as to when the Russian-Ukraine war would end, nor what the outcome would be. In the most pessimistic view economy-wise, trade between Russia and the West would never be restored, neighboring countries would plunge into recessions ( this is already happening in some areas ), agricultural and food production would reduce (Ukraine is an exporter of various products) and mobility of goods would decline as trade routes close.

While none of us would wish this to happen, these potential outcomes generally mean that defensive stocks would be an intelligent choice. Companies in consumer staples , healthcare and utilities are generally considered as defensive sectors.

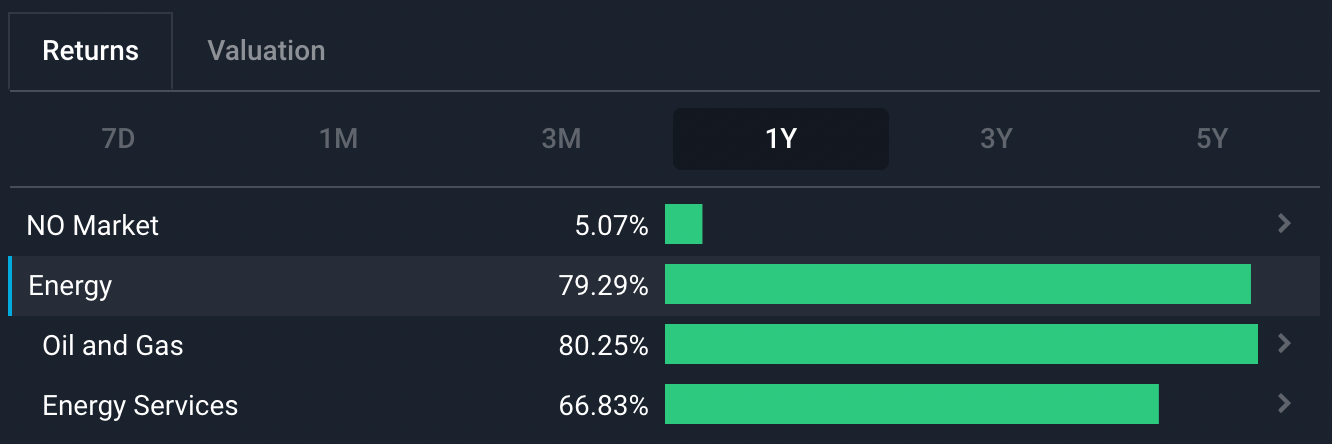

Additionally, while the broader market in the E.U. had lagged, there were some outliers in the sharemarket that had seen strong gains. Norway, as Western Europe’s largest oil and gas supplier, reached record export levels this July as demand and prices surged. The country’s energy sector saw strong returns over one year.

Some European countries had also ramped up military budgets, mainly in defence. Analysts project Germany’s arms manufacturer Rheinmetall ( XTRA:RHM ), and the U.K.'s defence companies BAE Systems ( LSE:BA. ) and Chemring Group ( LSE:CHG ) to outperform, as demand for their products grow stronger.

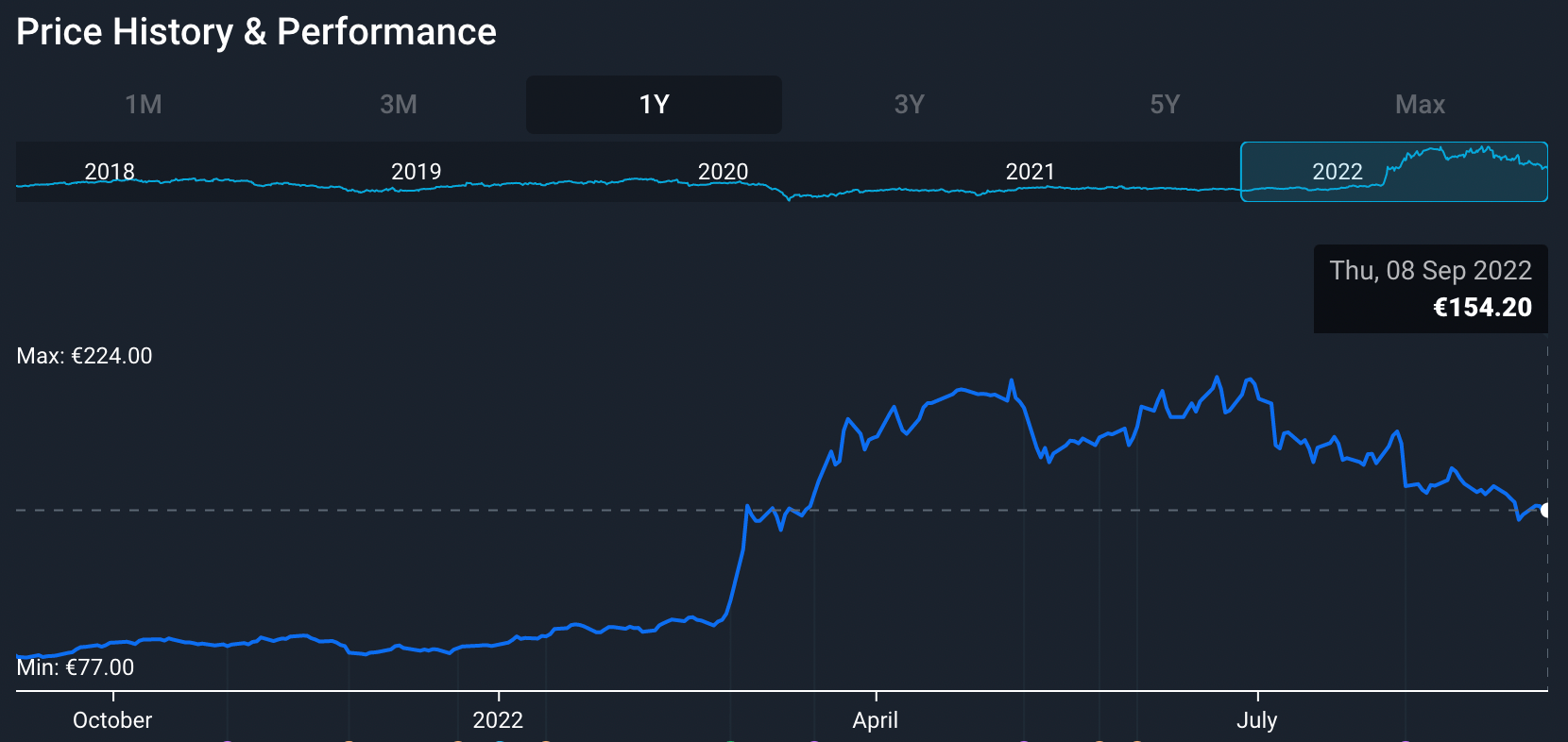

Rheinmehtall's ( XTRA:RHM ) share price performance over the last year from Simply Wall St. Share price has increased 97.7% in the last year. Analysts still think it has more room to grow.

For Long-Term Investors (5+ years)

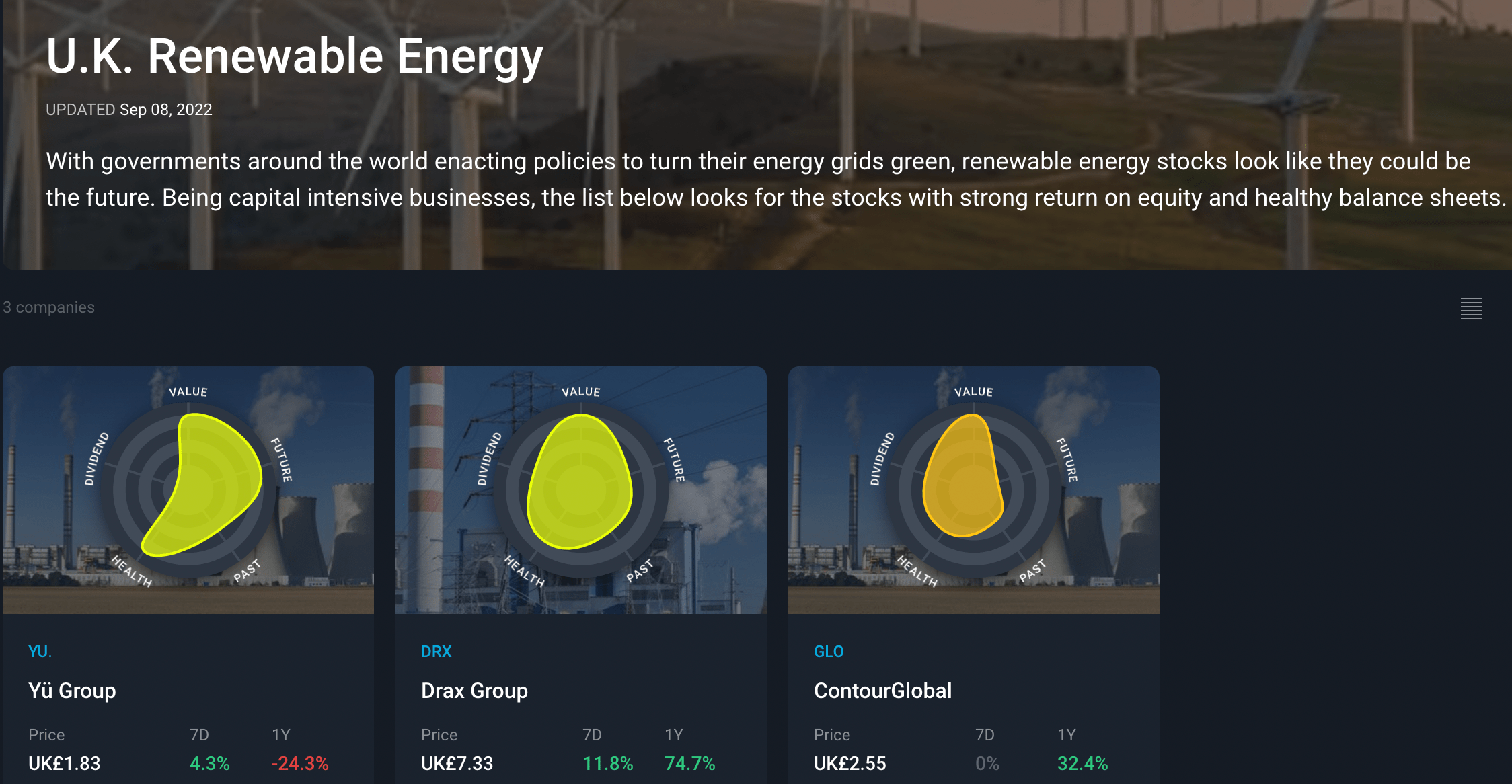

As mentioned earlier, the war has forced the European countries to accelerate their independence from Russia’s oil and gas supplies. As a result, several European countries have brought forward the development of renewable energy. European officials have voiced ideas of changing laws, such as fast-tracking the approval process to build solar and wind farms .

As such, while gas, coal and oil demand will be strong in the near future, long-term investors in Europe could look into companies that operate in the renewable energy sector. Examples are those in actual energy manufacturing, electric vehicles, companies that produce equipment for renewables such as wind turbines, and more.

The End of a Decade of Negative Interest Rates 🇩🇰

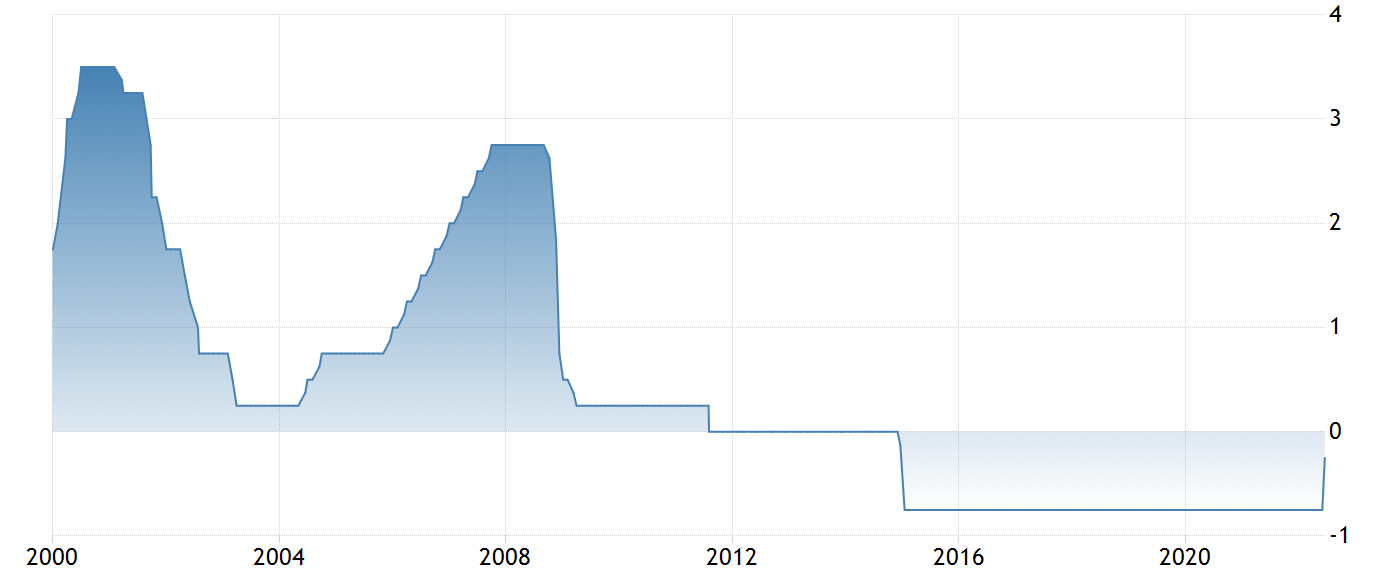

Back in 2012, Denmark had introduced an unprecedented economic policy - negative interest rates. You may have never heard of it thanks to all the hype around the Fed’s rate hikes , but yes, negative interest rates are a thing.

How in the world do negative interest rates work?

Previously, we had explained how increasing interest rates is a contractionary measure used by governments to tame inflation. Negative interest rates on the other hand, do the complete opposite. With a negative interest rate, depositing cash into a savings account would actually require you to pay interest (i.e. a storage fee), while taking out a loan would mean you actually earn money.

Take for example a -3% interest rate for a home loan - the bank actually pays you 3% annually to take out a mortgage - weird, right? 🤔

Why would a country use negative interest rates?

Central banks decrease rates to sub-zero levels when they want to stimulate the economy and to increase inflation. Additionally, countries also deploy negative rates when they want to deter investors from buying their currency. Switzerland for example, deployed -0.75% rate in 2015 when they wanted to decrease the value of the Swiss Franc. Japan also announced a -0.1% cash rate in 2016 due to fears of a deflationary economy.

At the present, the only countries with a negative cash rate are Switzerland , Denmark , and Japan . However, with the ECB’s rate hike last week, Switzerland and Denmark are expected to finally move into positive interest rate territory for the first time in years. Hooray for Swiss and Danish savers!

💡 The Insight: Getting out of Negative Interest Rates

👉 As Denmark moves out of negative rates and the ECB raises rates, the usual effects of a tightening monetary cycle are expected to be seen. These include funds moving out of riskier assets like the stock market, consumer spending typically slowing as cash becomes more expensive to hold , and funds moving into fixed income investments because typically their yields improve.

Key Events Next Week

The economic calendar for next week is pretty busy, with several countries announcing key economic indicators such as GDP and inflation rates:

Monday 12 September

- GDP MoM* and 3-month average ( U.K. )

Tuesday 13 September

Wednesday 14 September

- Inflation Rate MoM and YoY (U.K., Sweden , Finland , Armenia)

- Producer Price Index or PPI (U.K., U.S.)

- Balance of Trade ( Japan )

Thursday 15 September

- Unemployment Rate ( Australia , South Korea )

- Interest Rate Decision (U.K.)

- Retail Sales and Jobless Claims (U.S.)

Friday 16 September

- Unemployment Rate ( China )

- Retail Sales (U.K., China)

*Month-on-Month

**Year-on-Year

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stella and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.